First Fixed price, hard cap launch on @CamelotDex @arbitrum

Will this fix Camelot's launch problem?

Copy trading protocol @perpyFinance

📍In the Thread

1️⃣ What is Perpy

2️⃣ Opportunities & Challenges

3️⃣ Summary

$Grail $PSY

Will this fix Camelot's launch problem?

Copy trading protocol @perpyFinance

📍In the Thread

1️⃣ What is Perpy

2️⃣ Opportunities & Challenges

3️⃣ Summary

$Grail $PSY

But first check out my sponsor !

@ArchimedesFi is having their second leverage round 🏛️

Key takeaway:

👉 New leverage round starts Feb 23rd at 4pm PST

👉 Est. 33% Net APY 🤤

👉 Leverage Cap is increased by at least 3x for 2nd round!

Whats ArchimedesFi ?

2lambroz.substack.com

@ArchimedesFi is having their second leverage round 🏛️

Key takeaway:

👉 New leverage round starts Feb 23rd at 4pm PST

👉 Est. 33% Net APY 🤤

👉 Leverage Cap is increased by at least 3x for 2nd round!

Whats ArchimedesFi ?

2lambroz.substack.com

Perpy TLDR

It is a copy trade protocol integrated with @gmx_io , allows Traders to create a vault for Investors to deposit to copy trade.

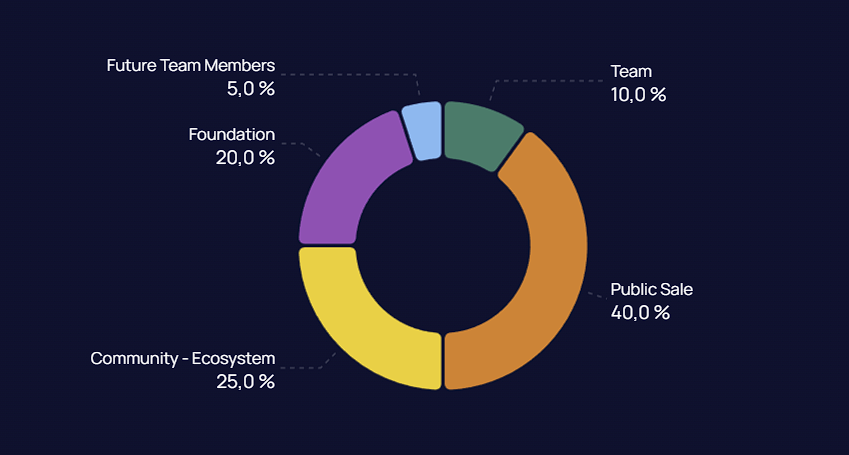

$PRY token can be stake for fees, platform fee reduction & governance

It is a copy trade protocol integrated with @gmx_io , allows Traders to create a vault for Investors to deposit to copy trade.

$PRY token can be stake for fees, platform fee reduction & governance

3 ) One its deposited into the trading vault, Investor will get a Share of the vault indicating it’s position (% of the vault investor owns)

4) User can withdraw the USDC when the trade is closed

4) User can withdraw the USDC when the trade is closed

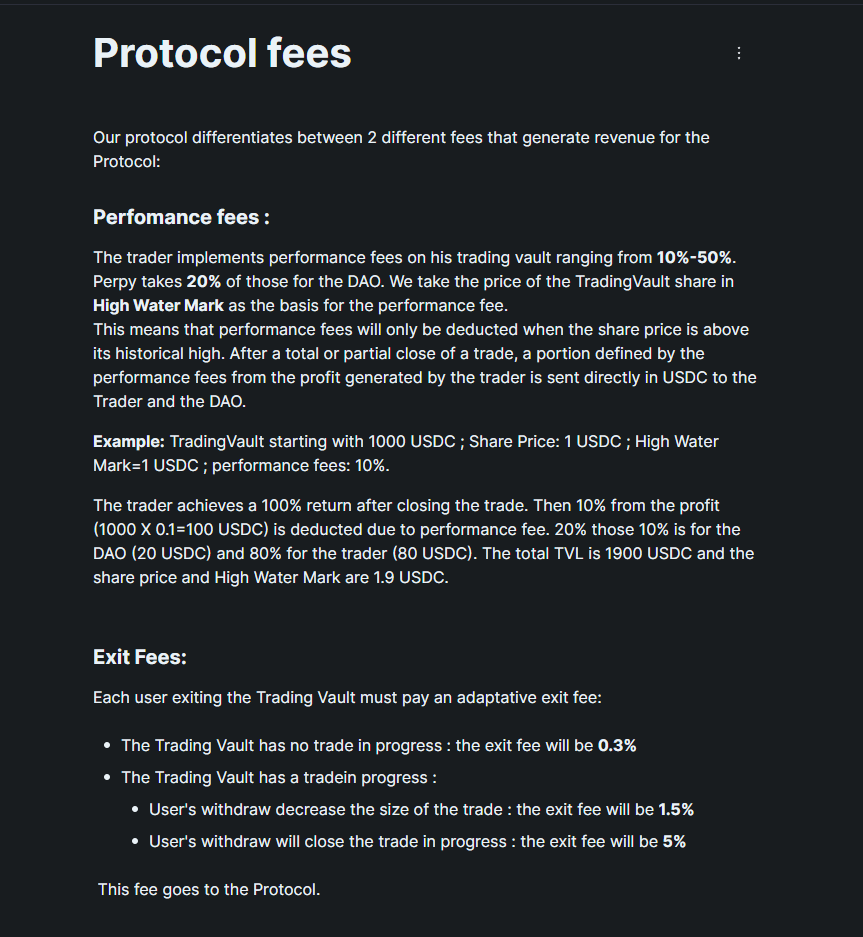

🔹Fees break down

🅰️Performance fee

• Trader can set 10%-50% on their vaults

• 20% of the 10%-50% goes to DAO

• Fees are only charged on profit

🅰️Performance fee

• Trader can set 10%-50% on their vaults

• 20% of the 10%-50% goes to DAO

• Fees are only charged on profit

🅱️Exit Fees

• 0.3% for Vaults without trade in progress

• 1.5% to decrease size when there is an active trade

• 5% to close the trade when there is an active trade

• 0.3% for Vaults without trade in progress

• 1.5% to decrease size when there is an active trade

• 5% to close the trade when there is an active trade

Protocol partnership so far

@vertex_protocol

@PythNetwork

@Buffer_Finance

Key marketing events happened

@fungialpha ama

@diamondpepes (not sure is it just single side integration or partnership)

@vertex_protocol

@PythNetwork

@Buffer_Finance

Key marketing events happened

@fungialpha ama

@diamondpepes (not sure is it just single side integration or partnership)

2️⃣ Opportunities & Challenges

🔹Not proven sector in decentralised (in CEX yes)

🔹Limited tradable asset based on GMX

🔹Competitive landscape

• @NestedFi over 30k portfolios, 1500 cryptocurrencies available, instant buy with fiat

🔹Not proven sector in decentralised (in CEX yes)

🔹Limited tradable asset based on GMX

🔹Competitive landscape

• @NestedFi over 30k portfolios, 1500 cryptocurrencies available, instant buy with fiat

• @stfx_io similar offering with more traction

• @puppetfinance ,by @GblueberryClub from @gmx_io

• @factorDao is hot with lot of marketing support

🔹CEX copy trading platform

• @puppetfinance ,by @GblueberryClub from @gmx_io

• @factorDao is hot with lot of marketing support

🔹CEX copy trading platform

However they are on @arbitrum (hot chain) launching on @camelotdex (hot launchpad) with “Fixed price, hardcap” which hopefully fixes @nitrocartel & maybe @factordao problem of pushing the valuation too high at the start.

🐑Action : wait for more details about the valuation & market when the launch comes closer. It doesn’t have to be the best product in the market to be a profitable investment.

Unrolled here for u!

2lambroz.substack.com

2lambroz.substack.com

@PerpyFinance First Fixed price, hard cap launch on @CamelotDex

@thewolfofdefi

@Eli5DeFi_

@PANewsCN

@TechFlowPost

@chainfeedsxyz

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

@0xKillTheWolf

@mrblocktw

@thewolfofdefi

@Eli5DeFi_

@PANewsCN

@TechFlowPost

@chainfeedsxyz

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

@0xKillTheWolf

@mrblocktw

Loading suggestions...