@ArchimedesFi Fix Rate borrowing + undercollateralized leverage & $ARCH token to capture value?

@CurveFinance @OriginProtocol

📍In this thread

1) What is it

2) How does it work

3) Lambro thoughts on protocol dynamics

4) How i would play it

$crv $ousd #defi

@CurveFinance @OriginProtocol

📍In this thread

1) What is it

2) How does it work

3) Lambro thoughts on protocol dynamics

4) How i would play it

$crv $ousd #defi

unrolled here for u

2lambroz.substack.com

2lambroz.substack.com

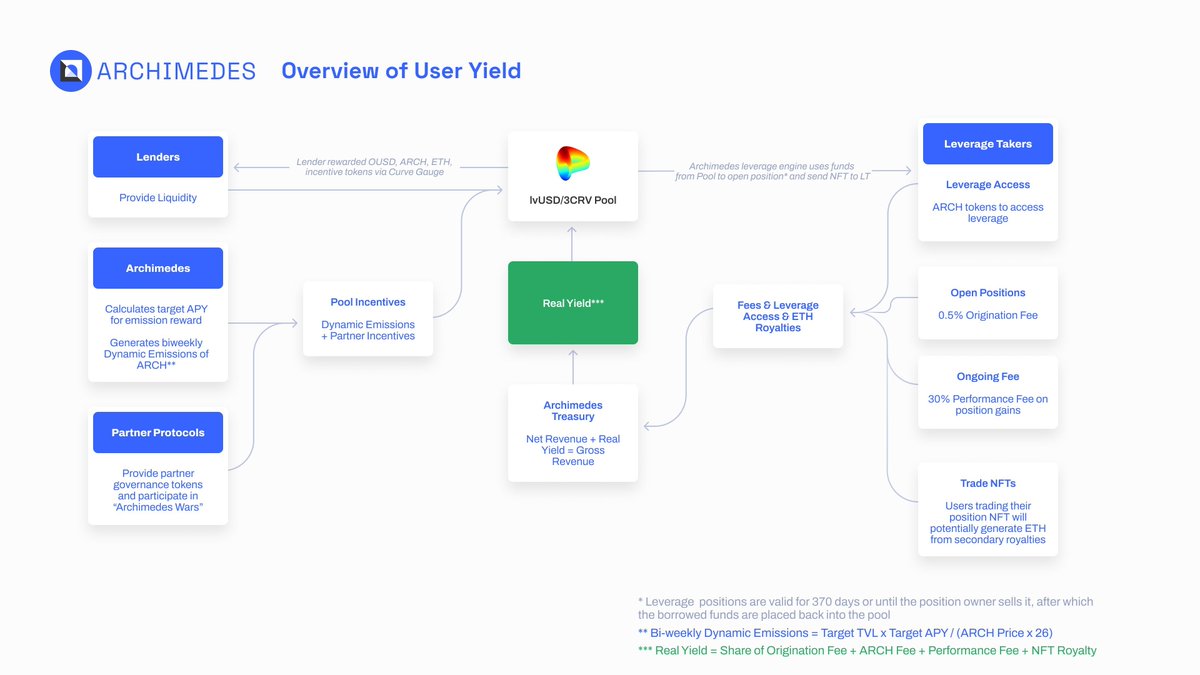

🔹Lenders (LP)

LP provide asset to 3CRV/lvUSD pool and receive interest which the protocol pays out in

- $ARCH tokens

- Stablecoins

LP provide asset to 3CRV/lvUSD pool and receive interest which the protocol pays out in

- $ARCH tokens

- Stablecoins

🔹Borrowers (LT)

LT borrow from these pools to create a leverage position from whitelisted yield-bearing stablecoin (starting with $OUSD) @OriginProtocol

LT borrow from these pools to create a leverage position from whitelisted yield-bearing stablecoin (starting with $OUSD) @OriginProtocol

Whenever a LT opens a position the price (lvUSD) will be higher and lower in price over the proceeding days until all the leverage is acquired. A bit like a dutch auction, and these auction will be done using $ARCH

E.g.

When a leverage round starts,

assume 1 $ARCH = 150 lvUSD

Depending on the rate of of the auction you can buy more and more lvUSD with 1ARCH

13:00 1$ARCH = 150lvUSD

14:00 1$ARCH = 160lvUSD

15:00 1$ARCH = 170lvUSD

When a leverage round starts,

assume 1 $ARCH = 150 lvUSD

Depending on the rate of of the auction you can buy more and more lvUSD with 1ARCH

13:00 1$ARCH = 150lvUSD

14:00 1$ARCH = 160lvUSD

15:00 1$ARCH = 170lvUSD

This way LT will buy “leverage power” (lvUSD) at the rate they prefer until the it has sold out it’s leverage capacity at the price they want.

🎟️You can imagine $ARCH as their tickets to buy leverage capacity.

🎟️You can imagine $ARCH as their tickets to buy leverage capacity.

📍Why would LT borrow with Archimedes?

🔹Predictable fee model

with the “bidding” auction model, LT will know their leverage cost

🔹Predictable fee model

with the “bidding” auction model, LT will know their leverage cost

🔹Tradability - Archimedes package position as an NFT, LT can trade it on NFT marketplaces for easy exit or potentially more composability in the future with other protocols.

In short, if you have strong conviction on a strategy APY why not leverage up it with fix cost?

In short, if you have strong conviction on a strategy APY why not leverage up it with fix cost?

🔹My thinking model of “fair” pricing of $ARCH

Hard demand to use auction = how good is the underlying apy, how much lvUSD is available to auction, how much $ARCH is circulating

Hard demand to use auction = how good is the underlying apy, how much lvUSD is available to auction, how much $ARCH is circulating

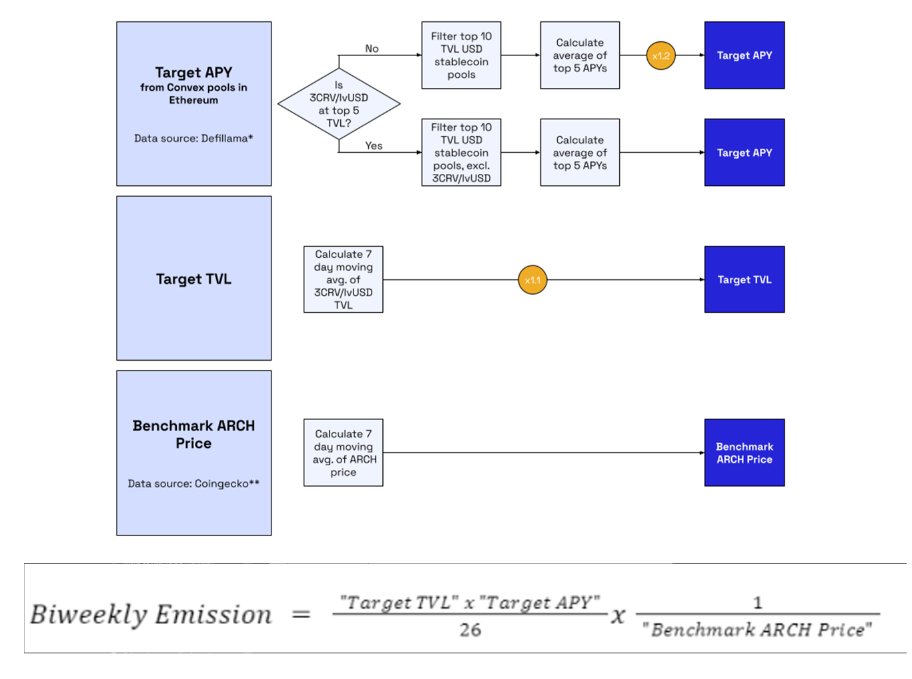

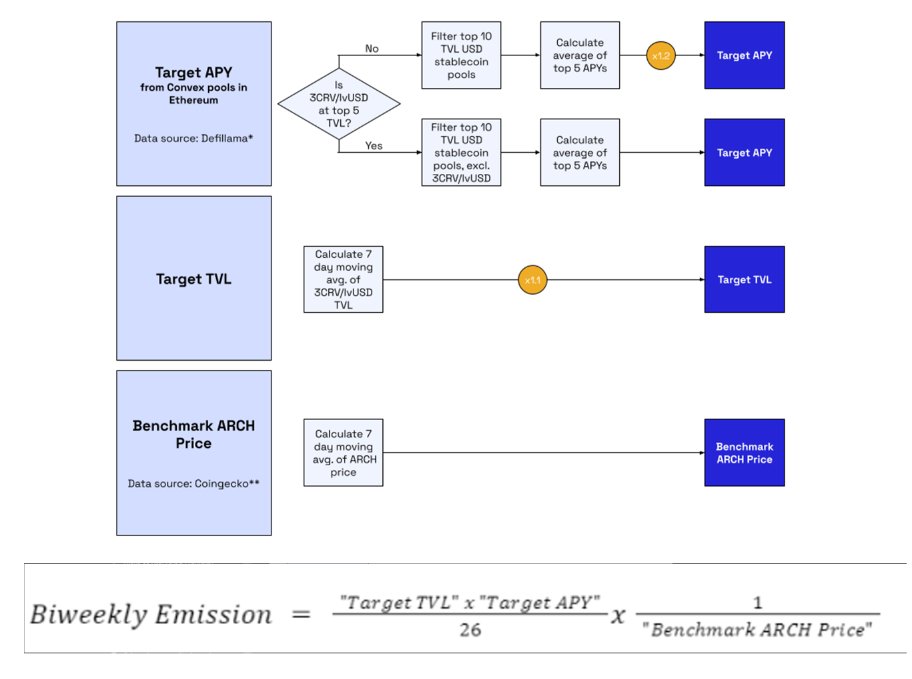

Meaning i have to monitor

🤔 3CRV/lvUSD + relationship of how much archimedesfi team for lvUSD available to auction

🤔OUSD (first yield bearing stablecoin) current APY & premium for future APY

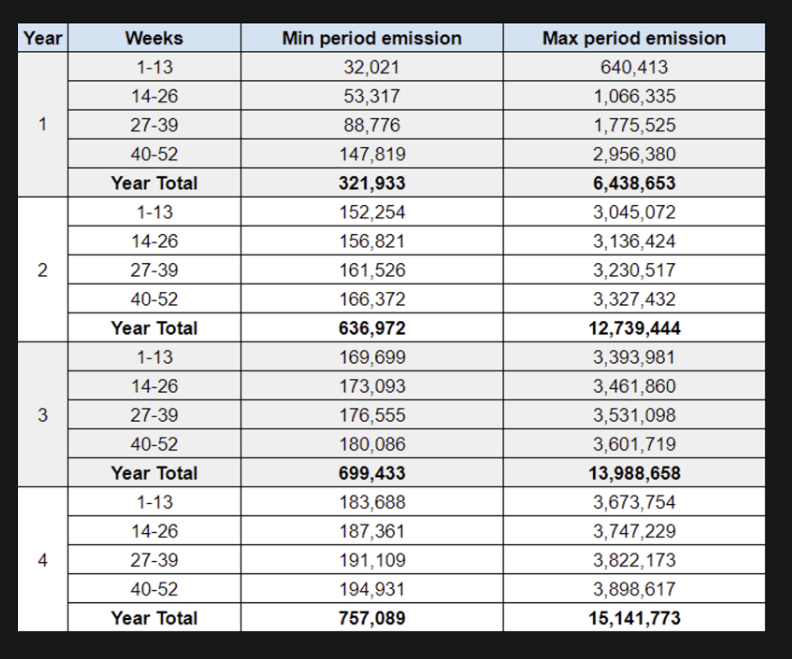

🤔Circulating $ARCH supply & upcoming emission based on dynamic emission

🤔 3CRV/lvUSD + relationship of how much archimedesfi team for lvUSD available to auction

🤔OUSD (first yield bearing stablecoin) current APY & premium for future APY

🤔Circulating $ARCH supply & upcoming emission based on dynamic emission

🔹Action

I personally won't go in $ARCH yet as I feel like I haven't fully understood the protocols but this is very interesting to follow. I’d keenly keep a close eye on what the “cost” to fix borrowing on OUSD & the relationship to its apy for first action first.

I personally won't go in $ARCH yet as I feel like I haven't fully understood the protocols but this is very interesting to follow. I’d keenly keep a close eye on what the “cost” to fix borrowing on OUSD & the relationship to its apy for first action first.

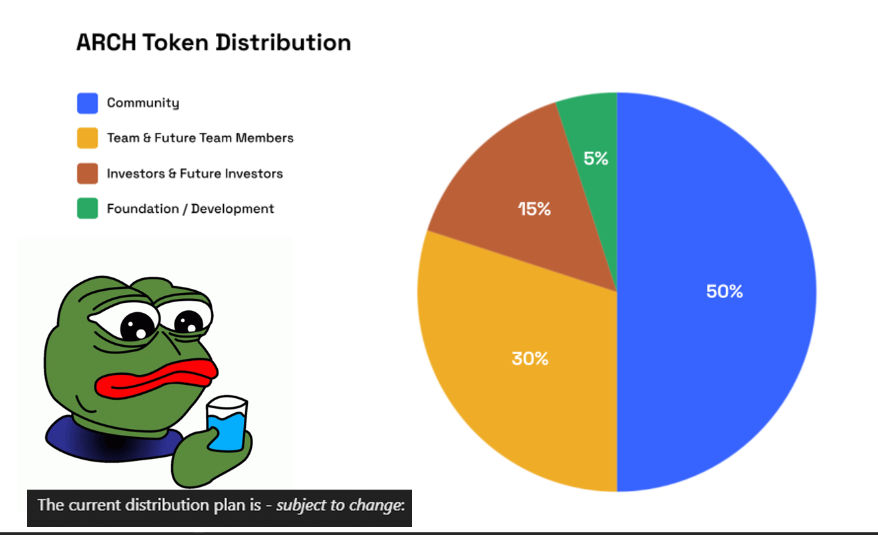

One thing I am not very comfortable with is the tokenomics “subject to change” on gitbook & no clear indication on the fix emission yet.

I really love to pick @newmichwill @mrblocktw the curve big brains thoughts on this protocol specially my summary & prediction

sub me on substack!

2lambroz.substack.com

2lambroz.substack.com

Help lambro in twitter algo pls ser

@thewolfofdefi

@Eli5DeFi_

@PANewsCN

@TechFlowPost

@chainfeedsxyz

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

@thewolfofdefi

@Eli5DeFi_

@PANewsCN

@TechFlowPost

@chainfeedsxyz

@0xAbel_eth

@victalk_eth

@nft_hu

@UST_DAO

@Dacongfred

@Arron_finance

@NintendoDoomed

Loading suggestions...