3) Basically, the odds of a soft landing were going vertical in November/December but then the economy started accelerating hard in January. Led by housing/autos which effectively are the cycle as recessions best understood as changes in replacement cycles for durable goods.

4) Unless there is more political pressure applied to the Fed (mkt up 96% of year 3s in Presidential Cycle as year 3 drives reelection), then “No Landing likely = Hard Landing.”

Political pressure began with Lagarde and then Yellen ramped it up on October 11. We will see.

Political pressure began with Lagarde and then Yellen ramped it up on October 11. We will see.

6) Economy may now be more sensitive to gasoline prices than rates right now, which is wild.

Economy will become more rate sensitive as excess savings burn off and/or rates go higher (exponential relationship IMO).

Yes, aware of lagged impact of rate increases.

Economy will become more rate sensitive as excess savings burn off and/or rates go higher (exponential relationship IMO).

Yes, aware of lagged impact of rate increases.

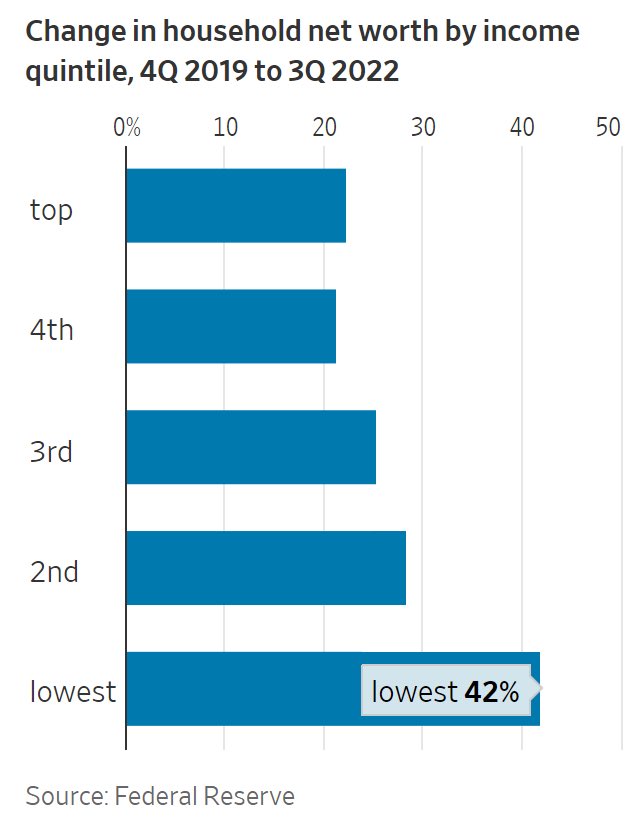

7) There is actually a reasonable case to be made that circa 60% of consumers (outside the top quintile) are *positively* exposed to rates until excess savings burn off.

The upside down. And increases the odds that the Fed has to break something.

The upside down. And increases the odds that the Fed has to break something.

8) TLDR: Economy is accelerating rapidly and “No Landing likely = Hard Landing” absent political pressure on Fed.

9) The last time I was this tuned into macro was 2008-2010. I’ll never forget Mike Goldstein saying that bear markets and recessions generally end when every PM has a nuanced macro view. Very true.

10) Finally, I will just say that the resilience of the market this week was surprising to me. Especially the close on Friday.

11) Appending as I was clearly not definitive enough. The economy accelerating is not good news.

No landing = hard landing (more Fed hikes) absent political pressure.

Need the economy gently decelerating and job openings continuing to decline for soft landing. Not happening rn

No landing = hard landing (more Fed hikes) absent political pressure.

Need the economy gently decelerating and job openings continuing to decline for soft landing. Not happening rn

Loading suggestions...