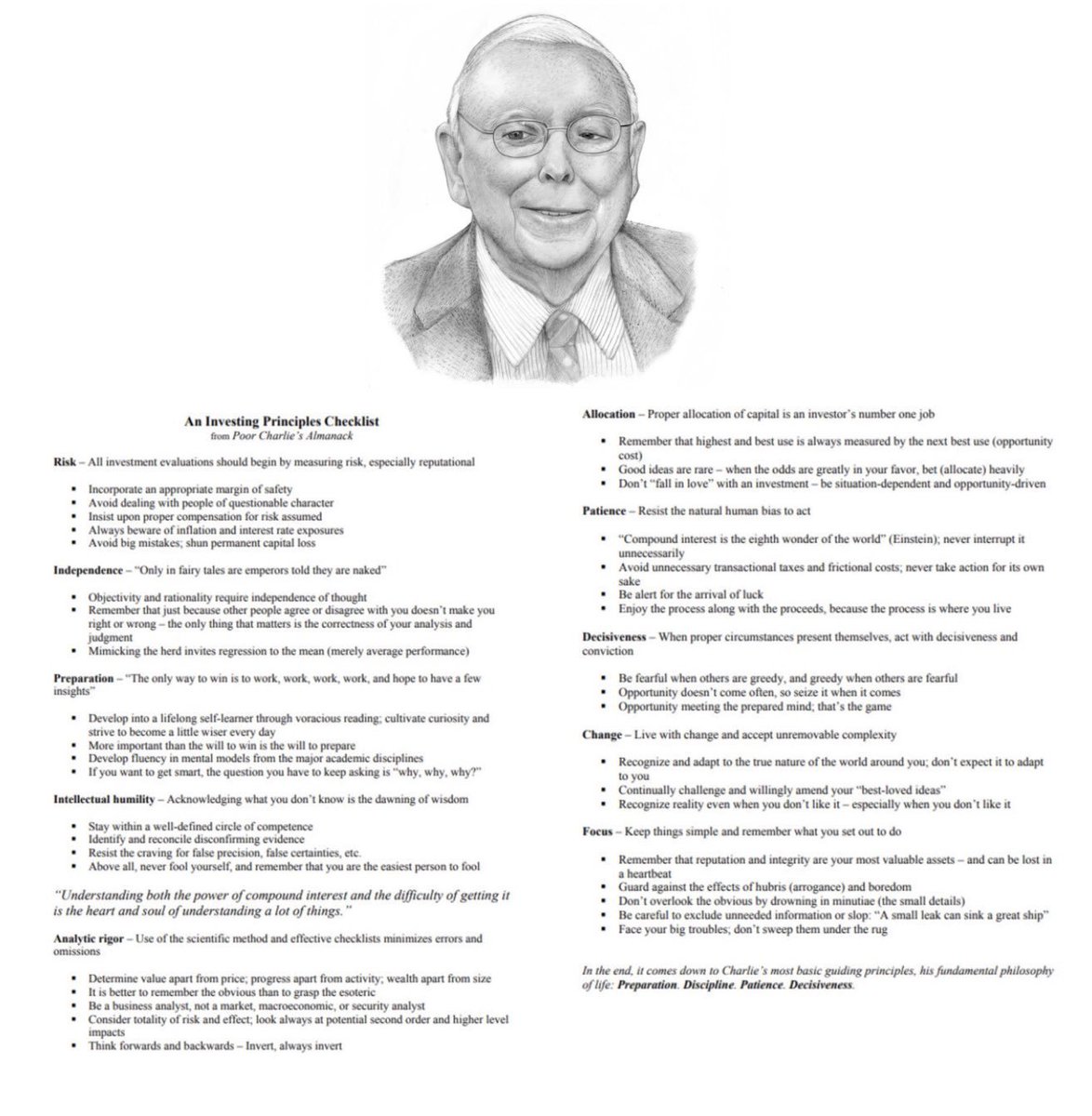

Charlie Munger uses 10 investment principles in his checklist:

▪️ Risk

▪️ Independence

▪️ Preparation

▪️ Intellectual humility

▪️ Analytical rigor

▪️ Allocation

▪️ Patience

▪️ Decisiveness

▪️ Change

▪️ Focus

▪️ Risk

▪️ Independence

▪️ Preparation

▪️ Intellectual humility

▪️ Analytical rigor

▪️ Allocation

▪️ Patience

▪️ Decisiveness

▪️ Change

▪️ Focus

1️⃣ Risk

All investment evaluations should begin by measuring risk, especially reputational.

The definition of true risk is the permanent loss of capital.

All investment evaluations should begin by measuring risk, especially reputational.

The definition of true risk is the permanent loss of capital.

2️⃣ Independence

To make good decisions, you should think independently.

You can't expect to outperform the market when you follow the herd.

To make good decisions, you should think independently.

You can't expect to outperform the market when you follow the herd.

3️⃣ Preperation

The only way to win is to work, work, work and hope to have a few good insights.

The best investors develop into lifelong self-learners.

The only way to win is to work, work, work and hope to have a few good insights.

The best investors develop into lifelong self-learners.

4️⃣ Intellectual humility

Acknowledging what you don't know is the dawning of wisdom.

Always stay withing your circle of competence.

Acknowledging what you don't know is the dawning of wisdom.

Always stay withing your circle of competence.

5️⃣ Analytic rigor

Always use checklists to minimize mistakes.

Be a business analyst, and not a security analyst.

Always use checklists to minimize mistakes.

Be a business analyst, and not a security analyst.

6️⃣ Allocation

Proper allocation is an investors' number one job.

Good ideas are very rare. Invest heavily when the odds are greatly in your favor.

Proper allocation is an investors' number one job.

Good ideas are very rare. Invest heavily when the odds are greatly in your favor.

7️⃣ Patience

Resist the natural human bias to act.

Compound interest is the eighth wonder of the world. Never interrupt it unnecessarily.

Resist the natural human bias to act.

Compound interest is the eighth wonder of the world. Never interrupt it unnecessarily.

8️⃣ Decisiveness

Always be fearful when others are greedy, and greedy when others are fearful.

Invest heavily during market corrections.

Always be fearful when others are greedy, and greedy when others are fearful.

Invest heavily during market corrections.

9️⃣ Change

Our world is changing all the time.

Always evolve and keep learning.

Our world is changing all the time.

Always evolve and keep learning.

🔟 Focus

Keep things simple and always focus on your goals.

Always remember that reputation and integrity are your most. valuable assets.

Keep things simple and always focus on your goals.

Always remember that reputation and integrity are your most. valuable assets.

The end. If you liked this, you'll love our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Start your journey here:

qualitycompounding.substack.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Start your journey here:

qualitycompounding.substack.com

Loading suggestions...