The easiest way to earn money is to take advantage of market inefficiencies.

Buying when a project is undervalued and selling when it’s overvalued 🥂

Let me show you how to find undervalued projects with @tokenterminal 🧵

Buying when a project is undervalued and selling when it’s overvalued 🥂

Let me show you how to find undervalued projects with @tokenterminal 🧵

A general rule in investment is to take advantage of undervalued projects, whether in terms of Financial ratios or global value.

Investors are looking to enter those projects or companies until the market realizes the inefficiency and brings the project to its fair value.

Investors are looking to enter those projects or companies until the market realizes the inefficiency and brings the project to its fair value.

So we understand that analyzing ratios is important, but it’s a complex and boring method to do by hand.

In this thread, I will present how to discern under and overvalued projects with @TokenTerminal's free version.

In this thread, I will present how to discern under and overvalued projects with @TokenTerminal's free version.

In short, it gathers all the important general and financial metrics regarding a protocol so you don’t have to check on multiple websites and do your own calculations.

To be relevant to the P/F and P/S categories, the project has to share a part of their earning with the token holders, the so-called real yield

To start with broad research you can land on the main page, where TT displays various data on major protocols

tokenterminal.com

To start with broad research you can land on the main page, where TT displays various data on major protocols

tokenterminal.com

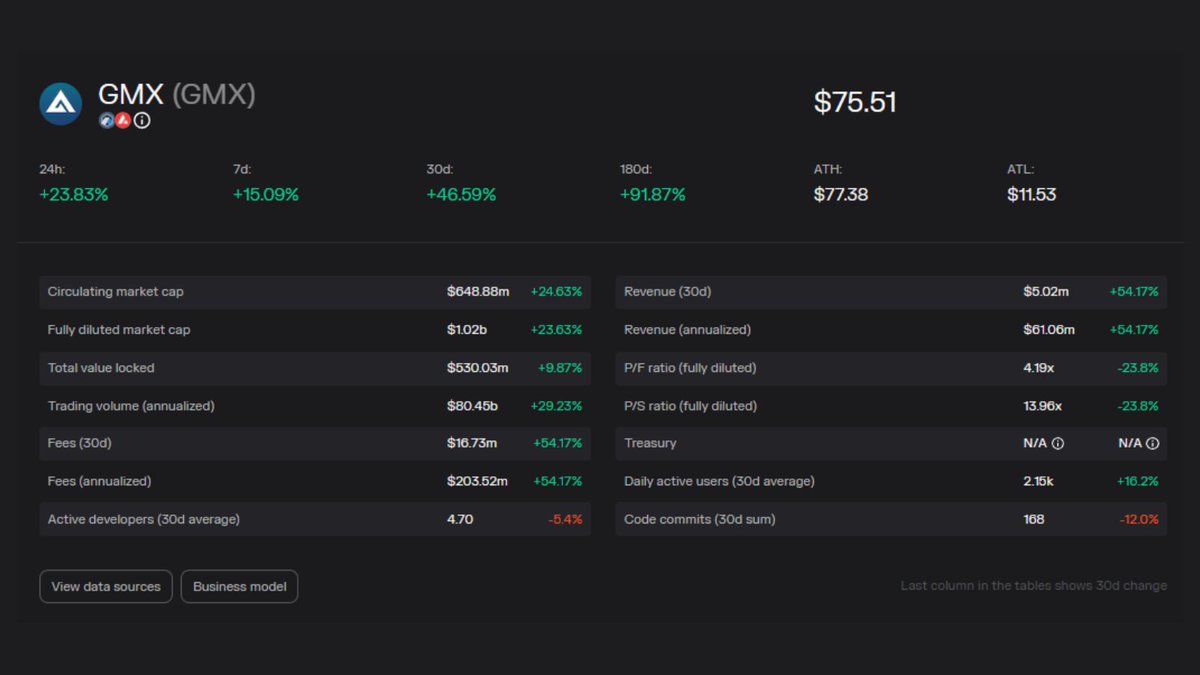

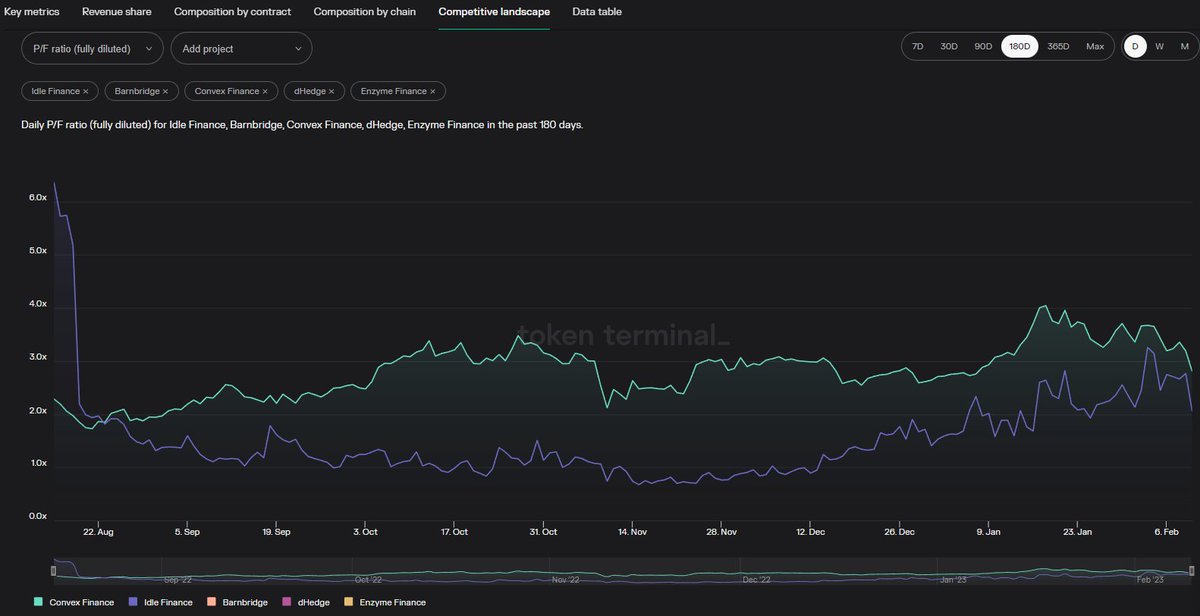

You will start looking for the lowest ratios and analyze more metrics such as the evolution in the last 30 days, the treasury, TVL...

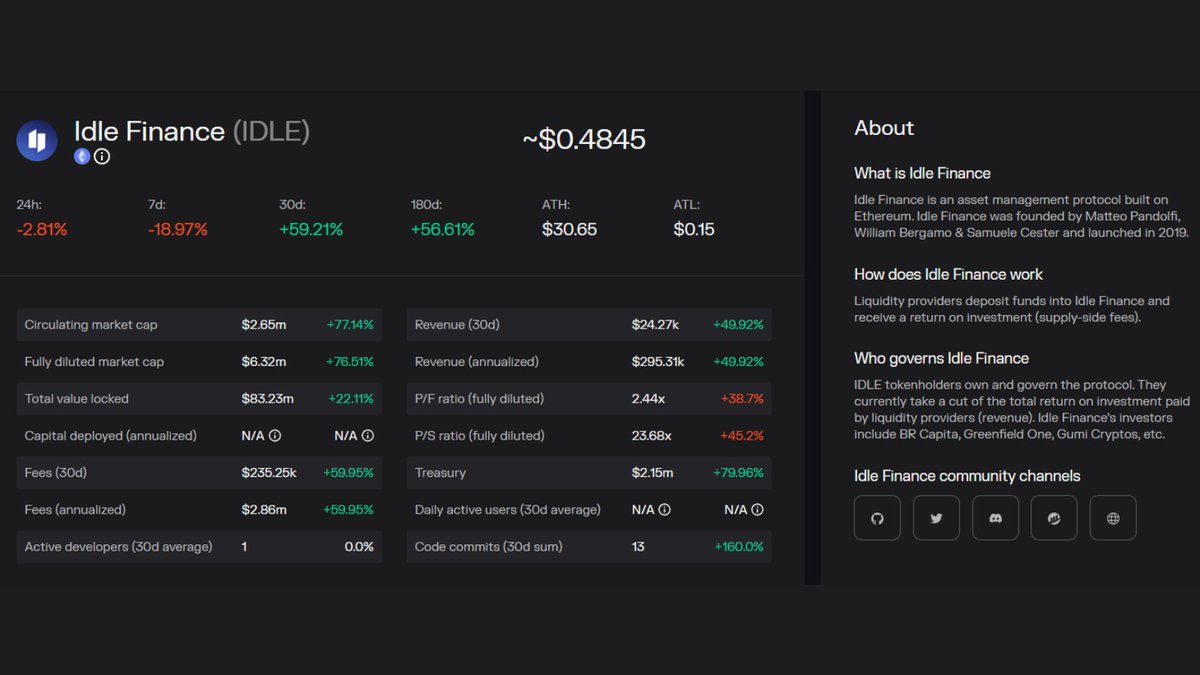

So here we can see that @idlefinance has a relatively low P/F

If you don’t know the project, Token terminal will give a brief overview

So here we can see that @idlefinance has a relatively low P/F

If you don’t know the project, Token terminal will give a brief overview

Let’s now find an example of an undervalued protocol and give some alphas to the ones still reading 🫡

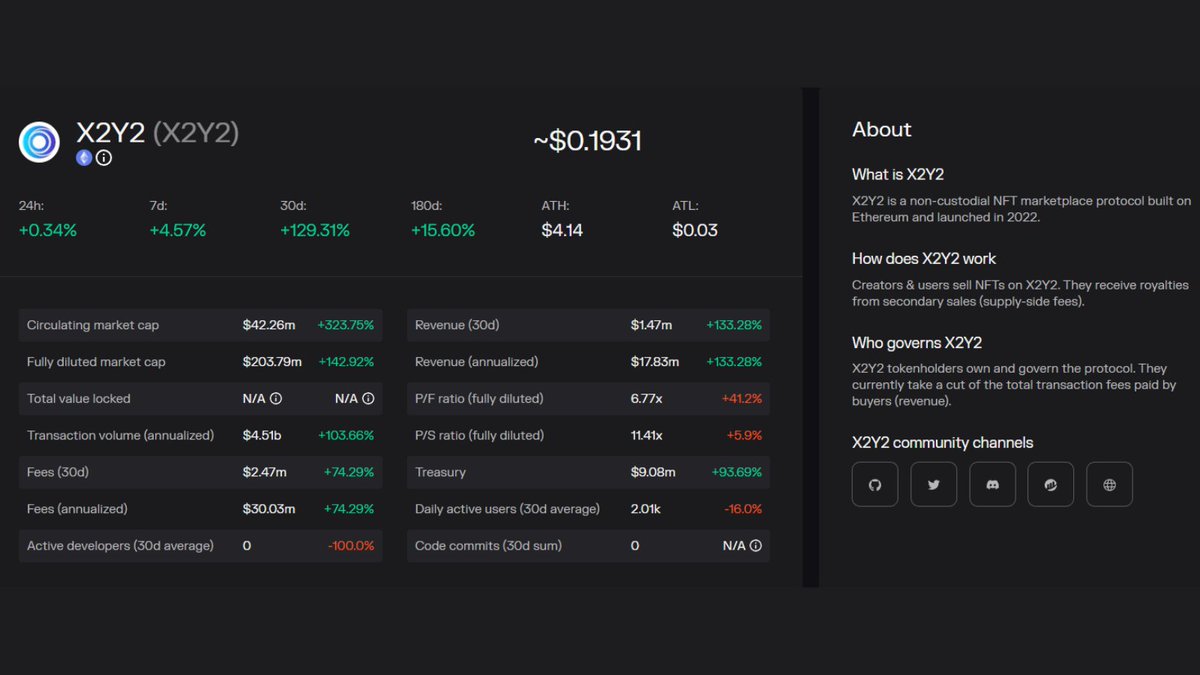

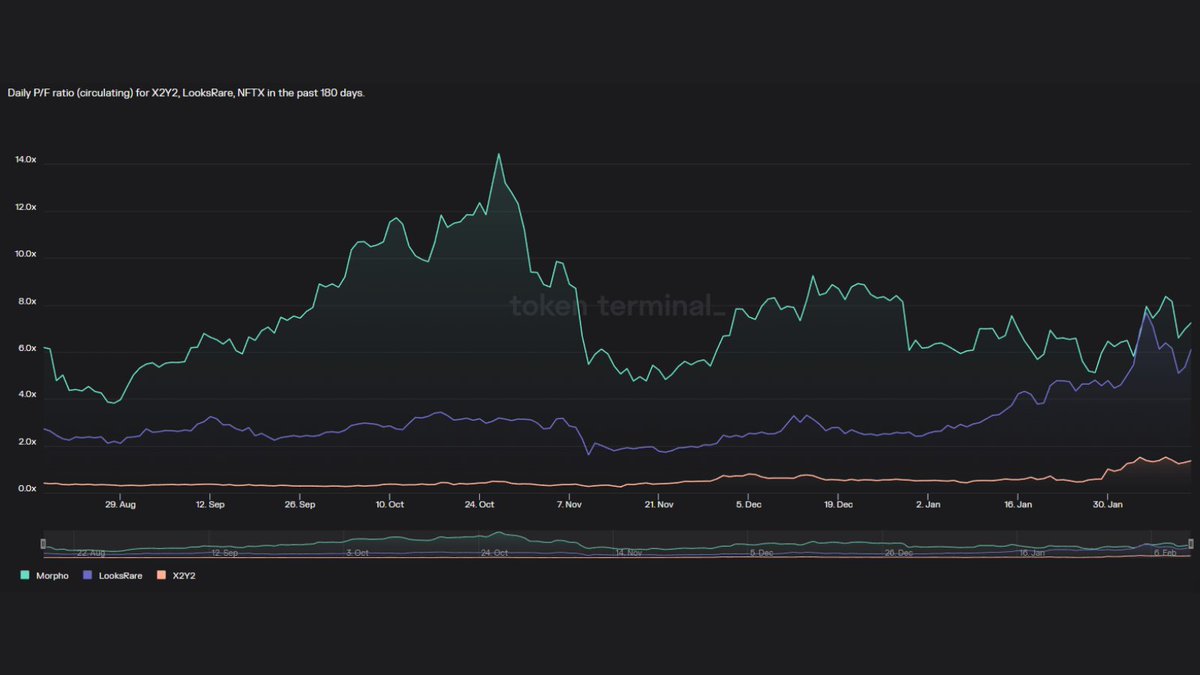

@the_x2y2 is an NFT marketplace that shares revenue with the token holders.

As we can see, the growth metrics are up only.

@the_x2y2 is an NFT marketplace that shares revenue with the token holders.

As we can see, the growth metrics are up only.

Once you found relatively attractive protocols, don’t only base your investment on financial metrics as some can have low ratios but are correctly valued

To go further with the research, I did a complete presentation on how to conduct due diligence 👇

To go further with the research, I did a complete presentation on how to conduct due diligence 👇

@tokenterminal remains one of the best tools to get started with financial metrics and draw some comparisons among protocols.

As a reminder, P/F and P/S are only relevant to projects sharing a part of their earnings, but you can use it to compare TVLs, users, FDV, ...

As a reminder, P/F and P/S are only relevant to projects sharing a part of their earnings, but you can use it to compare TVLs, users, FDV, ...

Tagging some frens that you should follow to make it

@Chinchillah_

@DeFiMinty

@Only1temmy

@GrowWithPassive

@Slappjakke

@DeFi_Cheetah

@TheDeFISaint

@0xTindorr

@crypto_linn

@WinterSoldierxz

@TheDeFinvestor

@Dynamo_Patrick

@eli5_defi

@Chinchillah_

@DeFiMinty

@Only1temmy

@GrowWithPassive

@Slappjakke

@DeFi_Cheetah

@TheDeFISaint

@0xTindorr

@crypto_linn

@WinterSoldierxz

@TheDeFinvestor

@Dynamo_Patrick

@eli5_defi

I hope you enjoyed this presentation, do not hesitate to give a RT and follow for more presentations 🥂

Loading suggestions...