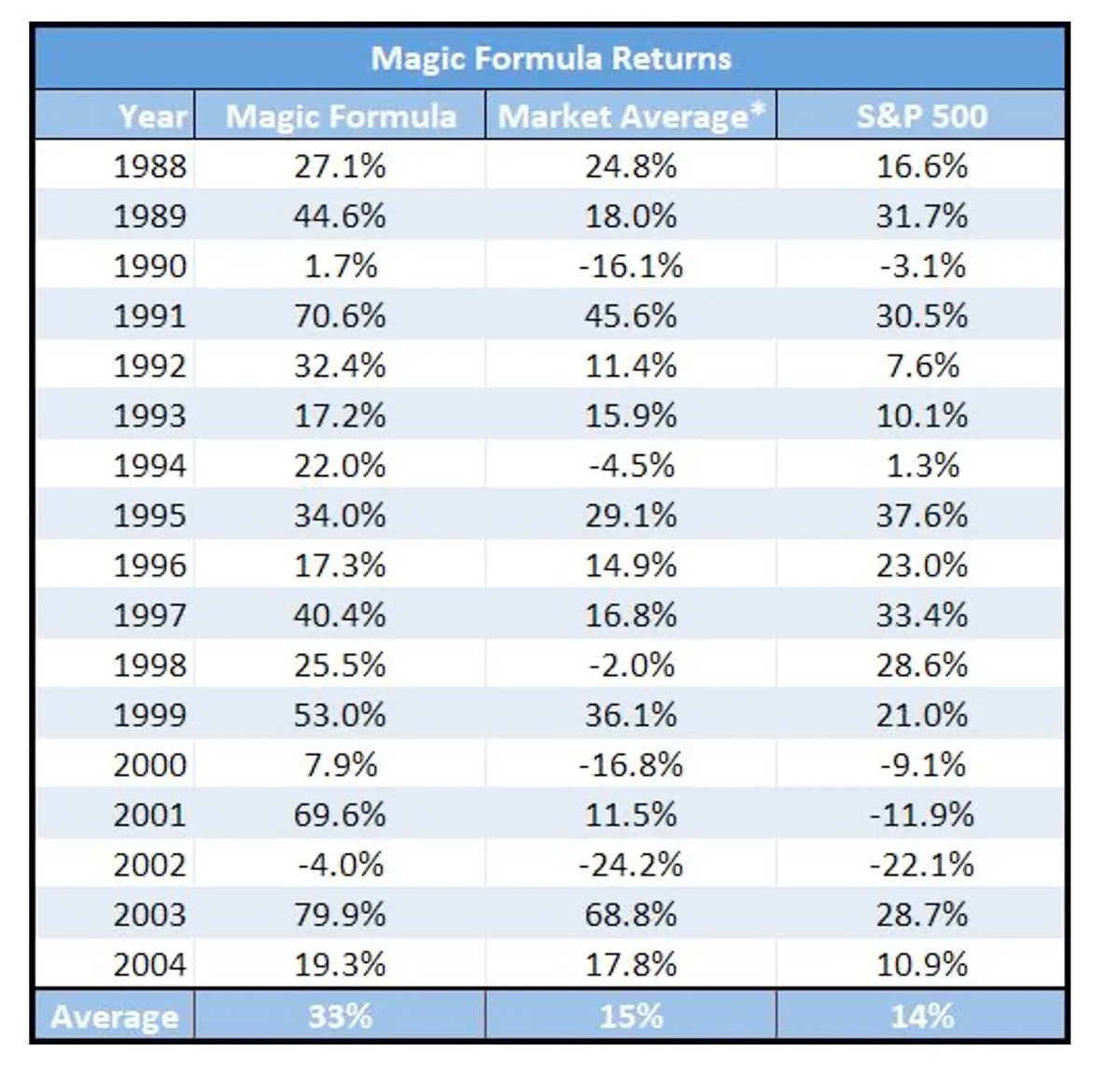

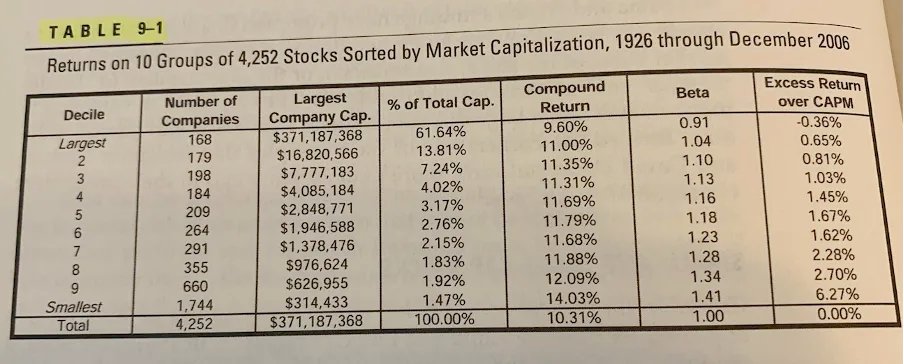

But is it so simple? Can you outperform the market by using these simple formulas? The answer is yes.

But what’s the catch?

But what’s the catch?

Never underestimate behavioral biases and investment psychology when you invest in these kind of strategies.

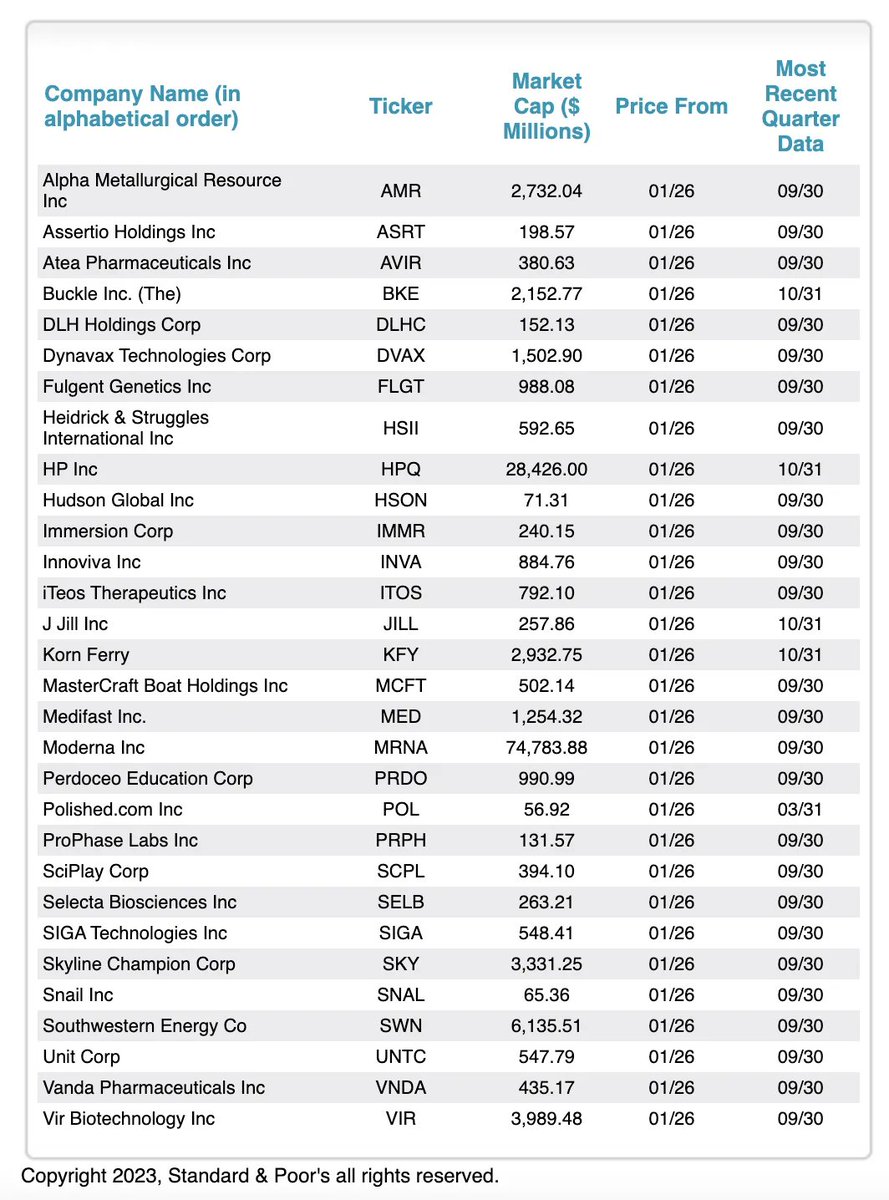

Let’s say that you started using The Magic Formula and you’re investing in small, unknown companies like Polished and Snail Inc...

Let’s say that you started using The Magic Formula and you’re investing in small, unknown companies like Polished and Snail Inc...

... After 2 years, your return is equal to -28% while the S&P500 returned +15%. Would you pursue?

Because that’s what needed to make this strategy a success.

Because that’s what needed to make this strategy a success.

1. Don’t try to time the market

Timing the market is a fools game.

Market timing has nothing to do with being a successful investor.

Timing the market is a fools game.

Market timing has nothing to do with being a successful investor.

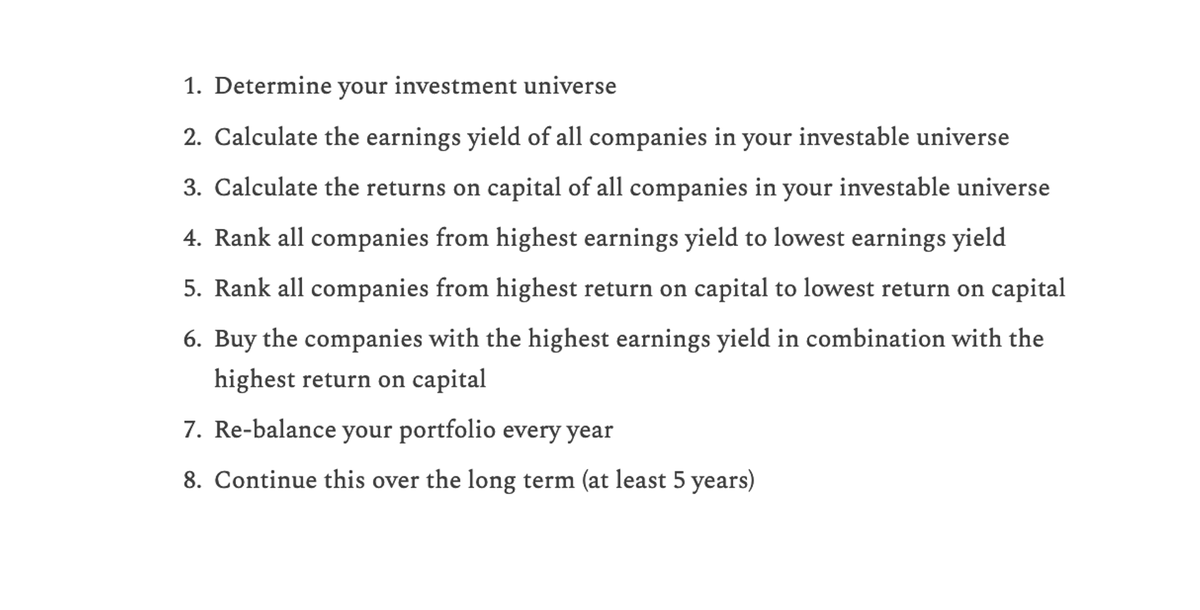

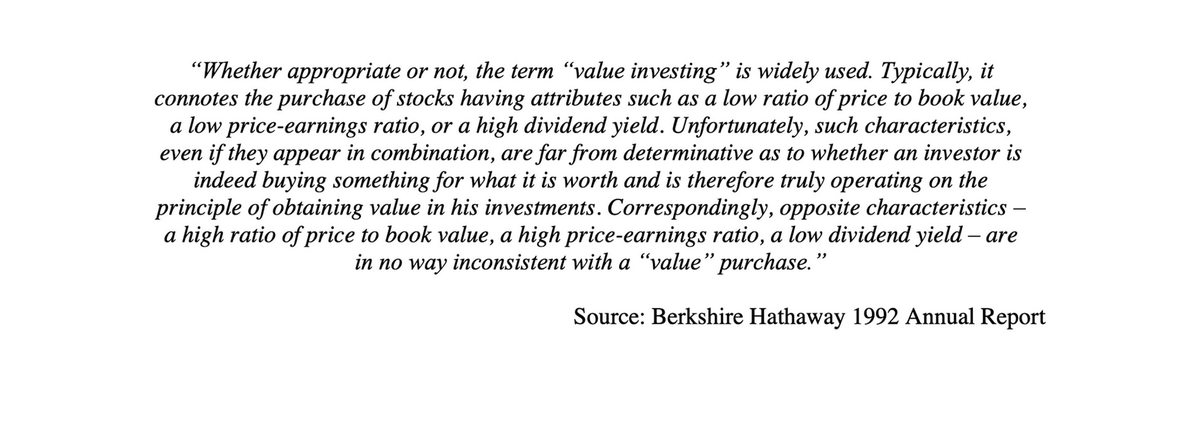

2. Buy good business at bargain prices

Buying a share of a good business is better than buying a share of a bad business.

You want to invest in companies which are able to reinvest their free cash flow at high rates of return.

Buying a share of a good business is better than buying a share of a bad business.

You want to invest in companies which are able to reinvest their free cash flow at high rates of return.

3. Know what you own

Investing is simple, but not easy.

Focus on easy companies in easy industries.

Always invest within your circle of competence.

Investing is simple, but not easy.

Focus on easy companies in easy industries.

Always invest within your circle of competence.

4. You will underperform

By definition, you will underperform the market from time to time.

Always focus on the big picture.

When you are using a strategy that has proven to work in the long term, you’ll end up fine.

By definition, you will underperform the market from time to time.

Always focus on the big picture.

When you are using a strategy that has proven to work in the long term, you’ll end up fine.

5. Every investor is unique

You can borrow someone’s idea, but you can’t borrow their conviction.

Every investor is unique and has its own objectives.

As an investor, you are always running your own marathon.

You can borrow someone’s idea, but you can’t borrow their conviction.

Every investor is unique and has its own objectives.

As an investor, you are always running your own marathon.

7. Determine your risk appetite

Howard Mark once said that there are old investors and there are bold investors, but they are no old bold investors.

Never make investments which will cause you to stay awake at night.

Howard Mark once said that there are old investors and there are bold investors, but they are no old bold investors.

Never make investments which will cause you to stay awake at night.

8. The market will eventually be right

If your investment case was correct, Mr. Market will eventually pay you.

In the short term (1-2 years), the market is inefficient.

But in the long-term, the market always gets it right.

If your investment case was correct, Mr. Market will eventually pay you.

In the short term (1-2 years), the market is inefficient.

But in the long-term, the market always gets it right.

9. Never underestimate incentives

Always look at management incentives.

How have they allocated capital in the past? Is their salary too high? Is there heavy insider buying or selling? What’s their track record?

Always look at management incentives.

How have they allocated capital in the past? Is their salary too high? Is there heavy insider buying or selling? What’s their track record?

The end.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

In this article we mapped all Greenblatt's class notes (> 300 pages) in 1 PDF for free:

qualitycompounding.substack.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

In this article we mapped all Greenblatt's class notes (> 300 pages) in 1 PDF for free:

qualitycompounding.substack.com

Loading suggestions...