1/ The DeFi stablecoins took a hit when UST collapsed, but DAI, FRAX, and LUSD held strong.

Now, GHO & crvUSD are preparing to join the space, bringing new innovations.

With regulators cracking down on BUSD – here's the bullish case for #DeFi stablecoins: 🐂

Now, GHO & crvUSD are preparing to join the space, bringing new innovations.

With regulators cracking down on BUSD – here's the bullish case for #DeFi stablecoins: 🐂

2/ Question: Which of the DeFi tokens would you hold to escape crypto volatility without expecting to earn any interest on it?

It would just sit in your wallet doing nothing.

It would just sit in your wallet doing nothing.

4/ The same monetary premium applies to centralized stablecoins.

The premium depends on their adoption, regulation compliance, liquidity and trust.

Now, the SEC charge against BUSD is shattering BUSD's monetary premium in favor of USDC, USDT, but mostly for DeFi stablecoins.

The premium depends on their adoption, regulation compliance, liquidity and trust.

Now, the SEC charge against BUSD is shattering BUSD's monetary premium in favor of USDC, USDT, but mostly for DeFi stablecoins.

5/ You can think of this premium as the US dollar has over other currencies:

It comes from reserve currency status, political stability, military & economic power, and financial markets.

Various factors are involved, and time is required to earn this monetary premium.

It comes from reserve currency status, political stability, military & economic power, and financial markets.

Various factors are involved, and time is required to earn this monetary premium.

6/ By the way, you can read this post with more details on my blog:

ignasdefi.substack.com

ignasdefi.substack.com

7/ $UST had a low monetary premium—it wasn't used as a ‘parking space’ to excape crypto volatility and was a risk asset to farm 20% APY on Anchor.

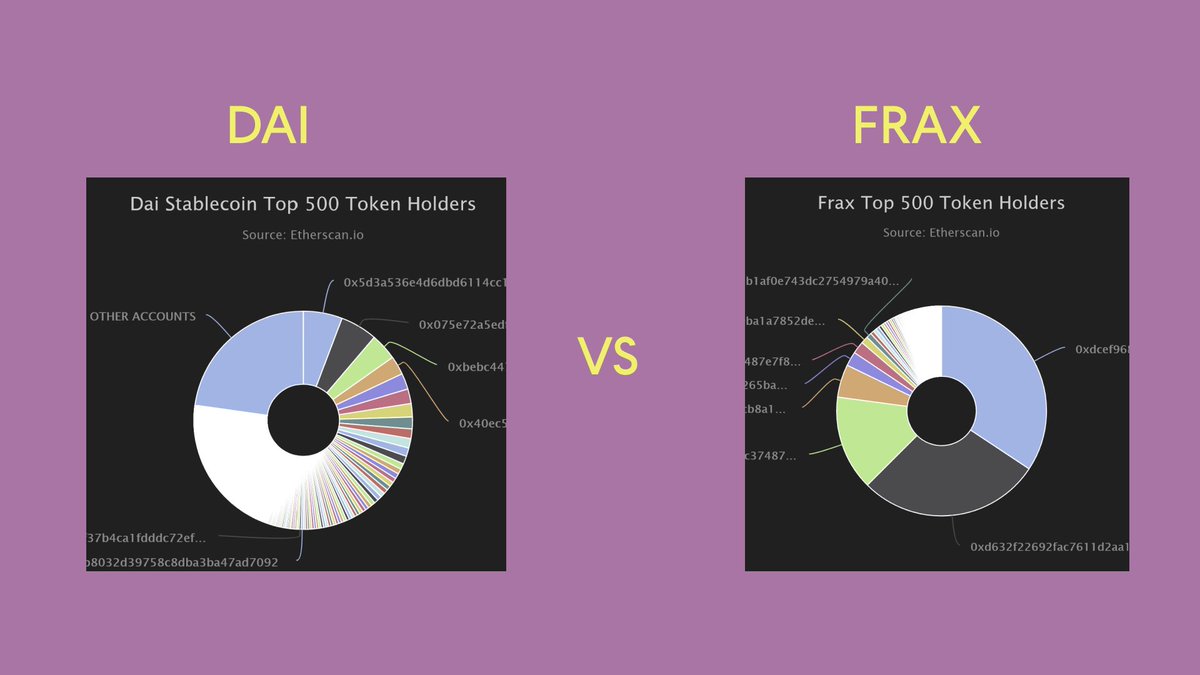

Having said that, DeFi stablecoins like FRAX and LUSD are building their monetary premiums and catching up with DAI.

Having said that, DeFi stablecoins like FRAX and LUSD are building their monetary premiums and catching up with DAI.

8/ It might seem they are substitutes, but each has a purpose.

DAI has shifted its focus to generating revenue from RWAs while the regulators allow.

Yet he goal is an Unbiased World Currency backed by decentralized, physically resilient collateral.

DAI has shifted its focus to generating revenue from RWAs while the regulators allow.

Yet he goal is an Unbiased World Currency backed by decentralized, physically resilient collateral.

9/ Liquity's (LUSD) mission is the same: to be the "most decentralized stablecoin capable of resisting all kinds of censorship."

But, it achieves this with minimal governance, no exposure to RWAs, only using ETH as collateral, and without abandoning the USD peg (unlike DAI).

But, it achieves this with minimal governance, no exposure to RWAs, only using ETH as collateral, and without abandoning the USD peg (unlike DAI).

10/ LUSD won't (probably) overtake DAI in market cap due to its design and immutable smart contracts.

However, it serves as a niche stablecoin for those concerned about centralization and censorship risks, while still maintaining a peg to USD.

However, it serves as a niche stablecoin for those concerned about centralization and censorship risks, while still maintaining a peg to USD.

12/ A Fed Master Account would allow holding dollars and transacting with the Federal Reserve directly, making FRAX the closest thing to a risk-free dollar.

This would enable FRAX to ditch USDC collateral and scale to a market cap of hundreds of billions of dollars.

This would enable FRAX to ditch USDC collateral and scale to a market cap of hundreds of billions of dollars.

15/ Synthetix's sUSD usage is also pragmatic and tied to it's own DeFi ecosystem:

• Kwenta - exchange

• Lyra - options

• Polynomial - structured vaults

• Thales - binary options

sUSD adoption depends on the growth of its DeFi products but its monetary premium is low.

• Kwenta - exchange

• Lyra - options

• Polynomial - structured vaults

• Thales - binary options

sUSD adoption depends on the growth of its DeFi products but its monetary premium is low.

16/ In an interesting change in direction, Maker wants to build its own DeFi ecosystem like Frax.

Maker is building a lending protocol and a synthetic LSD - EtherDAI - to create more utility & demand for DAI.

Maker is building a lending protocol and a synthetic LSD - EtherDAI - to create more utility & demand for DAI.

17/ My initial thought was that Spark Protocol is a clear competitor to Aave and a counter-move for $GHO

But that doesn't mean Maker and Aave shouldn't cooperate in the future.

In fact, I think cooperation is the most bullish outcome for both.

Let me explain:

But that doesn't mean Maker and Aave shouldn't cooperate in the future.

In fact, I think cooperation is the most bullish outcome for both.

Let me explain:

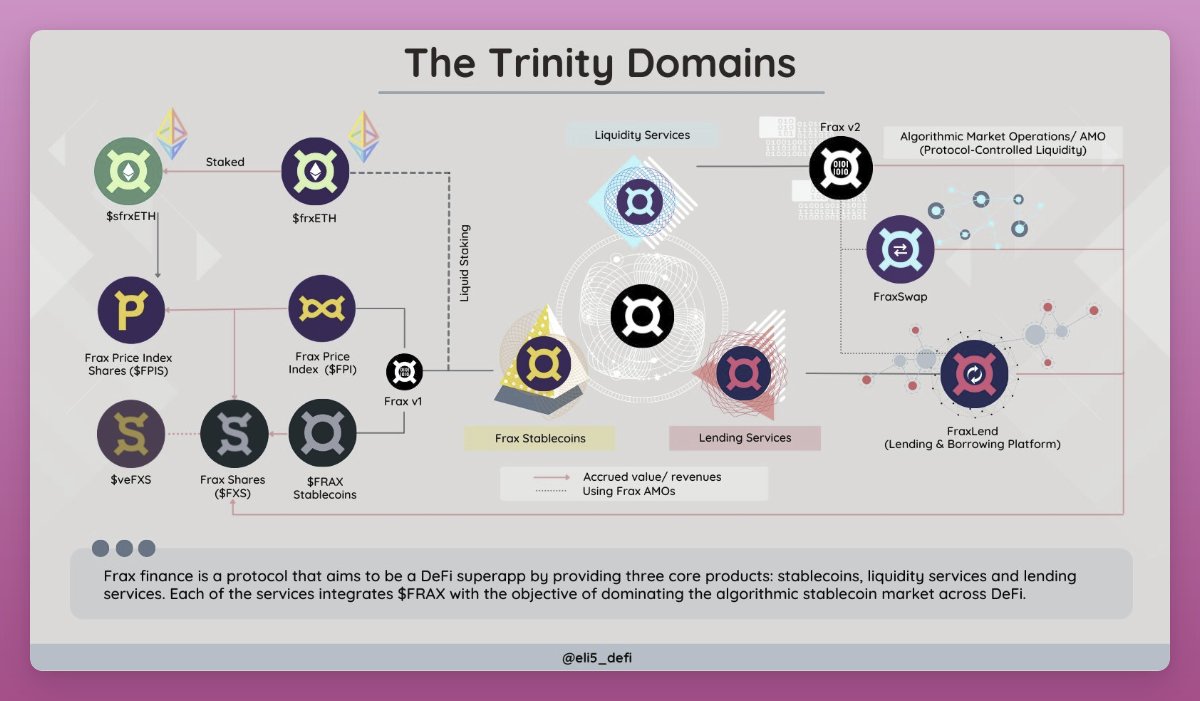

18/ Everything Frax has built is focused on empowering the FRAX stablecoin.

Similarly, Maker's new protocols will serve to increase utility for DAI.

For Maker, DAI as the Unbiased World Currency is the ultimate motivation, with new protocols being built to make it happen.

Similarly, Maker's new protocols will serve to increase utility for DAI.

For Maker, DAI as the Unbiased World Currency is the ultimate motivation, with new protocols being built to make it happen.

19/ Aave's mission, however, is different: It seeks to be the #1 money market protocol and $GHO is a tool to achieve the goal.

In short: DAI is the mission; Spark protocol is a tool.

For Aave, money market is the mission; $GHO is the tool.

In short: DAI is the mission; Spark protocol is a tool.

For Aave, money market is the mission; $GHO is the tool.

20/ Venus stablecoin $VAI is a perfect example.

It's a successful lending protocol on BNB Chain with $855M in TVL.

At its peak of $250M market cap, $VAI was bigger than FRAX —now it trades under peg ($0.94) with just 60K in 24h volume.

It's a successful lending protocol on BNB Chain with $855M in TVL.

At its peak of $250M market cap, $VAI was bigger than FRAX —now it trades under peg ($0.94) with just 60K in 24h volume.

21/ VAI isn't a priority to Venus; the lending protocol itself is the mission.

Still, $VAI has helped Venus to grow to where it is today.

Still, $VAI has helped Venus to grow to where it is today.

22/ Anyway, if this is how the founders truly think, then all stablecoins can co-exist and even support each other's growth.

Making DAI available on Aave means that more $GHO can be minted by the protocol, and $GHO could be supported on Spark Protocol as well.

Making DAI available on Aave means that more $GHO can be minted by the protocol, and $GHO could be supported on Spark Protocol as well.

23/ Same logic applies to Curve's crvUSD.

Curve is the backbone of spot liquidity in DeFi, and crvUSD will help make the protocol more capital efficient.

Thus, crvUSD isn't a threat to FRAX or DAI - it can actually increase spot liquidity for all DeFi stablecoins.

Curve is the backbone of spot liquidity in DeFi, and crvUSD will help make the protocol more capital efficient.

Thus, crvUSD isn't a threat to FRAX or DAI - it can actually increase spot liquidity for all DeFi stablecoins.

24/ Thus, I'm bullish on them because they offer unique differentiation.

They recognize that regulation is important, but have different approaches to deal with it:

DAI & LUSD seek to make themselves censorship resistant, while Frax is getting as close to the Fed as possible.

They recognize that regulation is important, but have different approaches to deal with it:

DAI & LUSD seek to make themselves censorship resistant, while Frax is getting as close to the Fed as possible.

25/ While GHO and crvUSD might appear like increased competition, their focus is to improve the underlying protocols.

They can all work together to strengthen each other in their own unique way.

Plus, with regulators on our heels, cooperation is needed now more than ever.

They can all work together to strengthen each other in their own unique way.

Plus, with regulators on our heels, cooperation is needed now more than ever.

26/ Let me know your thoughts!

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...