𝗣𝗶𝗹𝗹𝗮𝗿𝘀 𝗼𝗳 𝗮 𝗧𝗿𝗮𝗱𝗶𝗻𝗴

🔸 𝘗𝘴𝘺𝘤𝘩𝘰𝘭𝘰𝘨𝘺

🔸 𝘔𝘢𝘳𝘬𝘦𝘵 𝘈𝘯𝘢𝘭𝘺𝘴𝘪𝘴 𝘢𝘯𝘥 𝘛𝘳𝘢𝘥𝘪𝘯𝘨 𝘚𝘺𝘴𝘵𝘦𝘮𝘴

🔸 𝘔𝘰𝘯𝘦𝘺 𝘔𝘢𝘯𝘢𝘨𝘦𝘮𝘦𝘯𝘵

[2/18]

🔸 𝘗𝘴𝘺𝘤𝘩𝘰𝘭𝘰𝘨𝘺

🔸 𝘔𝘢𝘳𝘬𝘦𝘵 𝘈𝘯𝘢𝘭𝘺𝘴𝘪𝘴 𝘢𝘯𝘥 𝘛𝘳𝘢𝘥𝘪𝘯𝘨 𝘚𝘺𝘴𝘵𝘦𝘮𝘴

🔸 𝘔𝘰𝘯𝘦𝘺 𝘔𝘢𝘯𝘢𝘨𝘦𝘮𝘦𝘯𝘵

[2/18]

How to keep Emotions in check ?

🔸 𝗕𝗲 𝗥𝗲𝗮𝗹𝗶𝘀𝘁𝗶𝗰 : Don’t Expect 10% in a month or doubling your account every 6 months , Anywhere between 2 to 5% per month is a great return

🔸 Keep a Trading Journal : helps you identify your weakness , strengths.

[3/18]

🔸 𝗕𝗲 𝗥𝗲𝗮𝗹𝗶𝘀𝘁𝗶𝗰 : Don’t Expect 10% in a month or doubling your account every 6 months , Anywhere between 2 to 5% per month is a great return

🔸 Keep a Trading Journal : helps you identify your weakness , strengths.

[3/18]

🔸 Set up rules of exit before entering a trade .

🔸 Stop Trading if you feel you are overtrading , and feel your performance is lagging , Its OKAY not to trade !

[4/18]

🔸 Stop Trading if you feel you are overtrading , and feel your performance is lagging , Its OKAY not to trade !

[4/18]

🔸 𝗗𝗼𝗻'𝘁 𝗖𝗼𝘂𝗻𝘁 𝗠𝗼𝗻𝗲𝘆 : Follow the process and don’t run behind money , if you are disciplines , have a profitable system , money will automatically come it !

🔸 Practise Sound 𝗠𝗼𝗻𝗲𝘆 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁( Position Sizing , Stoploss )

[5/18

🔸 Practise Sound 𝗠𝗼𝗻𝗲𝘆 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁( Position Sizing , Stoploss )

[5/18

One Indicator to rule them all ?

Different Indicators , Different uses , Different Situations

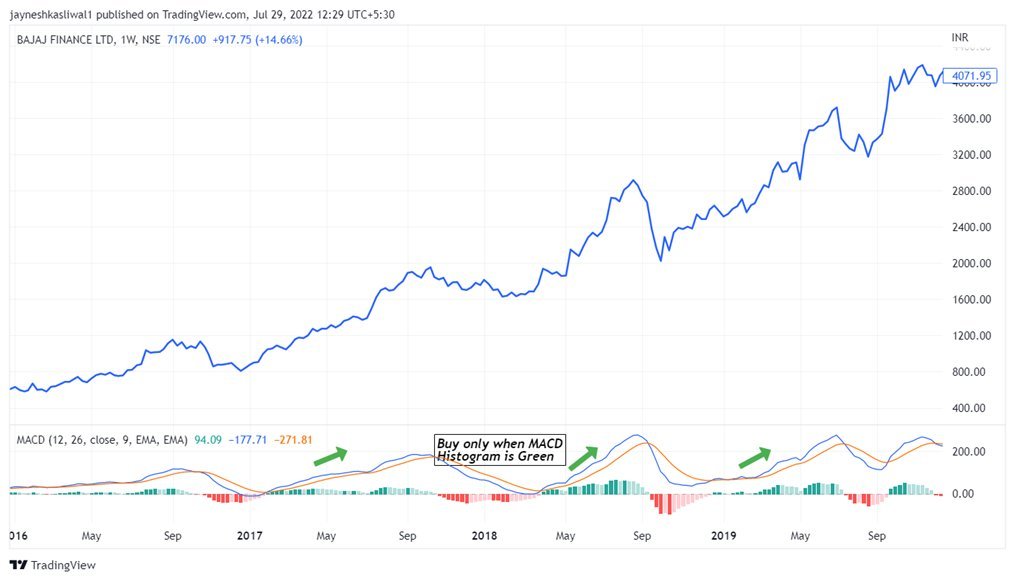

🔸 Long Term Trend Indicator ( MACD ,EMAs ADX )

🔸 OSCILLATOR ( Stochastics , RSI , MFI)

🔸 You cannot use a Trend Following indicator in sideways market

[6/18

Different Indicators , Different uses , Different Situations

🔸 Long Term Trend Indicator ( MACD ,EMAs ADX )

🔸 OSCILLATOR ( Stochastics , RSI , MFI)

🔸 You cannot use a Trend Following indicator in sideways market

[6/18

3. Rules of Thumb to use Indicators

EMAs is better than SMAs And focus on recent price data rather than average price data over a longer period of time

Weekly > Daily>Hourly> Intraday Charts

Use Few indicators , learn when to use , when not to use and how to use them

[7/18]

EMAs is better than SMAs And focus on recent price data rather than average price data over a longer period of time

Weekly > Daily>Hourly> Intraday Charts

Use Few indicators , learn when to use , when not to use and how to use them

[7/18]

𝟰. 𝗧𝗵𝗲 𝗧𝗿𝗶𝗽𝗹𝗲 𝗦𝗰𝗿𝗲𝗲𝗻 𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗦𝘆𝘀𝘁𝗲𝗺

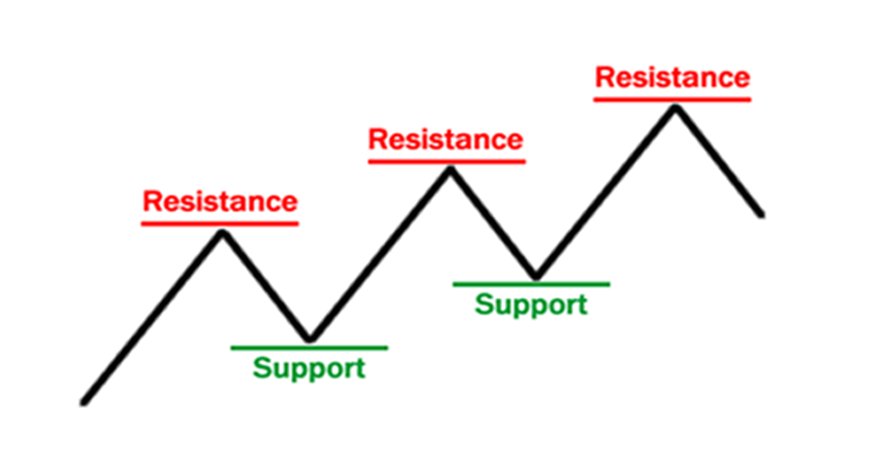

🔸 Trend is your friend ?

🔸 Buy Low , Sell High ?

🔸 Let your Profits Run ?

How high is high ?

And when to sell ?

Indicators can contradict each other , and they may Contradict itself.

[8/18]

🔸 Trend is your friend ?

🔸 Buy Low , Sell High ?

🔸 Let your Profits Run ?

How high is high ?

And when to sell ?

Indicators can contradict each other , and they may Contradict itself.

[8/18]

Market wave : Need to buy at correct places even in longer term trend as you may get stopped out

𝗜𝗻𝘁𝗿𝗮𝗱𝗮𝘆 𝗕𝗿𝗲𝗮𝗸𝗼𝘂𝘁

•When buying use Buying -Sell Stop and enter on breakouts if the longer term allows you to buy and Use stoploss as breakout candle low

[11/18]

𝗜𝗻𝘁𝗿𝗮𝗱𝗮𝘆 𝗕𝗿𝗲𝗮𝗸𝗼𝘂𝘁

•When buying use Buying -Sell Stop and enter on breakouts if the longer term allows you to buy and Use stoploss as breakout candle low

[11/18]

𝗣𝗼𝘀𝗶𝘁𝗶𝗼𝗻 𝗦𝗶𝘇𝗶𝗻𝗴

If you are long , then shift your stoploss upwards and not downwards !

How to Position Size ?

Capital = 1,00,000

Risk Per day = 2000

Stock Price =100

Stoploss = 90 ( Example Low of candle )

Qty = 2000/10 Rs

Total Qty = 200 !

[14/18]

If you are long , then shift your stoploss upwards and not downwards !

How to Position Size ?

Capital = 1,00,000

Risk Per day = 2000

Stock Price =100

Stoploss = 90 ( Example Low of candle )

Qty = 2000/10 Rs

Total Qty = 200 !

[14/18]

𝗠𝗼𝗻𝗲𝘆 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝟭𝟬𝟭

1.Survival,

2.Steady returns,

3.High returns

[15/18]

1.Survival,

2.Steady returns,

3.High returns

[15/18]

If you like this thread please retweet the first tweet and follow me for more!

@JayneshKasliwal

@JayneshKasliwal

جاري تحميل الاقتراحات...

![𝟯𝟬 𝗘𝗠𝗔 𝘃𝘀 𝗦𝘂𝗽𝗲𝗿𝘁𝗿𝗲𝗻𝗱 𝗪𝗲𝗲𝗸𝗹𝘆

[10/18] https://t.co/UKjPMRJ3zT](https://pbs.twimg.com/media/FohhXAcakAAU4Qk.jpg)

![𝟯𝟬 𝗘𝗠𝗔 𝘃𝘀 𝗦𝘂𝗽𝗲𝗿𝘁𝗿𝗲𝗻𝗱 𝗪𝗲𝗲𝗸𝗹𝘆

[10/18] https://t.co/UKjPMRJ3zT](https://pbs.twimg.com/media/FohhY3aaYAEoXje.jpg)

![The Triple Confirmation Trading System

[12/18] https://t.co/RR7R8alEov](https://pbs.twimg.com/media/Fohhk6bakAAfcdn.jpg)