#32 @GearboxProtocol

hidden gem of defi lending

high leverage+Decentralised Undercollateralized lending

📍In the 🧵

1)Gearbox TLDR

2)What is gearbox

3)How does it work

4)$gear token

5)Opportunity & Challenges

6)How🐑play the $gear token trade, what catalyst i follow

7)Summary

hidden gem of defi lending

high leverage+Decentralised Undercollateralized lending

📍In the 🧵

1)Gearbox TLDR

2)What is gearbox

3)How does it work

4)$gear token

5)Opportunity & Challenges

6)How🐑play the $gear token trade, what catalyst i follow

7)Summary

It allow DeFi-native under-collateralized loan via “credit accounts”, essentially a group of smart contracts that can act as a custodial to hold user’s leveraged position as collateral as well. This allow high capital efficiency trustlessly and chances of bad debt.

Passive lenders essentially earns interest via providing capital for Borrowers to leverage.

Borrowers utilise capital from passive lenders to leverage up their position. They can borrow up to 10x of what their notional size is.

Borrowers utilise capital from passive lenders to leverage up their position. They can borrow up to 10x of what their notional size is.

📍Core parts of Gearbox

Liquidity providers (passive lenders)

Credit Account (essentially smart contracts that executes & hold the leverage position)

Trader (Borrowers)

Whitelisted Strategies

Liquidity providers (passive lenders)

Credit Account (essentially smart contracts that executes & hold the leverage position)

Trader (Borrowers)

Whitelisted Strategies

📍Protocol working flow

1) Liquidity providers (Passive lenders) deposit tokens into Pool

2) Trader deposit initial funds into credit account

3) Trader sends orders to credit managers for their preference in leverage trade/strategy

1) Liquidity providers (Passive lenders) deposit tokens into Pool

2) Trader deposit initial funds into credit account

3) Trader sends orders to credit managers for their preference in leverage trade/strategy

4) Credit manager delivers msg to credit account

5) Credit account uses tokens from Pool to execute leverage position from trader into whitelisted strategy

6) Credit account manager & Credit account will monitor health level of the leverage position for liquidation if required

5) Credit account uses tokens from Pool to execute leverage position from trader into whitelisted strategy

6) Credit account manager & Credit account will monitor health level of the leverage position for liquidation if required

📍Whitelisted Strategies on gear

- One-Click Strategies

- Leveraged stablecoin farming

- Leverage vanilla yVaults

- Farming long/short or “free leverage position”

- Arbitrage of correlated assets

- One-Click Strategies

- Leveraged stablecoin farming

- Leverage vanilla yVaults

- Farming long/short or “free leverage position”

- Arbitrage of correlated assets

📍Key things to note

- Currently is only whitelisted wallets to be a trader

- Trader should be ready to borrow US$100K minimum

- New Strategy is done via Dao voting

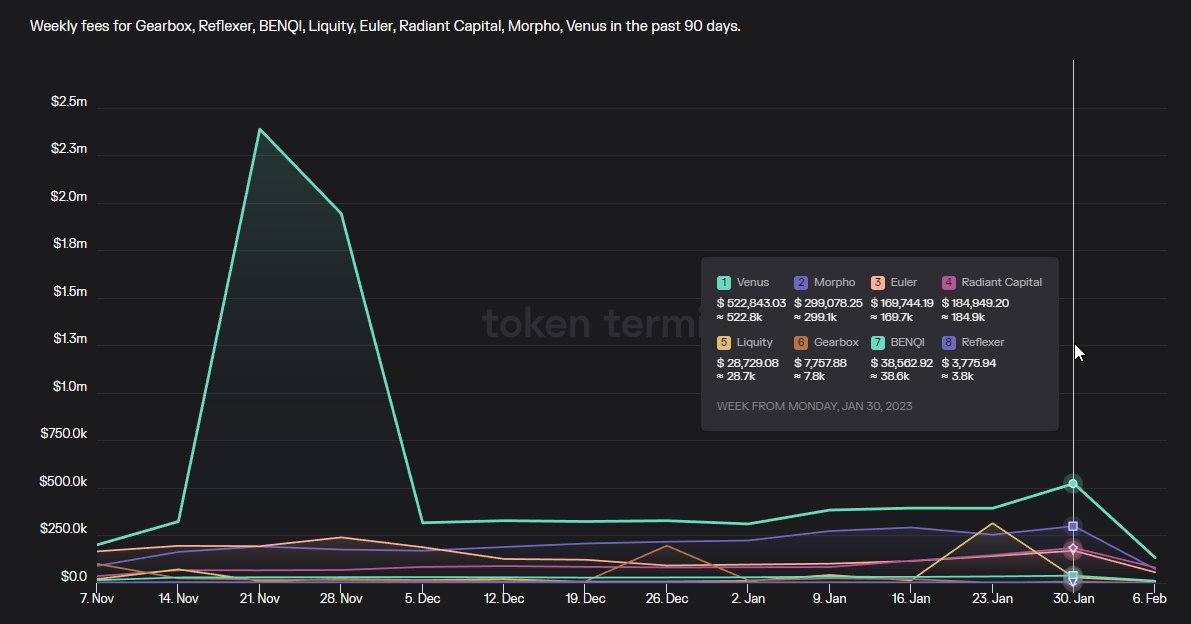

- Protocol Fees 1.5% liquidation fee, 50%apy spread fee

- Currently is only whitelisted wallets to be a trader

- Trader should be ready to borrow US$100K minimum

- New Strategy is done via Dao voting

- Protocol Fees 1.5% liquidation fee, 50%apy spread fee

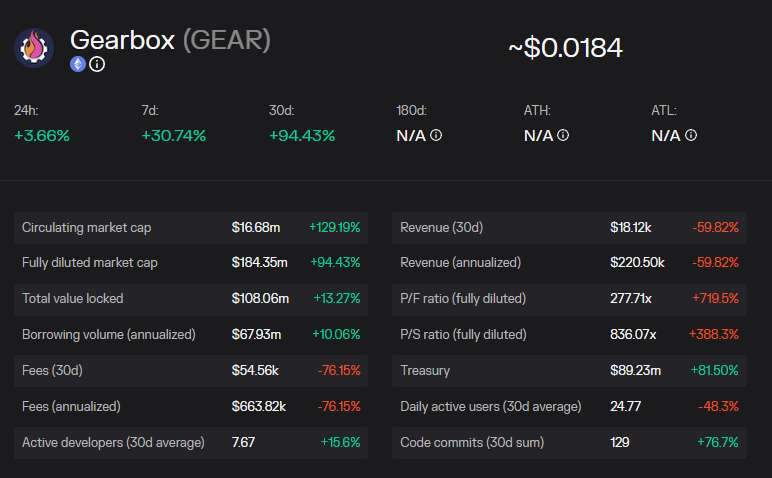

📍Gear token

Currently starting off as governance only token for the protocol and possibly taking any new function the dao could envision for it.

Currently starting off as governance only token for the protocol and possibly taking any new function the dao could envision for it.

📍Opportunity

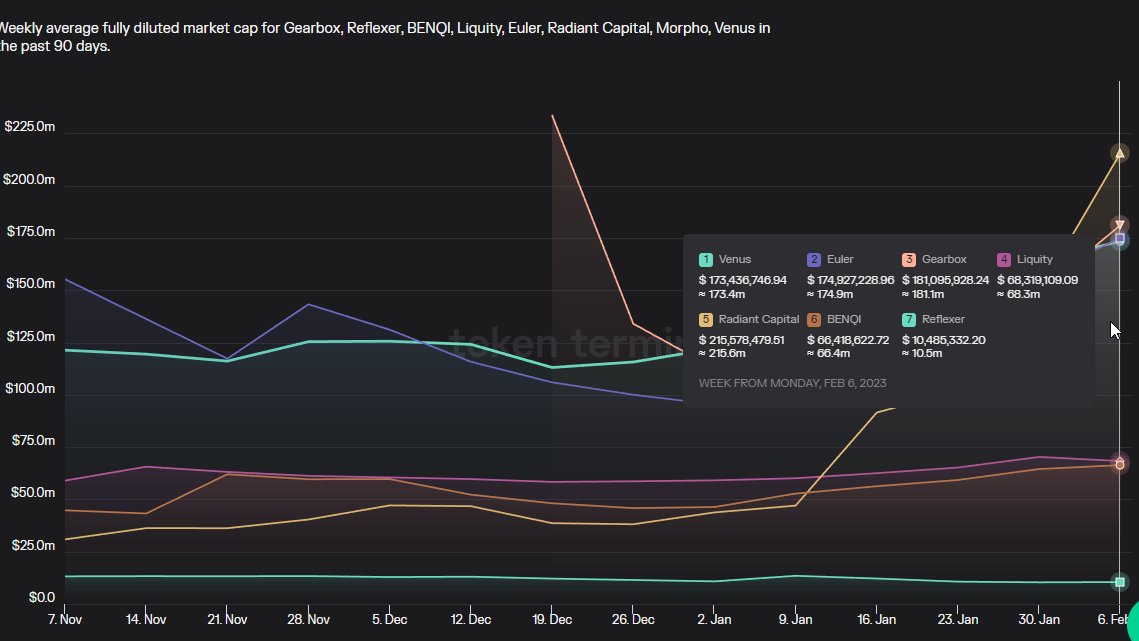

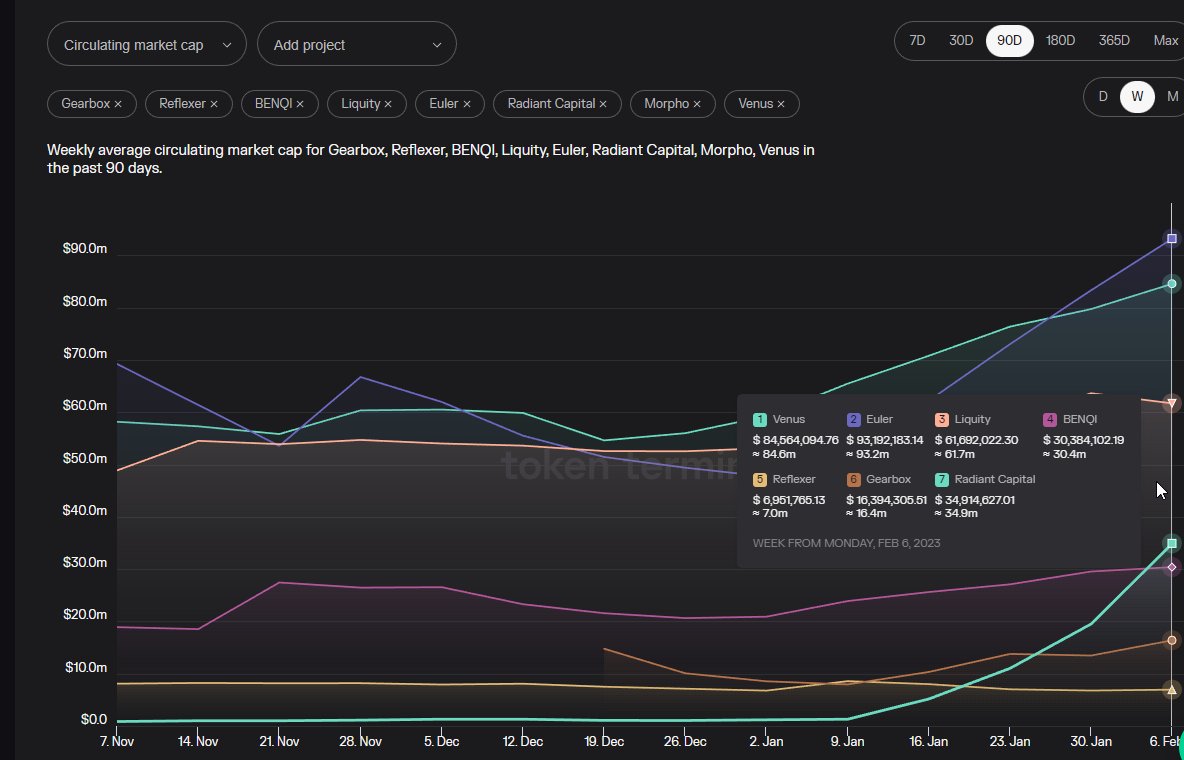

- “First”/ Go-to generate under-collateral DeFi lending protocol (however you can argue its in similar field such as leverage yield farms & strategy vaults)

- As a DeFi user, i truly thinks a non custodial under-collateral lending solves a real problem

- “First”/ Go-to generate under-collateral DeFi lending protocol (however you can argue its in similar field such as leverage yield farms & strategy vaults)

- As a DeFi user, i truly thinks a non custodial under-collateral lending solves a real problem

- New Liquid Staking Derivatives DeFi strategies + narrative

- Strong team & communities @ivangbi_ lobsterdao @10b57e6da0 One of the most high quality community defi community & tg chats

- Strong team & communities @ivangbi_ lobsterdao @10b57e6da0 One of the most high quality community defi community & tg chats

- Active Dao proposals

- Early stage of the protocol & the dao is not rushing for growth

- Token utilities to be enable

- Early stage of the protocol & the dao is not rushing for growth

- Token utilities to be enable

📍Challenges

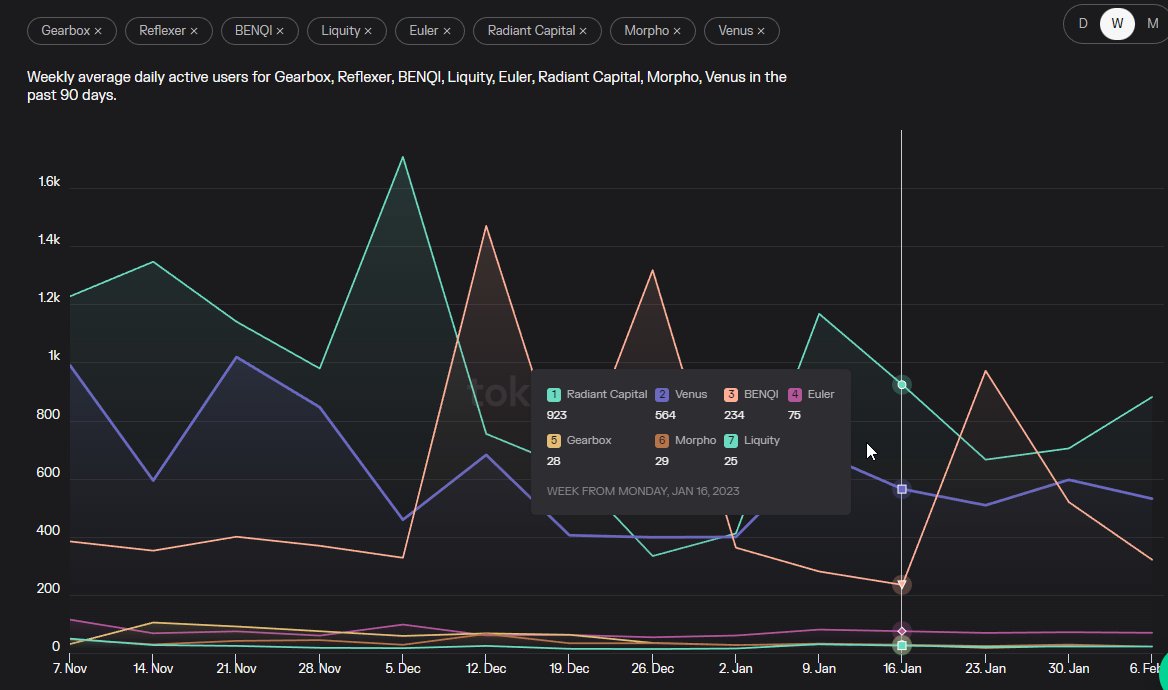

- Current market sentiment & low volatility, less demand for leverage

- heavily rely on external DeFi strategy, with lower yield in DeFi right now there are less strategies to build on top of

- Current market sentiment & low volatility, less demand for leverage

- heavily rely on external DeFi strategy, with lower yield in DeFi right now there are less strategies to build on top of

- Traders should be ready to borrow US$100K minimum

- Whitelisted and non smooth onboarding for traders

- Gear token is pure governance right now

- Whitelisted and non smooth onboarding for traders

- Gear token is pure governance right now

📍How 🐑 play the $gear token trade, what catalyst i follow

Lets look at key catalyst i’d keep eye on

- Future Token utilities (currently “preliminary discussion” on proposal-link in below)

- LSD enabled yield narrative

- Real yield narrative

Lets look at key catalyst i’d keep eye on

- Future Token utilities (currently “preliminary discussion” on proposal-link in below)

- LSD enabled yield narrative

- Real yield narrative

- Current talks of lower 100k minimum for traders

- Monitoring new listed & proposal of borrowable asset & strategies

- Monitoring new borrowable asset & strategies

- Monitoring new listed & proposal of borrowable asset & strategies

- Monitoring new borrowable asset & strategies

I haven’t drilled into the details yet but i like the protocol, need to do another deeper look into what is the best when & how to get $gear. They are currently doing some LP incentives for farming & using, and need to take a deeper look into what is the best way to get gear.

I’d properly start with just farming some $gear on a passive lender and look deeper into risk n reward for other LP strategies for $gear. Buying $gear on secondary will prob have to be based on some metric growth or catalyst I mentioned above.

📍In summary

I might be biassed towards gearbox because i am a fan of @ivangbi_ lobsterdao @10b57e6da0 even tho i got ban from speaking in the lobster TG because i was engagement farming or 2lambro’s tweets ahaha.

I might be biassed towards gearbox because i am a fan of @ivangbi_ lobsterdao @10b57e6da0 even tho i got ban from speaking in the lobster TG because i was engagement farming or 2lambro’s tweets ahaha.

I believe they have a strong community with tons of active proposal. I also like the approach of taking the more slow approach towards carefully growing instead of using tokenomics or aggressive strategies for hyper growth.

I’d consider gearbox as a good tool to use and potentially a good bet if the market picks up and it is able to ride on some catalyst I mentioned above. If ftx didnt rekt me too much i prob aggressively farm some for now.

I’d suggest everyone to have a look at their docs, well written alongside with a bit of educational material

links to token utility proposal

messari.io

Gearbox gitbook

docs.gearbox.finance

links to token utility proposal

messari.io

Gearbox gitbook

docs.gearbox.finance

@GearboxProtocol @TechFlowPost

thanks for translating my @CamelotDEX thread

this is one on @GearboxProtocol is a good one too!

engagement farming!🐑

thanks for translating my @CamelotDEX thread

this is one on @GearboxProtocol is a good one too!

engagement farming!🐑

Loading suggestions...