1/ MakerDAO just announced Spark Protocol: a competitor to Aave.

It's a sharp turn from Maker's old benign strategy of integrating $DAI into existing #DeFi protocols. Now Maker wants to build its own DeFi ecosystem.

Old Maker is dead. Long live the new Maker: 🧵

It's a sharp turn from Maker's old benign strategy of integrating $DAI into existing #DeFi protocols. Now Maker wants to build its own DeFi ecosystem.

Old Maker is dead. Long live the new Maker: 🧵

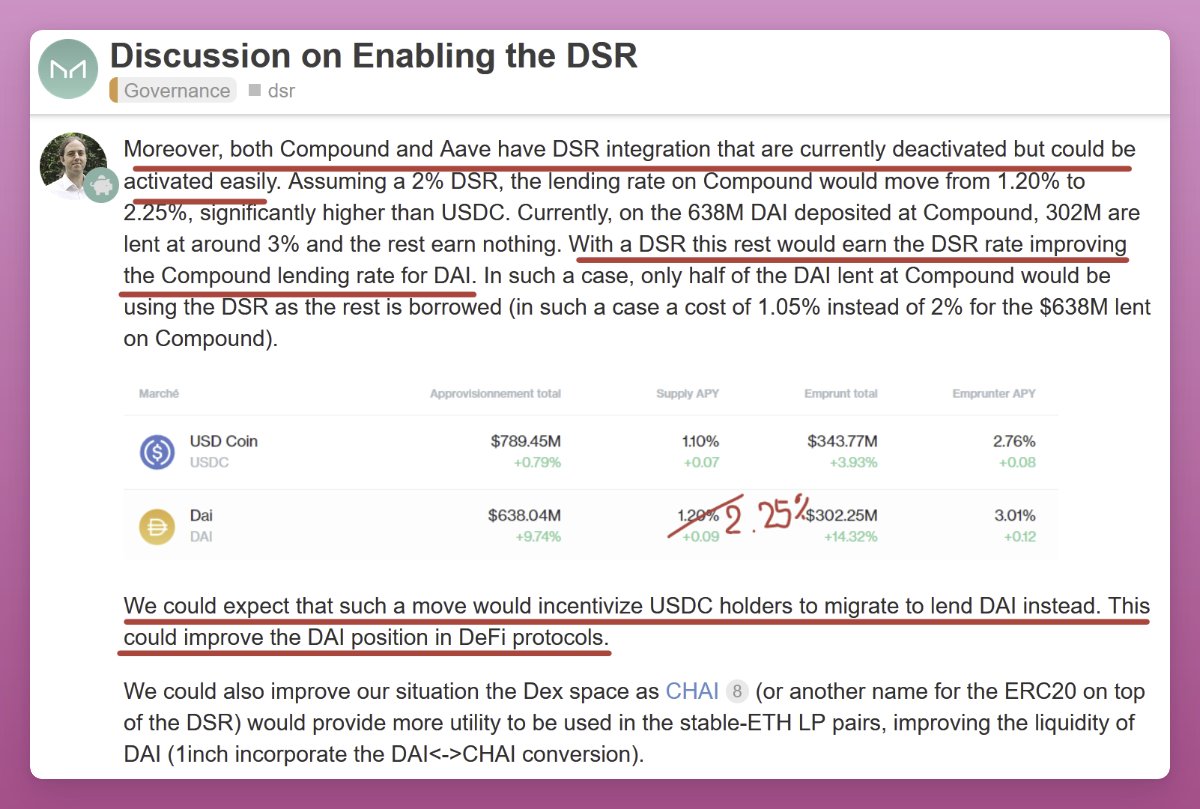

2/ Maker's strategy has been focused on integrating $DAI into leading #DeFi protocols.

For example, Maker recently enabled Dai Savings Rate (DSR) with a 1% APY yield.

The expectation was that Aave or Compound would integrate DSR and USDC holders would move to DAI.

For example, Maker recently enabled Dai Savings Rate (DSR) with a 1% APY yield.

The expectation was that Aave or Compound would integrate DSR and USDC holders would move to DAI.

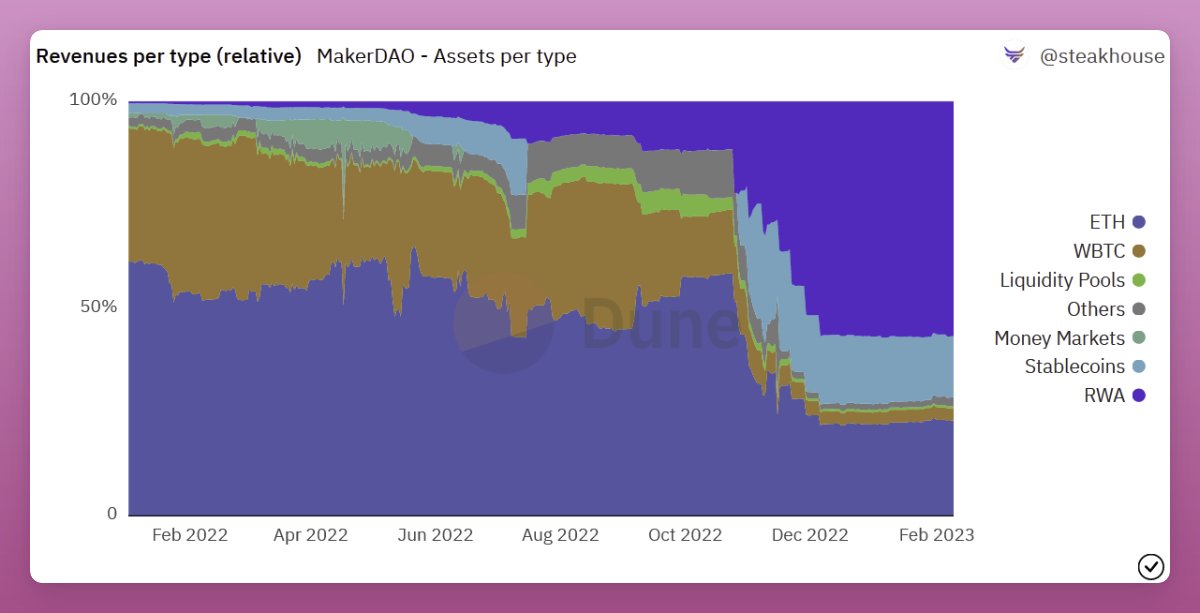

3/ That hasn't happened.

Instead, Maker is forking Aave v3 with DSR integration and EtherDAI (more on that later) at the center.

Sure, Aave gets 10% of the revenue, but the message is clear: Thanks boys, we are going to do it ourselves now.

Instead, Maker is forking Aave v3 with DSR integration and EtherDAI (more on that later) at the center.

Sure, Aave gets 10% of the revenue, but the message is clear: Thanks boys, we are going to do it ourselves now.

4/ It's no surprise when you think about it.

Aave is about to launch its own DeFi stablecoin $GHO—a clear competitor to $DAI.

Curve is also launching a stablecoin crvUSD, and Curve is crucial for DAI's liquidity on-chain.

Aave is about to launch its own DeFi stablecoin $GHO—a clear competitor to $DAI.

Curve is also launching a stablecoin crvUSD, and Curve is crucial for DAI's liquidity on-chain.

5/ Compound launched the v3 with only USDC supported for borrowing, while other crypto assets are supplied as collateral.

I think this new model is a threat to DAI.

Compound could have supported DAI, benefiting both protocols, but they haven't. Yet.

I think this new model is a threat to DAI.

Compound could have supported DAI, benefiting both protocols, but they haven't. Yet.

6/ What's more, Maker is soon launching EtherDAI.

Similarly to Frax's frxETH, EtherDAI is a synthetic liquid staking derivative (LSD) for ETH.

It's a core part of Maker's Endgame plan to make DAI the Unbiased World Currency.

Similarly to Frax's frxETH, EtherDAI is a synthetic liquid staking derivative (LSD) for ETH.

It's a core part of Maker's Endgame plan to make DAI the Unbiased World Currency.

7/ EtherDAI will depend on Lido at launch as Maker is not set up to run staking infrastructure themselves, for now.

But that could change in the future.

"This will help us capture market share in the rapidly growing Liquid Staking Derivatives (LSD) market."

But that could change in the future.

"This will help us capture market share in the rapidly growing Liquid Staking Derivatives (LSD) market."

8/ That's not all.

Maker's Spark Protocol will support two oracles: Chronicle 3 (prev. Maker Oracles) and Chainlink 😉

It's an extra security step in case on oracle fails😉

Maker's Spark Protocol will support two oracles: Chronicle 3 (prev. Maker Oracles) and Chainlink 😉

It's an extra security step in case on oracle fails😉

9/ Spark Protocol will have its own token, but it will be wholly owned by Maker's $MKR

This is a confusing part, so bear with me:

Maker's Endgame Plan envisions creating MetaDAOs (or SubDAOs) to reduce the complexity of how Maker is governed.

This is a confusing part, so bear with me:

Maker's Endgame Plan envisions creating MetaDAOs (or SubDAOs) to reduce the complexity of how Maker is governed.

12/ Each MetaDAO will have a token launched via yield farming - this is how we'll get Spark Protocol token.

No pre-allocation or private/public sales. A real feast for yield farming thirsty degens 🎉

SPOILER ALERT: You’ll need MKR to farm every single SubDAO token.

No pre-allocation or private/public sales. A real feast for yield farming thirsty degens 🎉

SPOILER ALERT: You’ll need MKR to farm every single SubDAO token.

13/ Maker's Endgame Plan assumes a possibility that there will be a significant deterioration of regulatory security alongside a global economic and social decline.

To adapt, survive and recover Maker will have 3 stances: Pigeon, Eagle and Pheonix.

To adapt, survive and recover Maker will have 3 stances: Pigeon, Eagle and Pheonix.

17/ Learn more about the Endgame Plan in my previous thread:

18/ Follow me @DefiIgnas for more insight not found elsewhere.

Like/Retweet the first tweet below if you can:

Like/Retweet the first tweet below if you can:

Loading suggestions...