In the next 3 minutes I'll show you how to identify the Highest Probability Flip Zones to trade from.

But before then, kindly retweet the first tweet for others to see.

Done?

Thank you my comrade 👍

Now let's face it 👇

But before then, kindly retweet the first tweet for others to see.

Done?

Thank you my comrade 👍

Now let's face it 👇

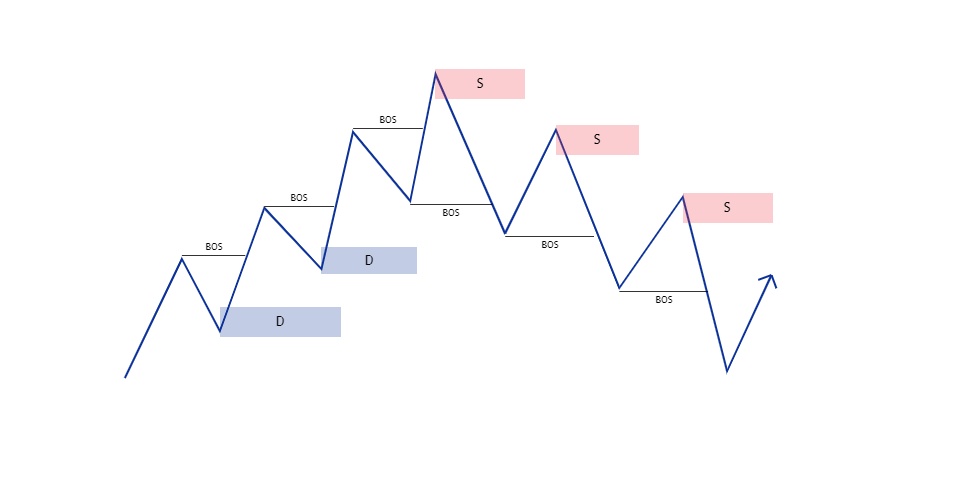

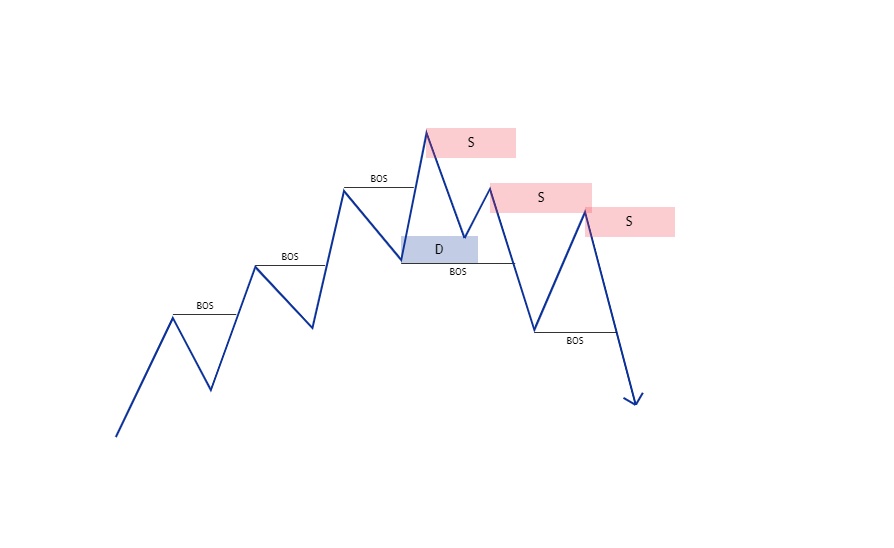

With that being established, if you should go and start mapping out every single S&D zone you identify, your chart will be a total mess.

Because they are every single where.

Therefore, we separate them out and focus on those that really matters. 👇

Because they are every single where.

Therefore, we separate them out and focus on those that really matters. 👇

...pullback into demand, form a higher low and continue upward to cause another BOS.

But you can clearly see what happened, it pulled back and reacted to the demand zone.

It showed some signs of bullish move, but then failed because supply overpowered and took out the demand.

But you can clearly see what happened, it pulled back and reacted to the demand zone.

It showed some signs of bullish move, but then failed because supply overpowered and took out the demand.

IMPORTANT NOTE: That reaction is key.

You need to clearly see that the 'valid zone' tried to push price upward or downward as the case may be, before it was then overpowered and failed.

If there's no reaction, then it's not a FLIP 🚫

You need to clearly see that the 'valid zone' tried to push price upward or downward as the case may be, before it was then overpowered and failed.

If there's no reaction, then it's not a FLIP 🚫

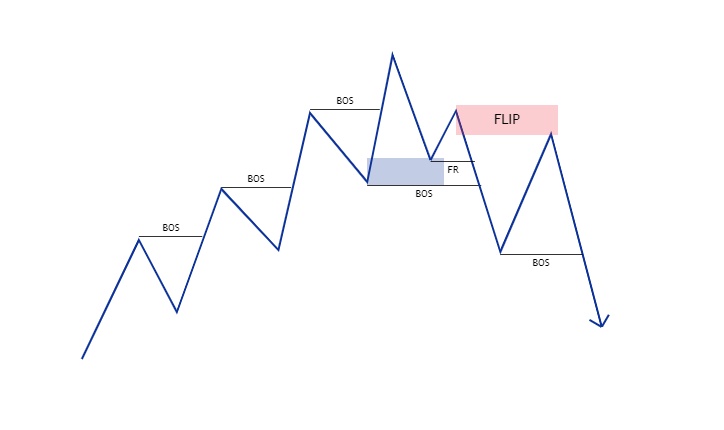

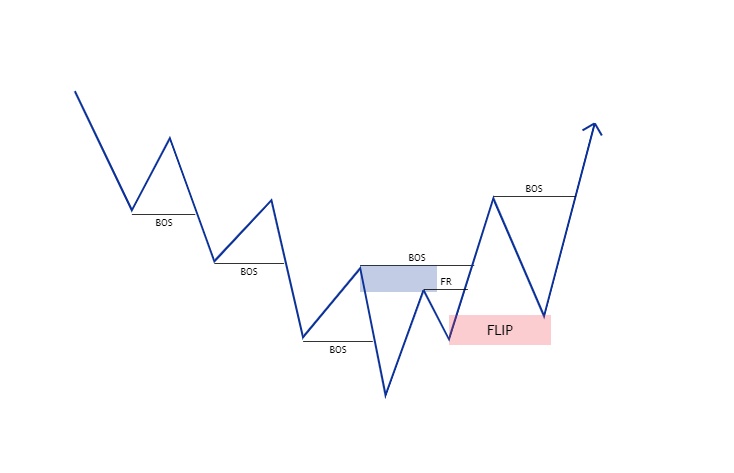

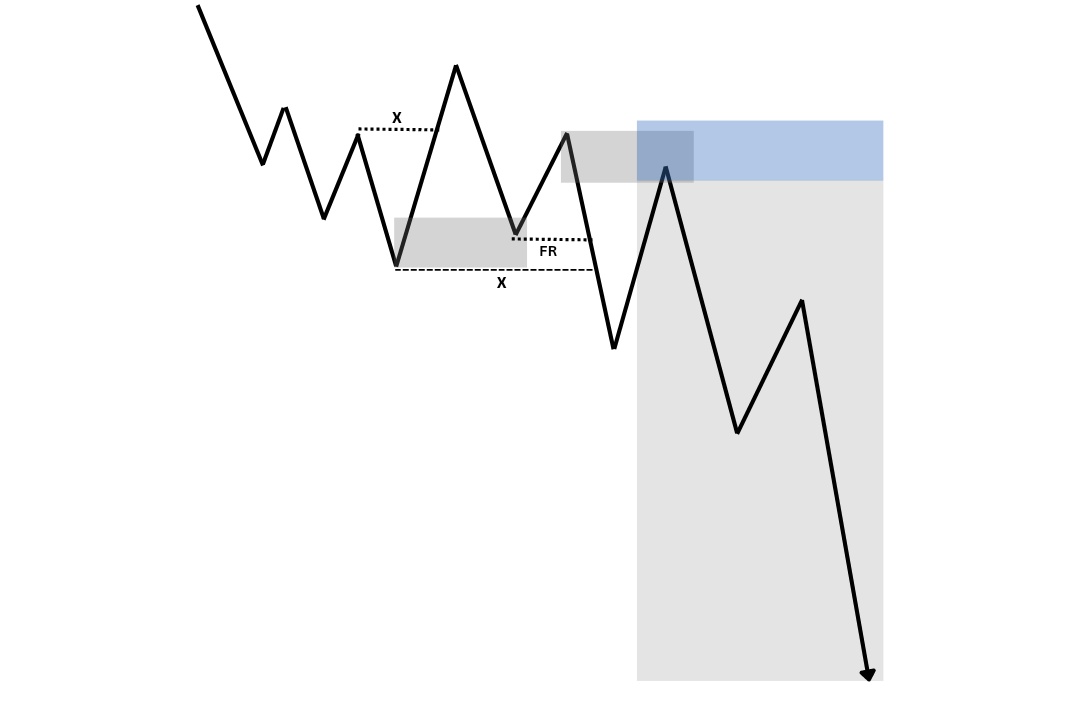

In the image above, notice how price was bearish and trending downward, then we saw demand overpowered supply (without FLIP) and caused a BOS to the upside..

Now that price is bullish, we expect it to pullback into the strong demand and continue the bullish orderflow..

Now that price is bullish, we expect it to pullback into the strong demand and continue the bullish orderflow..

But price pulled back and tried to continue bullish - demand was trying to push price upward,

But supply came in aggressively and overpowered it, causing a D2S Flip.

The FR - stands for Failed Reaction..

You draw it from the starting point of the reaction, to where it failed.

But supply came in aggressively and overpowered it, causing a D2S Flip.

The FR - stands for Failed Reaction..

You draw it from the starting point of the reaction, to where it failed.

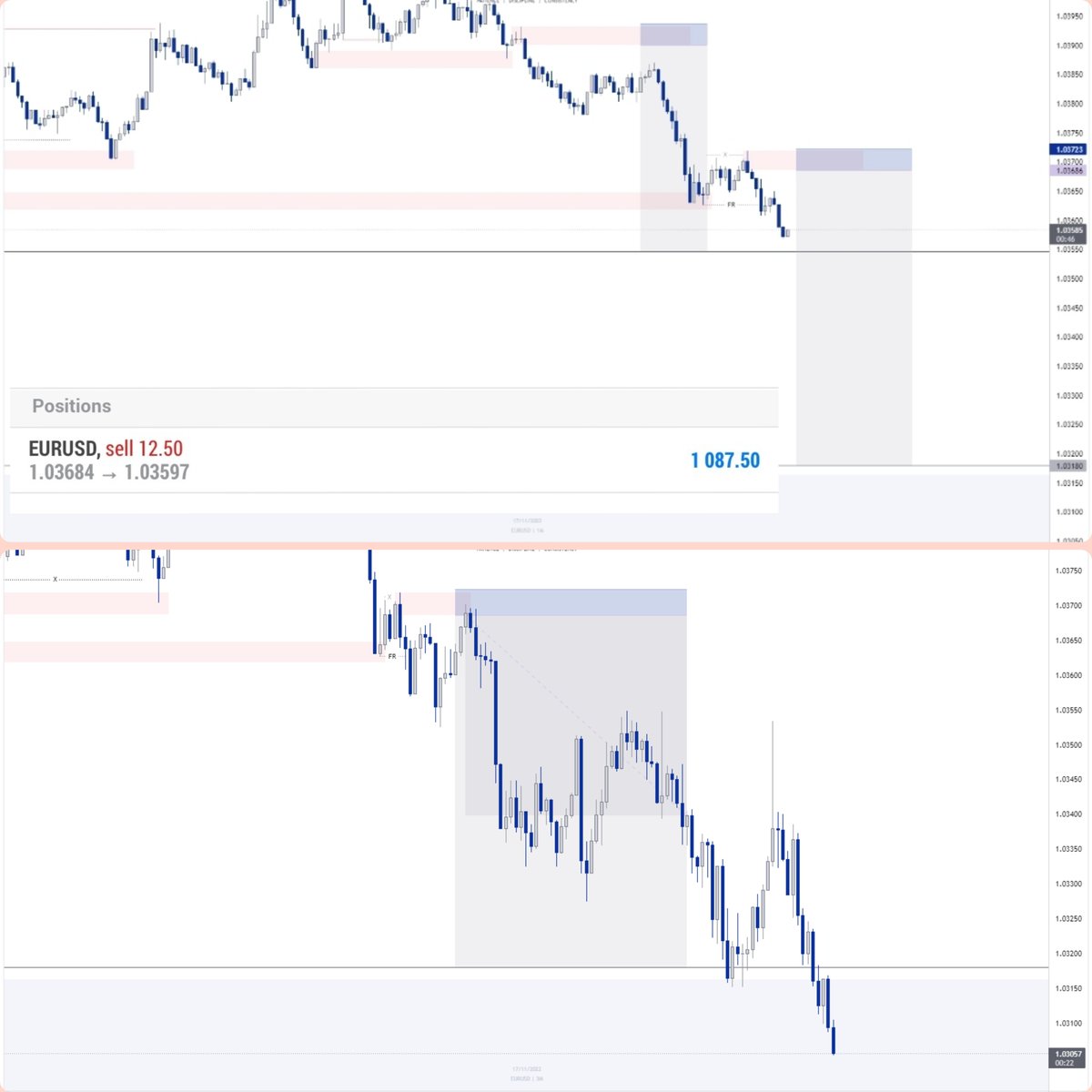

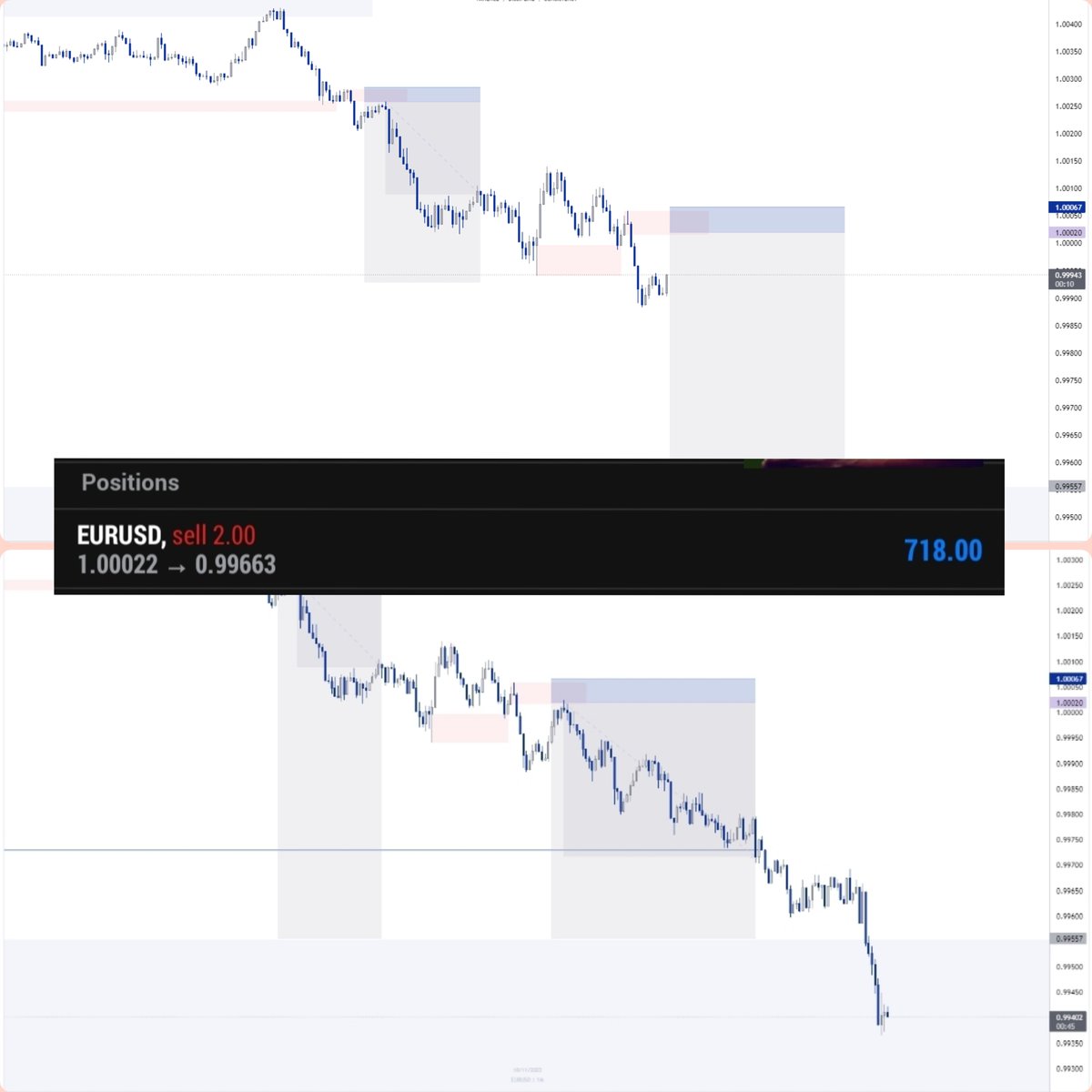

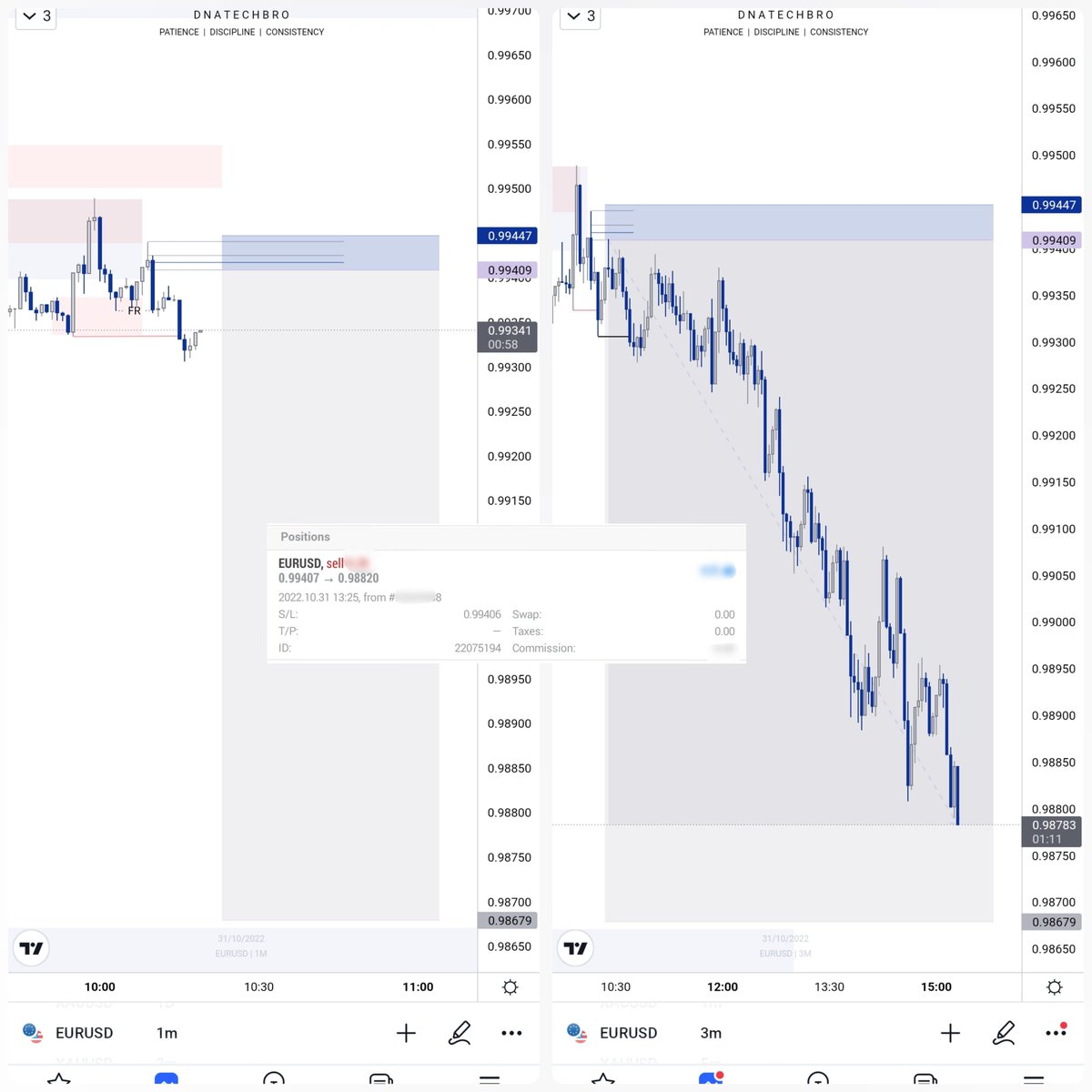

Here are some few more examples from the plenty data that I've collected to prove that this works (most of the time).

And you can see more examples in my FREE Telegram channel: t.me

And you can see more examples in my FREE Telegram channel: t.me

And that's a wrap (hopefully it didn't exceed 3 minutes 😂❤️)

I hope you found this helpful?

Now go and backtest it and also try it out in the live market.. I'll be waiting for feedback too.

Don't forget to like & RT this for others to see,

And follow me @dnatechbro for more.

I hope you found this helpful?

Now go and backtest it and also try it out in the live market.. I'll be waiting for feedback too.

Don't forget to like & RT this for others to see,

And follow me @dnatechbro for more.

Loading suggestions...