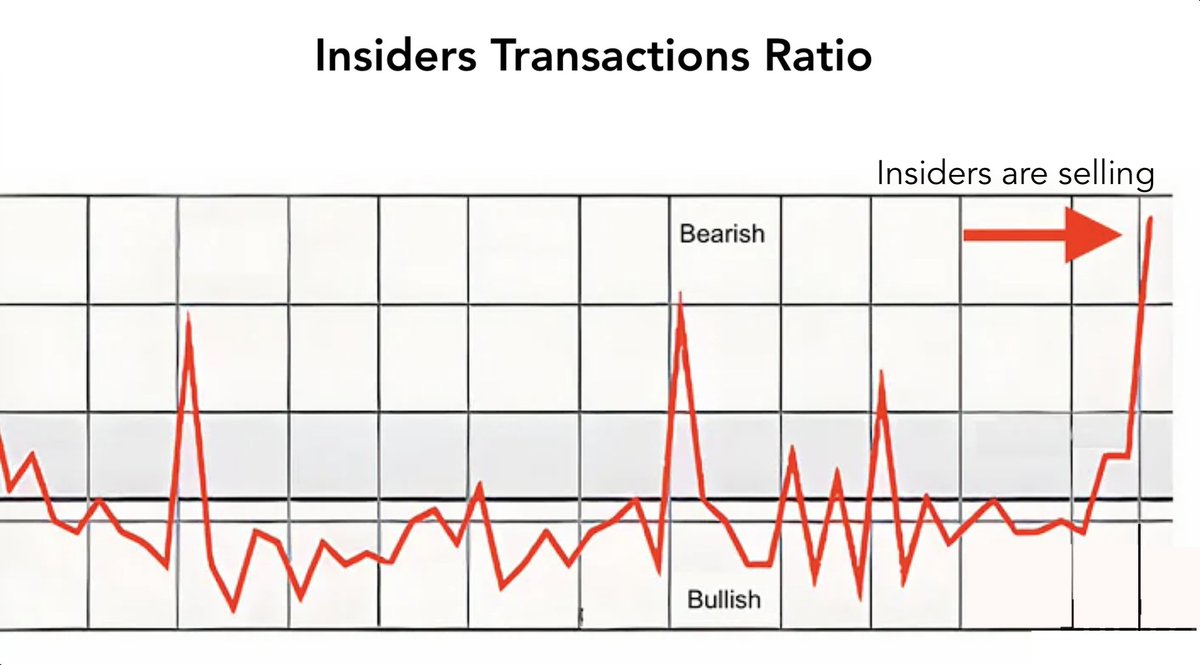

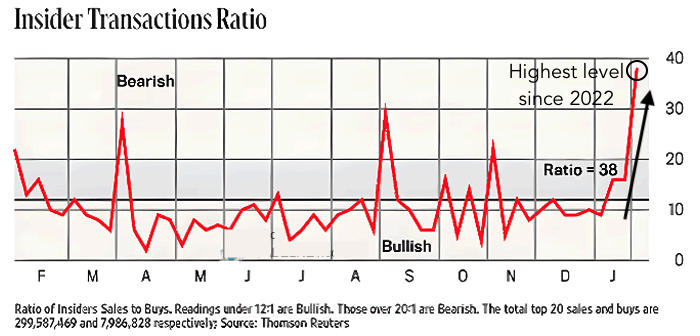

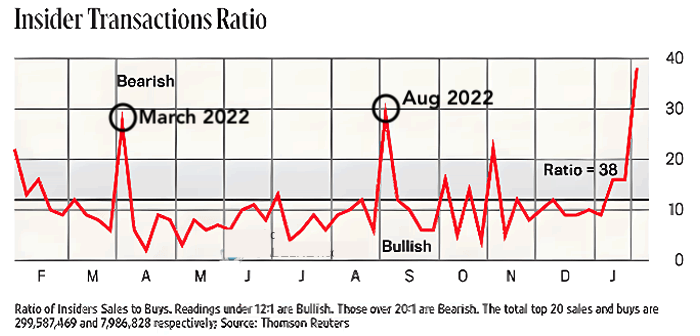

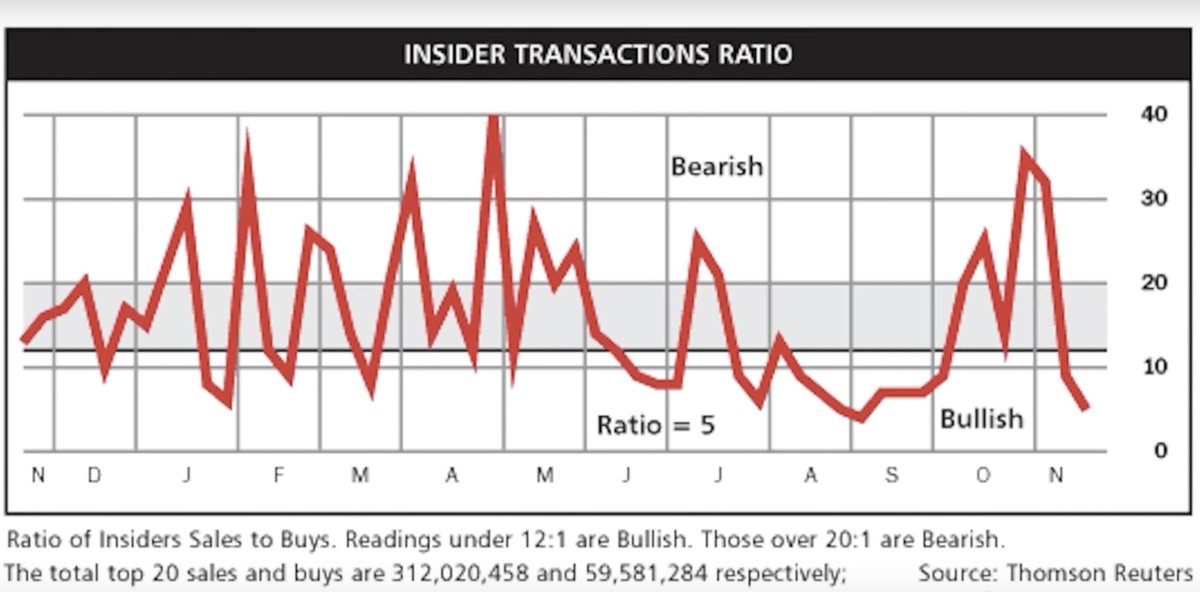

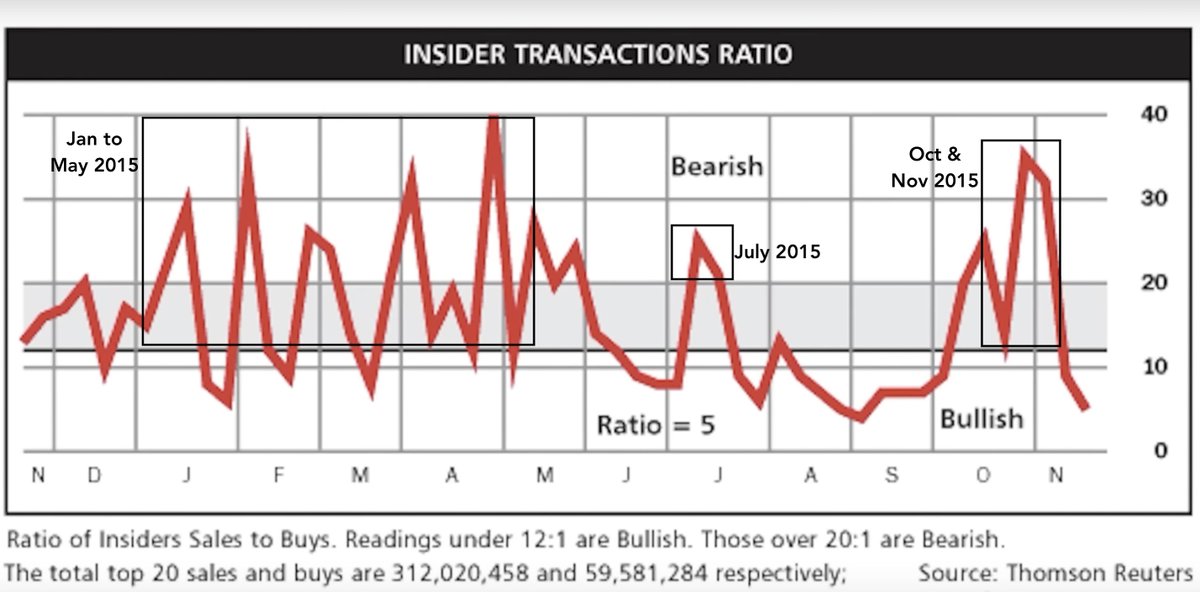

4/ Insiders consist of corporate insiders who have access to non-public information

But these insiders have to legally disclose their transactions

But these insiders have to legally disclose their transactions

5/ If insiders are selling, it likely means they know something that the average investor doesn't

Perhaps the company is weaker than what the market is currently pricing in, indicating there's rough times ahead for the company

Let's dive into some charts to see if that's true

Perhaps the company is weaker than what the market is currently pricing in, indicating there's rough times ahead for the company

Let's dive into some charts to see if that's true

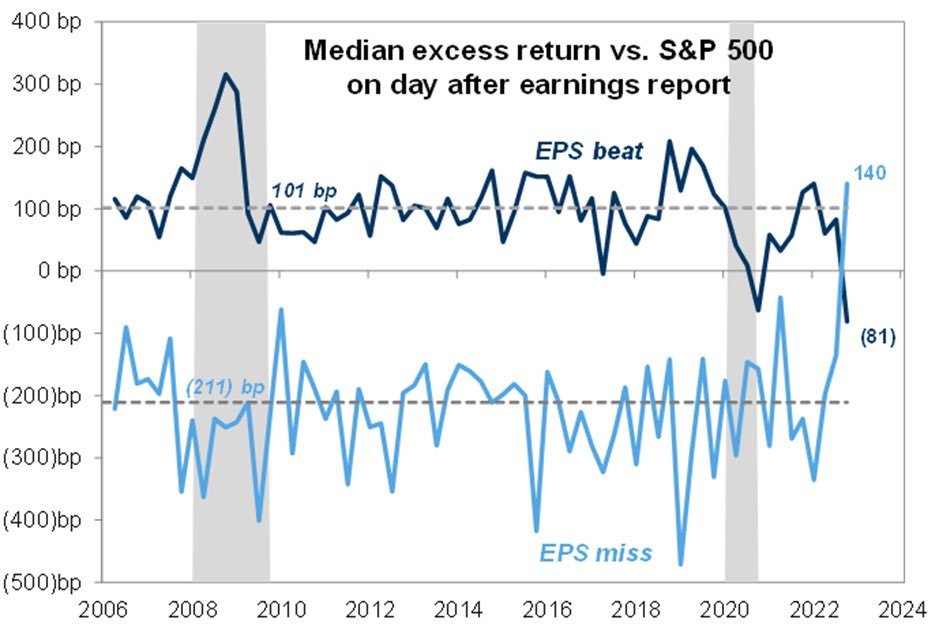

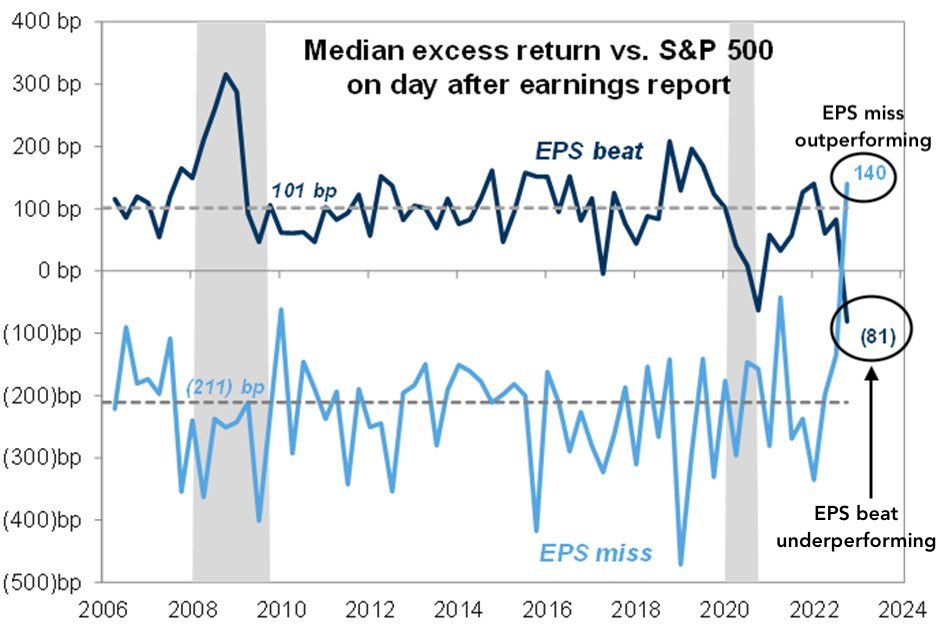

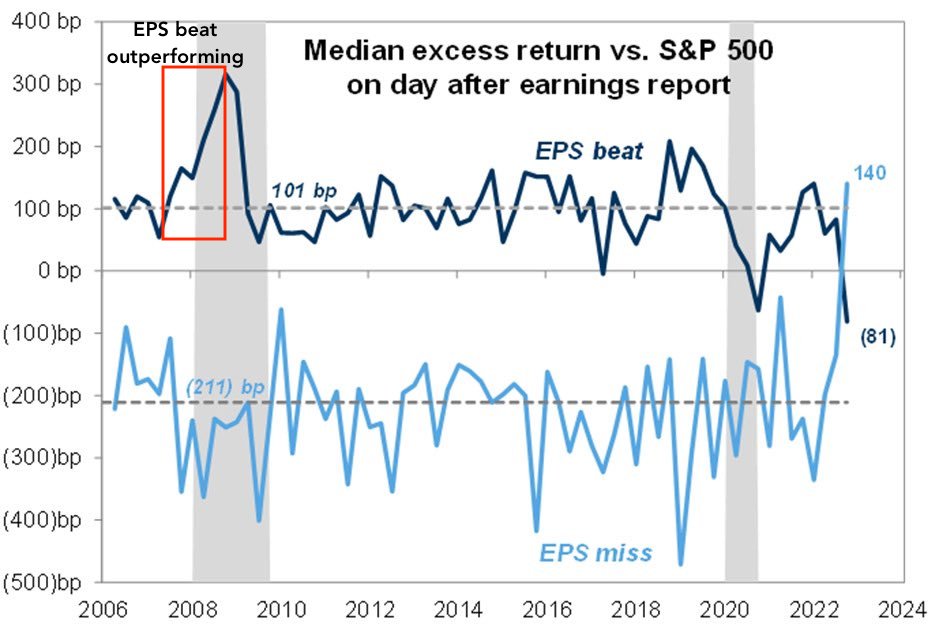

6/ This chart shows how the S&P 500 has reacted to earnings-per-share (EPS) beats and misses

And the current dynamics being played out are very different from those seen since 2000

H/T @GavinSBaker

And the current dynamics being played out are very different from those seen since 2000

H/T @GavinSBaker

9/ The companies that have reported poor earnings with a potential for further EPS weakening have been moving higher

And insiders are potentially taking this opportunity to offload part of their holdings

And insiders are potentially taking this opportunity to offload part of their holdings

17/ This doesn’t mean that insiders will be able to time the tops in the market accurately on every occasion

But it does speak to the odds of them being on the right side of the trade more often than not

But it does speak to the odds of them being on the right side of the trade more often than not

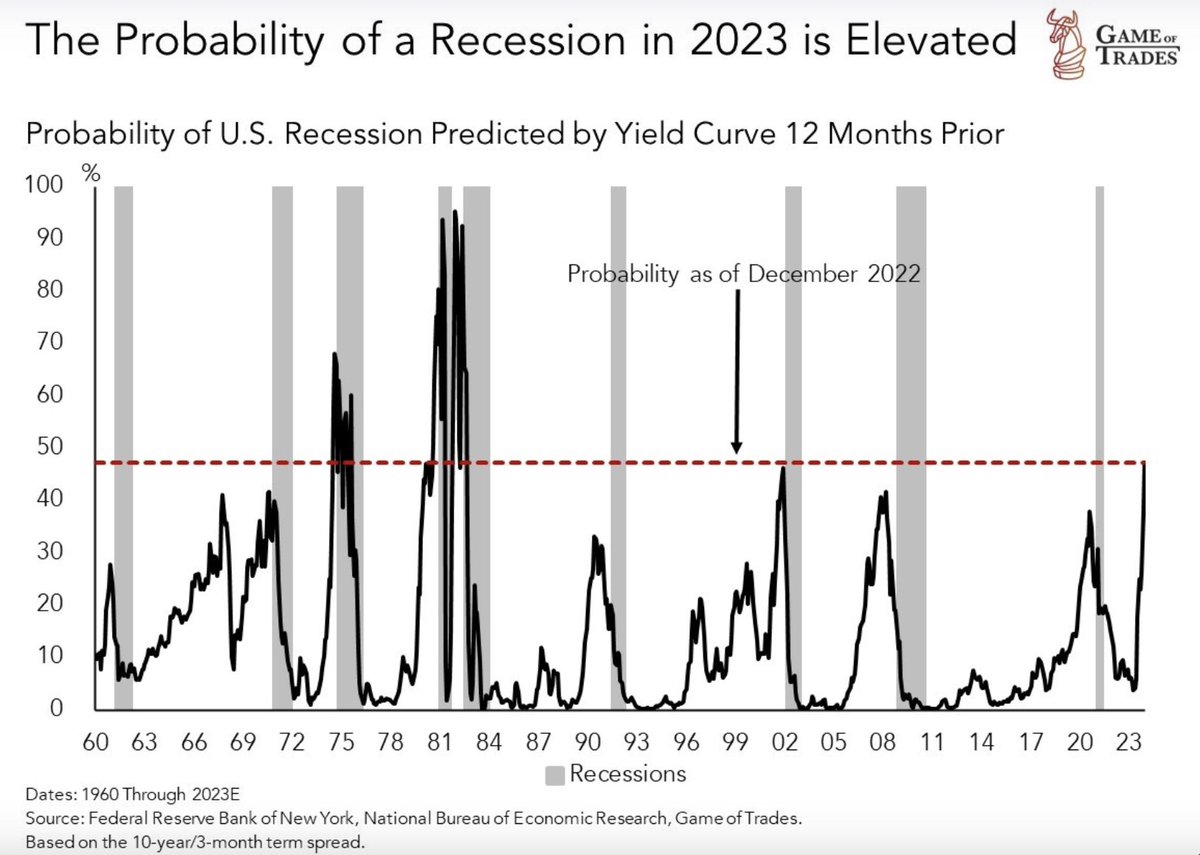

19/ We were constructive on stocks in late 2022, given that

- Inflation was coming down

- Economic data showed lesser inflationary pressures

- The odds of a Fed pause was rising

- Inflation was coming down

- Economic data showed lesser inflationary pressures

- The odds of a Fed pause was rising

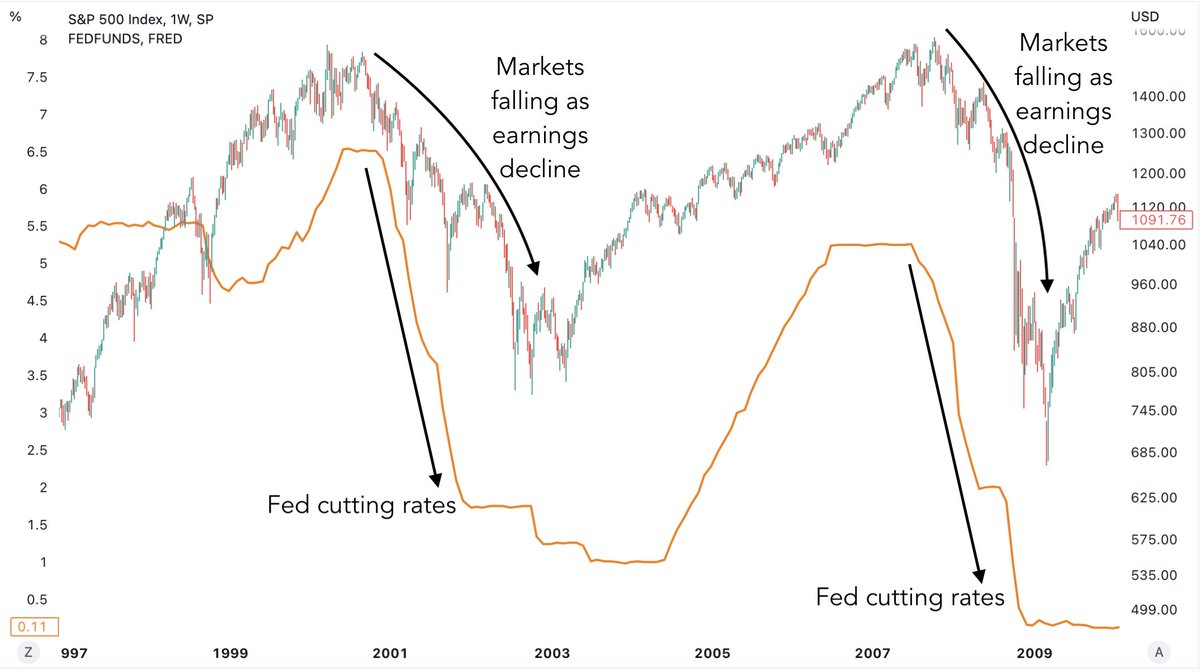

20/ But the Fed has been acting tough for a longer-than expected period of time

This has kept a lid on the PE ratios that have not been able to expand during this window of opportunity

This has kept a lid on the PE ratios that have not been able to expand during this window of opportunity

21/ The window of opportunity is now getting narrower with each passing day

And in the not-so-distant future, earnings are going to start contracting

And in the not-so-distant future, earnings are going to start contracting

24/ But with the macro environment deteriorating, it's important to stay vigilant and manage risk as the technicals could change on a dime

And that would be just the time to get defensive

And that would be just the time to get defensive

25/ How will the technicals develop in the short-term?

And how to position portfolios in this uncertain macro environment?

We provide data-driven macro insights, an actionable strategy and model portfolio to thousands of investors

Get your free trial at gameoftrades.net

And how to position portfolios in this uncertain macro environment?

We provide data-driven macro insights, an actionable strategy and model portfolio to thousands of investors

Get your free trial at gameoftrades.net

26/ Thanks for reading!

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

جاري تحميل الاقتراحات...