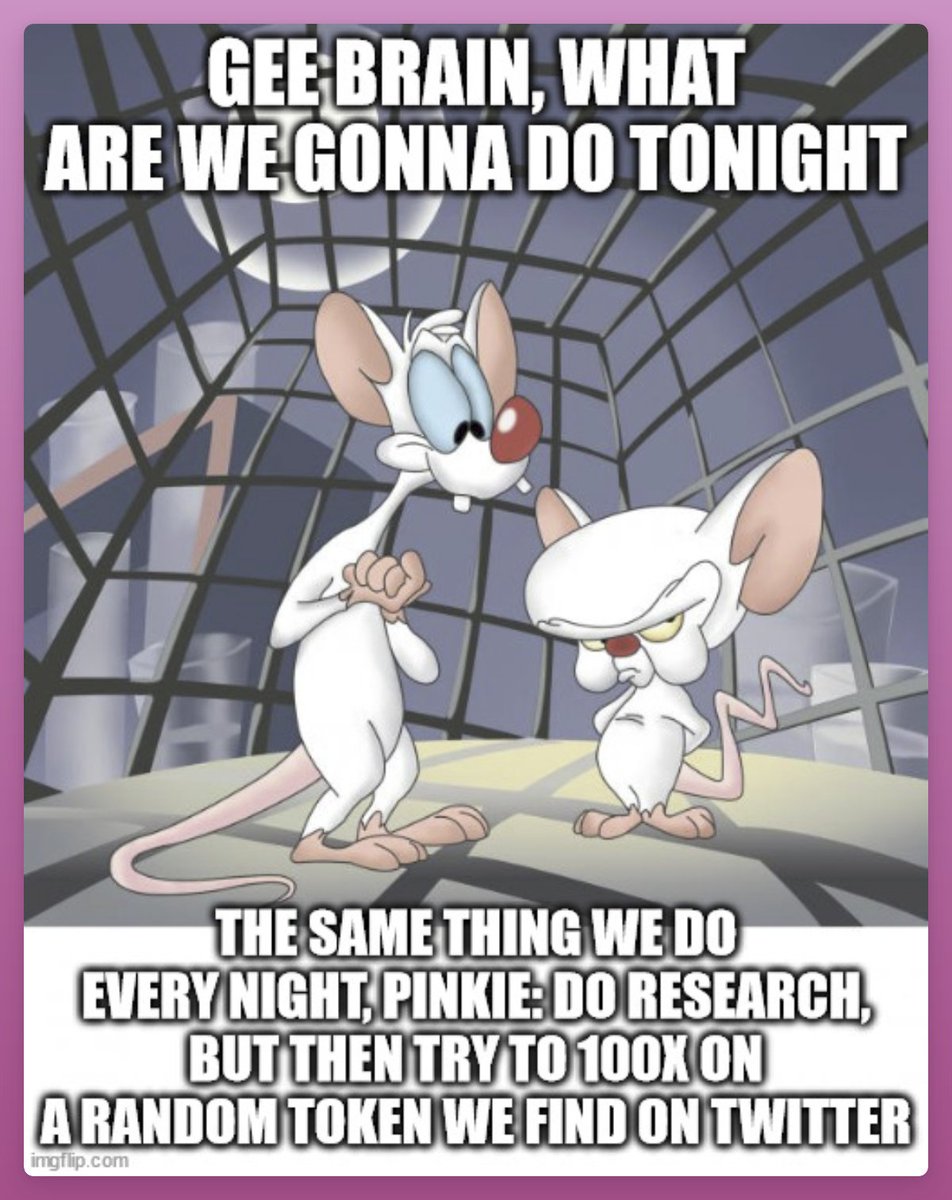

1/ Don't get swept away by what's popular—take a step back and think.

Sure, it's easy to fall for the latest fashion or tech gadgets.

But investing based on what's hot is a sure way to fail. Do your research and front-run the narrative, not follow it.

Here's my approach: 🐧

Sure, it's easy to fall for the latest fashion or tech gadgets.

But investing based on what's hot is a sure way to fail. Do your research and front-run the narrative, not follow it.

Here's my approach: 🐧

2/ Looking for a new hot narrative before it explodes is hard.

Instead, I look for counter-narratives or unpopular opinions.

It's something that exists already, but people either don't pay attention or dislike it.

Instead, I look for counter-narratives or unpopular opinions.

It's something that exists already, but people either don't pay attention or dislike it.

4/ These narratives stem from market fundamentals or newly built infrastructure products that haven't been discovered by the masses yet.

They lie dormant until key catalysts and stimulants appear that push the narrative forward.

They lie dormant until key catalysts and stimulants appear that push the narrative forward.

5/ The DeFi summer boom, for example, started with liquidity mining -- when projects gave their tokens for free in exchange for using the protocol.

It was a counter-intuitive approach, solving the "chicken or egg" problem of bootstrapping liquidity and bringing users.

It was a counter-intuitive approach, solving the "chicken or egg" problem of bootstrapping liquidity and bringing users.

6/ More recent example: #realyield.

I first wrote about "high-revenue tokens" in July, before the real yield narrative took off.

Back then, major price increases were mostly due to product updates.

Two months later, every real yield token outperformed other DeFi tokens.

I first wrote about "high-revenue tokens" in July, before the real yield narrative took off.

Back then, major price increases were mostly due to product updates.

Two months later, every real yield token outperformed other DeFi tokens.

7/ I believe there a few more mega-narratives in the making.

First is Real-World-Assets (RWAs).

Signal: Four out of the top 10 lending protocols by interest fees paid are RWA protocols.

RWAs also offer unique investment diversification and revenue sharing for staking.

First is Real-World-Assets (RWAs).

Signal: Four out of the top 10 lending protocols by interest fees paid are RWA protocols.

RWAs also offer unique investment diversification and revenue sharing for staking.

8/ That being said, the RWA tokens might not experience a prolonged bull run.

If the crypto market suddenly skyrockets, who cares about 10-20% APY on USDC?

However, if the market remains stable, 20% APY on stablecoins with revenue sharing to token holders becomes appealing.

If the crypto market suddenly skyrockets, who cares about 10-20% APY on USDC?

However, if the market remains stable, 20% APY on stablecoins with revenue sharing to token holders becomes appealing.

9/ Another mega-narrative is the rise of options trading.

Redditors are crazy for options trading, and it's essential for professional traders.

DeFi options are currently neglected, so I believe it's a matter of WHEN, not IF, they experience a surge in popularity.

Redditors are crazy for options trading, and it's essential for professional traders.

DeFi options are currently neglected, so I believe it's a matter of WHEN, not IF, they experience a surge in popularity.

10/ The third one is Soulbound tokens (SBTs).

I explained why in my blog post, but the point is to focus on what's already here - yet currently lacks a catalyst to light the fire up 🔥

Check it out here: ignasdefi.substack.com

I explained why in my blog post, but the point is to focus on what's already here - yet currently lacks a catalyst to light the fire up 🔥

Check it out here: ignasdefi.substack.com

11/ My RWA, options or SBT bets might not sound sexy to you, but that's what a counter-narrative is!

I could easily write about the next 100x tokens and get higher engagement and more followers.

But investing isn't a popularity show—we're here to make money.

I could easily write about the next 100x tokens and get higher engagement and more followers.

But investing isn't a popularity show—we're here to make money.

13/ That's why I include short-term plays into my counter-narrative strategy:

Ironically, Twitter is not the best place to find them, so look elsewhere:

• AMAs

• Discord

• DAO forums

• On-chain transactions

It requires time, effort, and specialized knowledge.

Ironically, Twitter is not the best place to find them, so look elsewhere:

• AMAs

• Discord

• DAO forums

• On-chain transactions

It requires time, effort, and specialized knowledge.

14/ For example, the Paraswap DAO discussed the new v2 tokenomics that aligned with the #realyield narrative in November.

$PSP had a run up in price days before the public announcement.

If you had followed the forum discussions, you would have known about it weeks in advance.

$PSP had a run up in price days before the public announcement.

If you had followed the forum discussions, you would have known about it weeks in advance.

16/ Another short-term play is a potential launch of Uniswap v4 or some Uniswap Super App.

The speculation is based on:

• The expiration of the V3 license preventing forks in 3 months

• The launch of v4 is overdue: Uni V1 launched in 2018, V2 in 2020, and v3 in 2021.

The speculation is based on:

• The expiration of the V3 license preventing forks in 3 months

• The launch of v4 is overdue: Uni V1 launched in 2018, V2 in 2020, and v3 in 2021.

17/ Not all bets will pay off, so you may need to adjust your strategy based on new information.

I learned months ago about Pancakeswap's new tokenomics and multi-chain strategy by reading AMA transcripts.

However, the price didn't increase as much as I expected.

I learned months ago about Pancakeswap's new tokenomics and multi-chain strategy by reading AMA transcripts.

However, the price didn't increase as much as I expected.

18/ I also follow where VC money flows to find early opportunities and new trends.

These seed-stage projects that raise funds during bear markets have a good chance of thriving in bull runs.

These seed-stage projects that raise funds during bear markets have a good chance of thriving in bull runs.

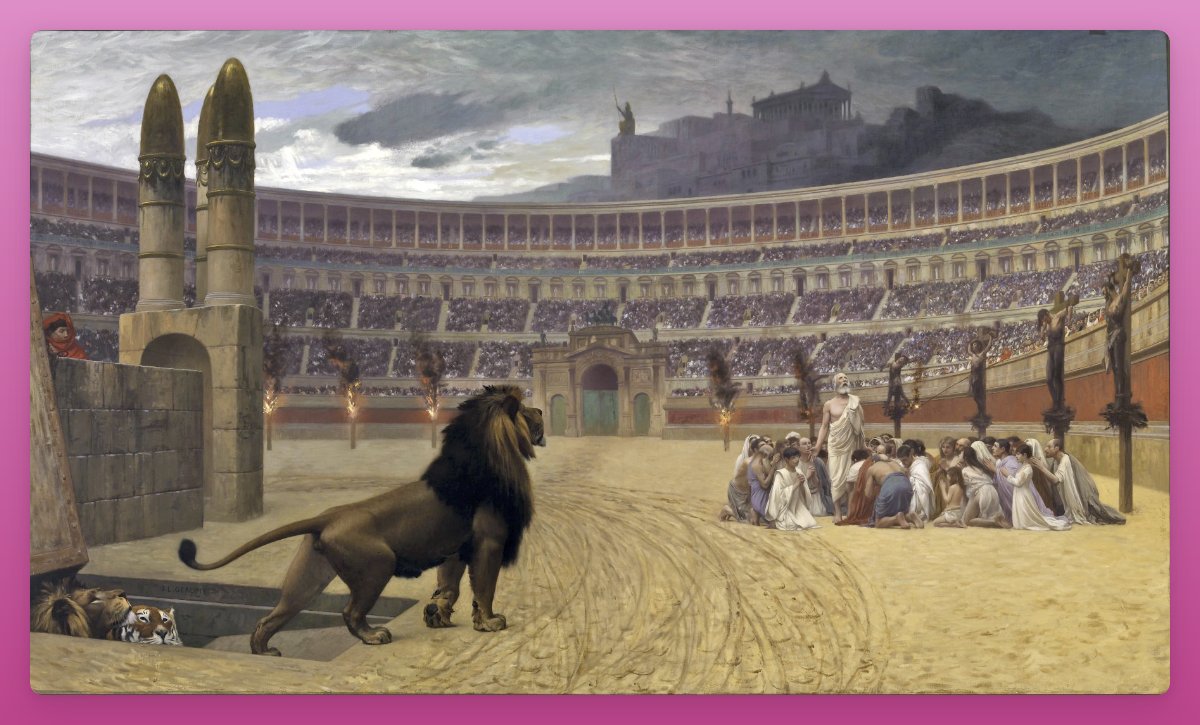

19/ The worst approach is to follow influencers who promise to reveal "the next x100 token."

I always read those threads - just to eliminate the most hyped tokens from my watch list.

They are either paid promotions or pure engagement farming.

I always read those threads - just to eliminate the most hyped tokens from my watch list.

They are either paid promotions or pure engagement farming.

20/ There's a reason my Twitter bio is "DeFi Research" and not "Degen Ignas".

It's a promise and a reminder to myself (and my followers) to make research-based decisions for long-term success.

Think for yourself, DYOR, and don't make emotional trading decisions.

It's a promise and a reminder to myself (and my followers) to make research-based decisions for long-term success.

Think for yourself, DYOR, and don't make emotional trading decisions.

21/ Lastly, it might not work for you.

You should develop a strategy that aligns with your strengths:

• Good at tracking on-chain transactions?

• Passionate about networking?

• Talented in creating memes?

• Proficient in coding?

Anything that sets you apart is an advantage.

You should develop a strategy that aligns with your strengths:

• Good at tracking on-chain transactions?

• Passionate about networking?

• Talented in creating memes?

• Proficient in coding?

Anything that sets you apart is an advantage.

22/ Let me know any counter-narrative or short-term trades you have in mind.

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

23/ I would also appreciate feedback on my approach. Tagging those who might help:

@thedefiedge

@DeFi_Dad

@TheDeFinvestor

@Dynamo_Patrick

@Route2FI

@ViktorDefi

@DAdvisoor

@defiprincess_

@rektdiomedes

@DeFi_Made_Here

@TheDeFISaint

@defi_mochi

@ThorHartvigsen

@thedefiedge

@DeFi_Dad

@TheDeFinvestor

@Dynamo_Patrick

@Route2FI

@ViktorDefi

@DAdvisoor

@defiprincess_

@rektdiomedes

@DeFi_Made_Here

@TheDeFISaint

@defi_mochi

@ThorHartvigsen

Loading suggestions...