We published our annual Big Ideas report this week

ark-invest.com

This has been a year marked by convergence

Convergences that should yield unprecedented value accrual

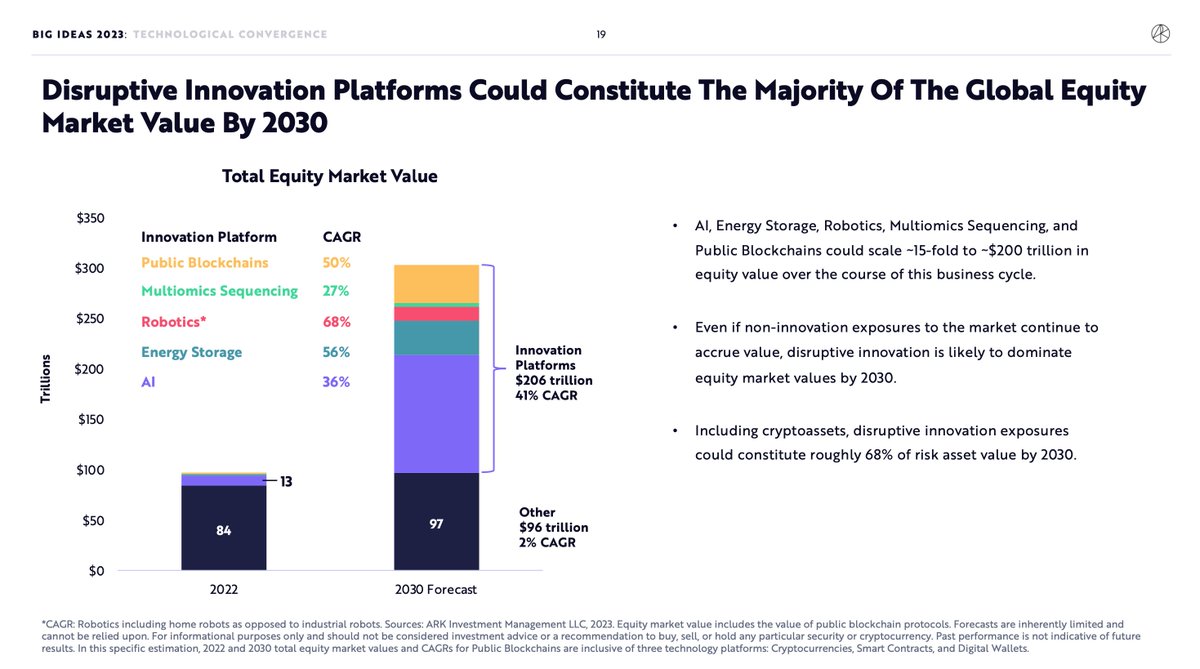

We believe that disruptive innovation should command more than half of total market cap by 2030

ark-invest.com

This has been a year marked by convergence

Convergences that should yield unprecedented value accrual

We believe that disruptive innovation should command more than half of total market cap by 2030

(Investable: there is the opportunity for extra-normal cashflow accrual in a part of the value chain that is materially mispriced in today’s equity markets.)

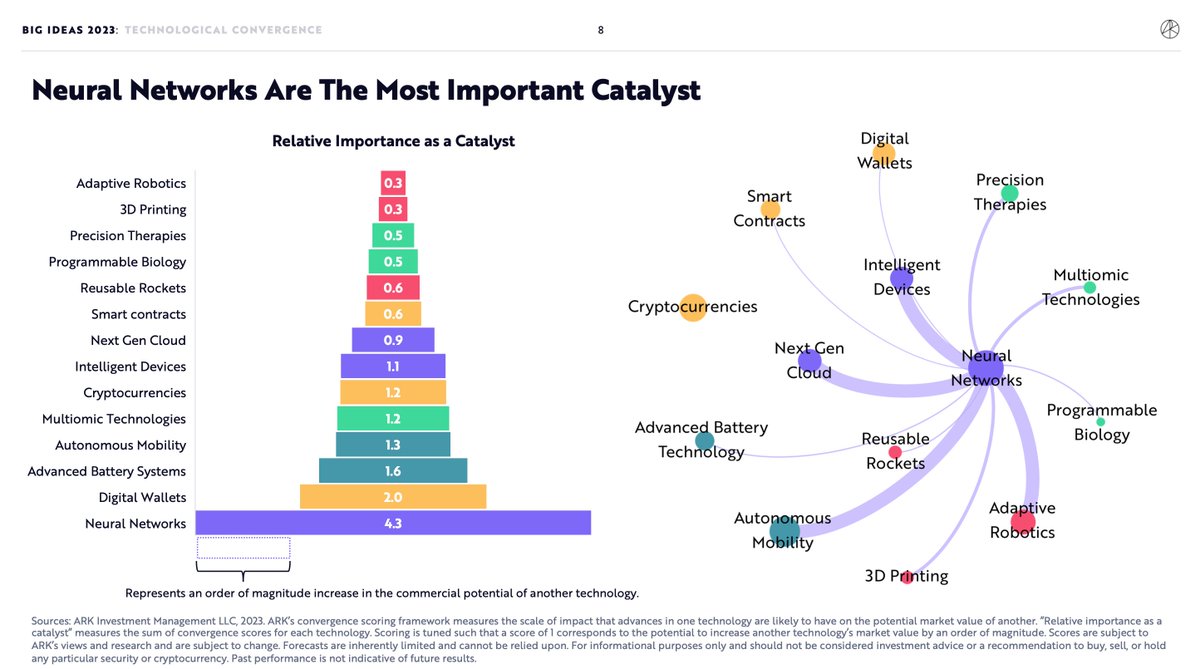

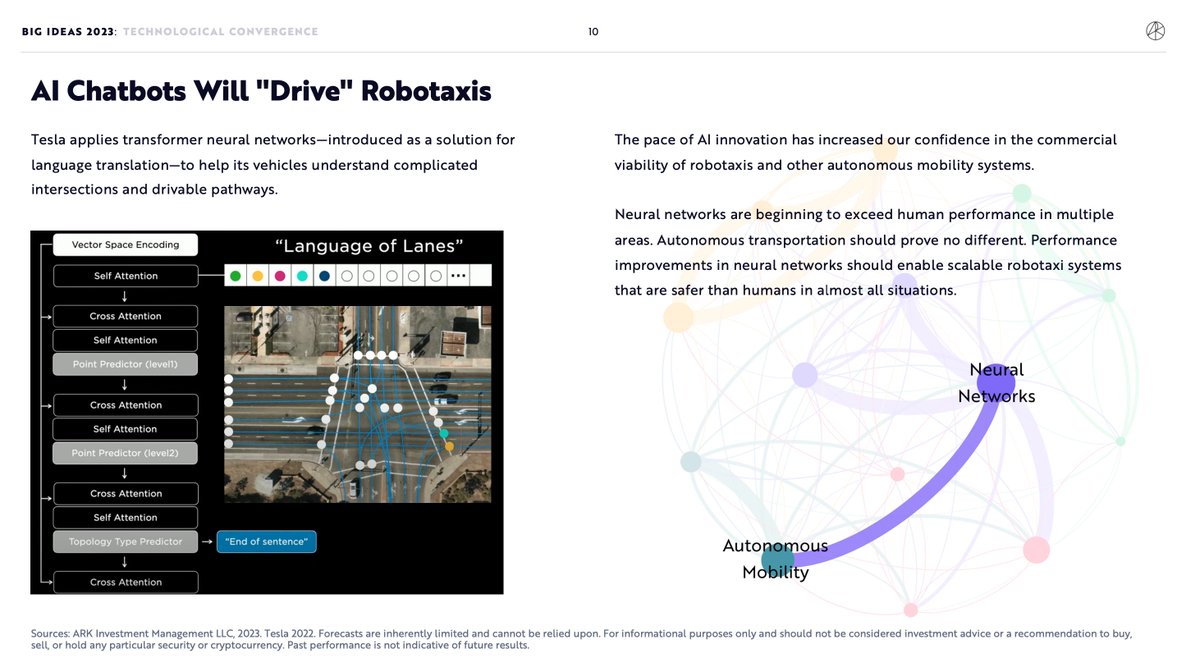

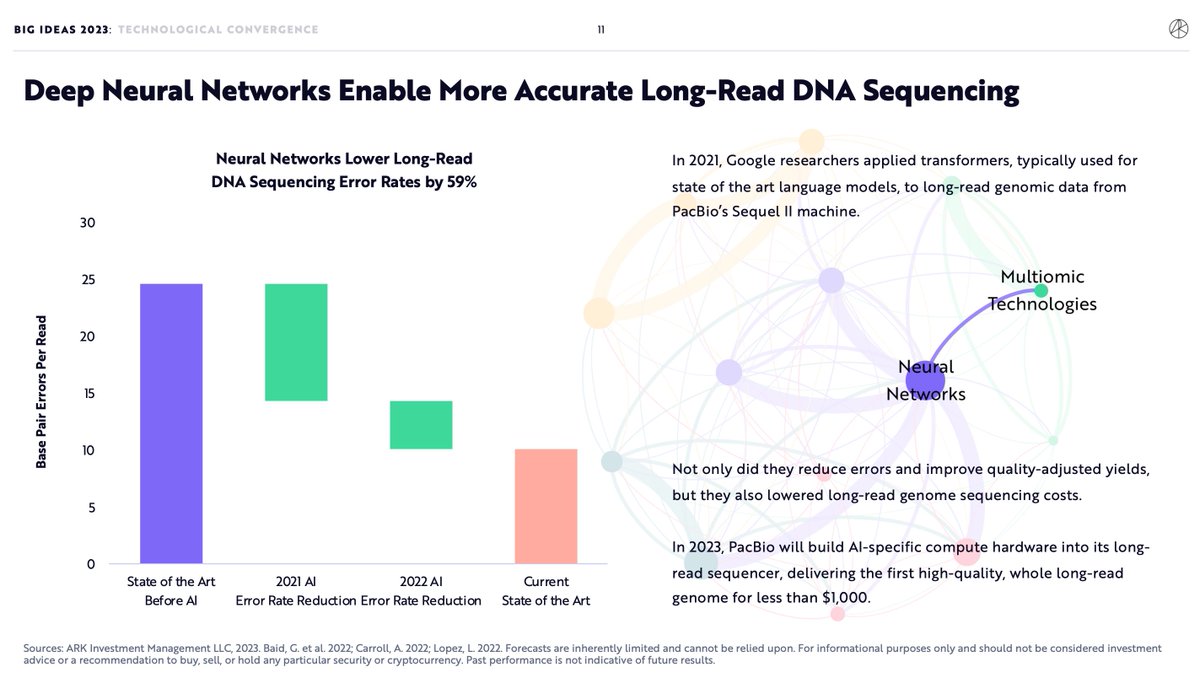

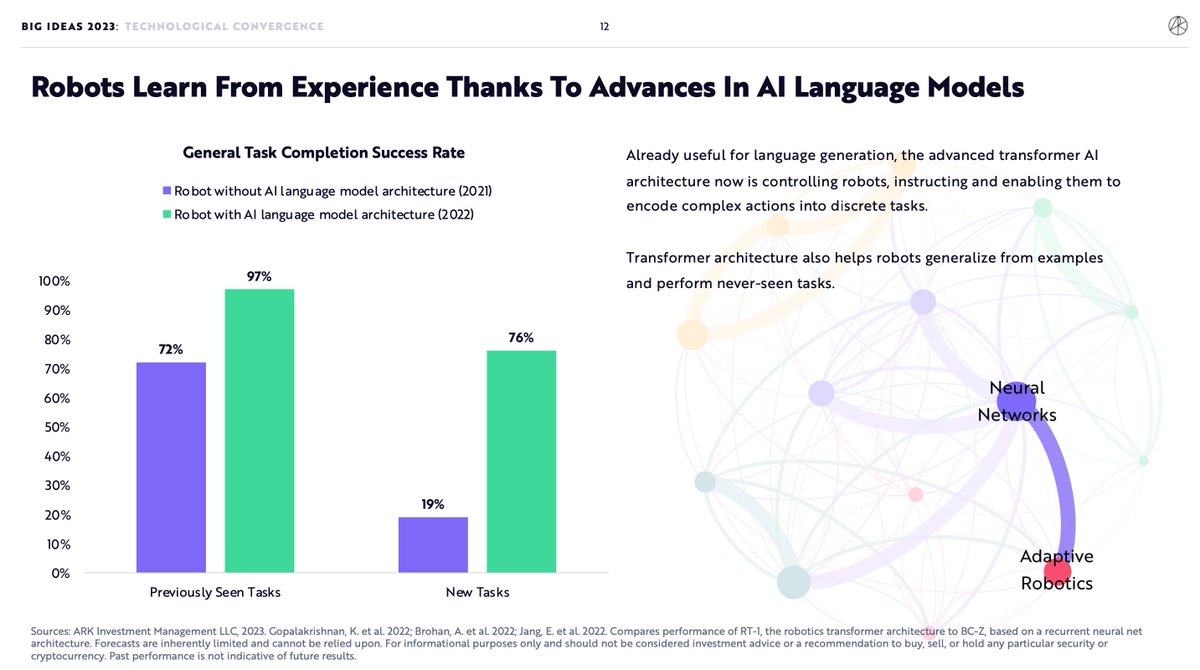

That AI is so obviously accelerating raises the odds for every accompanying technology to accelerate.

There is already plenty of evidence of convergence already.

There is already plenty of evidence of convergence already.

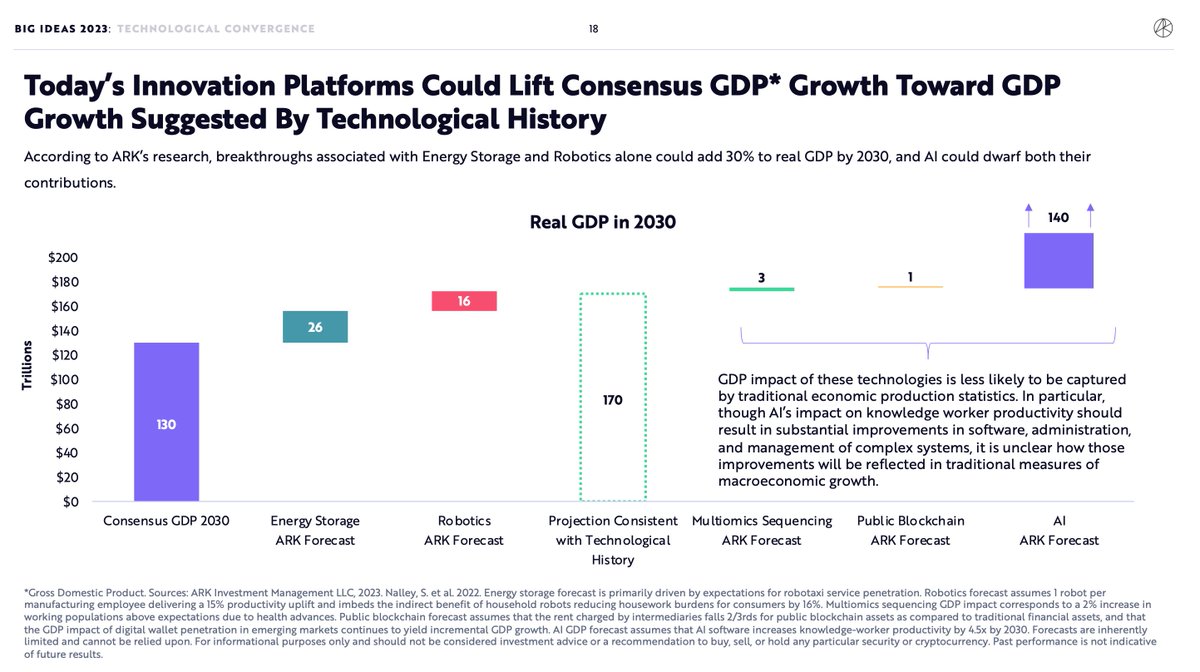

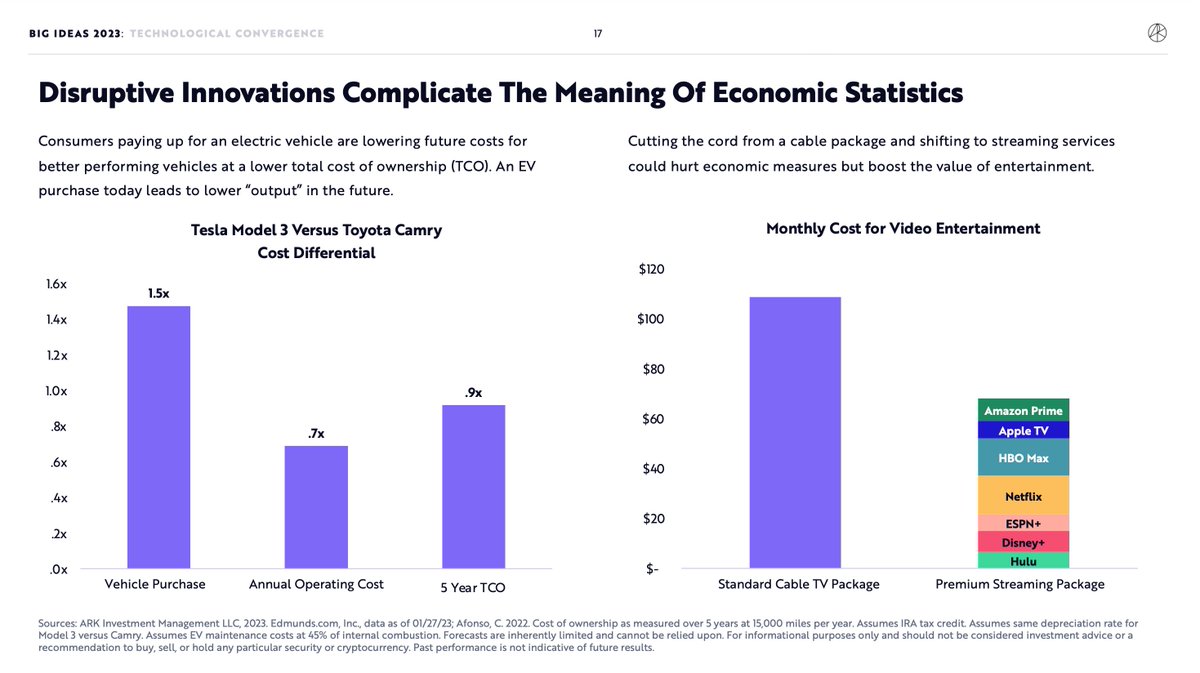

It is true, however, that disruptive technology confounds macroeconomic statistics, and though the strongest productivity advances are likely to feed through AI, it’s less clear how the deflationary growth that AI yields will appear in traditional measurements of output.

An AI acceleration begets an acceleration in everything.

(fly)wheels within (fly)wheels (within (fly)wheels)

(fly)wheels within (fly)wheels (within (fly)wheels)

Loading suggestions...