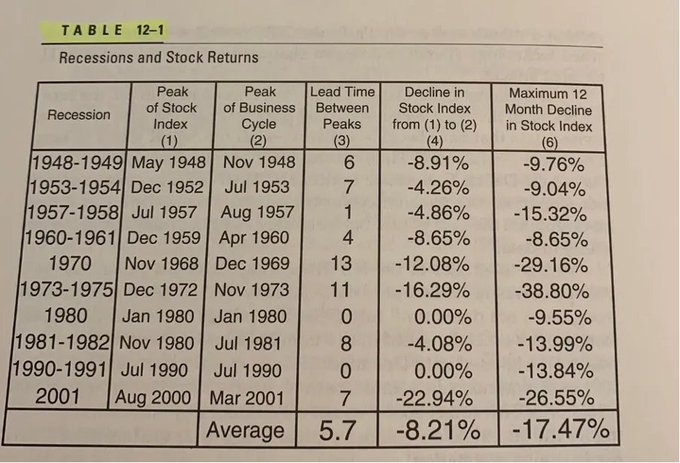

Lesson 4: Don’t try to time the market.

As difficult it is to sell when stock prices are high and everyone is optimistic, it is even more difficult to buy at market bottoms when pessimism is widespread and few have the confidence to venture back into stocks.

As difficult it is to sell when stock prices are high and everyone is optimistic, it is even more difficult to buy at market bottoms when pessimism is widespread and few have the confidence to venture back into stocks.

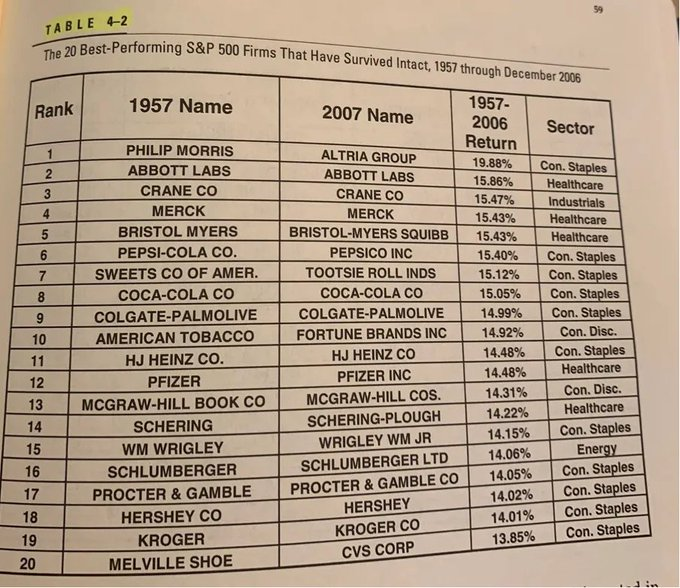

Lesson 5: Our world continuously changes.

As a quality investor, disruption is one of your worst enemies. Avoid companies who are highly exposed to rapidly changing industry dynamics.

As a quality investor, disruption is one of your worst enemies. Avoid companies who are highly exposed to rapidly changing industry dynamics.

Lesson 6: This time it’s not different.

“Most of the change we think we see in life is due to truths being in and out of favor.” – Robert Frost (1914)

“Most of the change we think we see in life is due to truths being in and out of favor.” – Robert Frost (1914)

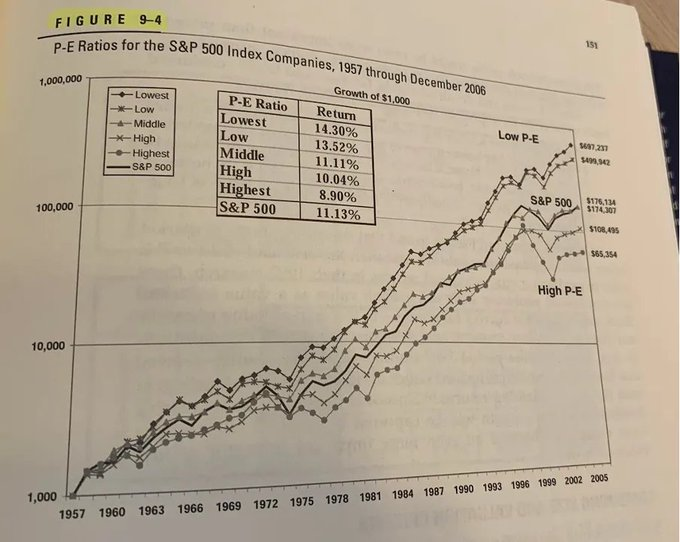

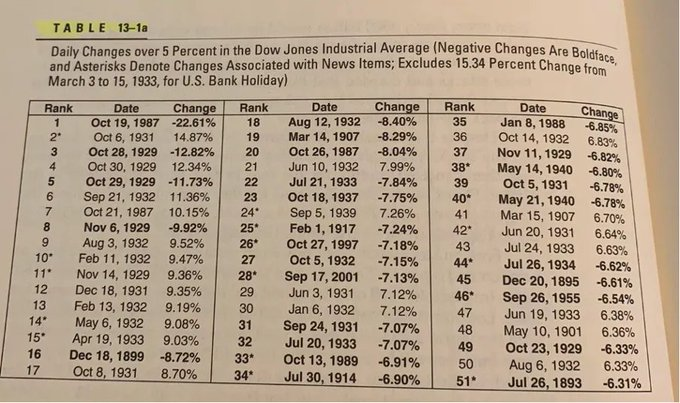

Lesson 8: Low stock prices are great for investors.

If investors become overly pessimistic about the prospects of a stock, the low price enables stockholders to buy the company on the cheap. Bear markets and corrections are great opportunities for long term investors.

If investors become overly pessimistic about the prospects of a stock, the low price enables stockholders to buy the company on the cheap. Bear markets and corrections are great opportunities for long term investors.

Lesson 9: Invest in companies that translate most earnings into free cash flow.

Earnings are an opinion, cash is a fact. Academical research found that companies that translate most earnings into free cash flow outperform companies who don't with more than 17% (!) per year.

Earnings are an opinion, cash is a fact. Academical research found that companies that translate most earnings into free cash flow outperform companies who don't with more than 17% (!) per year.

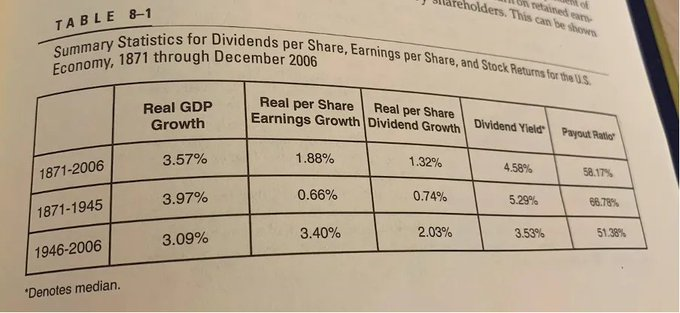

Lesson 11: Look at the equity premium.

Over the past 200 years, the equity premium (the spread between the return of stocks and return of government bonds) has averaged between 3% and 3.5%.

Over the past 200 years, the equity premium (the spread between the return of stocks and return of government bonds) has averaged between 3% and 3.5%.

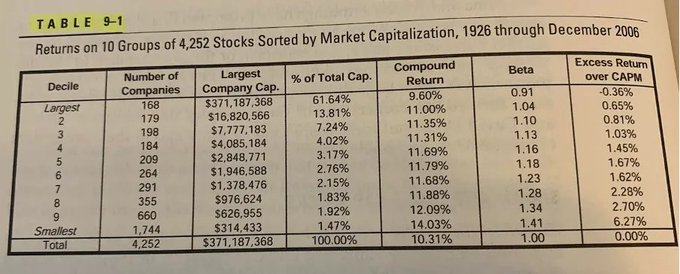

Lesson 15: Investors can outperform by using factors.

There are many strategies that can be used to outperform the market (low volatility, value, quality, …). It is important to note that you should stick to your plan as no strategy outperforms all the time.

There are many strategies that can be used to outperform the market (low volatility, value, quality, …). It is important to note that you should stick to your plan as no strategy outperforms all the time.

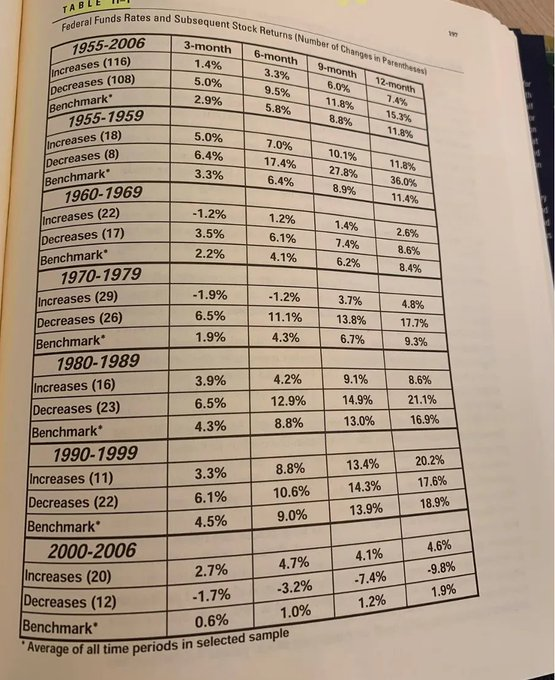

Lesson 18: Don’t use macro-economic factors to make investment decisions.

“Using macro-economic factors will lead to buy at high prices when times are good, and sell at the low when the recessions near its trough and pessimism prevails.” – Jeremy Siegel

“Using macro-economic factors will lead to buy at high prices when times are good, and sell at the low when the recessions near its trough and pessimism prevails.” – Jeremy Siegel

The end.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Here you can find the full article:

qualitycompounding.substack.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Here you can find the full article:

qualitycompounding.substack.com

Loading suggestions...