How to easily analyse the Cash Flow Statement of a company?🧵

What is a cash flow statement?

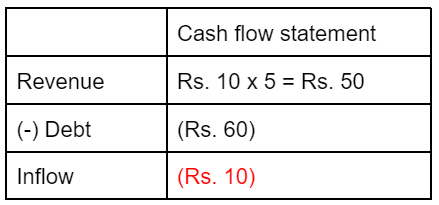

It records cash inflow and cash outflow from the company.

It tells how much cash the company is generating.

It records cash inflow and cash outflow from the company.

It tells how much cash the company is generating.

What is cash?

Cash comprises cash on hand, deposits in bank, and any other investment which can be easily converted to cash.

Cash comprises cash on hand, deposits in bank, and any other investment which can be easily converted to cash.

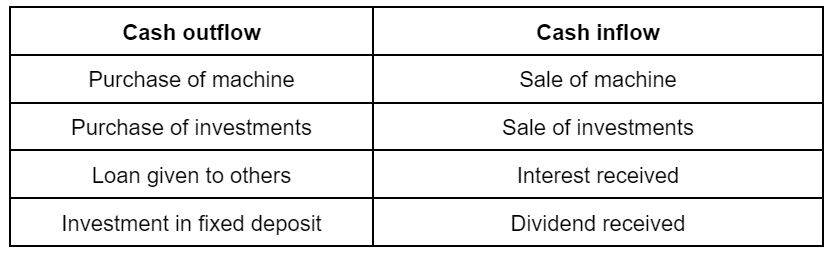

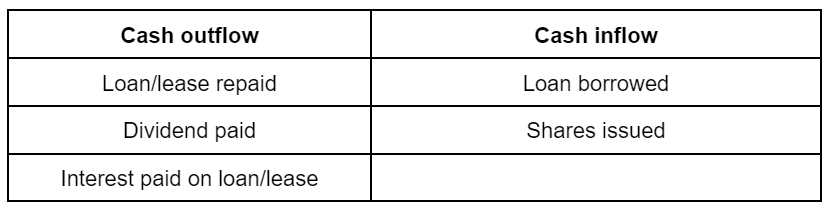

Cash coming in the business is cash inflow.

Ex: You sell goods worth Rs. 500 on credit. During the year you receive Rs. 200 - this is a cash inflow.

Ex: You sell goods worth Rs. 500 on credit. During the year you receive Rs. 200 - this is a cash inflow.

Cash going out of the business is cash outflow.

Now you buy goods worth Rs 500 on credit. During the year you paid Rs 200. Rs. 300 yet to be paid.

Payables reduce by Rs. 200 → Cash outflow of Rs. 200

Now you buy goods worth Rs 500 on credit. During the year you paid Rs 200. Rs. 300 yet to be paid.

Payables reduce by Rs. 200 → Cash outflow of Rs. 200

Cash flow follows this simple rule:

Cash inflow → Increase in cash, decrease in asset, increase in liability

Cash outflow → Decrease in cash, increase in asset, decrease in liability

Cash inflow → Increase in cash, decrease in asset, increase in liability

Cash outflow → Decrease in cash, increase in asset, decrease in liability

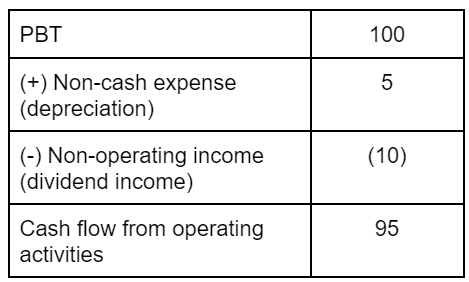

PAT is calculated after deducting expenses like tax and depreciation, and adding incomes like dividend income, interest income,etc.

But do all expenses and incomes result in cash inflow or outflow?

Are all these related to operating activities?

Ans: No

But do all expenses and incomes result in cash inflow or outflow?

Are all these related to operating activities?

Ans: No

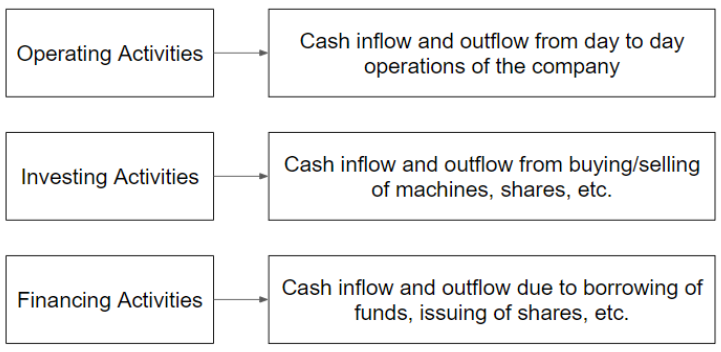

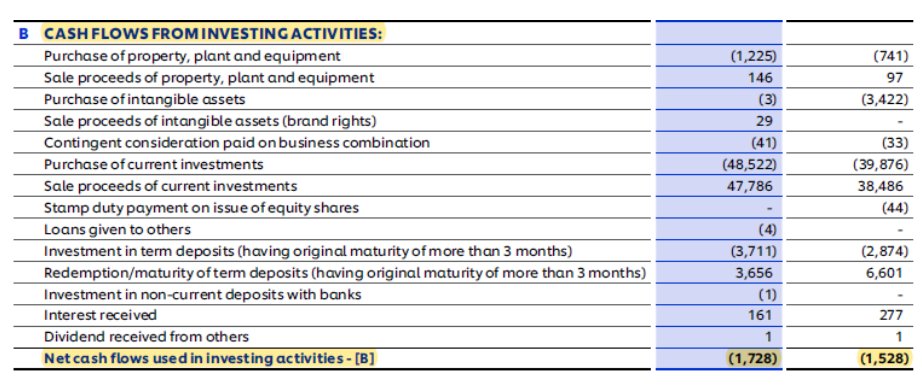

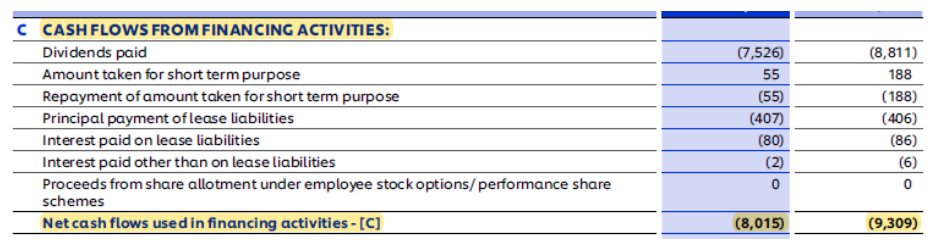

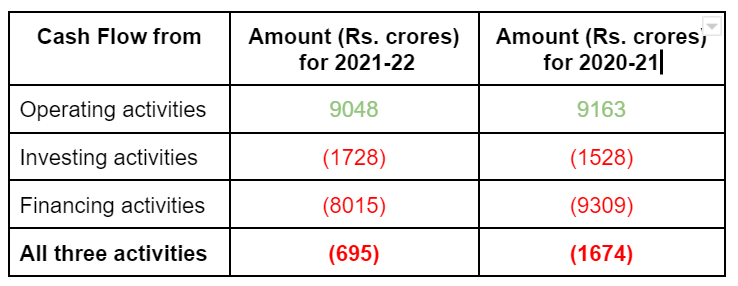

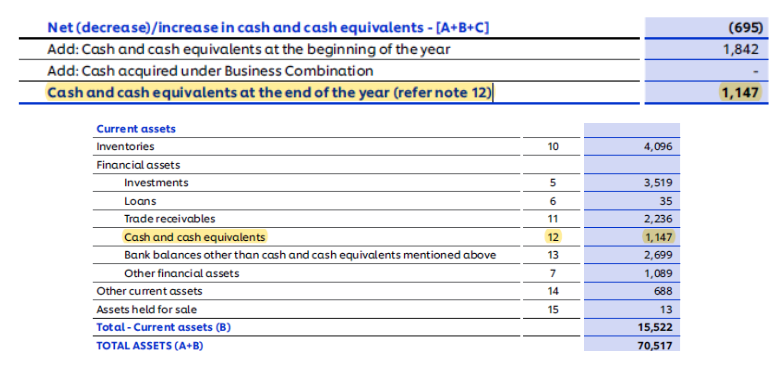

Addition of cash inflow and outflow from operating, investing and financing activities tells the amount of cash generated or consumed during a year.

You had Rs. 100 at the beginning of the year. During the year you earned cash Rs. 200.

How much cash do you have at the end of the year?

Rs. 100 + Rs. 200 = Rs. 300

How much cash do you have at the end of the year?

Rs. 100 + Rs. 200 = Rs. 300

Along with the balance sheet and income statement, cash flow statement is one of the 3 main financial statements filed by companies. To know how to easily analyze the balance sheet and income statement, please refer to our earlier threads.

جاري تحميل الاقتراحات...