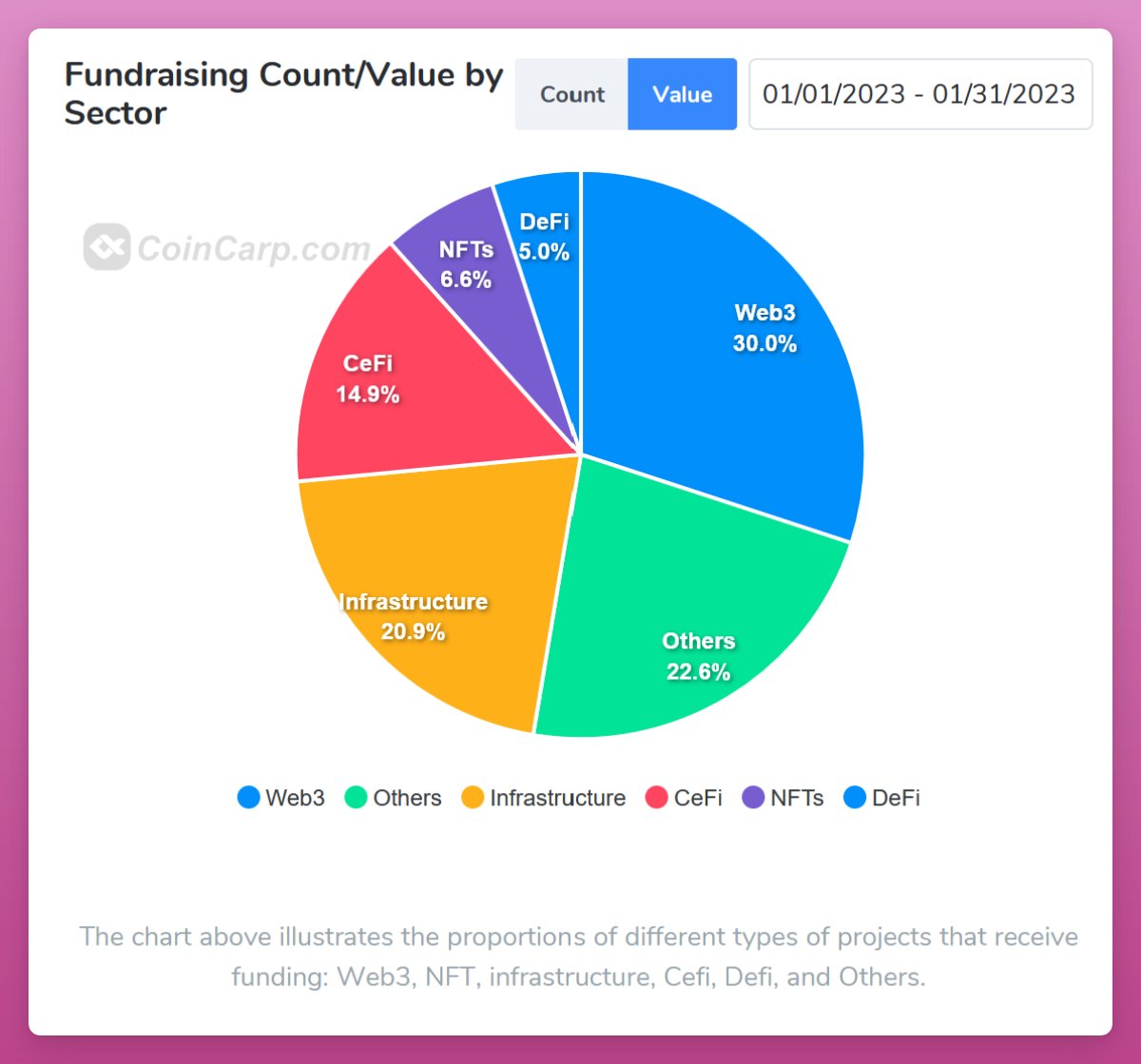

1/ What's new in #DeFi?

Every month I follow where the money flows to find out.

Early-stage projects that secure funding during bear markets have a good chance of thriving in bull runs.

Here's the current state of fundraising & top 5 projects that just raised money: 🧵

Every month I follow where the money flows to find out.

Early-stage projects that secure funding during bear markets have a good chance of thriving in bull runs.

Here's the current state of fundraising & top 5 projects that just raised money: 🧵

4/ I focus on seed round investments by prominent VCs.

Most of these project don't have a token yet, but if the market sentiment continues to improve, I expect them to launch tokens soon.

There are already 40 projects on my watch list at: ignasdefi.notion.site

Most of these project don't have a token yet, but if the market sentiment continues to improve, I expect them to launch tokens soon.

There are already 40 projects on my watch list at: ignasdefi.notion.site

7/ By the way, you can find more in-depth insight on DeFi by subscribing to my Substack blog:

ignasdefi.substack.com

ignasdefi.substack.com

8/

2️⃣ @ElixirProtocol is building an algorithmic market making (MM) protocol.

It enables anyone to participate in MM on both CEXes and DEXes.

Their Protocol-Owned liquidity model allows dApps to share MM returns to their communities.

2️⃣ @ElixirProtocol is building an algorithmic market making (MM) protocol.

It enables anyone to participate in MM on both CEXes and DEXes.

Their Protocol-Owned liquidity model allows dApps to share MM returns to their communities.

9/ Elixir is already being used by Perpetual Protocol, dYdX, Sudoswap, and the Perennial project teams.

Elixir raised $2.1M from FalconX, Op Crypto, KuCoin, and Arthur Hayes himself.

Elixir raised $2.1M from FalconX, Op Crypto, KuCoin, and Arthur Hayes himself.

10/

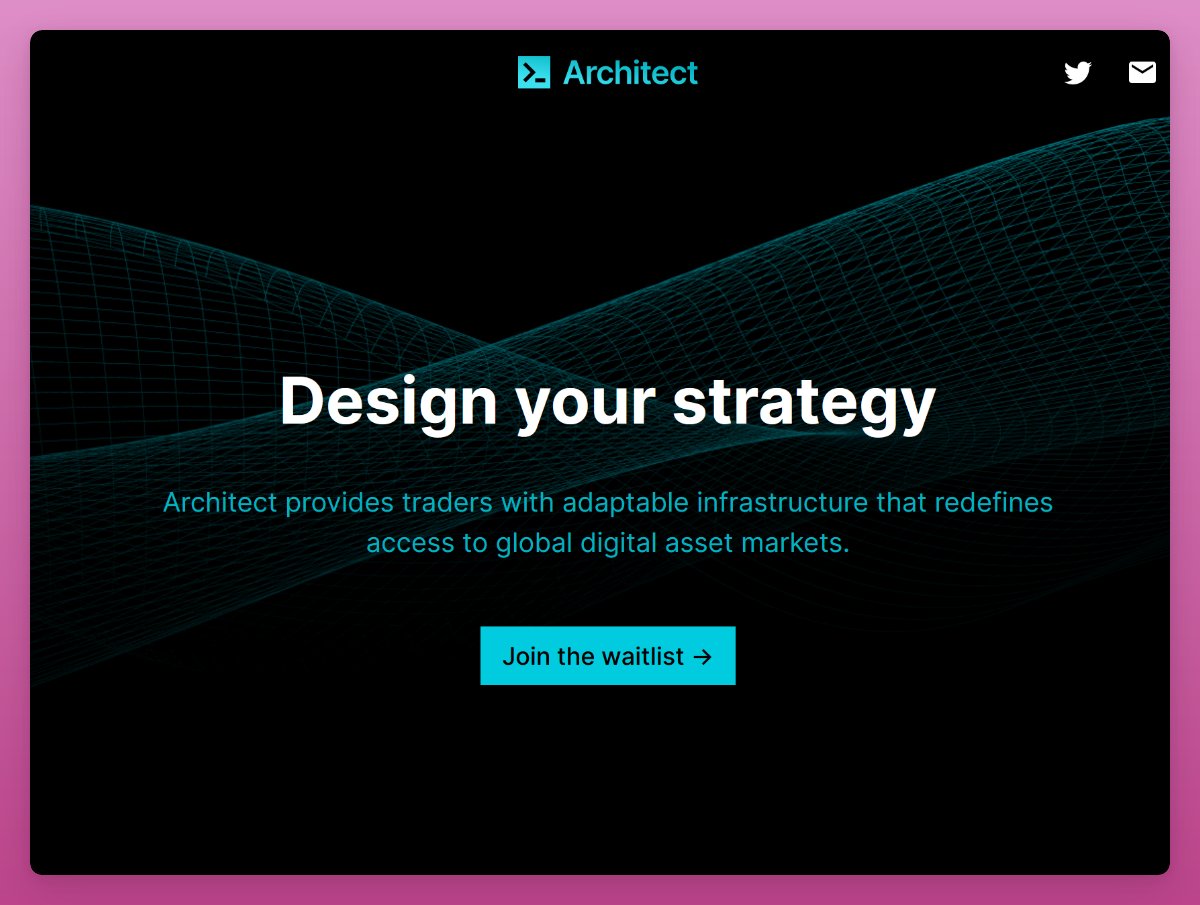

3️⃣ Ex-FTX President Brett Harrison raised $5M to build @Architect_xyz 👀

Architect will offer institutional-grade infrastructure for crypto connectivity across exchanges.

It will be a single trading platform for easy access to both custodians and self-custody options.

3️⃣ Ex-FTX President Brett Harrison raised $5M to build @Architect_xyz 👀

Architect will offer institutional-grade infrastructure for crypto connectivity across exchanges.

It will be a single trading platform for easy access to both custodians and self-custody options.

11/

4️⃣ Arbitrum fans will like @VestExchange

Vest is a perpetual futures exchange to trade 'almost any asset you can think of.'

The team promises improved risk management, clear risk/returns for liquidity providers and long-tail asset support.

4️⃣ Arbitrum fans will like @VestExchange

Vest is a perpetual futures exchange to trade 'almost any asset you can think of.'

The team promises improved risk management, clear risk/returns for liquidity providers and long-tail asset support.

12/

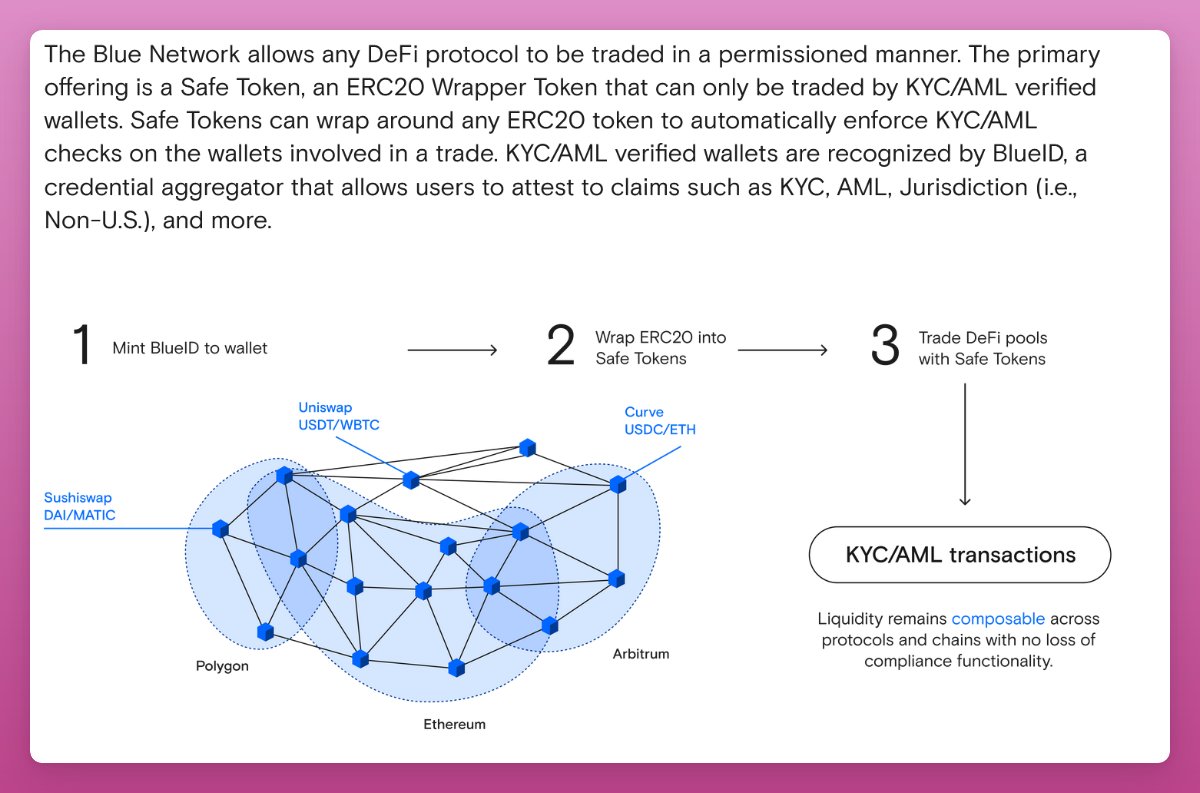

5️⃣ @BIueFi offers KYC/AML trading on DeFi protocols like Uniswap and Curve.

The solution is based on a Safe Token, an ERC20 Wrapper Token that enforces KYC/AML checks on the wallets involved in a trade.

5️⃣ @BIueFi offers KYC/AML trading on DeFi protocols like Uniswap and Curve.

The solution is based on a Safe Token, an ERC20 Wrapper Token that enforces KYC/AML checks on the wallets involved in a trade.

14/ Did I miss any innovative project that just raised money?

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...