#26 @smileefinance

Decentralized Volatility Product,

My simplified version so everyone understands

In the thread

1) TLDR

2) What is Smilee finance

3) How does it work

4) What does it enable

5) Opportunity & Challenges

6) Summary & how I would play it

Decentralized Volatility Product,

My simplified version so everyone understands

In the thread

1) TLDR

2) What is Smilee finance

3) How does it work

4) What does it enable

5) Opportunity & Challenges

6) Summary & how I would play it

unrolled here,

Sub me, trust me...

im going to start hiding special alpha in the newsletter

if you been following me, u know i do anything to farm engagement

2lambroz.substack.com

Sub me, trust me...

im going to start hiding special alpha in the newsletter

if you been following me, u know i do anything to farm engagement

2lambroz.substack.com

📍What is Smilee finance?

They have just released their white paper

medium.com

Let’s not focus on the maths and formulas if it confuses u

Trust me bro on this

✅Providing Liquidity (uniswapv2) is shorting volatility

✅In high volatile market you get implement loss

They have just released their white paper

medium.com

Let’s not focus on the maths and formulas if it confuses u

Trust me bro on this

✅Providing Liquidity (uniswapv2) is shorting volatility

✅In high volatile market you get implement loss

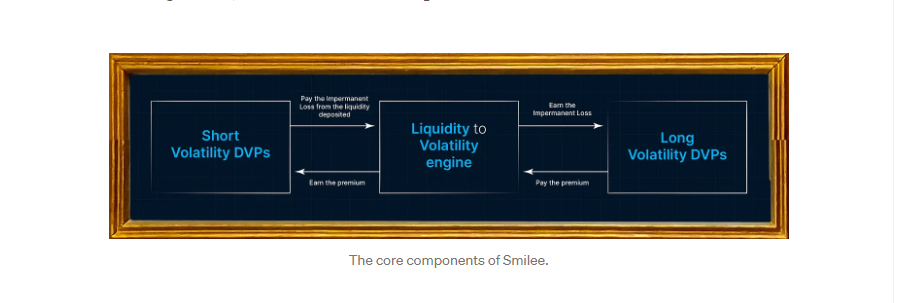

📍The problem

You can’t long volatility right now & hedging your IL, and smilee wants to provide a solution to that.

📍How does similee work.

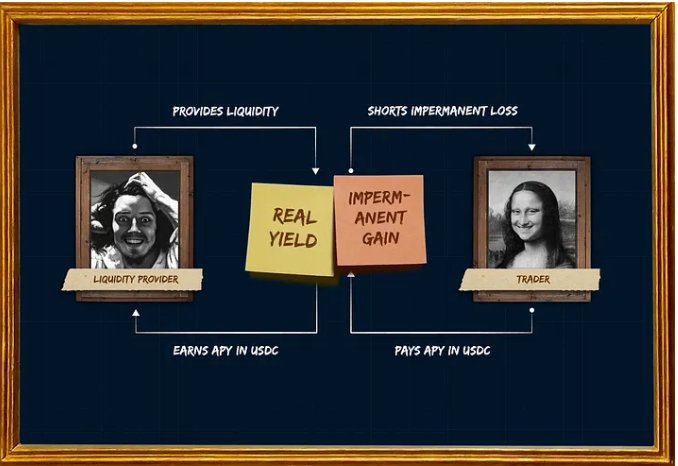

It creates a market between “Liquidity provider” and ‘ppl who want to long volatility”

You can’t long volatility right now & hedging your IL, and smilee wants to provide a solution to that.

📍How does similee work.

It creates a market between “Liquidity provider” and ‘ppl who want to long volatility”

📍Now that you understand the core of smilee lets go into more details

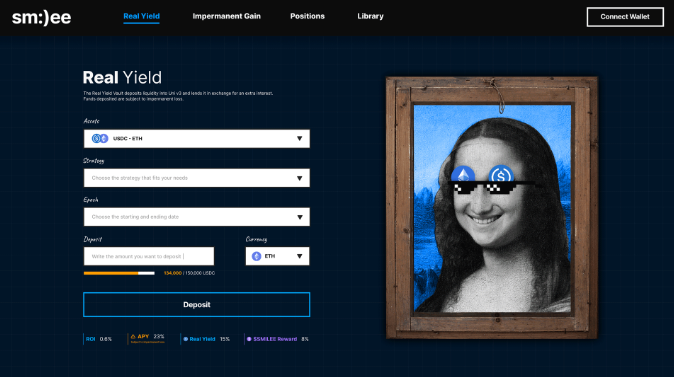

Each “volatility market” is a “vault” with a LP pair, Strategy and time frame.

Each “volatility market” is a “vault” with a LP pair, Strategy and time frame.

“Real Yield (LP short volatility)” will earn additional yield based on volume of “impermanent Gain ( low volatility)”

“impermanent Gain ( low volatility)” will earn the IL.

“impermanent Gain ( low volatility)” will earn the IL.

📍Opportunity & Challenges

📍Opportunity

- This enable users to trade, hedge and speculate on volatility on LP pairs, might be the first of something

- Additional yield for people who are providing liquidity anyways. (added time frame element tho)

📍Opportunity

- This enable users to trade, hedge and speculate on volatility on LP pairs, might be the first of something

- Additional yield for people who are providing liquidity anyways. (added time frame element tho)

- The same model can be apply on a lot of different LP strategy, might be a new page for vault/ leverage yield farm protocols

- New is always interesting

- New is always interesting

📍Challenges

- LP & IL is a complicated topic, can the UIUX display risk & return of IL to traders speculating on “impermanent gain”?

- Even tho LP is earning extra yield, will there be an extreme one sided long/shot volatility balance, making the pay out not attractive?

- LP & IL is a complicated topic, can the UIUX display risk & return of IL to traders speculating on “impermanent gain”?

- Even tho LP is earning extra yield, will there be an extreme one sided long/shot volatility balance, making the pay out not attractive?

📍Summary and how I would play it

I like smilee, their products enable a new field of speculation, their discord fomo and attracting threadoors, kol like @BarryFried1 is good.

I like smilee, their products enable a new field of speculation, their discord fomo and attracting threadoors, kol like @BarryFried1 is good.

It will be interesting to see what strategy you can long/short volatility on, a leverage LP position with leveraged IL will be fun. I can’t wait to see how the market will take this.

📍My play on this will be simple.

🐏Free ride @defi_mochi future dashboard to:

🐏Check out potential LP position that might end up +EV with additional yield from implement gain to deploy

🐏Try to work out potential IL to see is it worth to long volatility

🐏Free ride @defi_mochi future dashboard to:

🐏Check out potential LP position that might end up +EV with additional yield from implement gain to deploy

🐏Try to work out potential IL to see is it worth to long volatility

🐏Key dates, if they launch before shanghai update will be very very interesting as it’s likely to be high volatility. My degen sense is tingling

Sub me if you are a bro,

im going to start hiding special alpha in the newsletter

2lambroz.substack.com

im going to start hiding special alpha in the newsletter

2lambroz.substack.com

Loading suggestions...