#25 @Contango_xyz

New Dex with a cheaper way for you to leverage long/short?

Leverage trading with expirables

In this thread

1) TLDR

2) How does it work

3) What does it enable

4) Opportunities & Challenges

5) How I would value it, what metrics to look at

6) Summary

New Dex with a cheaper way for you to leverage long/short?

Leverage trading with expirables

In this thread

1) TLDR

2) How does it work

3) What does it enable

4) Opportunities & Challenges

5) How I would value it, what metrics to look at

6) Summary

Unrolled for u here, sub me!

2lambroz.substack.com

2lambroz.substack.com

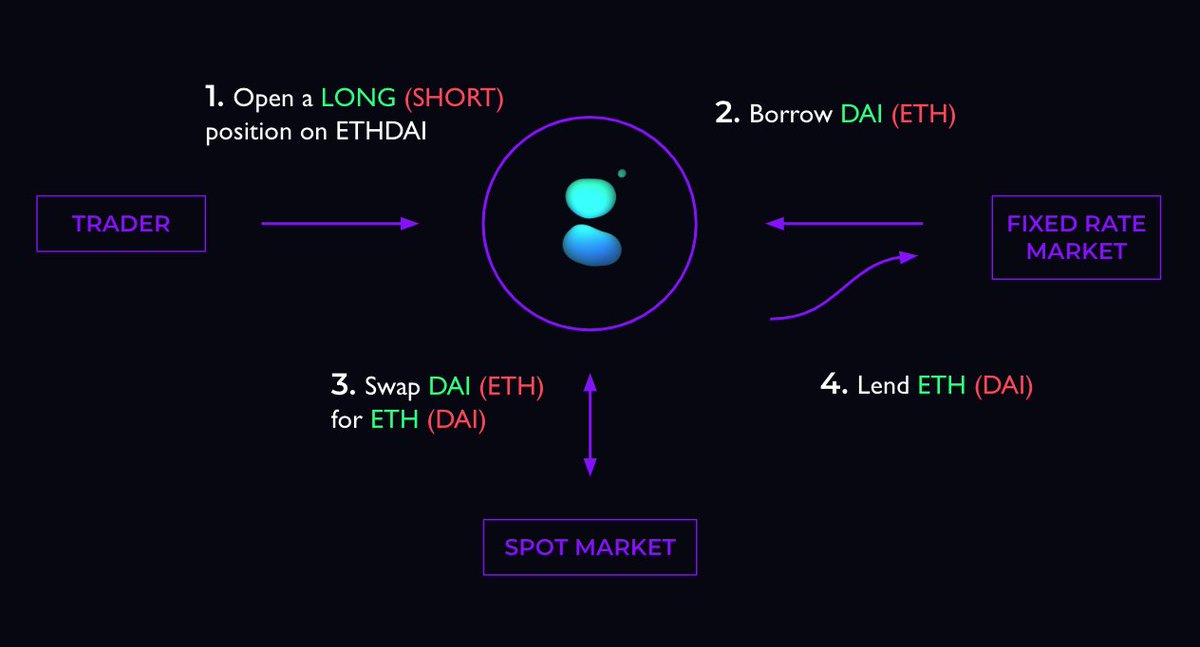

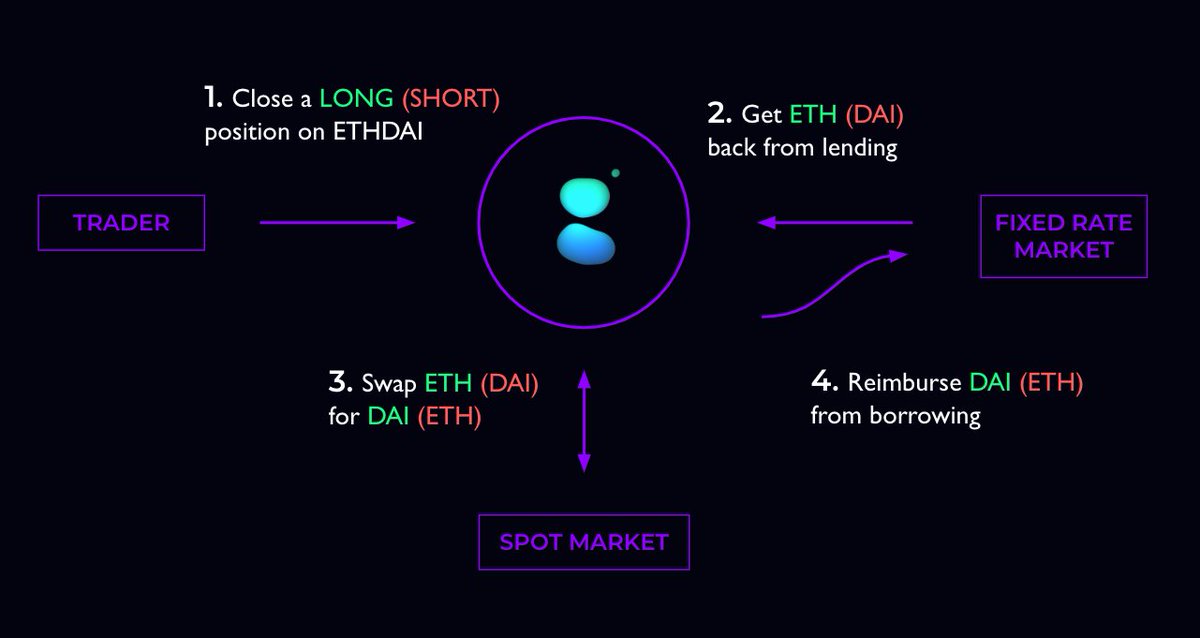

📍How does it work

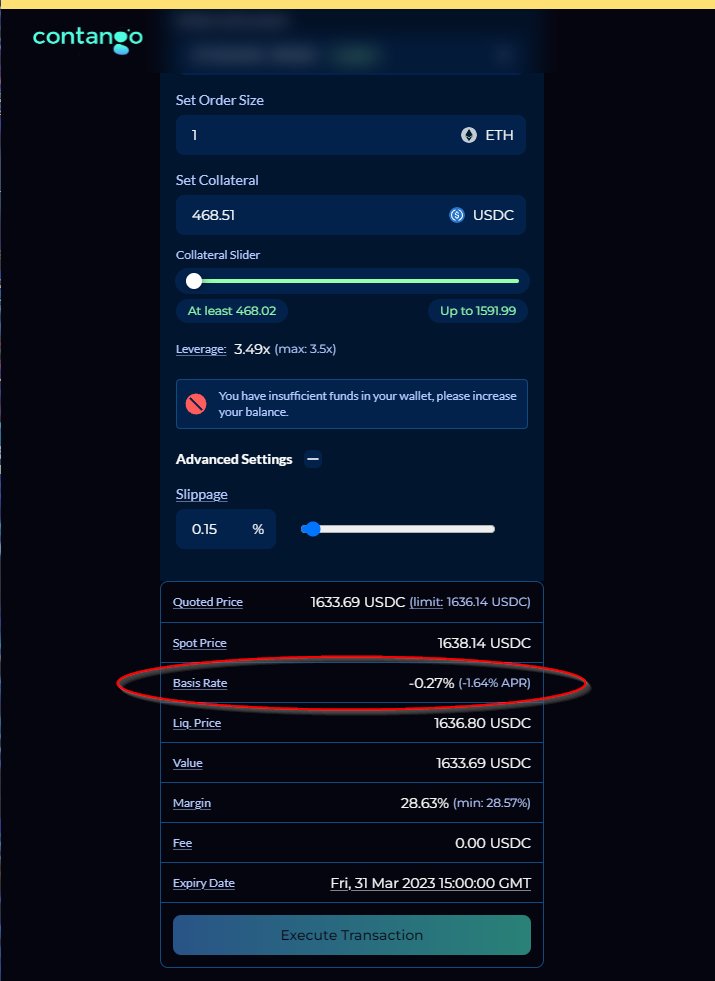

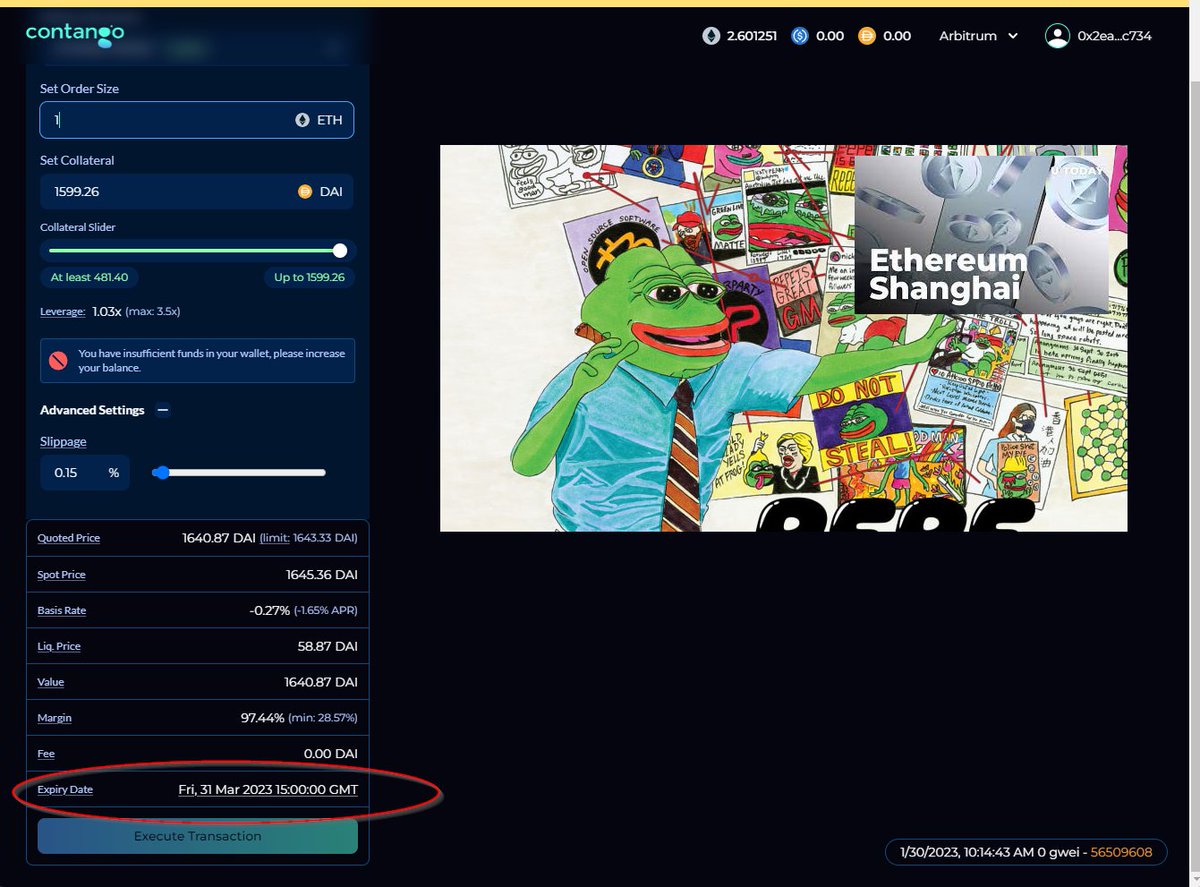

Contango leverage @yield, a fixed lending protocol to support its expirable contracts.

It allows traders to open long/short position up to 3.5x with an expiry date.

Contango leverage @yield, a fixed lending protocol to support its expirable contracts.

It allows traders to open long/short position up to 3.5x with an expiry date.

📍What does it enable

- Cheaper way to leverage

- More Predictable way to leverage

- More dimension to speculate ( time )

- Cheaper way to leverage

- More Predictable way to leverage

- More dimension to speculate ( time )

📍Opportunities & Challenges

📍Opportunities

-New tool easier to cheaply leverage using lending markets, bringing more trading volume?

-Will this drive up the potential yield/market for fixed rate lending?

-Alternative model for a new type of perp dex?

📍Opportunities

-New tool easier to cheaply leverage using lending markets, bringing more trading volume?

-Will this drive up the potential yield/market for fixed rate lending?

-Alternative model for a new type of perp dex?

📍Challenges

-Current model can’t support lots of pairs due to the underlying fixed rate lending protocol

-Current model are not able to provide a wide range of time frames.

-Potentially a cap on possible open interest due to fixed rate lending (good problem to have tho)

-Current model can’t support lots of pairs due to the underlying fixed rate lending protocol

-Current model are not able to provide a wide range of time frames.

-Potentially a cap on possible open interest due to fixed rate lending (good problem to have tho)

-New model of trading can be confusing for retail, UIUX can be improved

-Degens might want more leverage (you can’t cater everyone tho)

-Degens might want more leverage (you can’t cater everyone tho)

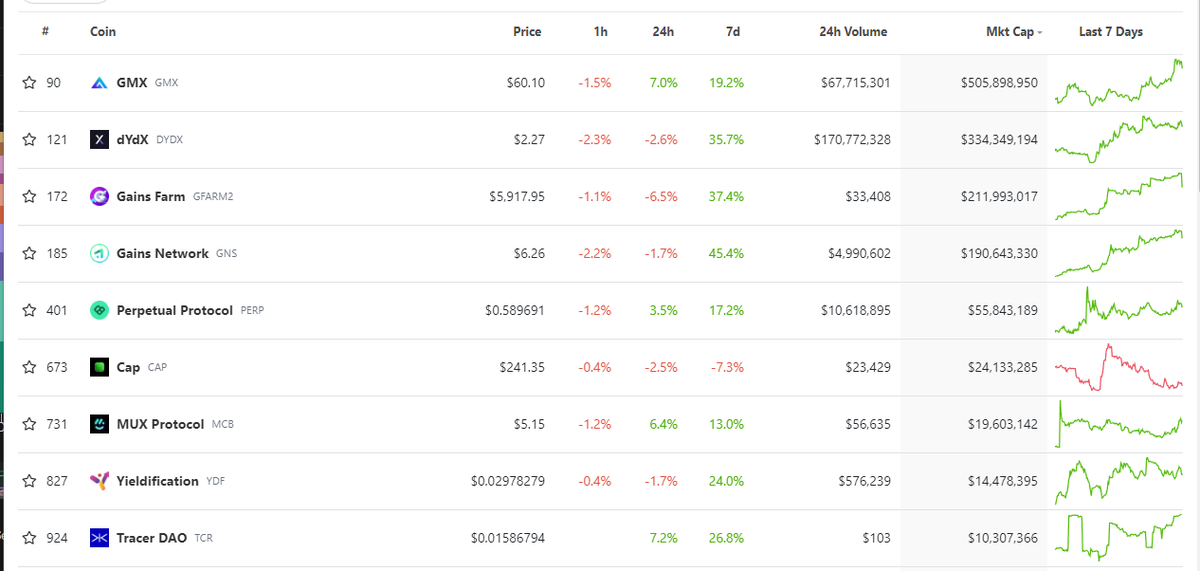

📍How I would value it, what metrics to look at.

-Trading volume, actual n growth

-Number of traders

-Liquidations

-In relation to other perpetual protocols

Contango dashboard (NOT by @defi_mochi surprising right?)

dune.com

-Trading volume, actual n growth

-Number of traders

-Liquidations

-In relation to other perpetual protocols

Contango dashboard (NOT by @defi_mochi surprising right?)

dune.com

📍Summary

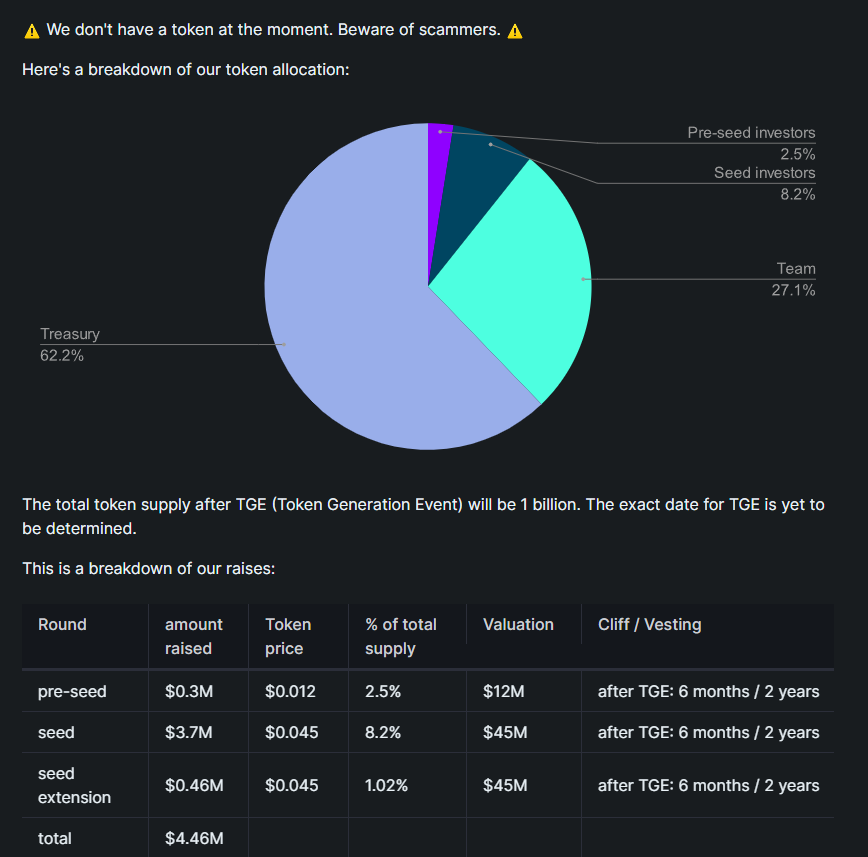

I like new things. Their investor list is top tier, gitbook well written, total addressable market is big. The core concern I have is how expandable is their structure in offering more time frames/pairs.

I like new things. Their investor list is top tier, gitbook well written, total addressable market is big. The core concern I have is how expandable is their structure in offering more time frames/pairs.

However GMX has proven even with limited pairs, when executed well there is enough trading volume to support its valuation. Their tutorials & documents are clear+easy to follow, the next step will be community & improving the UIUX. In conclusion 🐏 like 🐏 keeping an eye on it

Loading suggestions...