1/ The Real-World Asset revolution in #DeFi is already here — but many aren't paying enough attention yet.

Here's the current state of RWAs to help you catch the wave 🌊

Here's the current state of RWAs to help you catch the wave 🌊

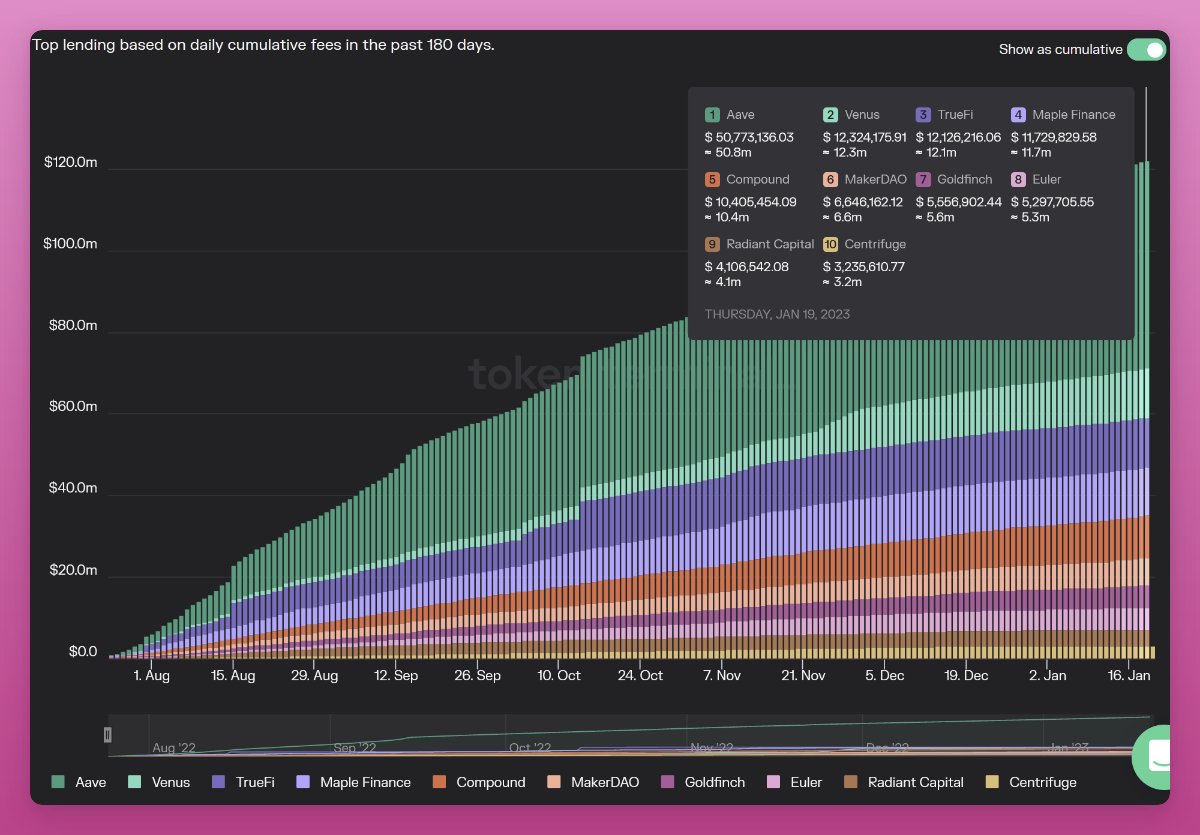

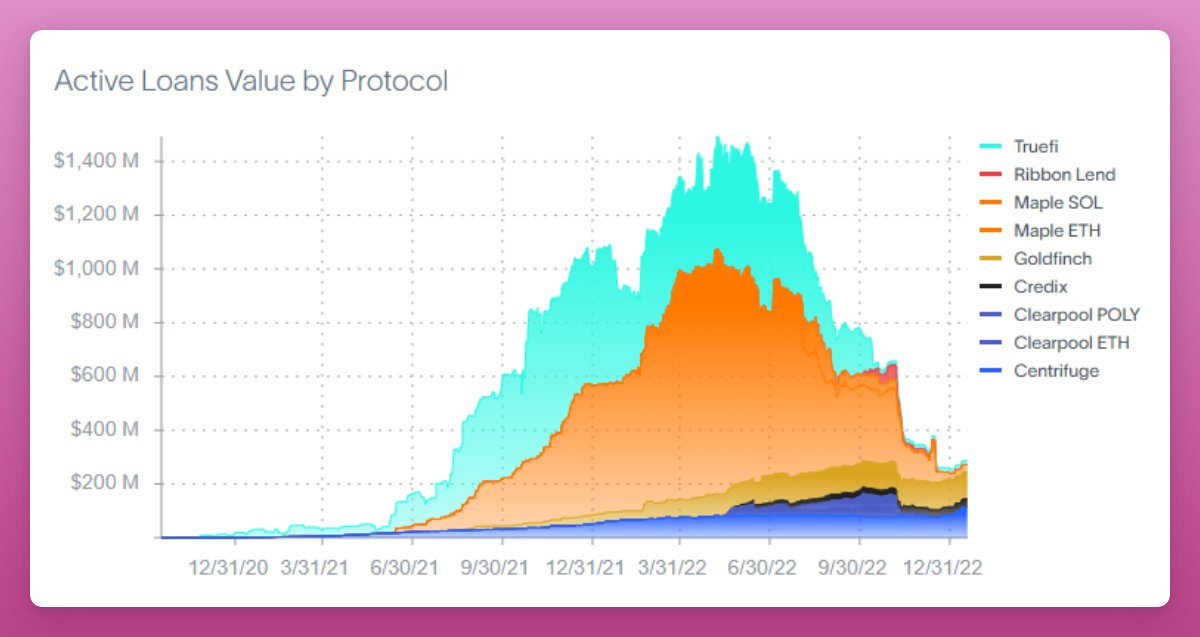

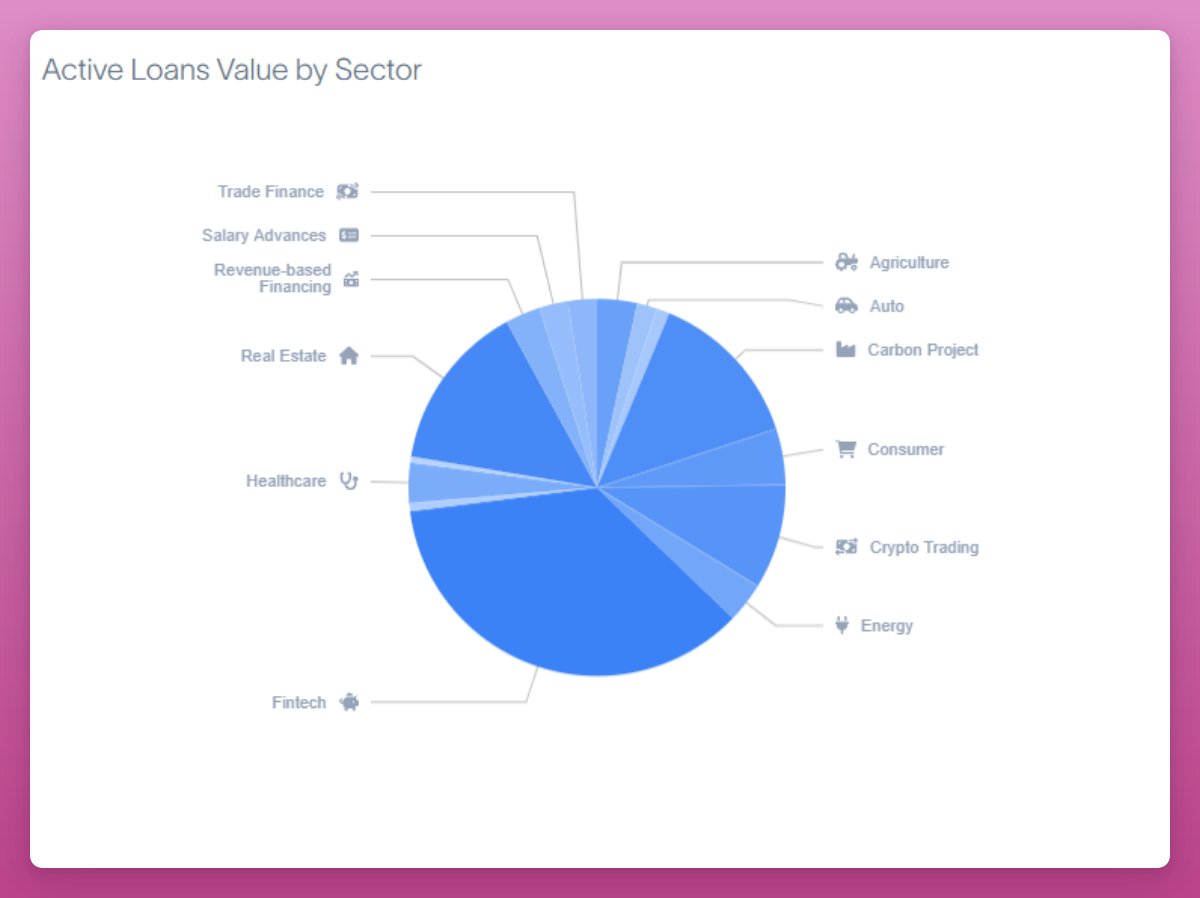

3/ Borrowing demand on protocols like Aave or Compound depends mostly on leverage.

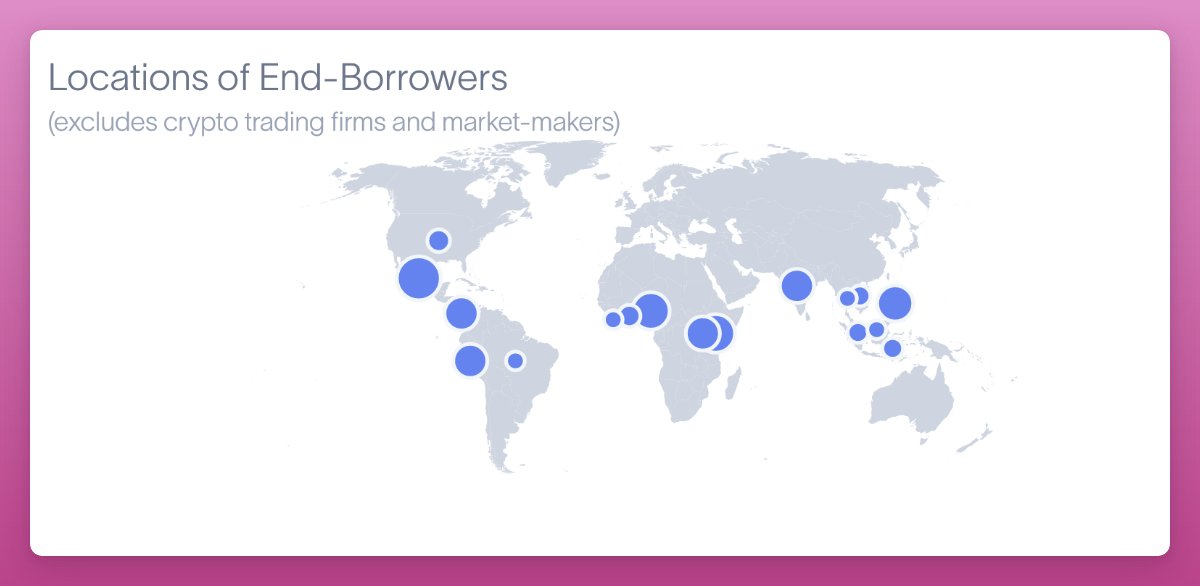

But RWA protocols offer under-collateralized lending outside the circular crypto world.

RWAs enable DeFi lending to grow from tens of billions to a $1.6T TradFi private credit loan market.

But RWA protocols offer under-collateralized lending outside the circular crypto world.

RWAs enable DeFi lending to grow from tens of billions to a $1.6T TradFi private credit loan market.

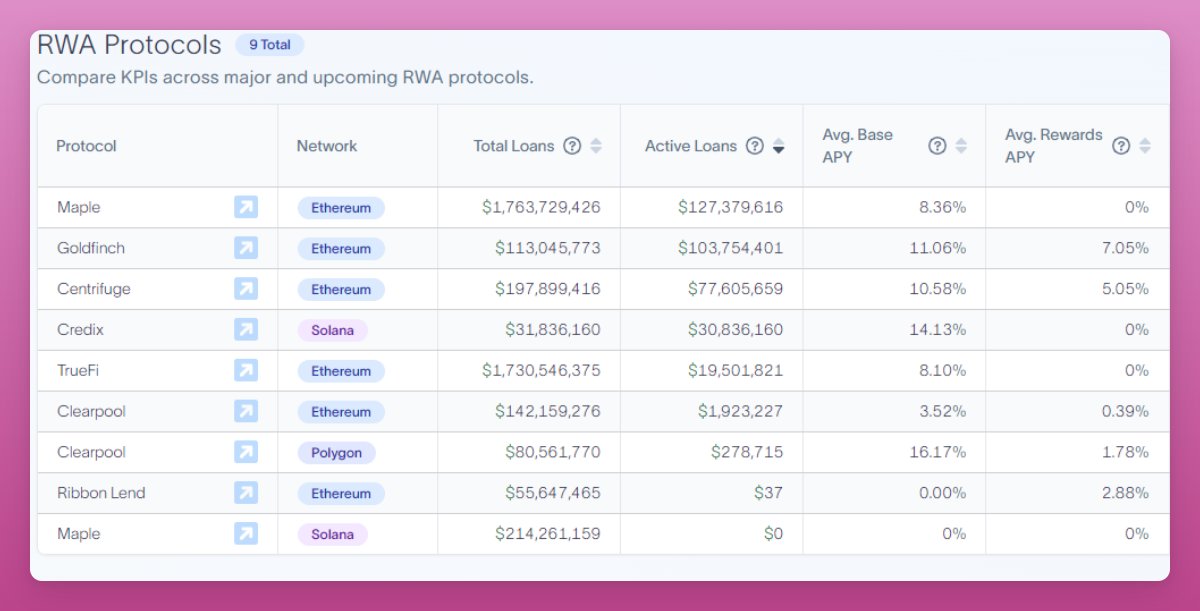

7/ The base average yield per protocol varies from 3.5% to 16%, and gets even higher when token rewards are included.

This is much higher than the current stablecoin yields on crypto-to-crypto lending protocols like Aave or Compound.

(Data: @rwa_xyz)

This is much higher than the current stablecoin yields on crypto-to-crypto lending protocols like Aave or Compound.

(Data: @rwa_xyz)

12/ Tokenomics of each protocol are slightly different, but some have staking for revenue sharing rewards.

As of writing token staking APYs are:

• $TRU - 22.94%

• $GFI - 9.37%

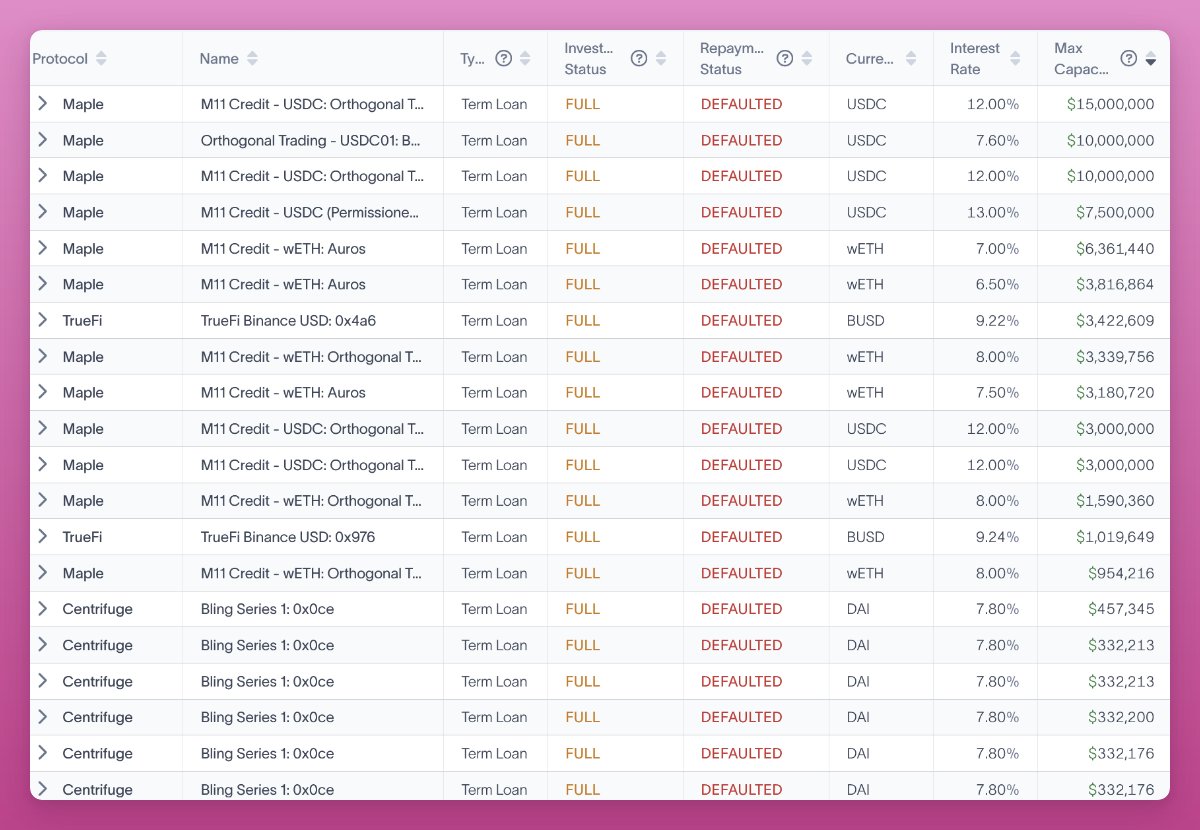

Maple staking used to generate yield, but defaults hit the protocol hard.

#realyield?

As of writing token staking APYs are:

• $TRU - 22.94%

• $GFI - 9.37%

Maple staking used to generate yield, but defaults hit the protocol hard.

#realyield?

13/ Maple recently announced Maple 2.0, which removes MPL from First Loss Capital.

The main goal of Maple 2.0 is to handle defaults more quickly by loan managers (known as "pool delegates"), who will suffer first in the event of a default.

maple.finance

The main goal of Maple 2.0 is to handle defaults more quickly by loan managers (known as "pool delegates"), who will suffer first in the event of a default.

maple.finance

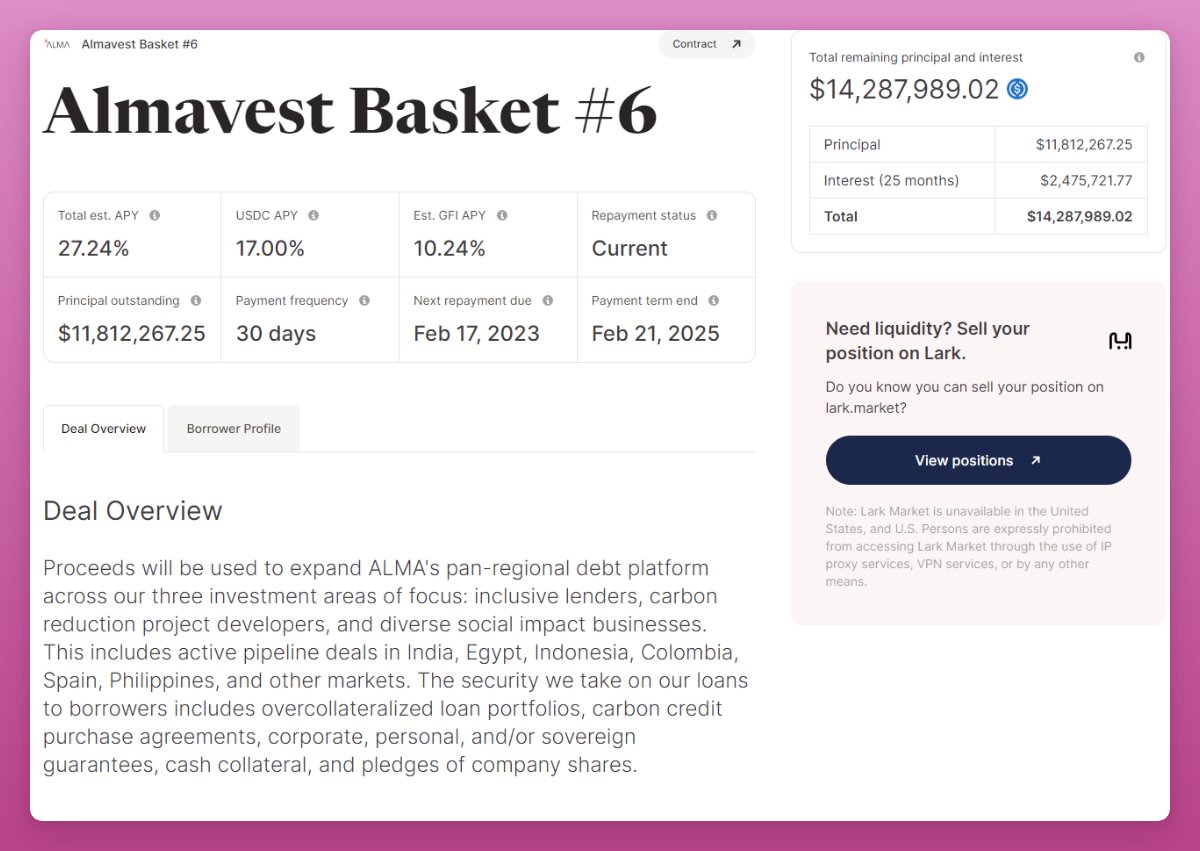

14/ Goldfinch manages risk by having Auditors who vote to approve Borrowers.

Goldfich also requires all participants to pass 'Unique Entity Check'.

These are Soulbound tokens (SBTs) in a form of non-transferrable NFTs.

To learn more, check my thread below: 👇

Goldfich also requires all participants to pass 'Unique Entity Check'.

These are Soulbound tokens (SBTs) in a form of non-transferrable NFTs.

To learn more, check my thread below: 👇

16/ Overall, I think RWA lending has a lot of room to grow: Maker went all-in on RWAs and Aave will introduce them too.

Only a few protocols exist at the moment, but with yields on crypto-to-crypto lending so low, more protocols will enter the space & boost yields in DeFi.

Only a few protocols exist at the moment, but with yields on crypto-to-crypto lending so low, more protocols will enter the space & boost yields in DeFi.

17/ I think RWA narrative boom is yet to come.

For 'Token Performance and Token On-Chain Data' check my free blog post on Substack.

I'm migrating my blog from Medium to Substack so make sure to subscribe 🔔

ignasdefi.substack.com

For 'Token Performance and Token On-Chain Data' check my free blog post on Substack.

I'm migrating my blog from Medium to Substack so make sure to subscribe 🔔

ignasdefi.substack.com

18/ What are your thoughts on RWAs?

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...