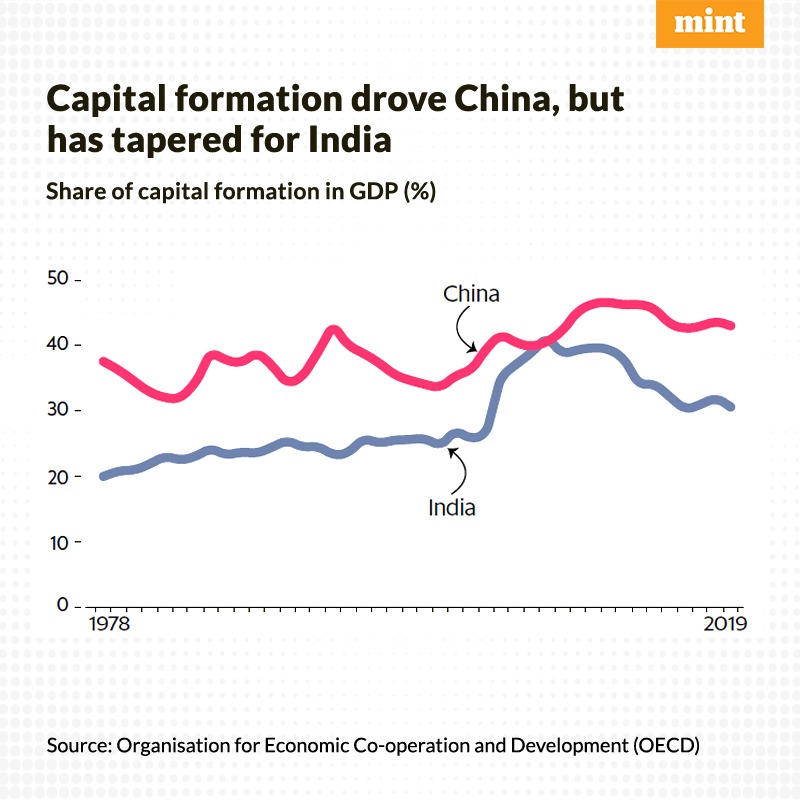

#MintPlainFacts | China’s great strength, and India’s weakness over the past 15 years or so, has been investment, or the net addition to capital goods like machinery and equipment.

Read here: livemint.com

Read here: livemint.com

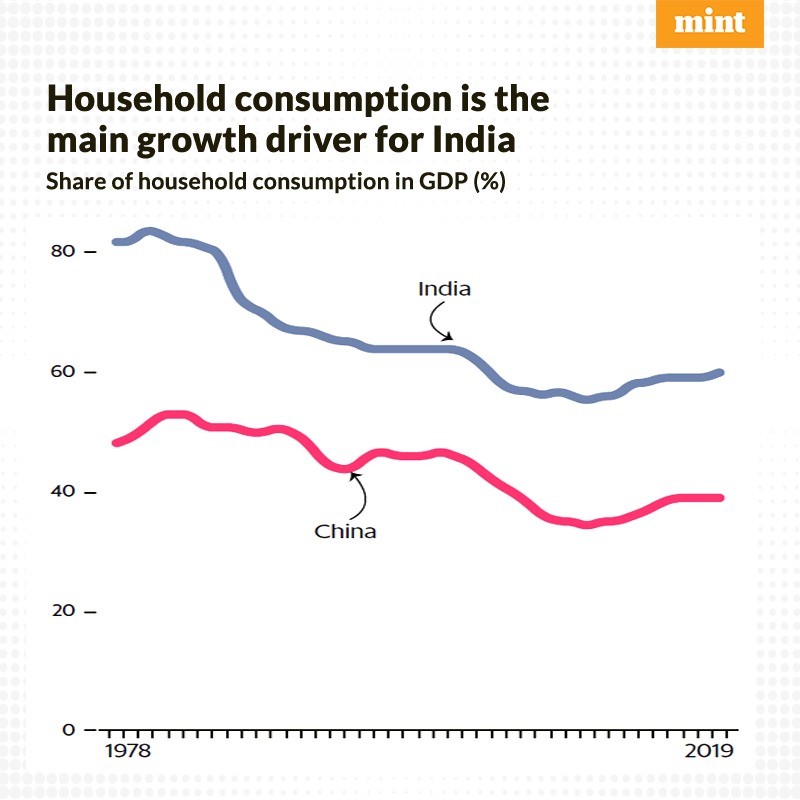

#MintPlainFacts | For India, consumption—essentially, spending by households—has been the economic driver.

It accounted for 84% of India’s GDP in 1980 & still accounts for about 60%. By comparison, consumption accounts for 39% of China’s GDP.

Read here: livemint.com

It accounted for 84% of India’s GDP in 1980 & still accounts for about 60%. By comparison, consumption accounts for 39% of China’s GDP.

Read here: livemint.com

#MintPlainFacts | Recent Indian initiatives such as the production-linked incentive (PLI) scheme are intended to lift capital formation, but the challenge is immense.

Read here: livemint.com

Read here: livemint.com

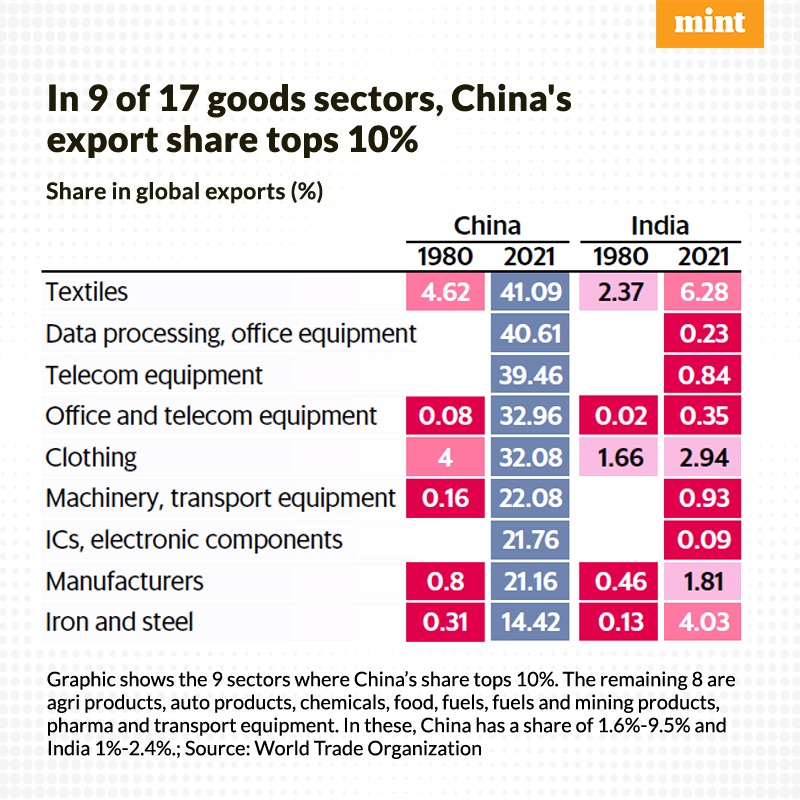

#MintPlainFacts | China powered its growth through exports, and invested surpluses from there to create infrastructure to become the world’s manufacturing hub.

Read here: livemint.com

Read here: livemint.com

#MintPlainFacts | In none of the 17 sectors tracked by WTO did China’s global export share cross 10% in 1980.

But, this shot up to nine sectors by 2020, as it made large investments in domestic infrastructure.

Read here: livemint.com

But, this shot up to nine sectors by 2020, as it made large investments in domestic infrastructure.

Read here: livemint.com

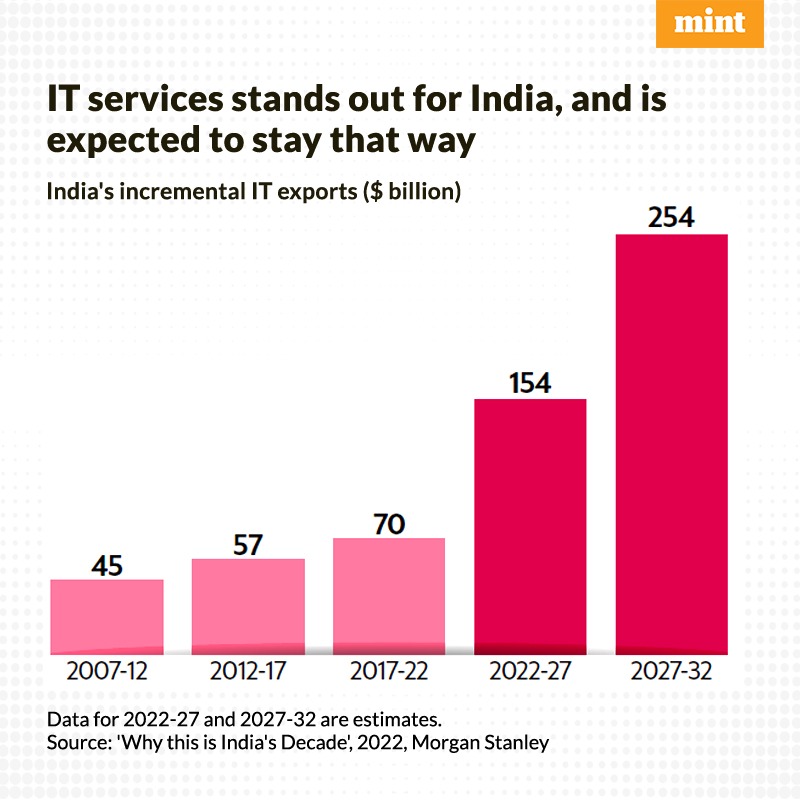

#MintPlainFacts | According to Morgan Stanley, Indian IT exports have grown from $40 billion to an estimated $178 billion in 2021-22, & are likely to grow to $527 billion in 2031-32.

Read here: livemint.com

Read here: livemint.com

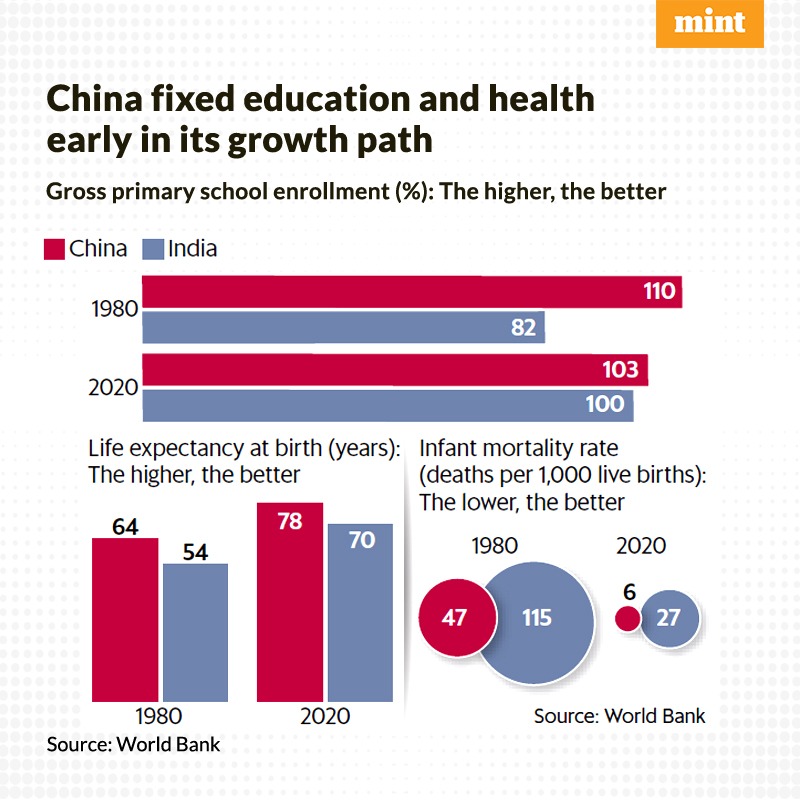

#MintPlainFacts | One thing that enabled China to grow this fast, and for this long, was the social capital it had in place in 1980, when it initiated reforms like greater private participation.

Read here: livemint.com

Read here: livemint.com

Loading suggestions...