1️⃣ Rochon’s investment philosophy

Rochon's investment philosophy is based on a few CRUCIAL pillars:

- In the long run, stocks are the best asset class to put your money in

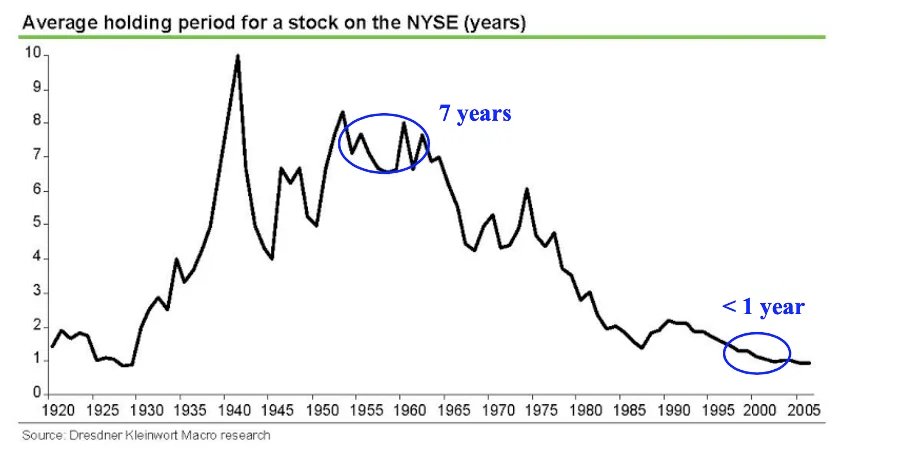

- Time in the market beats timing the market

Rochon's investment philosophy is based on a few CRUCIAL pillars:

- In the long run, stocks are the best asset class to put your money in

- Time in the market beats timing the market

- Only buy companies with a competitive advantage

- A lot of opportunities can be found in monopolistic and oligopolistic markets

- A lot of opportunities can be found in monopolistic and oligopolistic markets

- Focus on companies with high margins and high returns on capital

- Good long term prospects and a dedicated management team are crucial

- Good long term prospects and a dedicated management team are crucial

- The stock market isn’t always efficient in the short term. Take advantage of it

- If you are right on the business, you’ll eventually be right about the stock

- If you are right on the business, you’ll eventually be right about the stock

2️⃣ Things to consider when analyzing a company

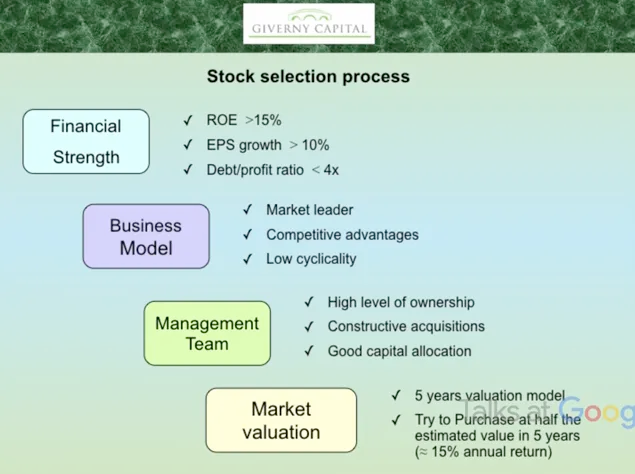

In general, Rochon focuses on 5 things when he analyzes a company:

1. The business model: Do I understand how the company makes money? How much market share does the company have? What about product innovation…?

In general, Rochon focuses on 5 things when he analyzes a company:

1. The business model: Do I understand how the company makes money? How much market share does the company have? What about product innovation…?

2. The financials: Does the company have a healthy balance sheet? Does the company have a high profit margin? Are most earnings translated into free cash flow…?

3. Management quality: Does management allocate capital efficiently? Do they have skin in the game? Are they obsessed by their product / service…?

4. Outlook: Can the company grow its earnings at an attractive rate (> 12%)? Is the company active in a secular trend…?

5. Valuation: Is the company over- or undervalued compared to its historic average? How did the intrinsic value evolve over time in relation to its valuation…?

This framework is beautiful as it will allow you to act more rational and think on the long term.

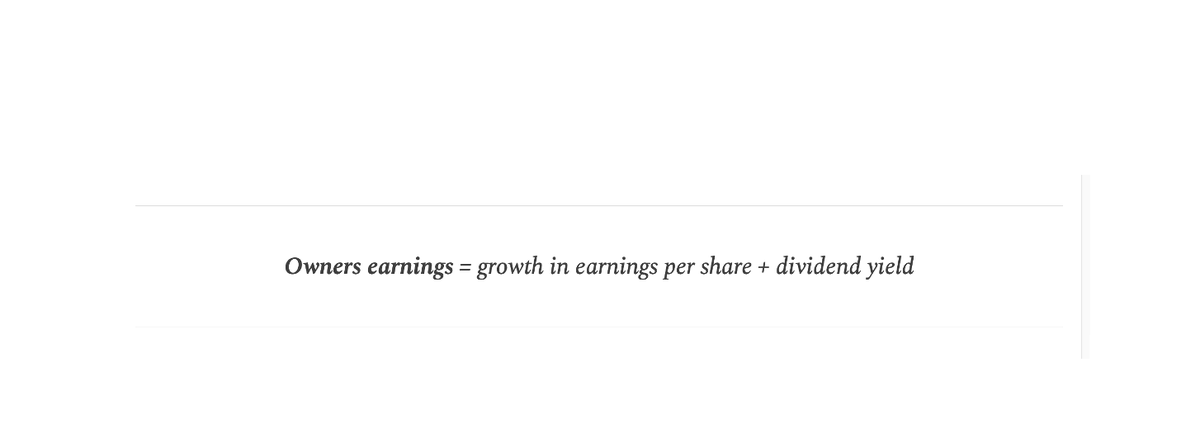

4️⃣ Owners earnings

Benjamin Graham once said: In the short run, the market is a voting machine but in the long run, it is a weighing machine.

Benjamin Graham once said: In the short run, the market is a voting machine but in the long run, it is a weighing machine.

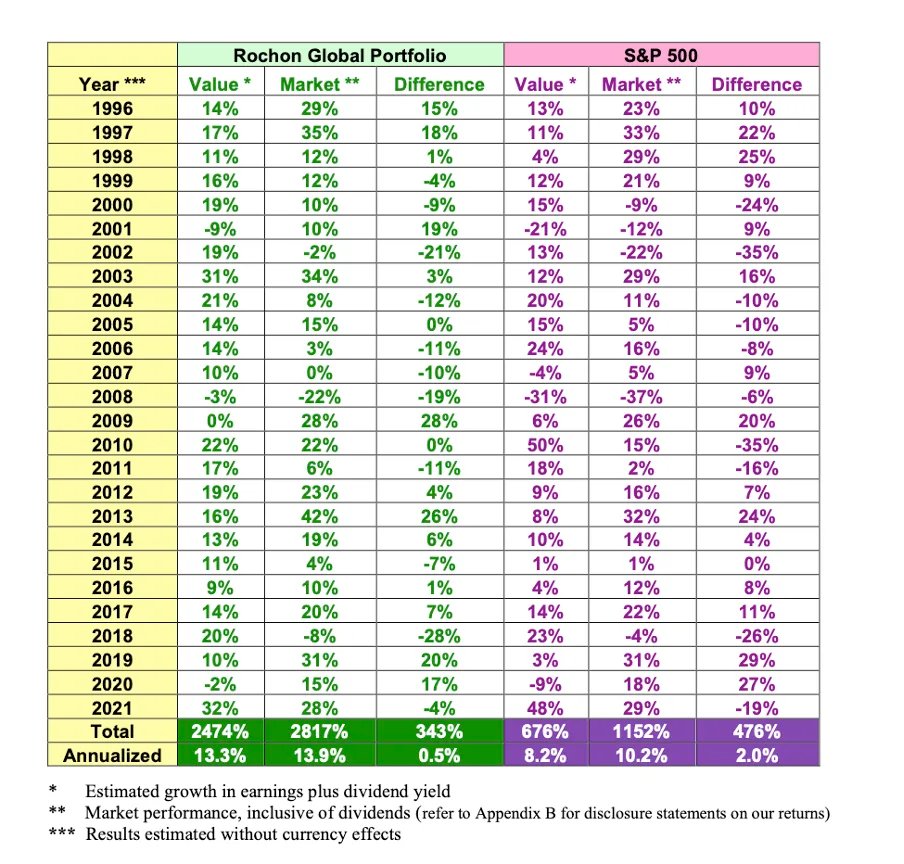

That’s why you should never focus on how your portfolio performed in a certain year and always look at the evolution of the intrinsic value of the companies within your portfolio.

Market performance (stock price) and corporate performance (owners earnings) are rarely synchronized over the course of a calendar year. But as more time goes by, the synchronization between the two begins to affirm itself.

Since 1996, the companies withon Rochon’s portfolio have grown their value by about 2474% and their stocks have achieved a total return of approximately 2817%. On an annualized basis, they achieved an intrinsic performance of 13.3% versus 13.9% for their stock market performance.

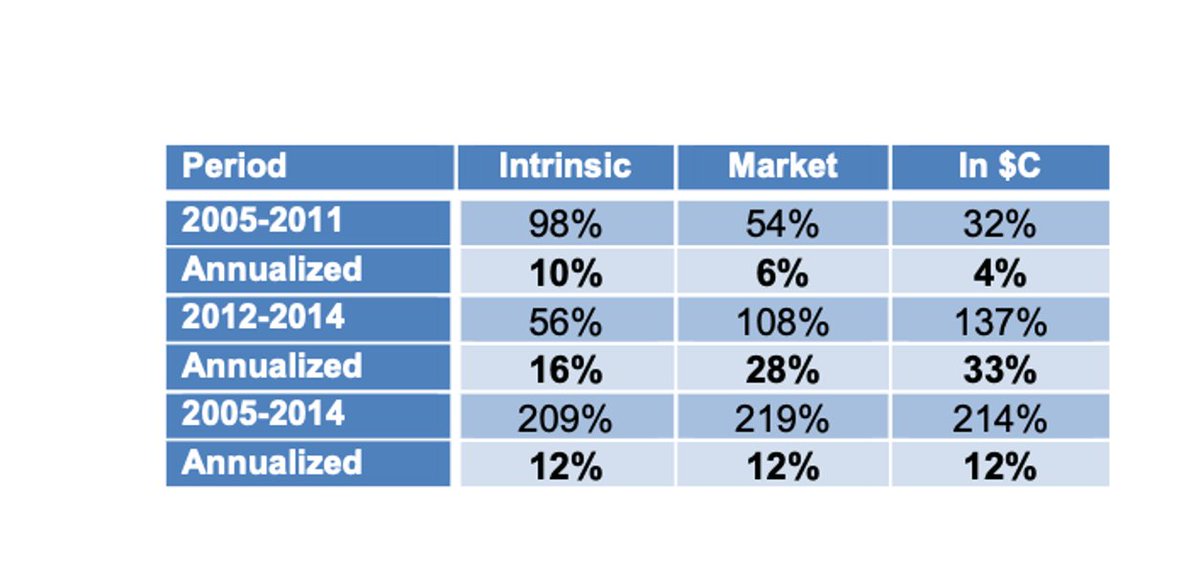

Between 2005 and 2011, Giverny Capital increased its owner earnings by 10% per year while Rochon’s stocks only rose by 6% per year.

Between 2012 and 2014, Rochon increased its owners earnings by 16% per year while his stocks increased by 28% per year.

Between 2012 and 2014, Rochon increased its owners earnings by 16% per year while his stocks increased by 28% per year.

However, when you look at the big picture (2005-2014), you conclude that the owners earnings and stock prices compounded at exactly the same rate of 12% per year.

The key takeaway is that in the short term stock prices are heavily influenced by changes in valuation, while in the long term stock prices always follow the evolution of its owner earnings.

The key takeaway is that in the short term stock prices are heavily influenced by changes in valuation, while in the long term stock prices always follow the evolution of its owner earnings.

6️⃣ Have patience

Patience is the supreme of quality investing.

Patience is the supreme of quality investing.

7️⃣ Rochon doesn’t like to sell

Rochon doesn’t like to sell stocks.

Rochon doesn’t like to sell stocks.

Selling your winners too early is one of the biggest mistakes you can make. A stock with a weight of 1.5% within your portfolio that goes down 7% ‘only’ represents a 1% loss in capital.

However, when you sell a company that had a 4% weight in your portfolio and that goes on to rise with 200%, it will cost you 8%. You may not see it, but such opportunity costs are real.

8️⃣ Skin in the game

When you read Rochon’s annual letters, there is one thing that always comes back: Rochon wants to invest in companies lead by exceptional people with skin in the game.

When you read Rochon’s annual letters, there is one thing that always comes back: Rochon wants to invest in companies lead by exceptional people with skin in the game.

When insider ownership is high and / or the company is run by their founder(s), you increase the chance that interests of management are aligned with yours as a shareholder.

9️⃣ Re-evaluate your decisions

Do you want to improve your investment skills? Keep an investment journal.

Do you want to improve your investment skills? Keep an investment journal.

In this journal you write down why you bought and sold a certain stock. You will learn a lot when you periodically take a look at the decisions you took and whether they worked out or not.

Since 1945, there have been 11 recessions. Four times, the stock market dropped by more than 40%.

Every crisis had one thing in common: they all ended.

Every crisis had one thing in common: they all ended.

Each correction offers opportunities. The key to successful investing is being psychologically ready for recessions and market corrections.

You don’t know when a correction will take place, but you can mentally prepare for it.

You don’t know when a correction will take place, but you can mentally prepare for it.

The problem is that in a bull market, investors tend to forget that stocks can also go down. They buy stocks at any level without consideration of their intrinsic values.

And then, after a big drop, they sell believing that never again stocks will be a rewarding source of wealth (or they wait for a “better” time to buy time, meaning when they will have gone up a lot).

Timing the market is a fools game. Be aware that 90% of stock returns happen in 1.5% of trading days.

The end!

If you want to read the full article, take a look at our website.

For those even more dedicated, all François Rochon's annual letters can be downloaded via this link. Special thanks to @Invesquotes for compiling all letters.

qualitycompounding.substack.com

If you want to read the full article, take a look at our website.

For those even more dedicated, all François Rochon's annual letters can be downloaded via this link. Special thanks to @Invesquotes for compiling all letters.

qualitycompounding.substack.com

@ArneUlland “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” - Charlie Munger

Loading suggestions...