1/ DeFi yields are low, but there's an opportunity to bring TradFi yields into the mix.

A few protocols are doing just that: 🧵

A few protocols are doing just that: 🧵

4/ This partnership with Genesis is becoming a bit of a problem: MakerDAO holds 85%+ of GUSD's $572M total supply.

Yet yesterday, the SEC charged Gemini (issuer of GUSD) with selling unregistered securities – posing some headaches to the DAO.

Yet yesterday, the SEC charged Gemini (issuer of GUSD) with selling unregistered securities – posing some headaches to the DAO.

5/ This is exactly, what Rune (co-founder of Maker) has warned about in the End Game Plan.

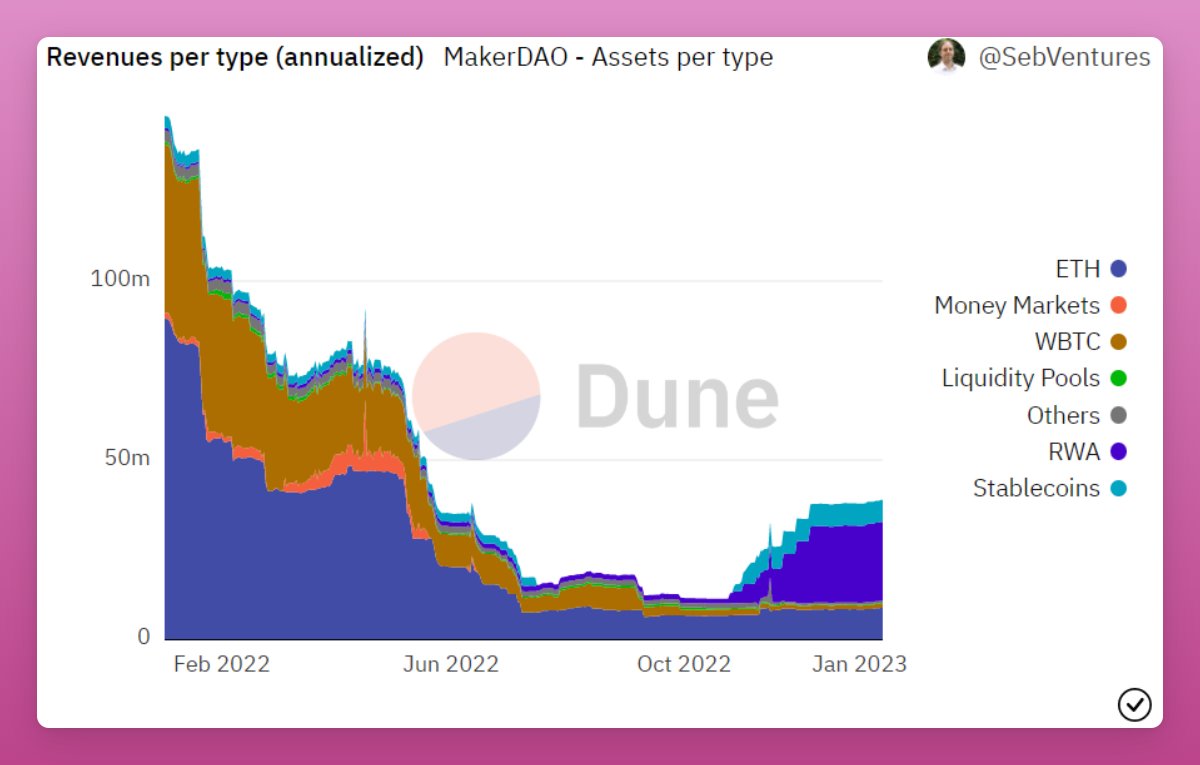

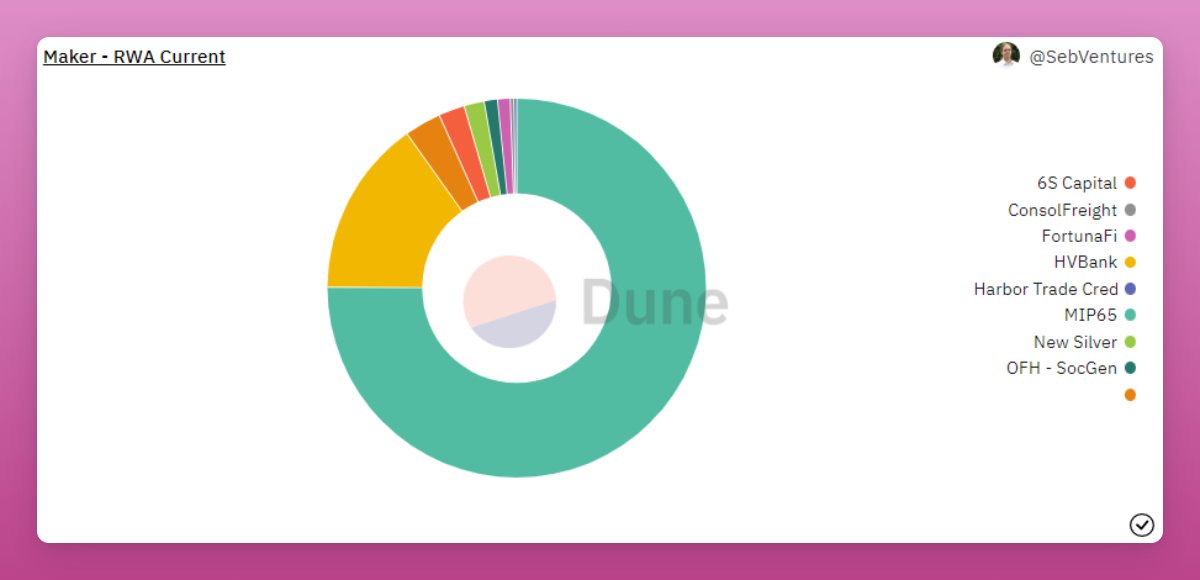

Their RWA strategy is meant to generate as much revenue from RWAs then migrate to censorship resistant collateral.

But the risks seem to appear faster than anyone has though.

Their RWA strategy is meant to generate as much revenue from RWAs then migrate to censorship resistant collateral.

But the risks seem to appear faster than anyone has though.

6/ Anyway, the 1% yield for DSR is still too low for me.

But Rune told that DSR yield 'will equilibrate with real world yields as maker manages to ramp up efficient RWA deployment'.

But Rune told that DSR yield 'will equilibrate with real world yields as maker manages to ramp up efficient RWA deployment'.

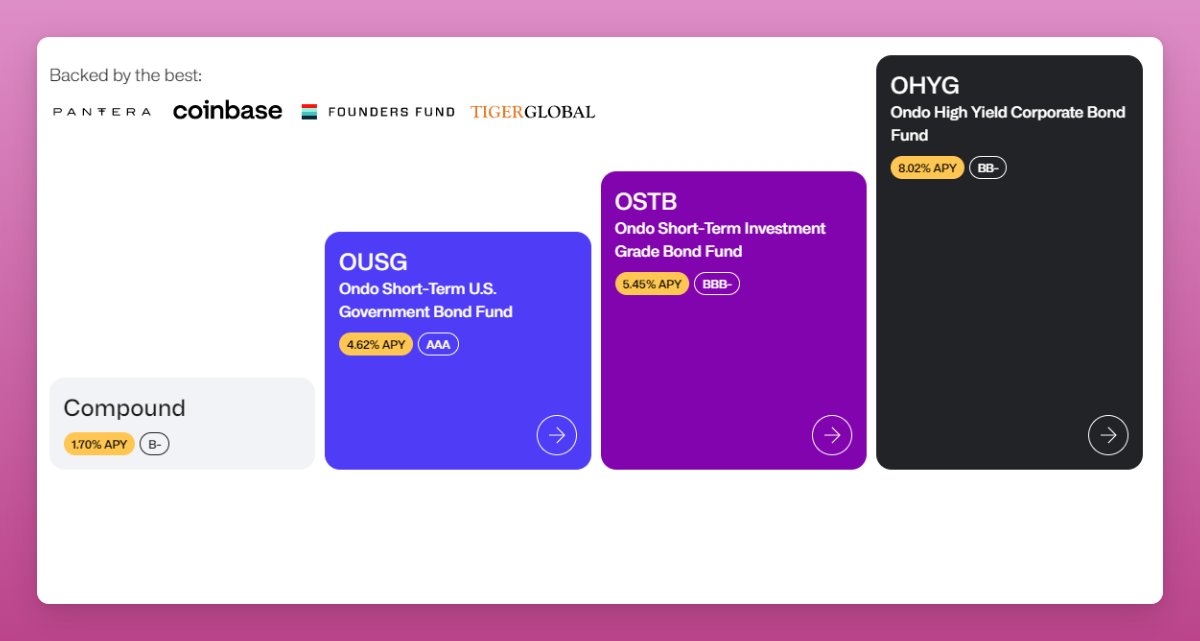

7/ Another protocol bringing TradiFi 'risk-free rate on-chain' is @OndoFinance

Ondo launched a tokenized fund that allows stablecoin holders to invest in bonds and US Treasuries, making traditional capital markets more accessible to investors.

Ondo launched a tokenized fund that allows stablecoin holders to invest in bonds and US Treasuries, making traditional capital markets more accessible to investors.

9/ Interestingly, the tokenized fund interests are transferable on-chain via APPROVED smart contracts.

There are management fees (0.15%)+ ETF fees.

Needs KYC & other personal info. Minimum size is 100k USDC.

There are management fees (0.15%)+ ETF fees.

Needs KYC & other personal info. Minimum size is 100k USDC.

10/ What's more, Ondo is launching @FluxDeFi where 'decentralized lending meets tokenized securities.'

A fork of Compound V2, it will support permissionless (e.g. USDC) and permissioned (e.g. Ondo's OUSG) tokens.

The protocol will be governed by $ONDO token holders.

A fork of Compound V2, it will support permissionless (e.g. USDC) and permissioned (e.g. Ondo's OUSG) tokens.

The protocol will be governed by $ONDO token holders.

11/ The idea behind Flux is simple:

Deposit USDC to Ondo (receiving OUSG) to earn TradFi yields. Then, deposit OUSG to borrow USDC (probably at a lower rate than lending interest), and you can fold it again.

You can also borrow other crypto to use it in other DeFi protocols.

Deposit USDC to Ondo (receiving OUSG) to earn TradFi yields. Then, deposit OUSG to borrow USDC (probably at a lower rate than lending interest), and you can fold it again.

You can also borrow other crypto to use it in other DeFi protocols.

12/ DSR and Ondo/Flux are interesting solutions to bring TradFi yield to DeFi, which should boost yields in DeFi for all.

One of my 10 predictions for 2023 is that more protocols will be built connecting TradFi to DeFi.

One of my 10 predictions for 2023 is that more protocols will be built connecting TradFi to DeFi.

13/ Do you know other protocols bringing low-risk TradFi yields to DeFi?

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...