Terry Smith is one of the best Quality Investors in the world.

This week he published a new annual letter.

An updated PDF with all his shareholder letters can now be found on our website: qualitycompounding.substack.com

This week he published a new annual letter.

An updated PDF with all his shareholder letters can now be found on our website: qualitycompounding.substack.com

Since 2010, Fundsmith compounded at 15.5% per year.

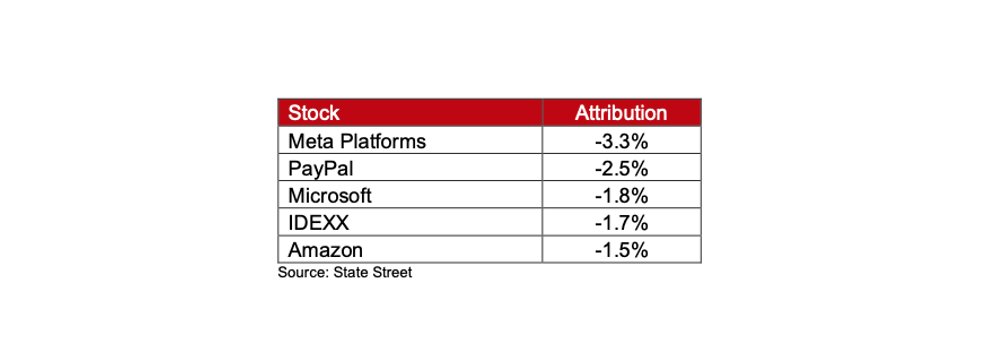

2022 was the first year ever that Fundsmith didn’t outperform the MSCI World.

2022 was the first year ever that Fundsmith didn’t outperform the MSCI World.

In his letters, Terry underlines multiple times that they won’t outperform the market every single year.

Underperforming from time to time is the fate of active investors.

Underperforming from time to time is the fate of active investors.

The main reason for the stock market correction in 2022 according to Terry?

A long period of ‘easy money’: a period of large fiscal deficits, where government spending significantly exceeds revenues and low interest rates.

A long period of ‘easy money’: a period of large fiscal deficits, where government spending significantly exceeds revenues and low interest rates.

One of the problems of easy money is that it leads to bad capital allocation or investment decisions which are exposed as the tide goes out.

Sending good money after bad is never a recipe for success.

Sending good money after bad is never a recipe for success.

2. Don’t overpay

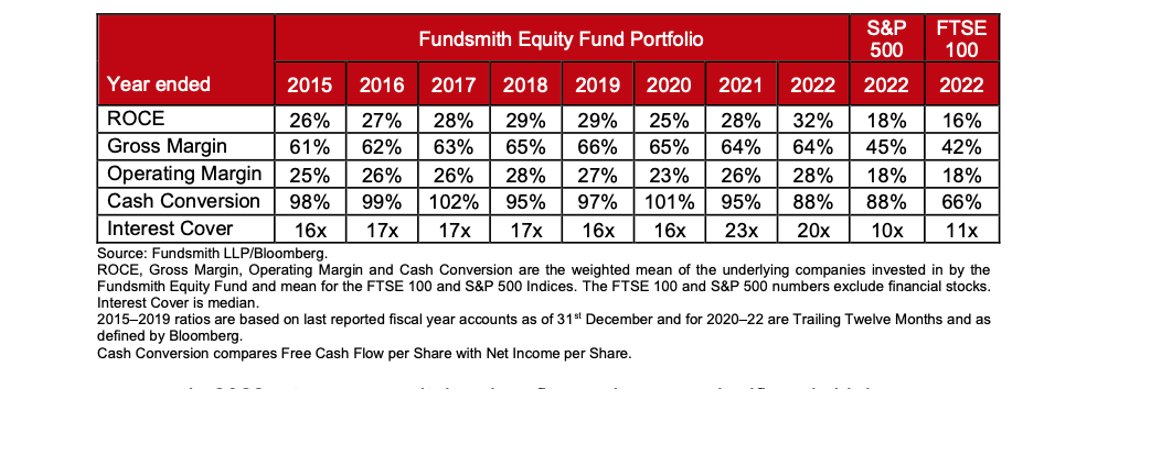

Fundsmith’s portfolio currently has a FCF Yield of 3.2% compared to 3.4% for the MSCI World.

Terry's portfolio is fundamentally way better than the S&P500, and is only valued slightly higher.

Fundsmith’s portfolio currently has a FCF Yield of 3.2% compared to 3.4% for the MSCI World.

Terry's portfolio is fundamentally way better than the S&P500, and is only valued slightly higher.

3. Do nothing

On average, Fundsmith trades signifcantly less than other funds.

In 2022, Fundsmith sold their stakes in Johnson & Johnson, Starbucks, Kone, Intuit and PayPal and purchased stakes in Mettler-Toledo, Adobe, Otis and Apple.

On average, Fundsmith trades signifcantly less than other funds.

In 2022, Fundsmith sold their stakes in Johnson & Johnson, Starbucks, Kone, Intuit and PayPal and purchased stakes in Mettler-Toledo, Adobe, Otis and Apple.

That's it!

Do you want to get all his annual letters mapped in 1 PDF?

Take a look at the link in our first tweet, go to the 'Reading' section and download them for free.

Do you want to get all his annual letters mapped in 1 PDF?

Take a look at the link in our first tweet, go to the 'Reading' section and download them for free.

Loading suggestions...