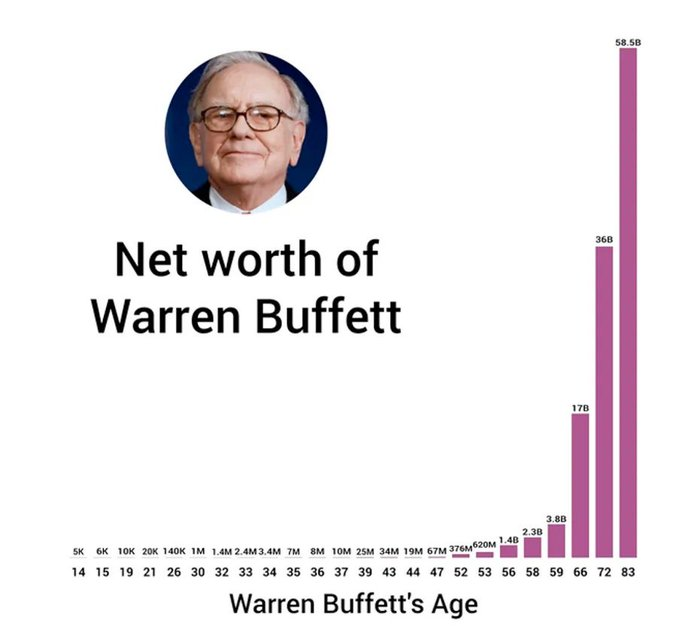

Since Buffett took over Berkshire Hathaway in 1965, the stock compounded at 20% per year.

This means an investment of $10.000 would grow to more than $800 million (!).

This means an investment of $10.000 would grow to more than $800 million (!).

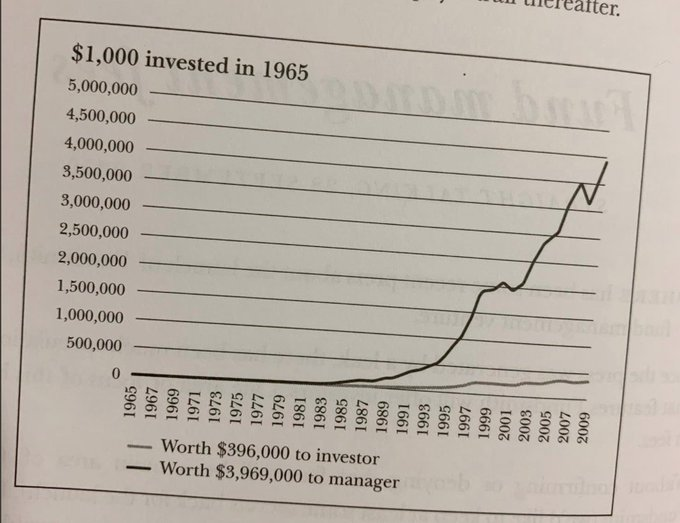

One of the key criteria for Buffett's success?

Berskhire Hathaway's low cost structure.

Berskhire Hathaway's low cost structure.

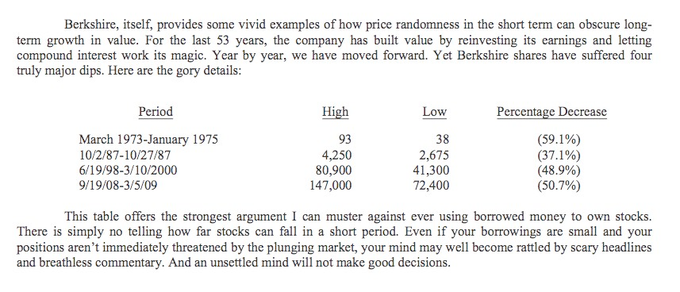

Now let's take a look at Buffett's top positions.

Top 5 positions of Berkshire Hathaway:

1. Apple (41.8%)

2. Bank of America (10.3%)

3. Chevron (8.0%))

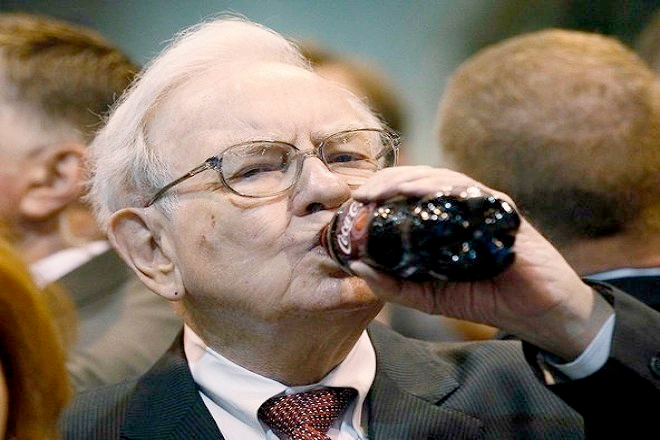

3. Coca-Cola (7.6%)

5. American Express (6.9%)

Top 5 positions of Berkshire Hathaway:

1. Apple (41.8%)

2. Bank of America (10.3%)

3. Chevron (8.0%))

3. Coca-Cola (7.6%)

5. American Express (6.9%)

Do you know what these 5 companies have in common?

It all starts with the moat for Warren Buffett.

You want to own companies with very strong brand names.

It all starts with the moat for Warren Buffett.

You want to own companies with very strong brand names.

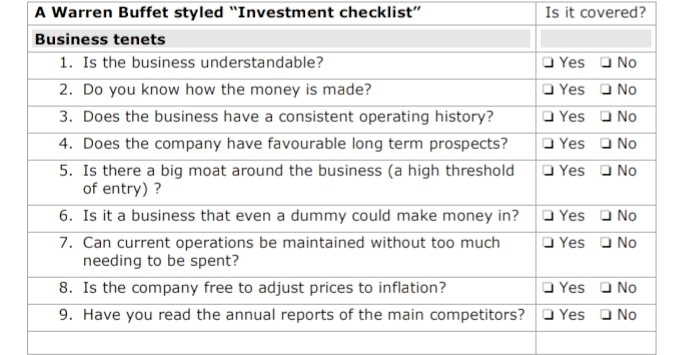

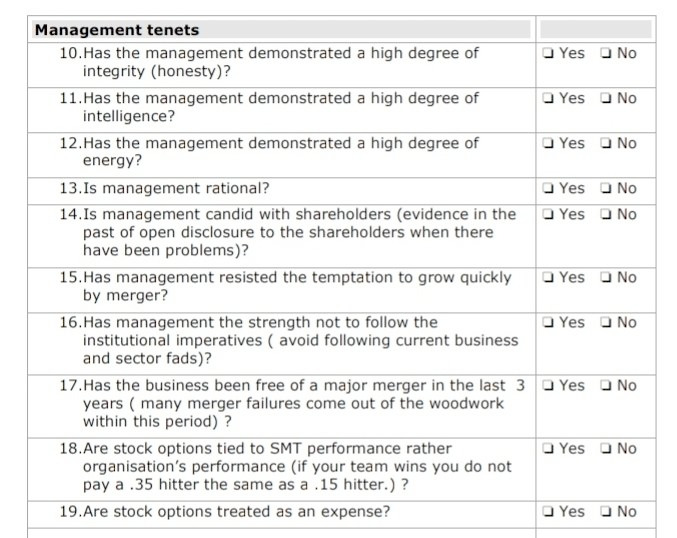

To help you find these kind of companies, you can use Buffett's investment checklist.

The checklist has 3 parts:

1. Business model

2. Management

3. Financials

The checklist has 3 parts:

1. Business model

2. Management

3. Financials

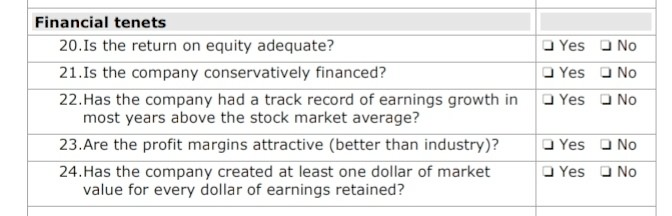

Now let's go to Buffett's view on today's market environment.

2022 has been a difficult year for the stock market.

You should be greedy when others are fearful, and fearful when others are greedy.

Today is the day to start to become more greedy again.

2022 has been a difficult year for the stock market.

You should be greedy when others are fearful, and fearful when others are greedy.

Today is the day to start to become more greedy again.

On our website, you can find all public writings of Warren Buffett (> 5000 pages) for free.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Start your journey here:

qualitycompounding.substack.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Start your journey here:

qualitycompounding.substack.com

Loading suggestions...