A major paradigm shift is upon us

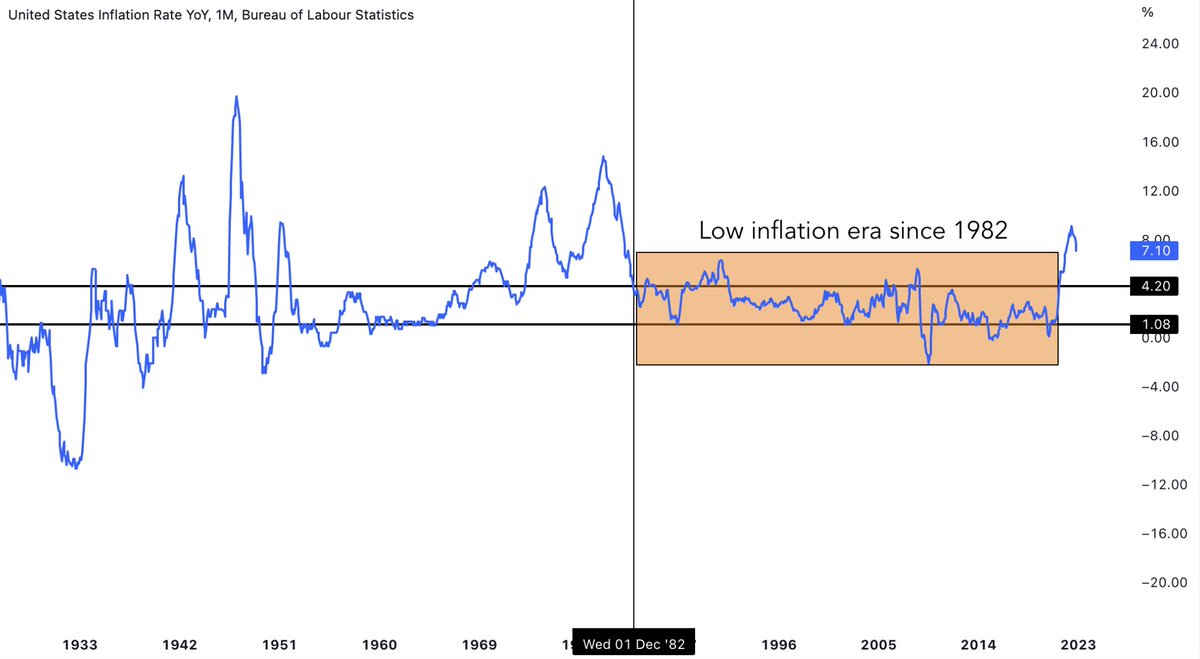

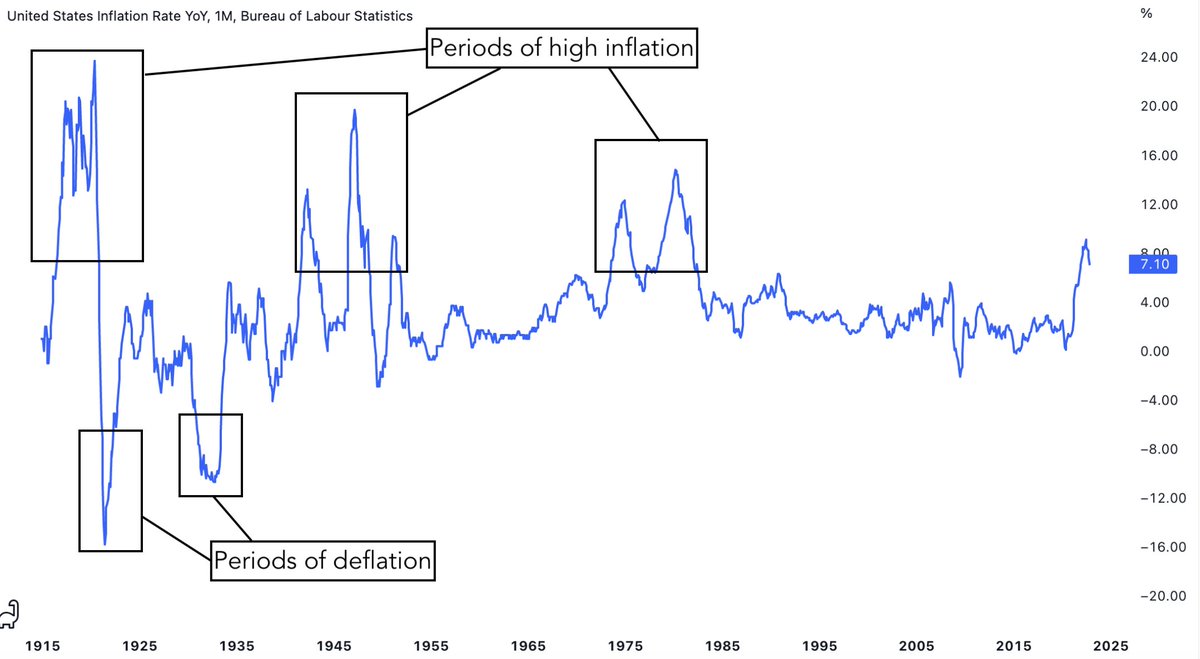

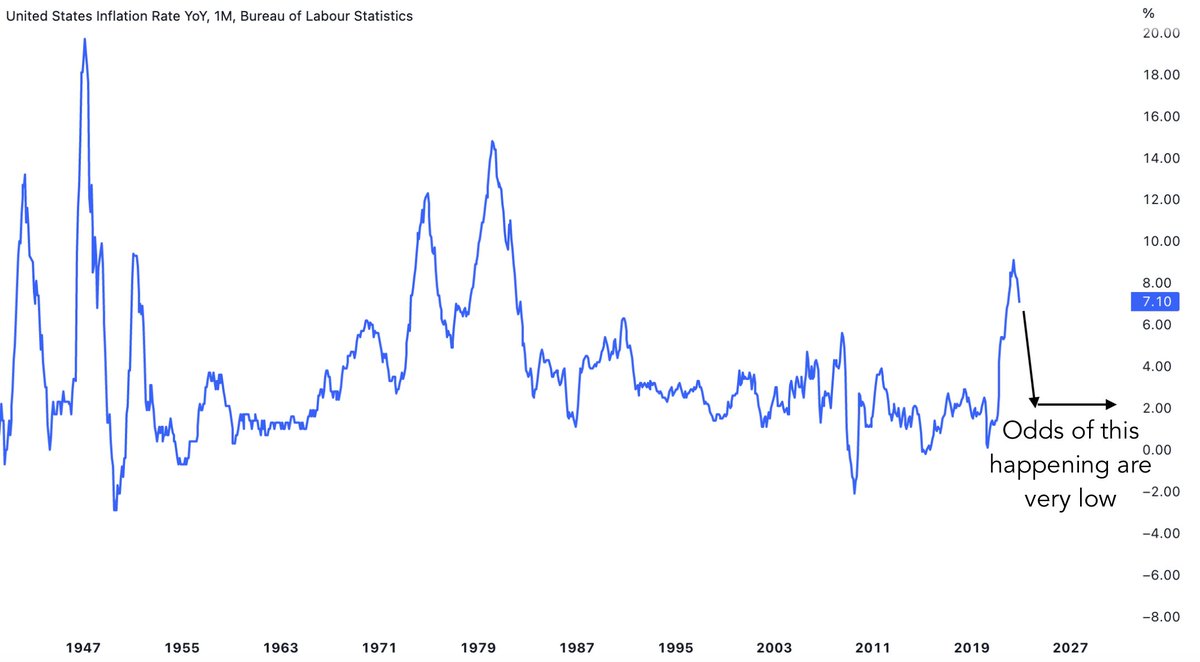

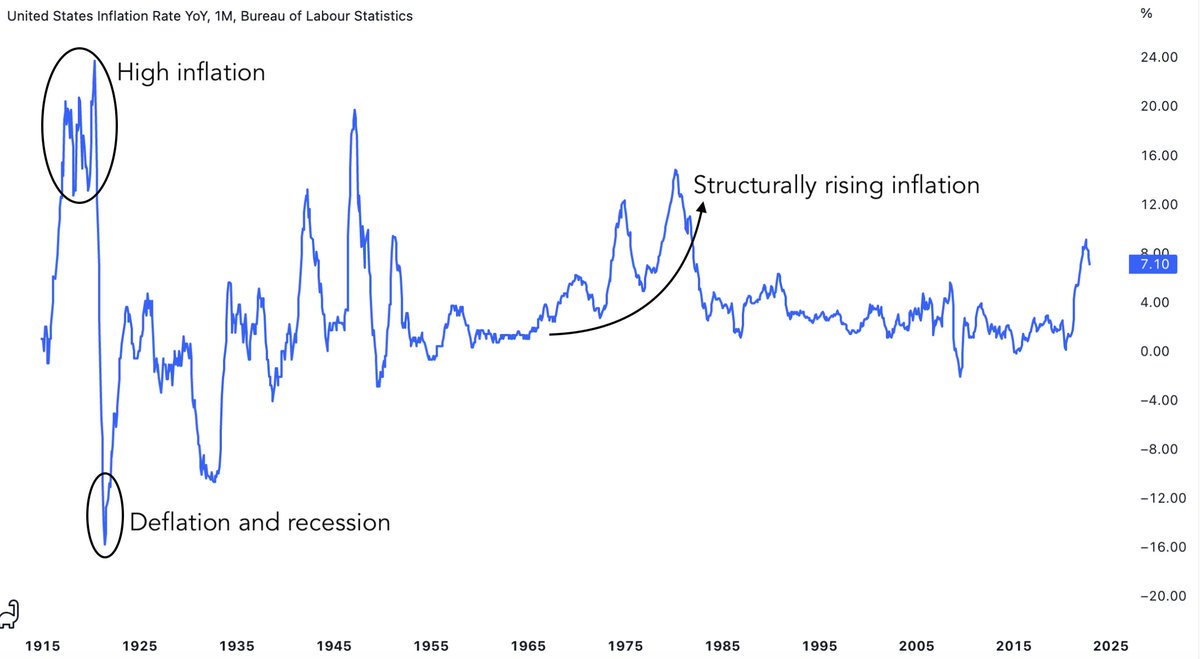

Inflation has broken out of a 40-year range

I believe this shift in regime offers both short and long-term opportunities

A thread

Inflation has broken out of a 40-year range

I believe this shift in regime offers both short and long-term opportunities

A thread

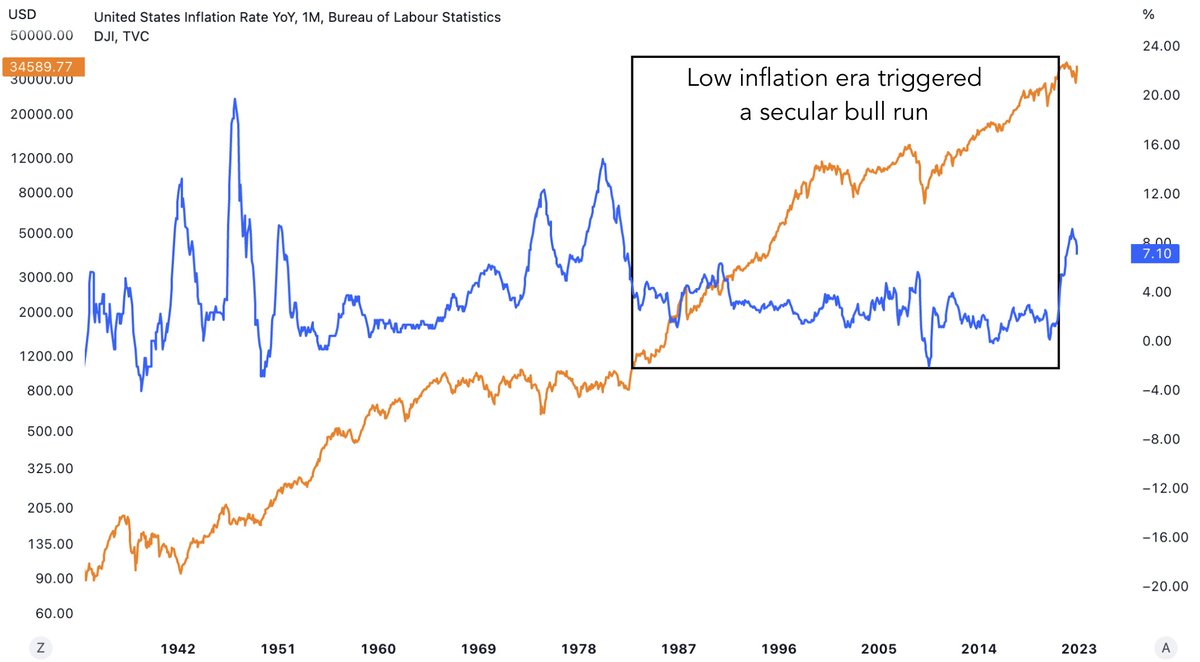

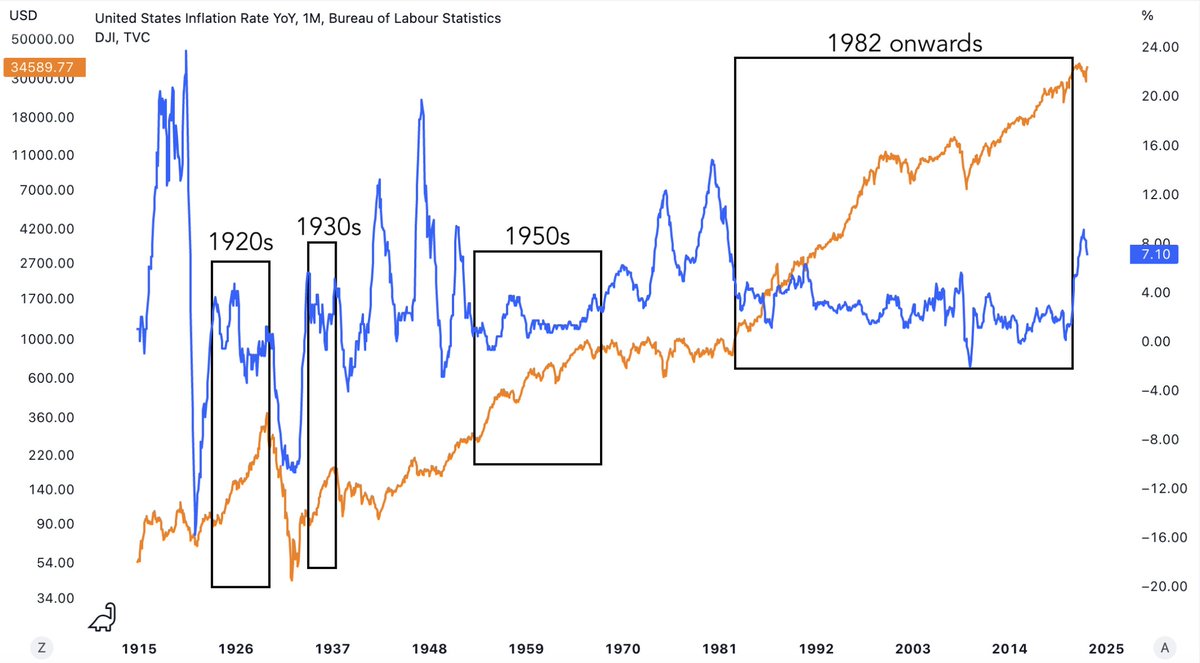

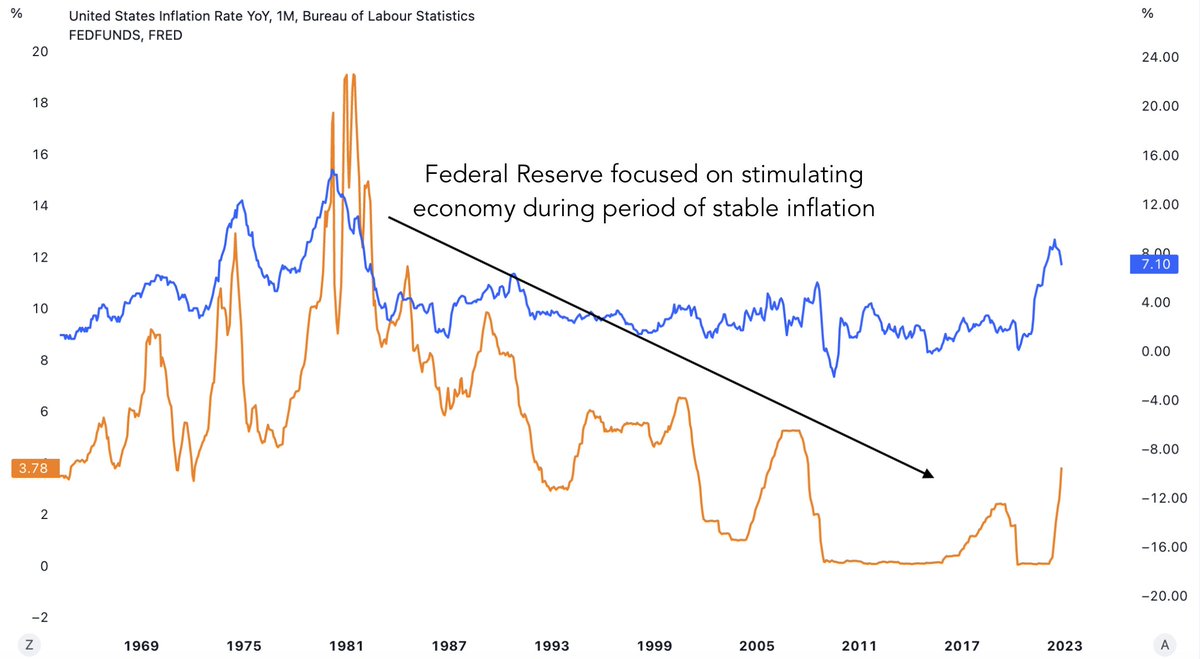

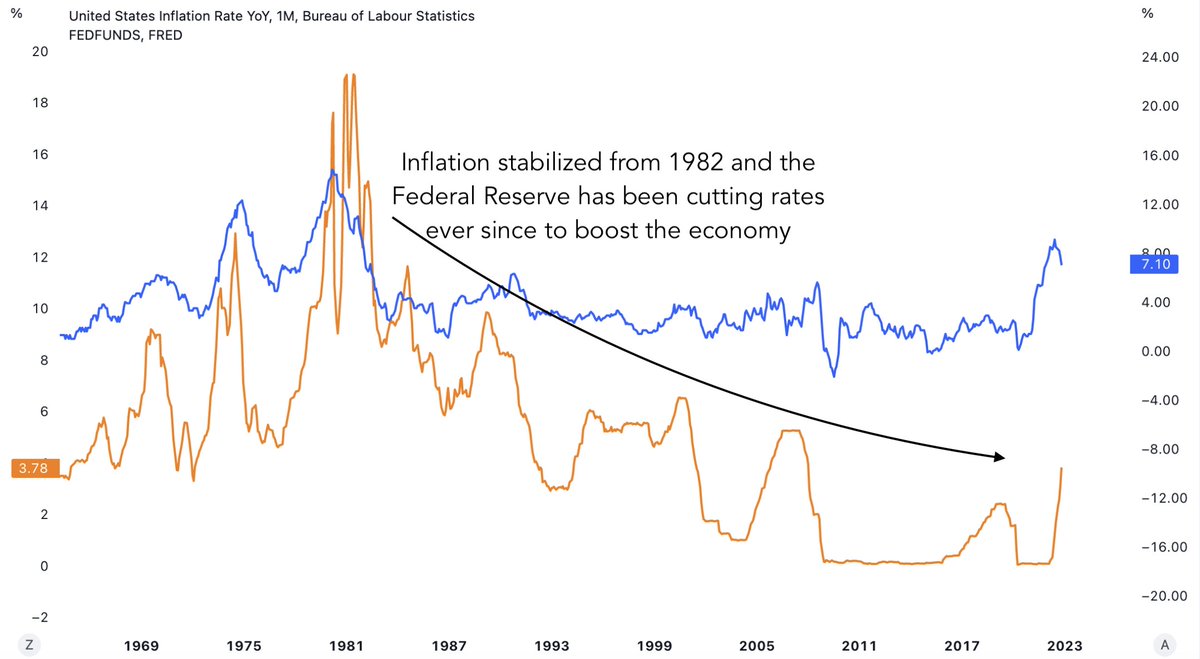

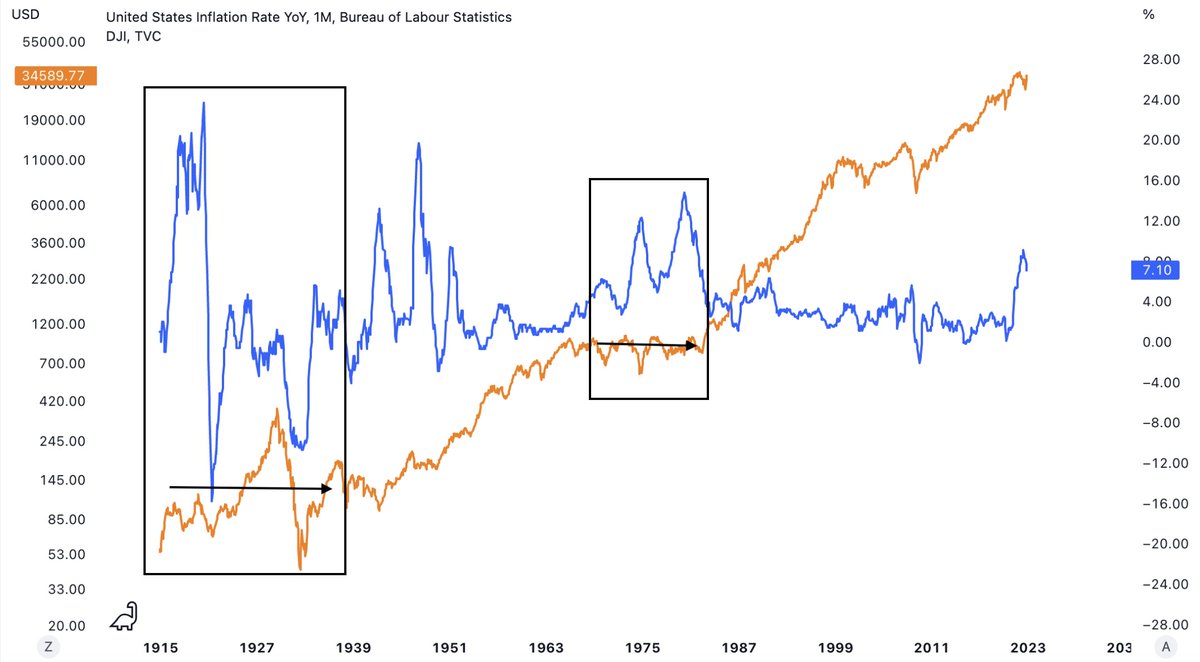

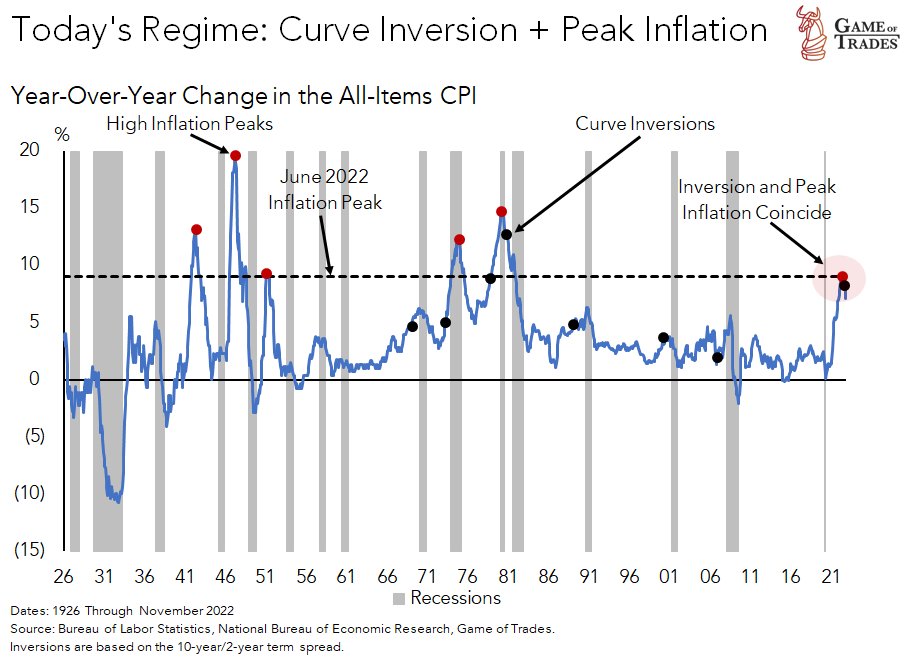

7/ And now that inflation has broken out from its range, it destabilizes the trend that’s been in place since 1982

9/ The Federal Reserve has 2 key mandates:

- Prices stability

- Employment

- Prices stability

- Employment

10/ Prices have been stable since 1982, so the Fed’s focus has been on keeping unemployment rates low and growth high

They did this by being stimulative and accommodating towards the economy and the markets

They did this by being stimulative and accommodating towards the economy and the markets

11/ But then why is the current inflation breakout such a big deal if most economists believe that inflation is heading back to the Fed’s target level i.e., 2%?

18/ The greed in the financial system is not going to dissipate overnight

And the fierce competition amongst institutions to post high returns as the markets have gone up in this easy money environment is still omnipresent

And the fierce competition amongst institutions to post high returns as the markets have gone up in this easy money environment is still omnipresent

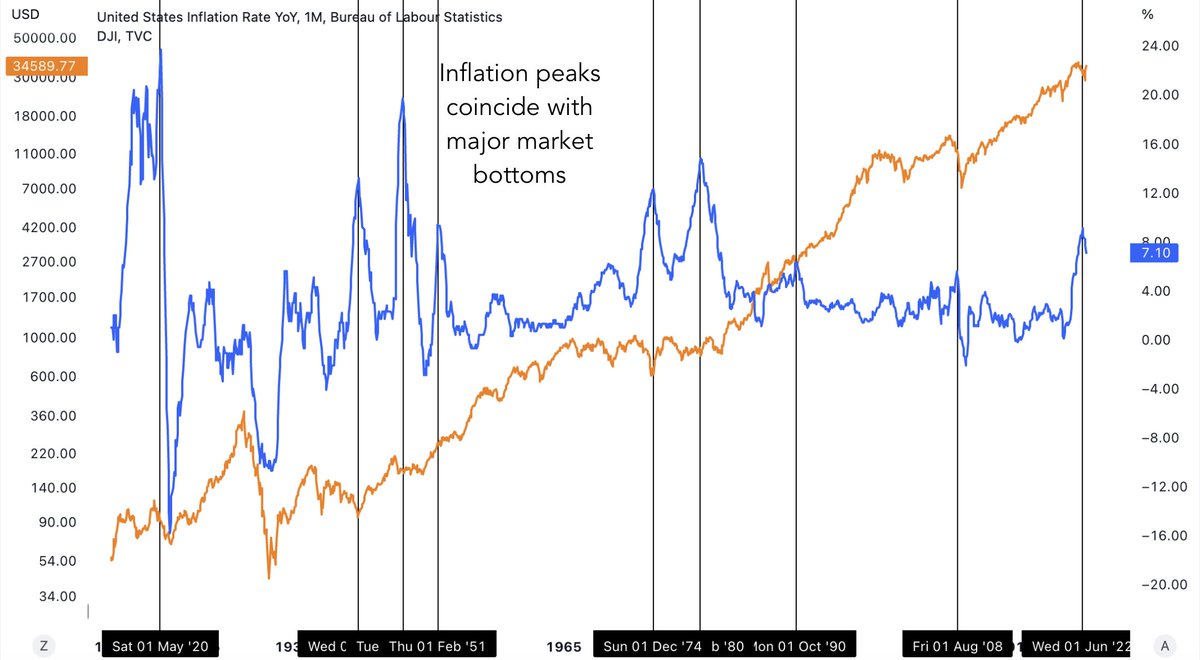

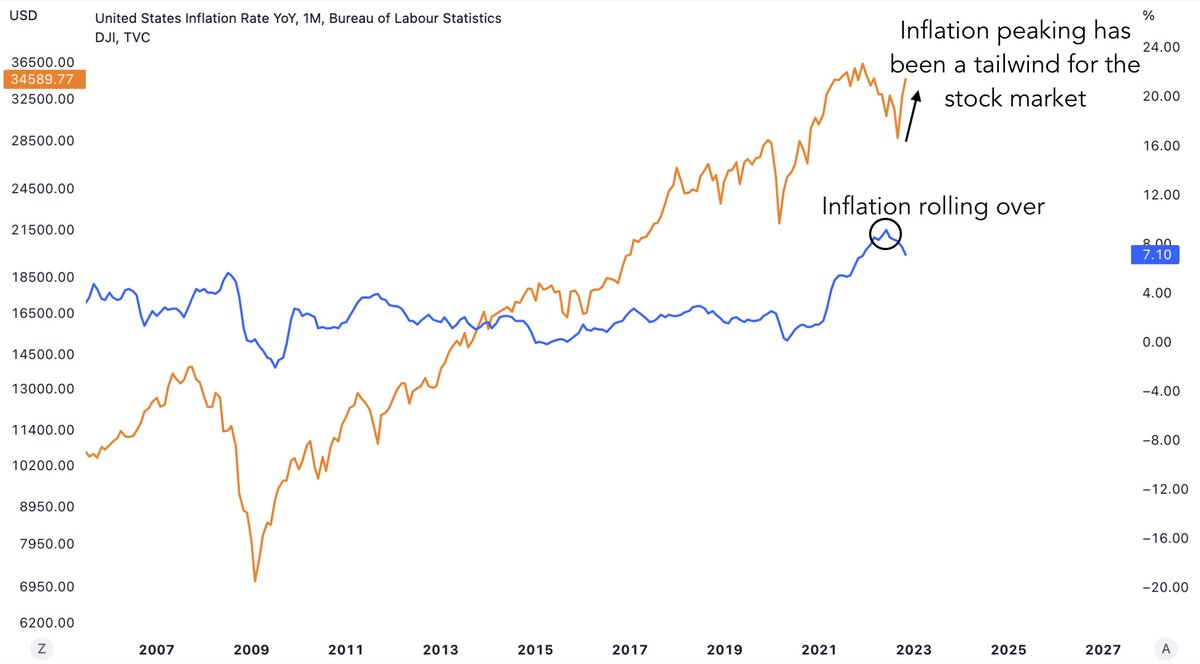

19/ Investors are looking for the first reason for the markets to go up

And inflation coming down significantly might be the fuel for a final leg-up for the markets

And inflation coming down significantly might be the fuel for a final leg-up for the markets

21/ Thanks for reading!

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

If you liked this, please like and retweet the first tweet below.

And follow @gameoftrades_ for more market insights, finance and investment strategy content.

جاري تحميل الاقتراحات...