If you liked this, you'll love our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Start your journey here:

qualitycompounding.substack.com

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

Start your journey here:

qualitycompounding.substack.com

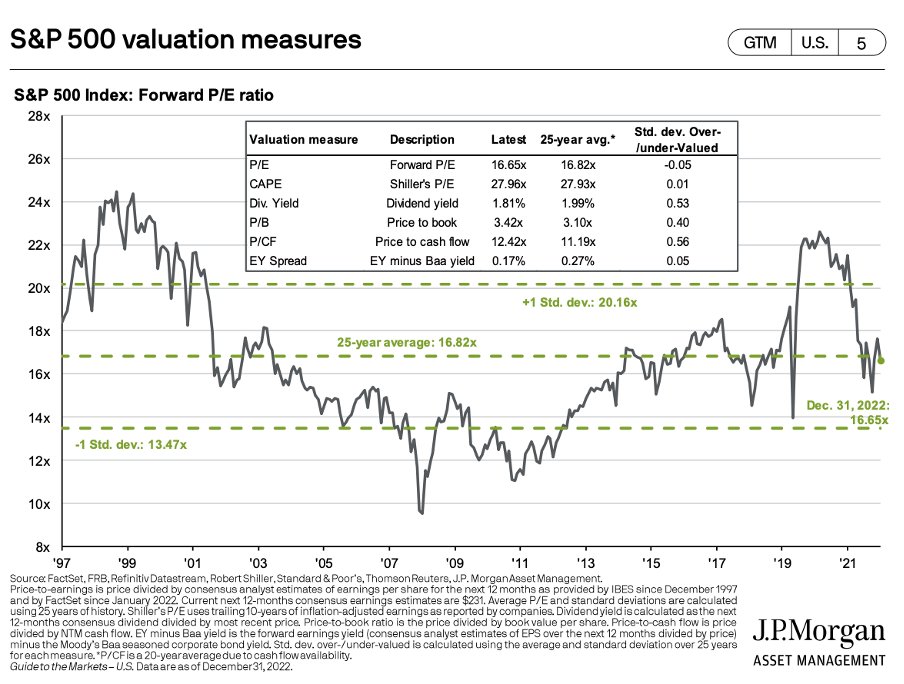

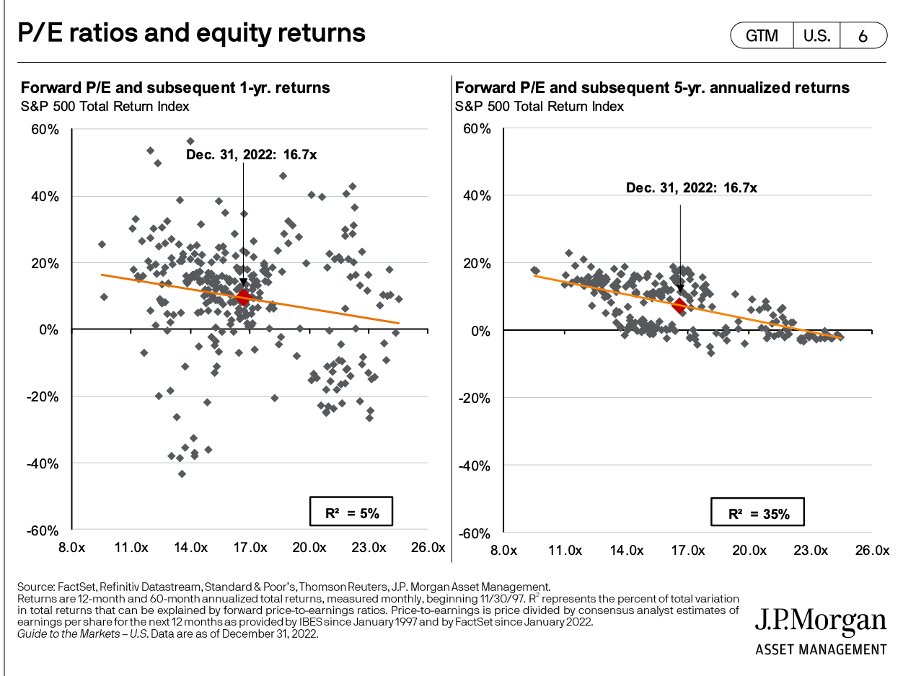

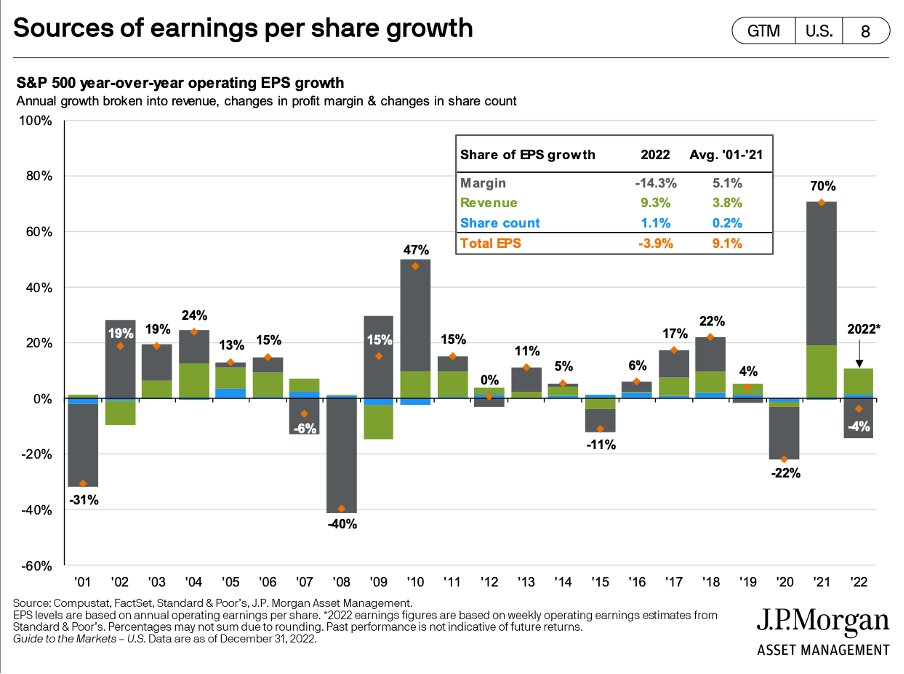

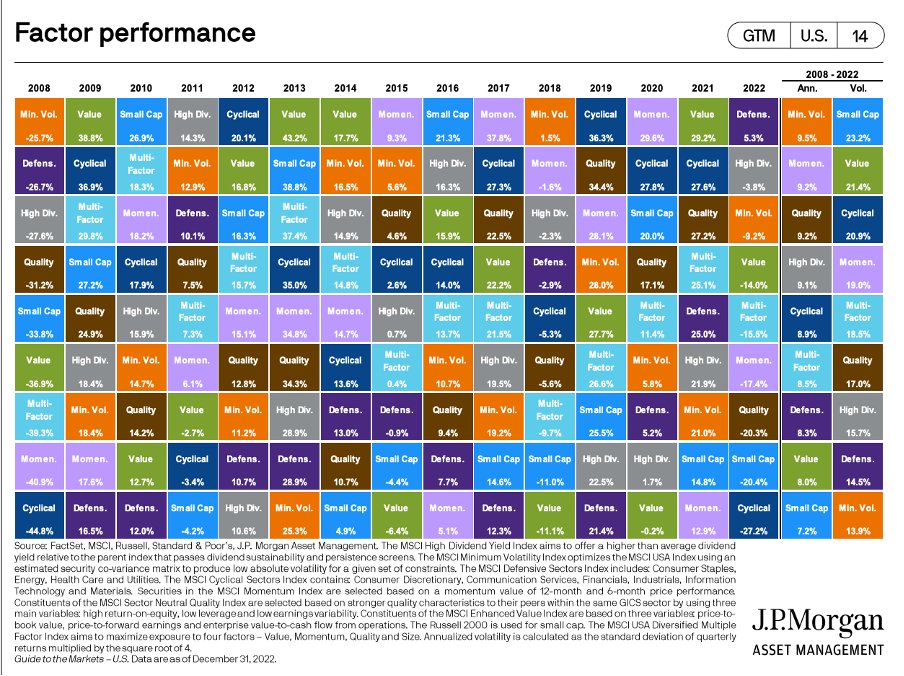

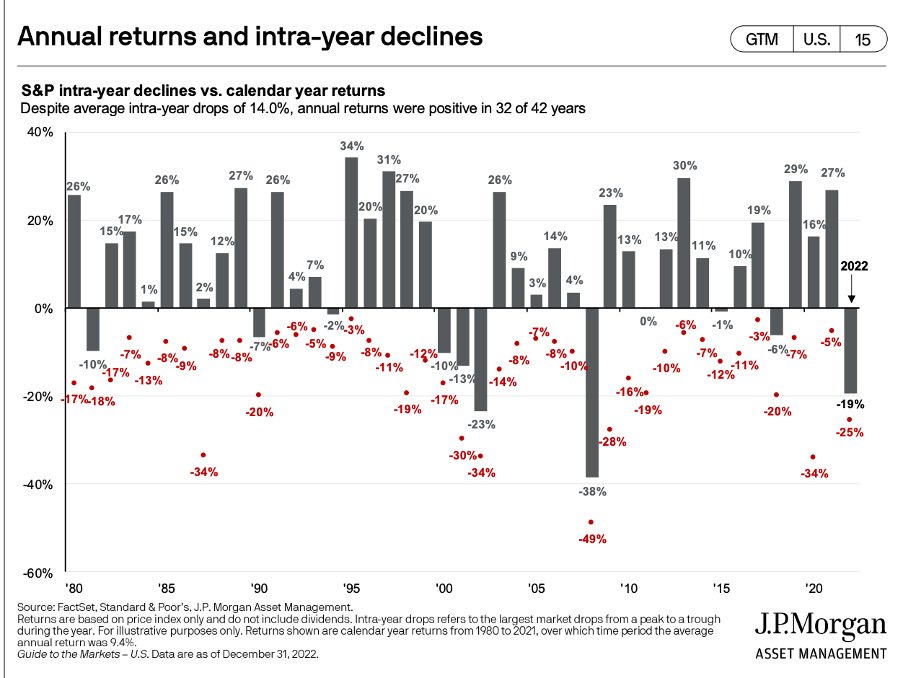

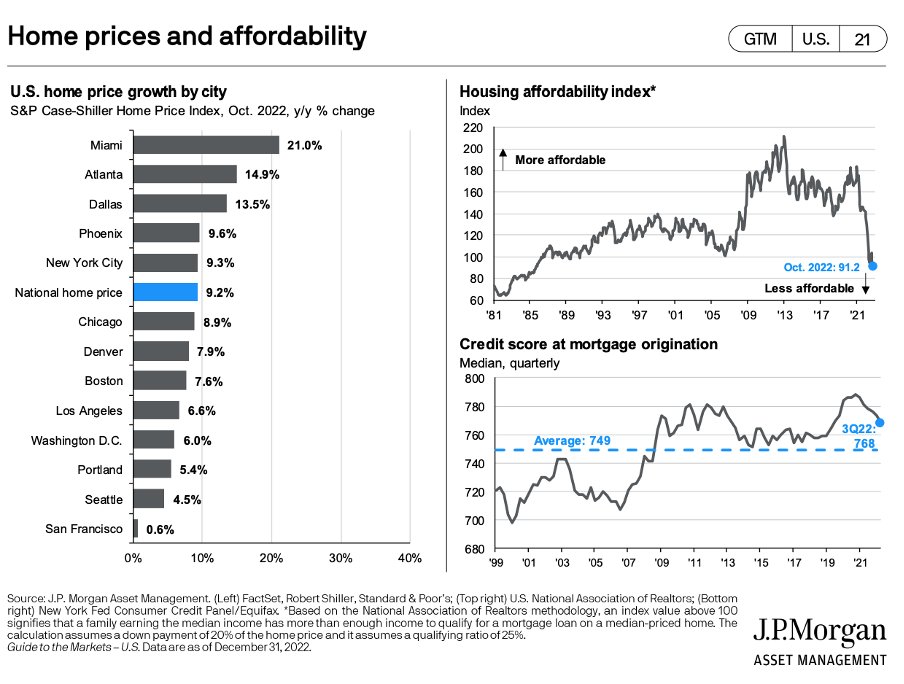

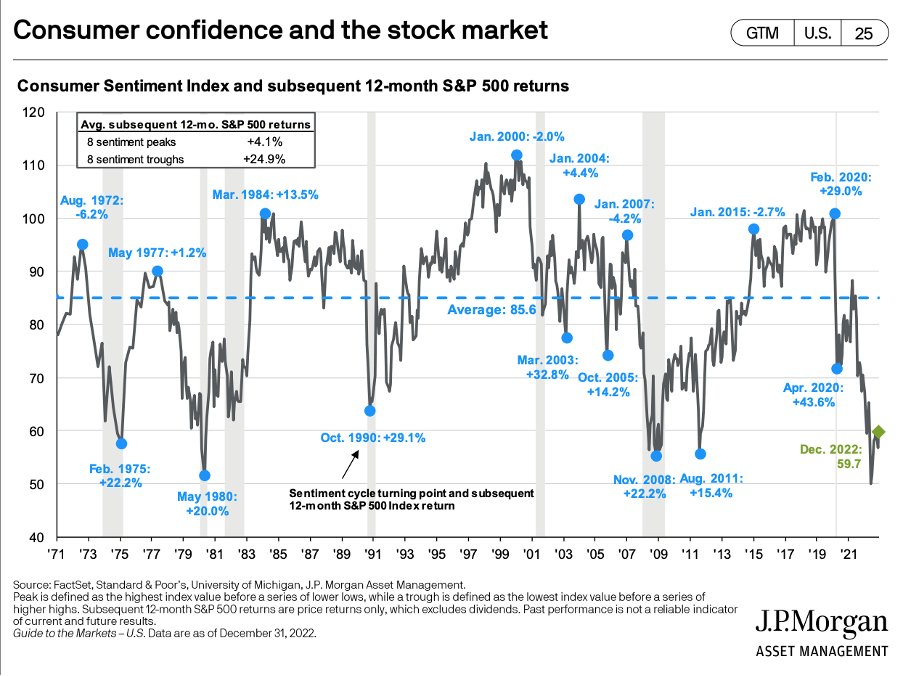

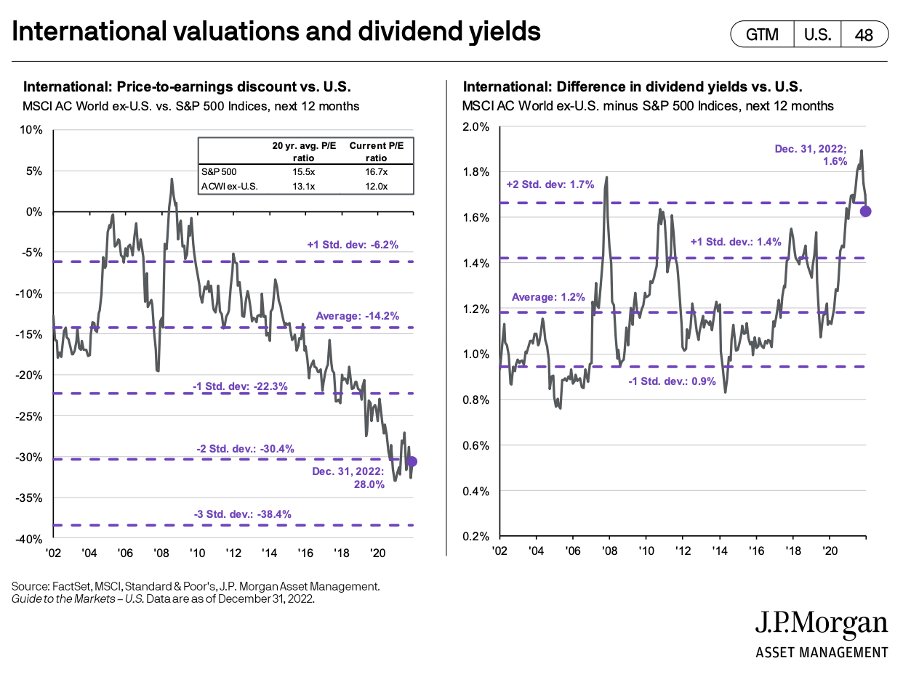

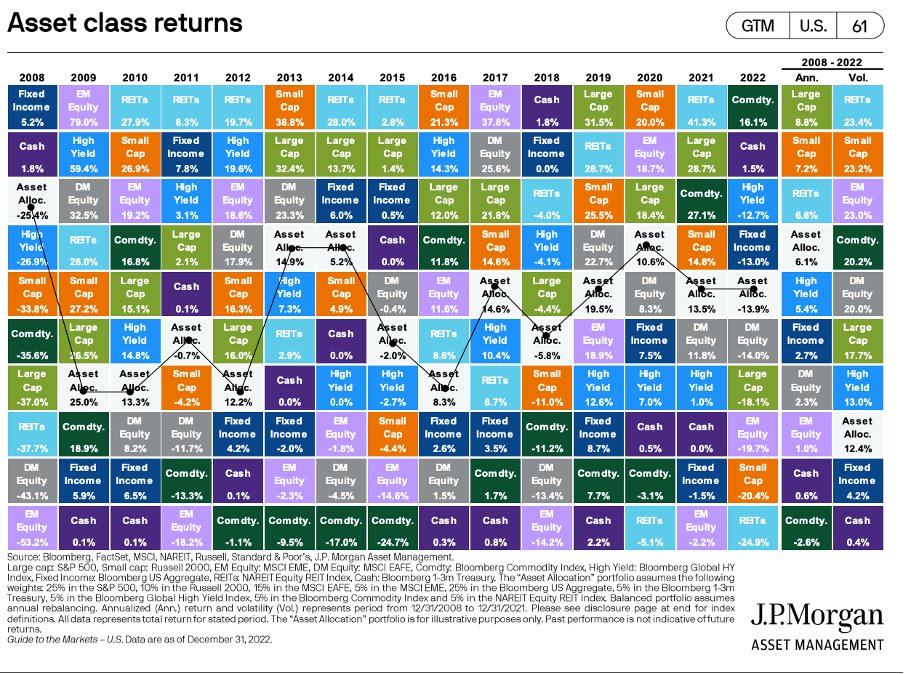

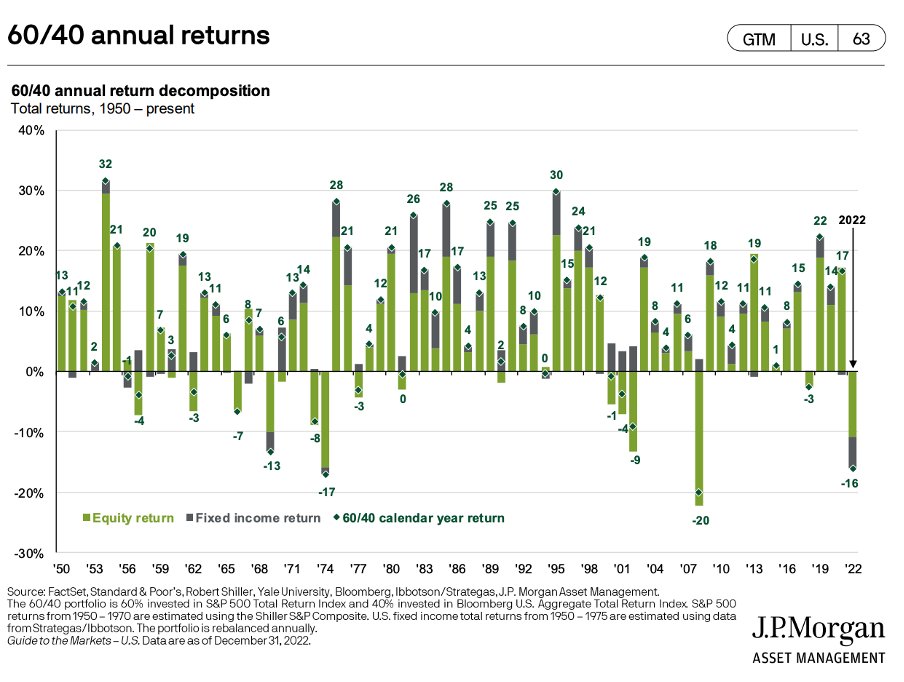

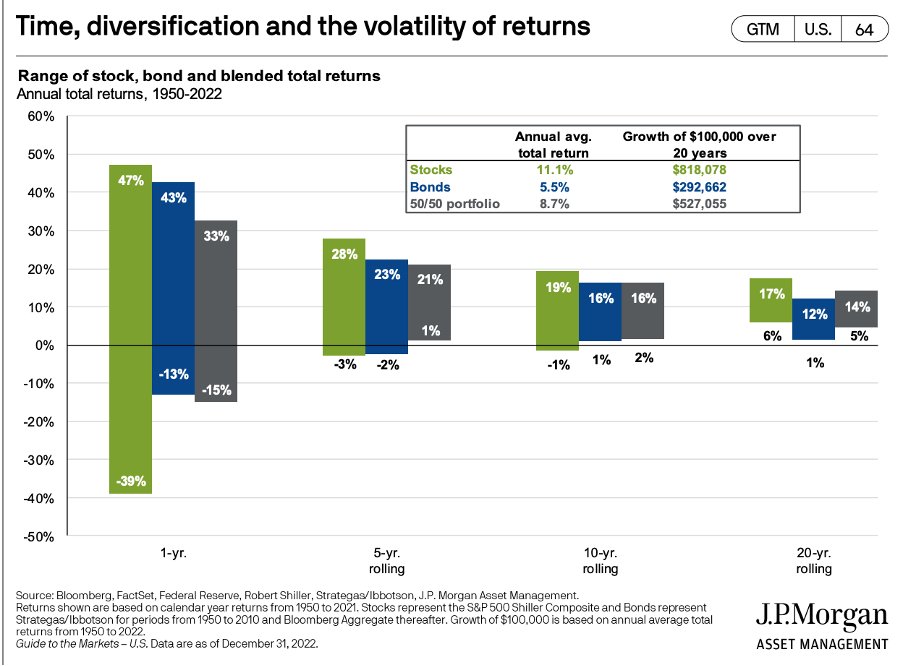

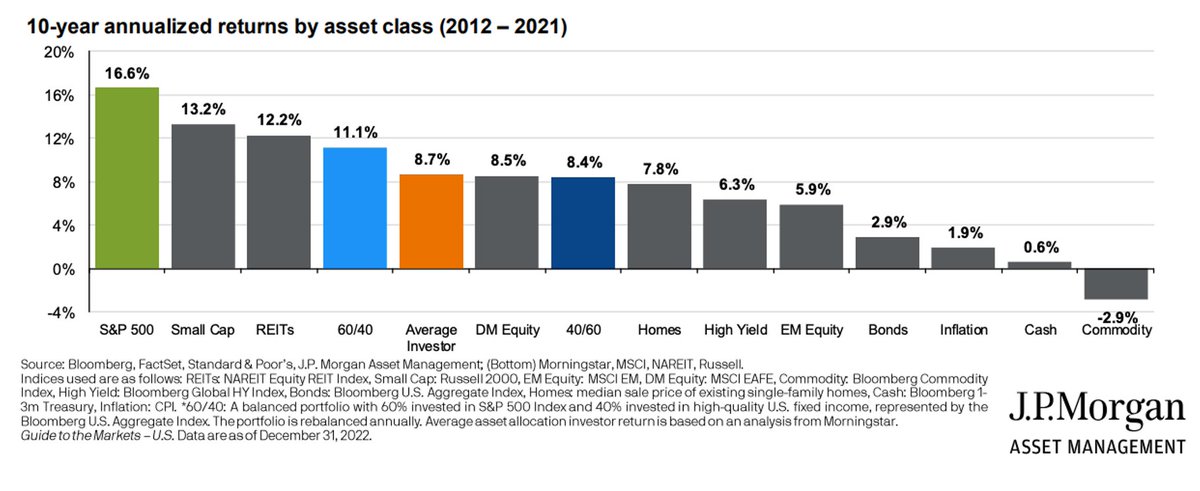

This thread was based on JPM's excellent Guide To The Markets (always a must read).

Loading suggestions...