#WeeklyIndexCheck CW52/2022

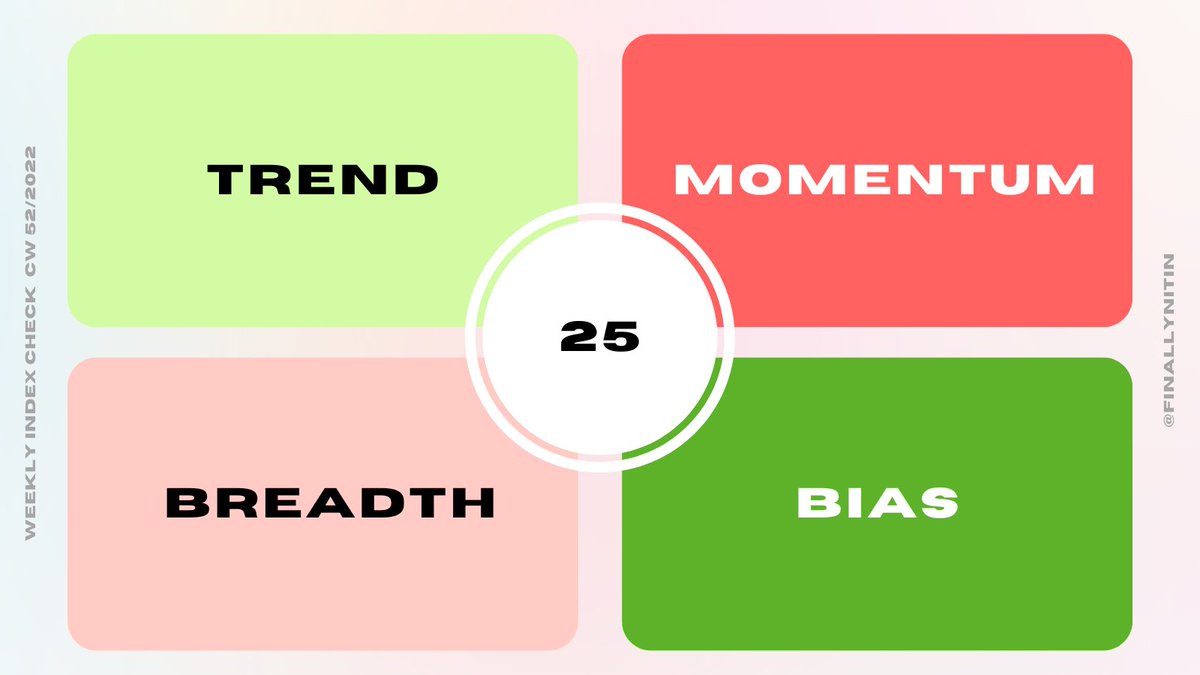

Market Quadrant:

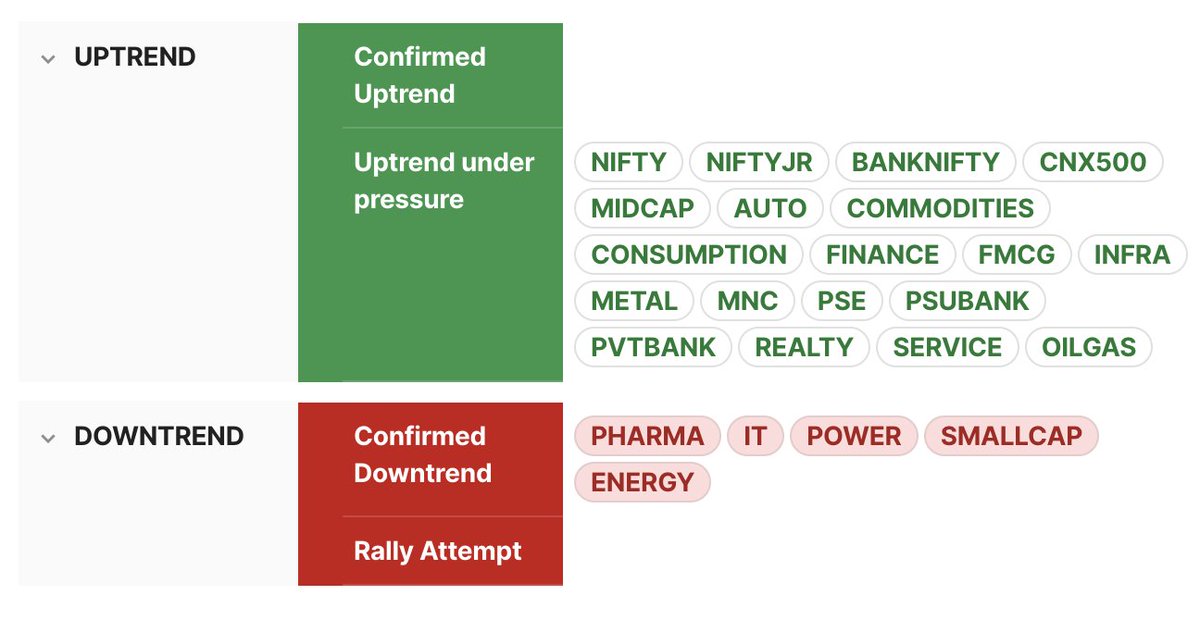

⦿ Trend: Uptrend under pressure

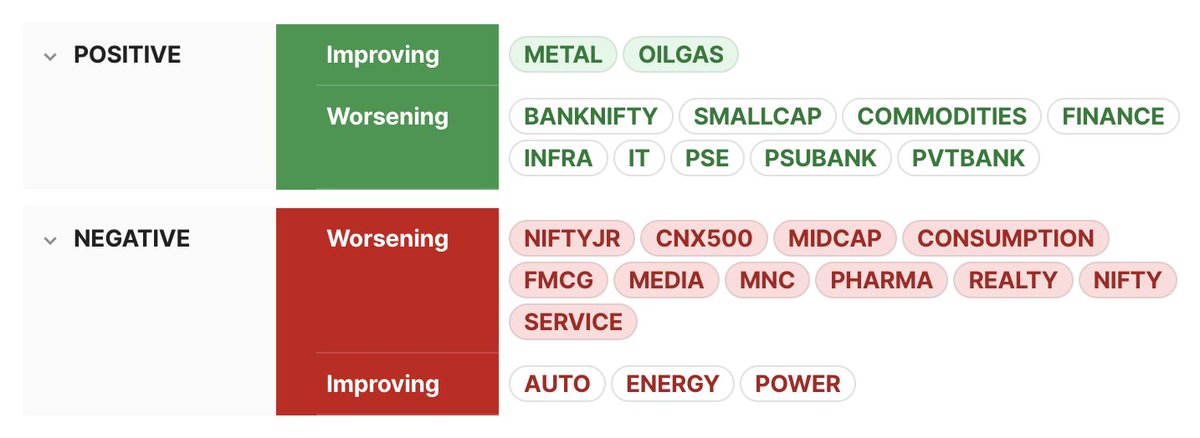

⦿ Momentum: Negative & Worsening

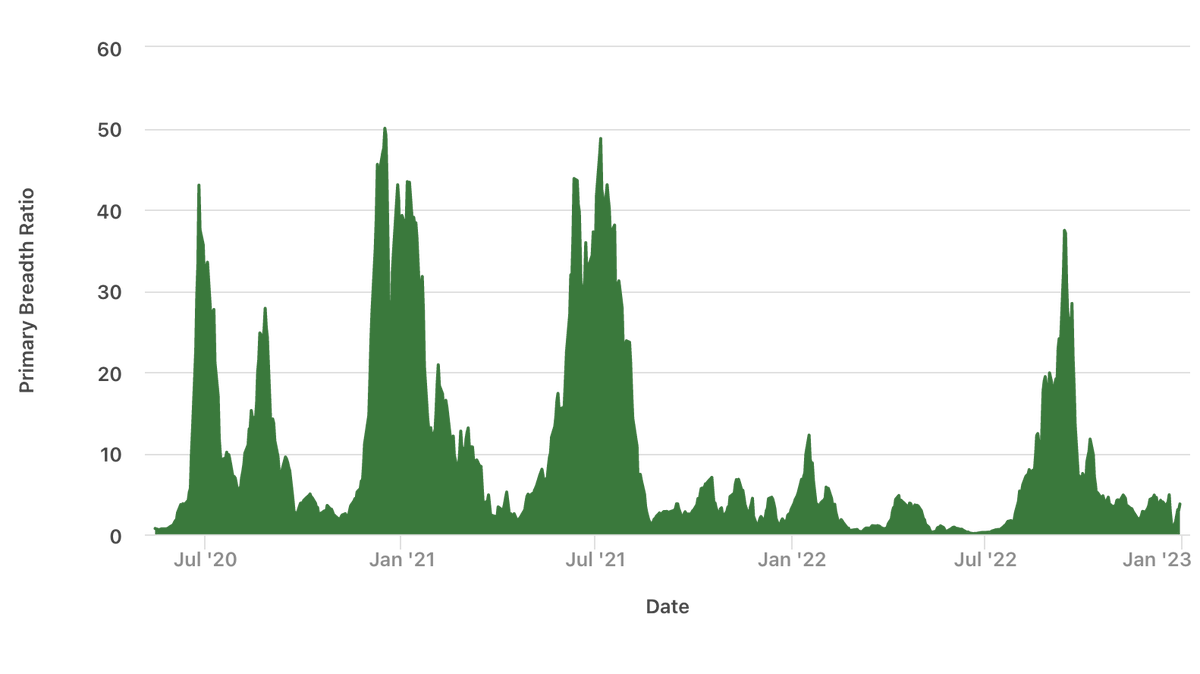

⦿ Breadth: Weak but strengthening

⦿ Bias: Bullish

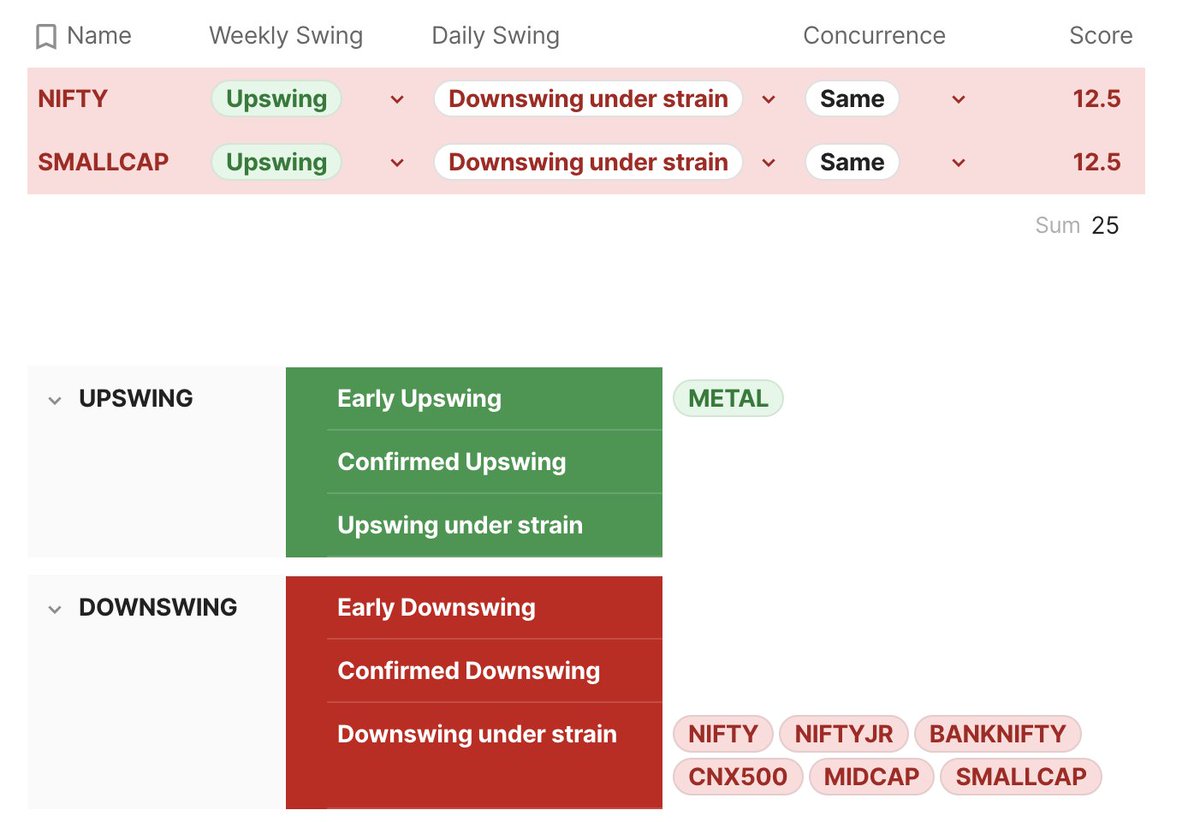

⦿ Swing Confidence: 25

Market Quadrant:

⦿ Trend: Uptrend under pressure

⦿ Momentum: Negative & Worsening

⦿ Breadth: Weak but strengthening

⦿ Bias: Bullish

⦿ Swing Confidence: 25

That’s all for this week. If you'd like to read this as a newsletter, find it here:

world.hey.com

world.hey.com

Loading suggestions...