I just listened to Jeff Currie's bullish oil talk for 2023.

Below is the pitch and the real data!

Consider it a X-mas gift to my followers. Merry Christmas to you all.

1/n @UrbanKaoboy @simon_ree

Below is the pitch and the real data!

Consider it a X-mas gift to my followers. Merry Christmas to you all.

1/n @UrbanKaoboy @simon_ree

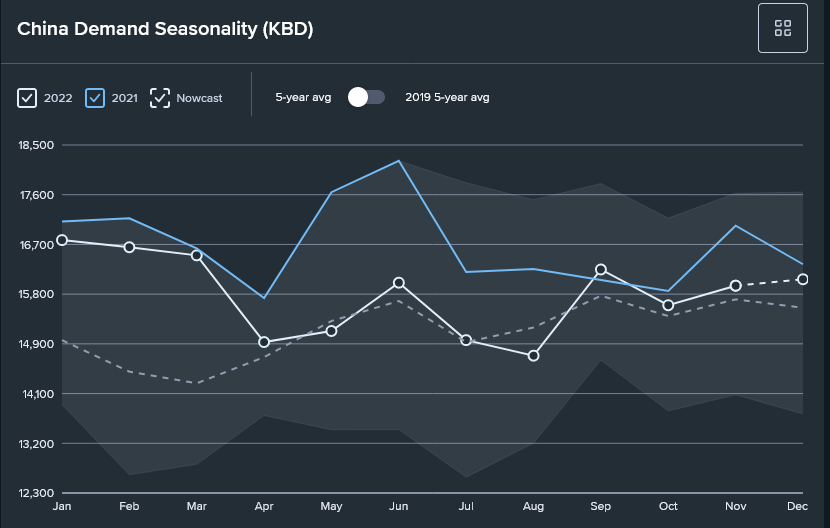

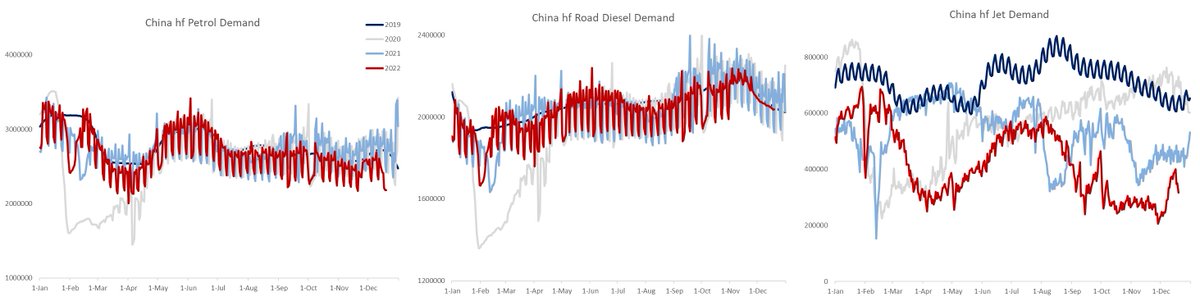

CapitalOne's Laskhmi Sreekumar nailed this:

"Chinese HF product demand is tracking LOWER m/m even with a pop in jet fuel demand. Remember I told you guys, what JET GAINS, GASOLINE (and sometimes HSRD, high speed road diesel) LOSES."

Cheers @UrbanKaoboy for introducing us!

7/n

"Chinese HF product demand is tracking LOWER m/m even with a pop in jet fuel demand. Remember I told you guys, what JET GAINS, GASOLINE (and sometimes HSRD, high speed road diesel) LOSES."

Cheers @UrbanKaoboy for introducing us!

7/n

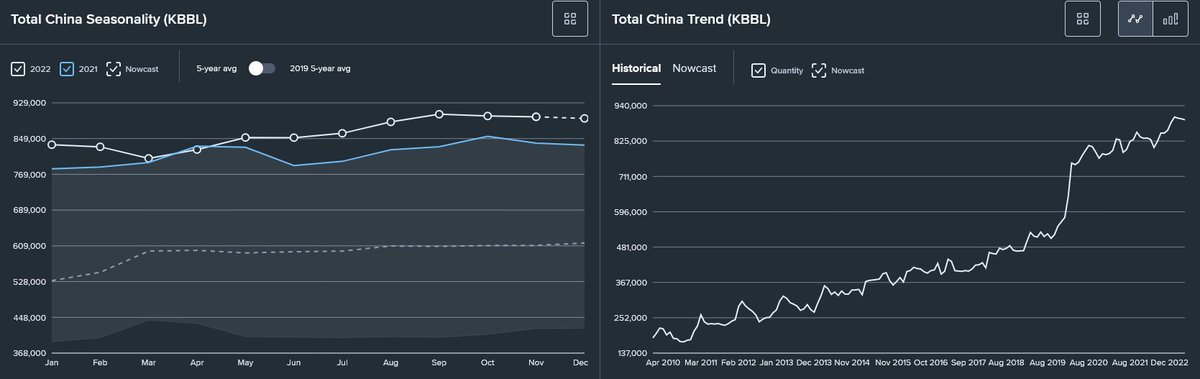

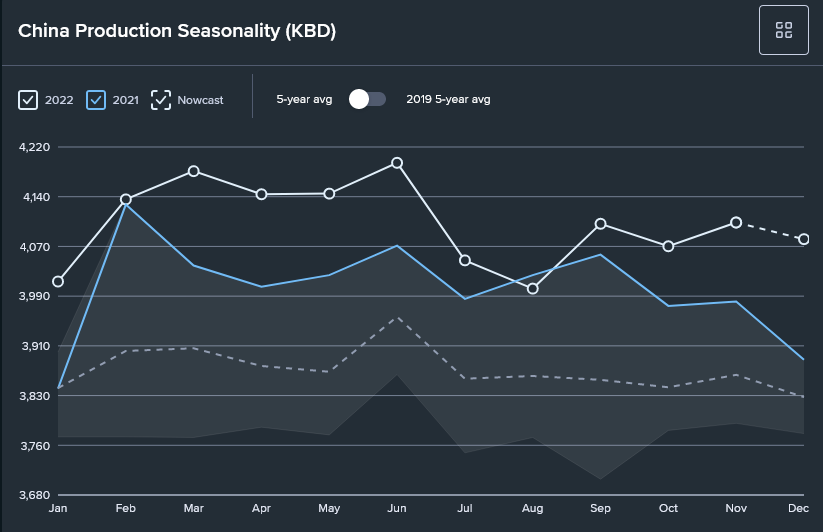

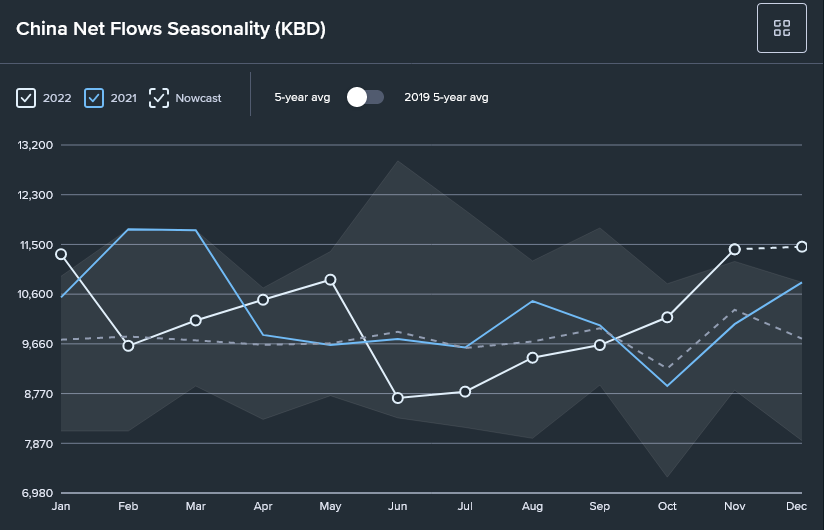

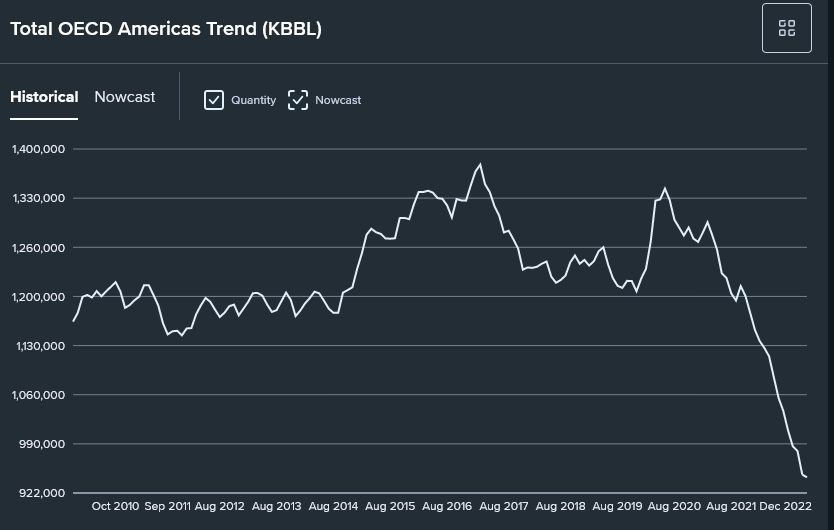

Message: as refined products have no place to go, China will likely reduce Q1 runs & in all likelihood (nothing is every certain) reduce oil imports.

By how much? How about by the amount Russian exports reduce (500-700kbpd). But don't be surprised if it is 1-1.5mbpd.

8/n

By how much? How about by the amount Russian exports reduce (500-700kbpd). But don't be surprised if it is 1-1.5mbpd.

8/n

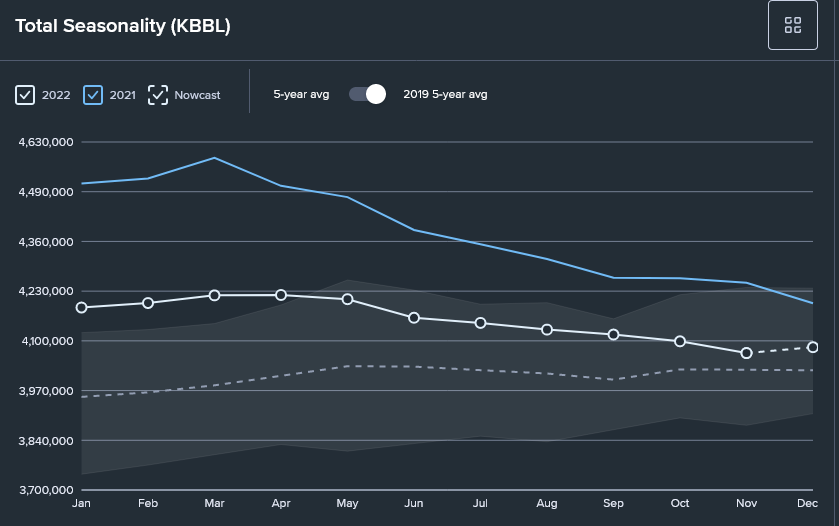

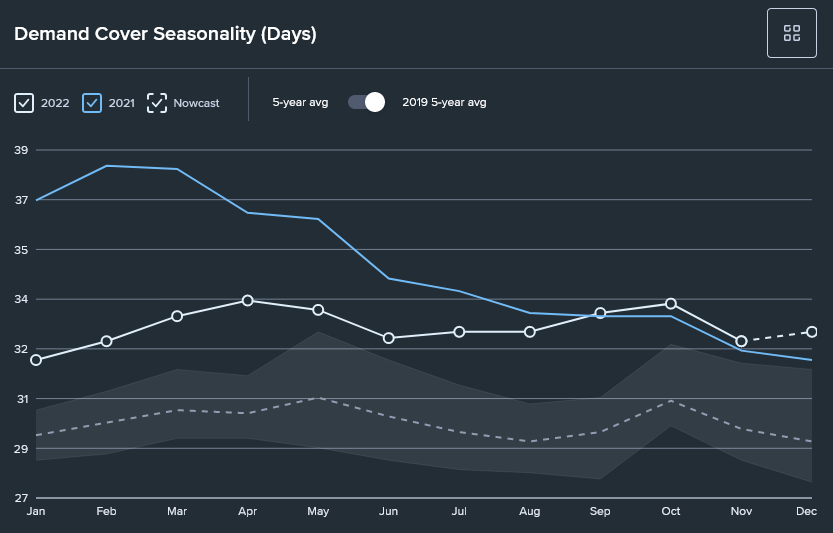

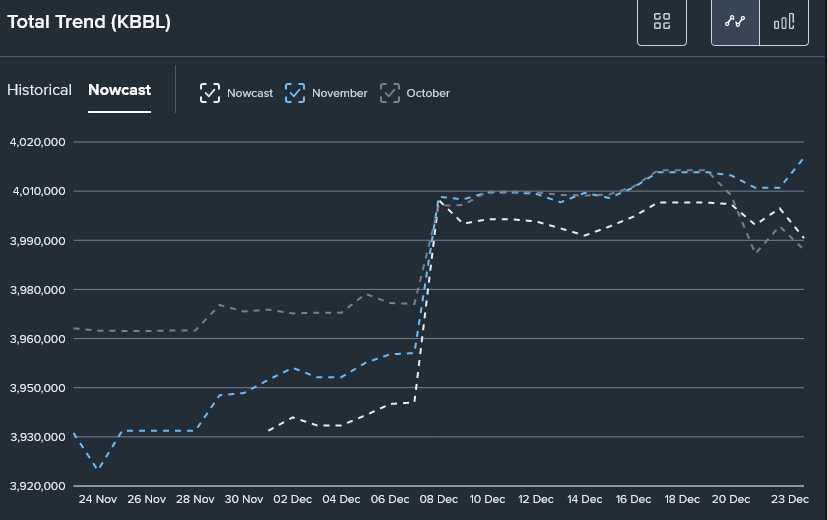

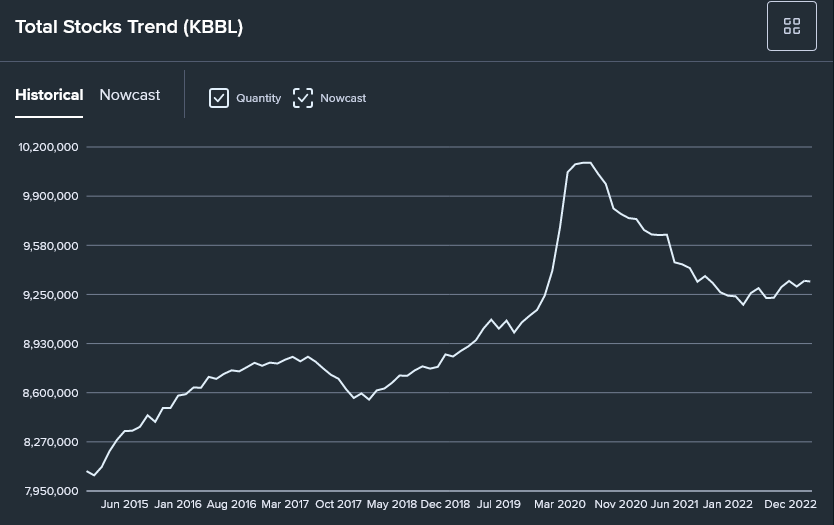

In fact, @OilX's nowcast suggests petroleum product inventories may reach an ATH in December 2022 globally.

Now, that is NOT bullish even if China re-opens twice!

11/n

Now, that is NOT bullish even if China re-opens twice!

11/n

Loading suggestions...