Technology

Finance

Cryptocurrency

Investment

Technical Analysis

Trading

Financial Tools

Instructional

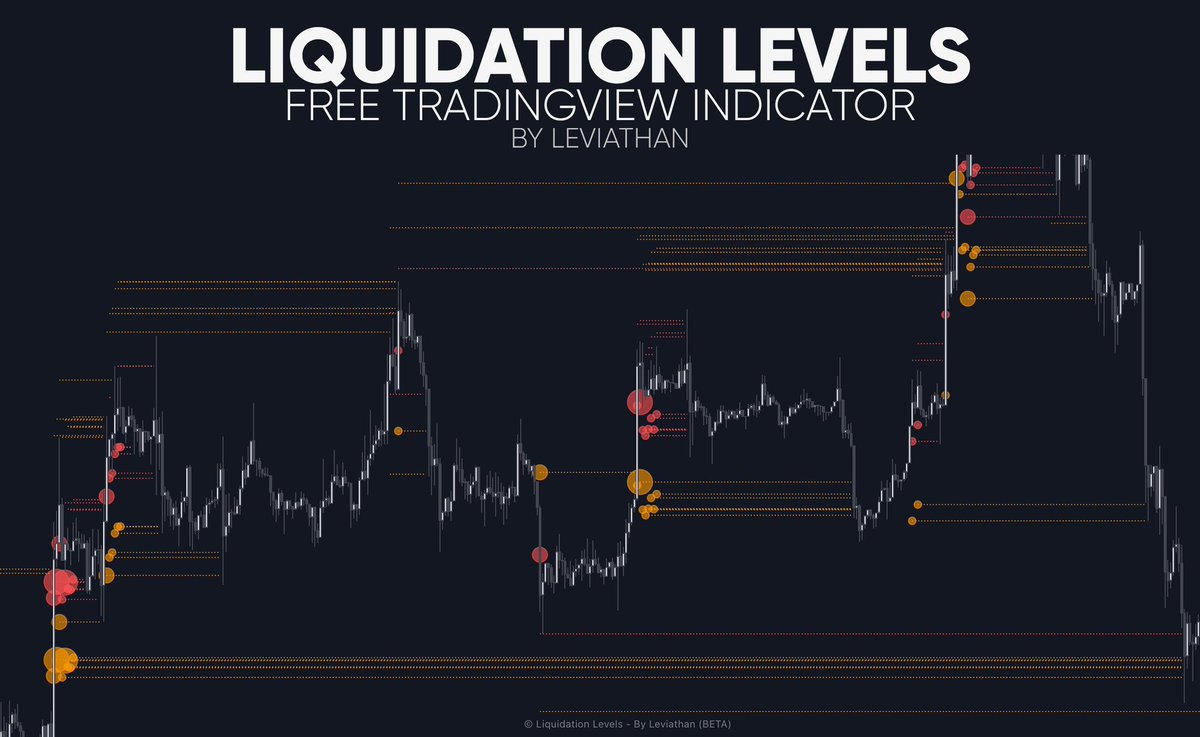

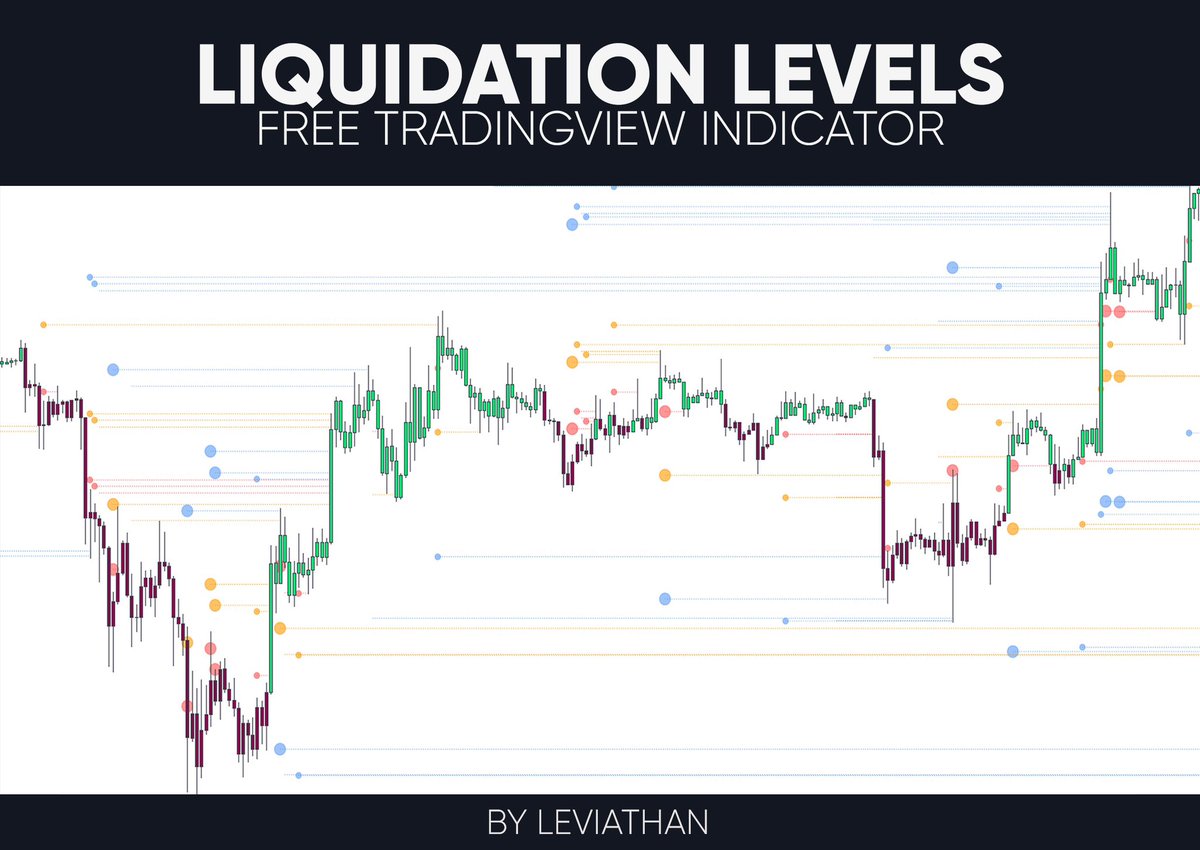

Free Liquidation Levels indicator

My new script is live & includes:

• Long & Short Liquidation levels

• OI & Volume analysis tools

• and much more

Please continue reading this thread to learn more about it.

Retweets are appreciated.

🔗 levia.io

1/16 🧵

My new script is live & includes:

• Long & Short Liquidation levels

• OI & Volume analysis tools

• and much more

Please continue reading this thread to learn more about it.

Retweets are appreciated.

🔗 levia.io

1/16 🧵

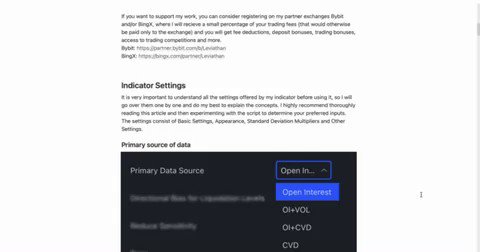

Instructional article

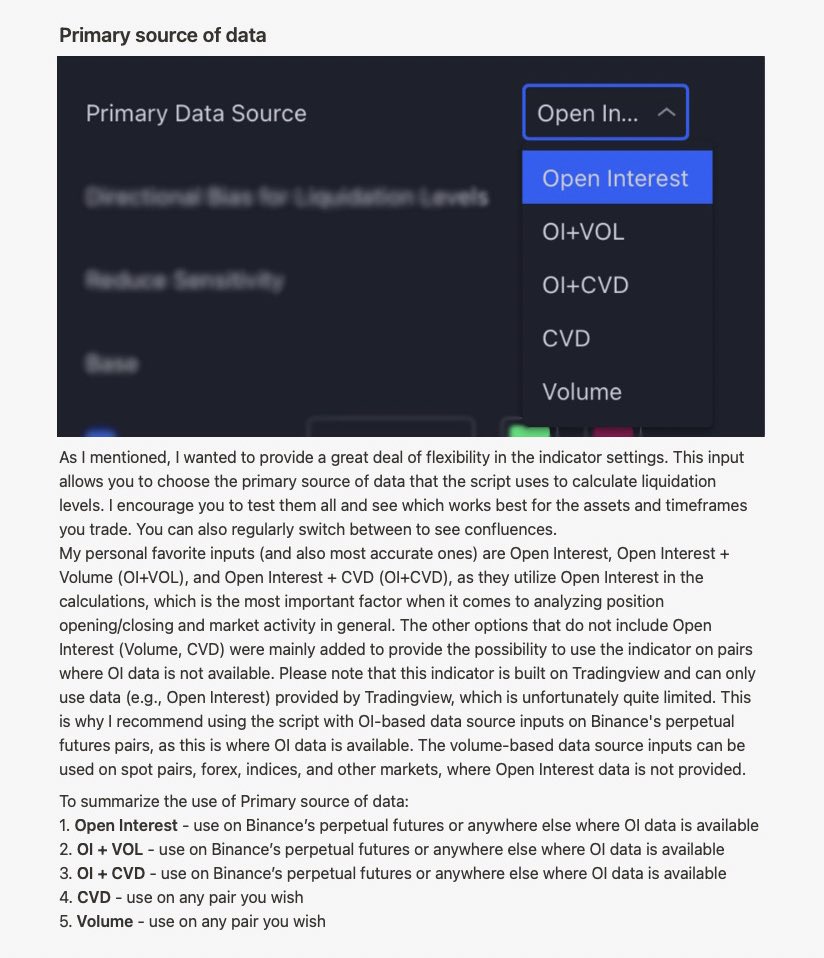

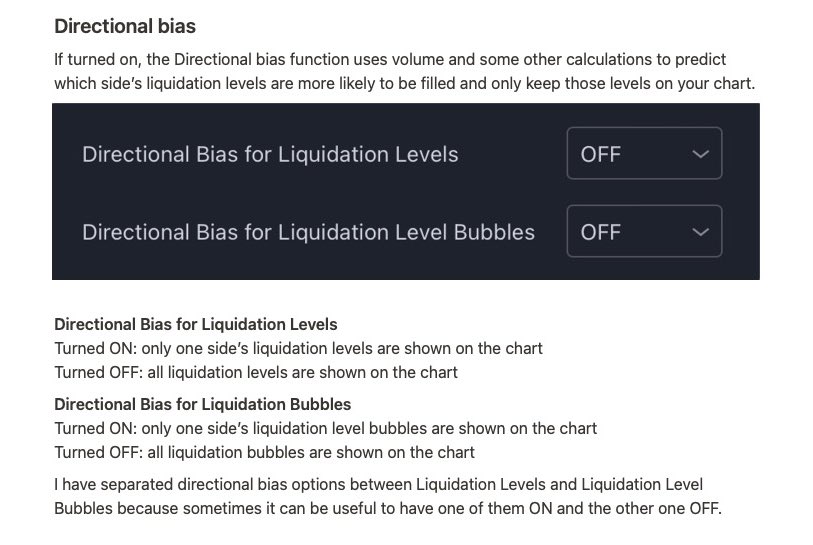

This script utilizes a lot of flexibility in setting and offers additional tools besides liquidation levels. Please read this short article to learn some basics about the indicator.

Read it here: levia.io

Or here: leviathancrypto.notion.site

This script utilizes a lot of flexibility in setting and offers additional tools besides liquidation levels. Please read this short article to learn some basics about the indicator.

Read it here: levia.io

Or here: leviathancrypto.notion.site

This is just the first version. It’s not perfect but I will continue on improving the script and posting updates.

If you appreciate my work, please consider registering on my partner exchanges:

BingX: bingx.com

Bybit: partner.bybit.com

If you appreciate my work, please consider registering on my partner exchanges:

BingX: bingx.com

Bybit: partner.bybit.com

Loading suggestions...