1. Introduction:

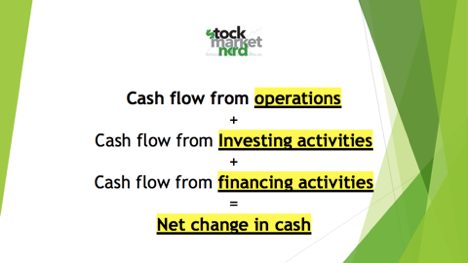

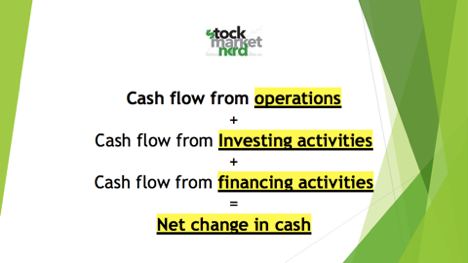

The Cash Flow Statement is comprised of three sections:

1) Cash flow from operations (CFOp)

2) Cash flow from investing activities (CFI)

3) Cash flow from financing activities (CFF)

Let’s briefly review all three.

The Cash Flow Statement is comprised of three sections:

1) Cash flow from operations (CFOp)

2) Cash flow from investing activities (CFI)

3) Cash flow from financing activities (CFF)

Let’s briefly review all three.

2a. CFOp

CFOp pulls net income from the income statement (IS) to begin (IS thread linked for review).

From there...

We make a series of adjustments to remove non-$ items & account for cash outlays or receipts that don’t impact the IS.

CFOp pulls net income from the income statement (IS) to begin (IS thread linked for review).

From there...

We make a series of adjustments to remove non-$ items & account for cash outlays or receipts that don’t impact the IS.

2c. CFOp Adjustment 2

Some non-$ items are accounted for on the IS, but don’t change a firm's $ position.

Examples:

1) Depreciation (amortization) as tangible (intangible) assets move through useful life.

2) Stock comp (More later).

After adding back these items, we get CFOp.

Some non-$ items are accounted for on the IS, but don’t change a firm's $ position.

Examples:

1) Depreciation (amortization) as tangible (intangible) assets move through useful life.

2) Stock comp (More later).

After adding back these items, we get CFOp.

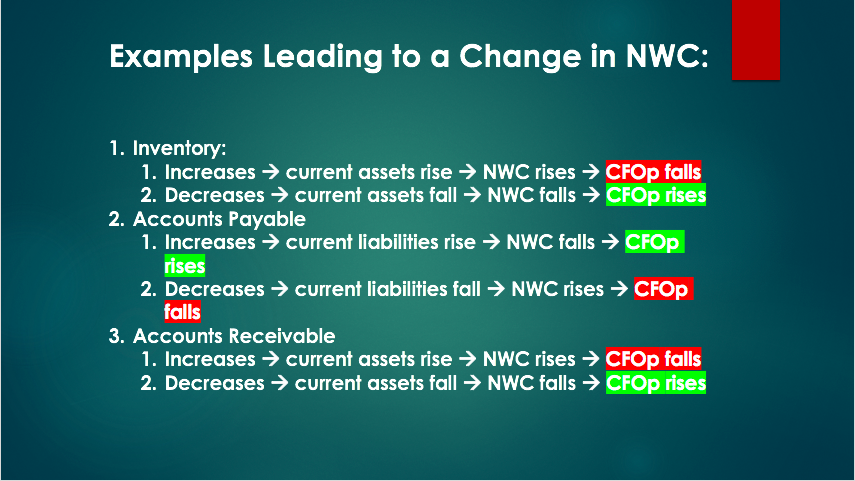

2d. A nuanced view of operational $ uses

Retailers stocking inventory to juice sales amid strong demand use $.

Financial Institutions buying loan pools to boost net interest income use $.

&

$PTON building excess, unwanted supply uses $.

Some uses of $ are better than others.

Retailers stocking inventory to juice sales amid strong demand use $.

Financial Institutions buying loan pools to boost net interest income use $.

&

$PTON building excess, unwanted supply uses $.

Some uses of $ are better than others.

3. Cash Flow from Investing Activities (CFI) is exactly what it sounds like.

Examples & relationships:

1) Buying marketable securities lowers CFI & vice versa.

2) Buying property, plant & equipment lowers CFI & vice versa.

3) M&A lowers CFI while asset sales raise it.

Examples & relationships:

1) Buying marketable securities lowers CFI & vice versa.

2) Buying property, plant & equipment lowers CFI & vice versa.

3) M&A lowers CFI while asset sales raise it.

4. Cash Flow from Financing Activities (CFF) is also intuitive.

It relates how firms fund projects & compensate stakeholders.

Examples:

1) Issuing more equity raises CFF; buybacks lower it.

2) Issuing more debt raises CFF; retiring debt lowers it.

3) Dividends lower CFF.

It relates how firms fund projects & compensate stakeholders.

Examples:

1) Issuing more equity raises CFF; buybacks lower it.

2) Issuing more debt raises CFF; retiring debt lowers it.

3) Dividends lower CFF.

6. FCF

FCF is a non-GAAP metric that takes GAAP CFOp & subtracts capital expenditures (CapEx)

CapEx involves investments to maintain & grow firm operations… such as building a new factory.

I repeat: FCF is NOT net change in cash.

Analysts mess this up all the time.

FCF is a non-GAAP metric that takes GAAP CFOp & subtracts capital expenditures (CapEx)

CapEx involves investments to maintain & grow firm operations… such as building a new factory.

I repeat: FCF is NOT net change in cash.

Analysts mess this up all the time.

7. More on Stock Based Compensation (SBC)

While SBC is technically a non-$ expense, it’s undeniably a shareholder cost as claims to a firm's profits are diluted.

Considering this, investors can adjust CFOp & FCF to account for SBC in 2 ways:

While SBC is technically a non-$ expense, it’s undeniably a shareholder cost as claims to a firm's profits are diluted.

Considering this, investors can adjust CFOp & FCF to account for SBC in 2 ways:

7b. SBC Accounting

1. Calculate CFOp & FCF with the SBC add back AND without it. Compare.

2. Track FCF/share rather than total FCF. This way, we account for the cost that shareholders incur by dividing FCF by a larger share count amid any dilution.

1. Calculate CFOp & FCF with the SBC add back AND without it. Compare.

2. Track FCF/share rather than total FCF. This way, we account for the cost that shareholders incur by dividing FCF by a larger share count amid any dilution.

8. Conclusion

Like the IS, the cash flow statement is a key piece of understanding the financial health & efficiency of a firm.

While it's not perfect & certainly has its limitations (just like the IS)...

It is absolutely imperative to understand & wise to never ignore.

Like the IS, the cash flow statement is a key piece of understanding the financial health & efficiency of a firm.

While it's not perfect & certainly has its limitations (just like the IS)...

It is absolutely imperative to understand & wise to never ignore.

If you found this valuable, a like/comment/share would be greatly appreciated!

If not... no worries 🤷♂️🙂

If not... no worries 🤷♂️🙂

& will be posting a balance sheet thread in the coming weeks to round out the 3 fin statements.

Plan to just link back to these going forward when I'm asked about specific metrics or items. 🙂

Have a great day!

Plan to just link back to these going forward when I'm asked about specific metrics or items. 🙂

Have a great day!

Loading suggestions...