This thread will consist of 8 parts.

1️⃣ What is FCF?

2️⃣ What can a company do with its FCF?

3️⃣ FCF Margin

4️⃣ FCF is NOT the same as net income

5️⃣ FCF Conversion

6️⃣ FCF Yield

7️⃣ Watch out for stock-based compensation

8️⃣ Expected return

1️⃣ What is FCF?

2️⃣ What can a company do with its FCF?

3️⃣ FCF Margin

4️⃣ FCF is NOT the same as net income

5️⃣ FCF Conversion

6️⃣ FCF Yield

7️⃣ Watch out for stock-based compensation

8️⃣ Expected return

1️⃣ What is free cash flow?

In child language, the free cash flow of a company is equal to all the cash that enters a company minus all the cash that leaves a company over a certain period.

In child language, the free cash flow of a company is equal to all the cash that enters a company minus all the cash that leaves a company over a certain period.

The official formula of free cash flow goes as follows:

Free cash flow = operating cash flow - CAPEX

In which:

- Operating cash flow= operating income + non-cash changes - changes in working capital - taxes

- CAPEX = changes in Property, Plant & Equipment + depreciation

Free cash flow = operating cash flow - CAPEX

In which:

- Operating cash flow= operating income + non-cash changes - changes in working capital - taxes

- CAPEX = changes in Property, Plant & Equipment + depreciation

The operating cash flow measures the amount of cash that is generated by a company’s normal business operations.

In other words, the operating cash flow measures all the cash a company generates by selling its products / services.

In other words, the operating cash flow measures all the cash a company generates by selling its products / services.

The capital expenditures (CAPEX) shows how much money a company has used to maintain or buy physical assets.

A distinction can be made between maintenance CAPEX and growth CAPEX.

A distinction can be made between maintenance CAPEX and growth CAPEX.

Maintenance CAPEX = investments made in existing assets

Growth CAPEX = investments made in new assets in order to grow

Growth CAPEX = investments made in new assets in order to grow

When a company is investing heavily in future growth, the free cash flow will decline due to the fact that the growth CAPEX is high.

Growth investments can be very valuable if they create added value for the company.

Growth investments can be very valuable if they create added value for the company.

That’s why some people prefer to only take the maintenance CAPEX into account to calculate the free cash flow.

In that case the formula for free cash flow goes as follows:

Free cash flow = operating cash flow - maintenance CAPEX

In that case the formula for free cash flow goes as follows:

Free cash flow = operating cash flow - maintenance CAPEX

It goes without saying that the higher the free cash flow of a company, the better.

As in investor you want to buy companies that generate a lot of cash.

As in investor you want to buy companies that generate a lot of cash.

2️⃣ What can a company do with its free cash flow?

The free cash flow of a company is the cash a company has generated over a certain period.

The free cash flow of a company is the cash a company has generated over a certain period.

The company can do different things with its free cash flow:

- Reinvesting in itself for organic growth

- Pay down debt

- Acquisitions and takeovers (M&A)

- Paying out dividends

- Buying back shares

- Reinvesting in itself for organic growth

- Pay down debt

- Acquisitions and takeovers (M&A)

- Paying out dividends

- Buying back shares

Capital allocation (choosing what to do with its free cash flow) is the most important task of management.

You want to invest in companies that manage to allocate capital very efficiently.

You want to invest in companies that manage to allocate capital very efficiently.

In general, reinvesting in itself for organic growth is the most preferred capital allocation strategy.

Obviously, the company needs to have enough growth opportunities in order to do this.

Obviously, the company needs to have enough growth opportunities in order to do this.

It is also important to underline that it only makes sense to invest in organic growth when these organic investments create value (ROIC > WACC).

3️⃣ Free cash flow margin

The best way to look at the profitability of a company, is by taking a look at the FCF margin.

This metric indicates how much cash a company is generating per dollar in sales.

FCF margin = (free cash flow / sales)

The best way to look at the profitability of a company, is by taking a look at the FCF margin.

This metric indicates how much cash a company is generating per dollar in sales.

FCF margin = (free cash flow / sales)

Visa for example has a free cash flow margin of 60.2%. This means that for every $100 in sales, Visa generates $60.2 in pure cash.

This in stark contrast with General Electric, which has a FCF margin of only 2.9%.

This in stark contrast with General Electric, which has a FCF margin of only 2.9%.

It goes without saying that it is justified to pay a higher valuation multiple for Visa compared to General Electric.

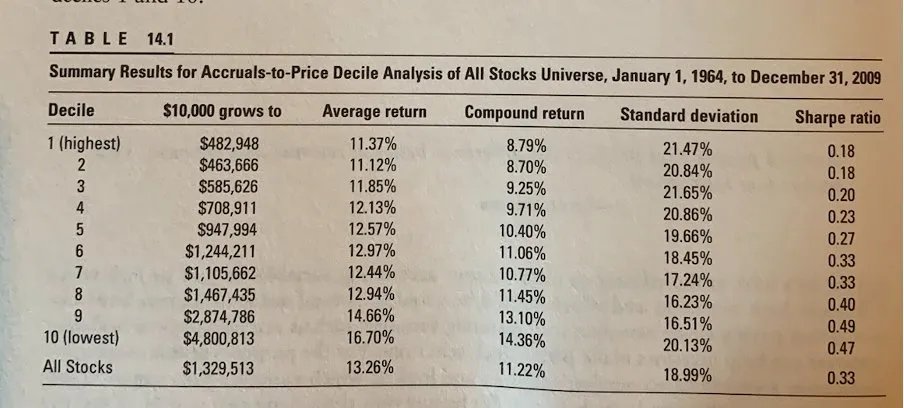

A study of @jposhaughnessy (What Works on Wall Street) found that companies who translated most earnings into FCF outperformed companies that translated the least earnings into FCF by 18% (!) per year.

4️⃣ Free cash flow is NOT the same as net income

Earnings are an opinion, cash is a fact.

That’s why you should always look at the free cash flow of a company and not at its earnings.

Earnings are an opinion, cash is a fact.

That’s why you should always look at the free cash flow of a company and not at its earnings.

While earnings are an accounting metric, free cash flow looks at the money that actually entered and left the firm over a certain period.

In other words: the net income of a company contains a lot of non-cash items whereas free cash flow looks at the cash that effectively entered and exited the business.

Net income = total revenue - total expenses

Free cash flow = operating cash flow - CAPEX

Free cash flow = operating cash flow - CAPEX

To go from the net income of a company to its free cash flow, you should make the following adaptions:

Free cash flow = Net income + depreciation / amortization - change in working capital - capital expenditures

Free cash flow = Net income + depreciation / amortization - change in working capital - capital expenditures

In general, free cash flow can be seen as a better metric compared to the earnings of a company because this metric is more reliable and is harder to manipulate.

5️⃣ FCF conversion

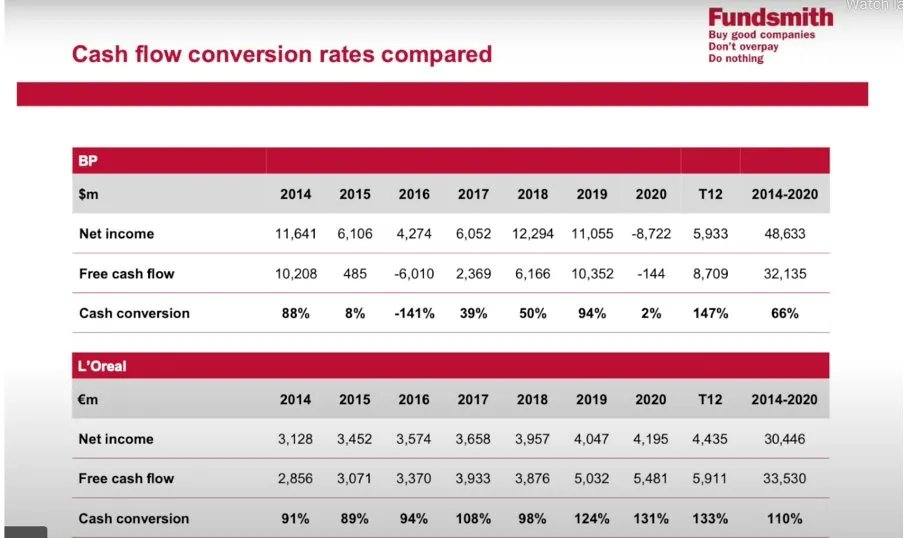

Quality companies convert most earnings into free cash flow.

FCF Conversion = (free cash flow / net earnings)

When there is a huge difference between the free cash flow and the earnings of a company, you should be suspicious as an investor.

Quality companies convert most earnings into free cash flow.

FCF Conversion = (free cash flow / net earnings)

When there is a huge difference between the free cash flow and the earnings of a company, you should be suspicious as an investor.

6️⃣ Free cash flow yield

The free cash flow yield (FCF Yield) of a company is a great way to look at the valuation of a company.

Free cash flow yield = (Free cash flow per share/ stock price)

The free cash flow yield (FCF Yield) of a company is a great way to look at the valuation of a company.

Free cash flow yield = (Free cash flow per share/ stock price)

The higher this ratio, the cheaper the stock.

You can compare the FCF Yield of a company to its historical average FCF Yield to get a grasp about how expensive the company is an historic perspective.

You can compare the FCF Yield of a company to its historical average FCF Yield to get a grasp about how expensive the company is an historic perspective.

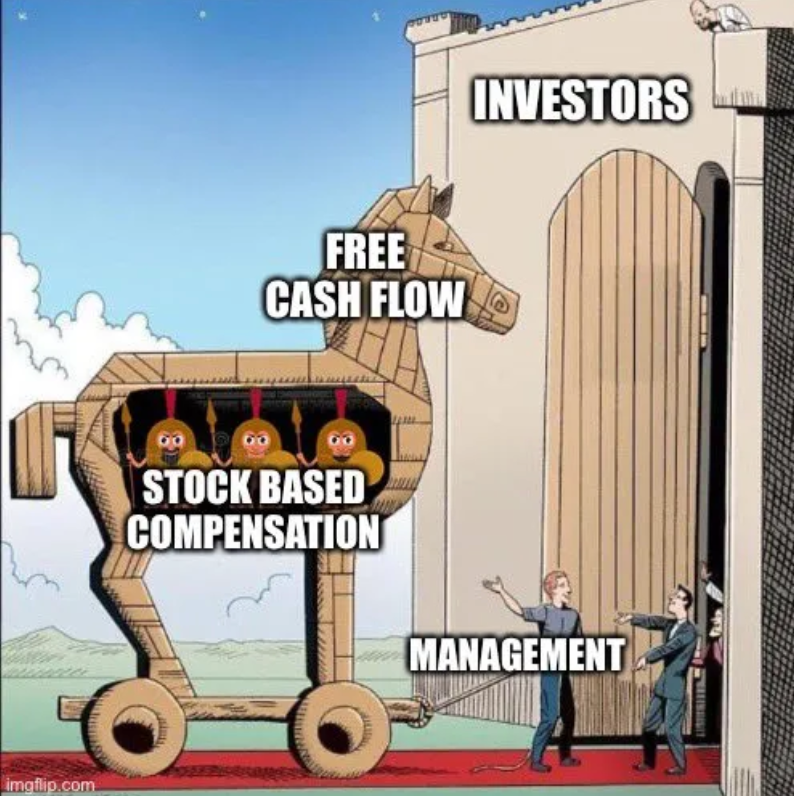

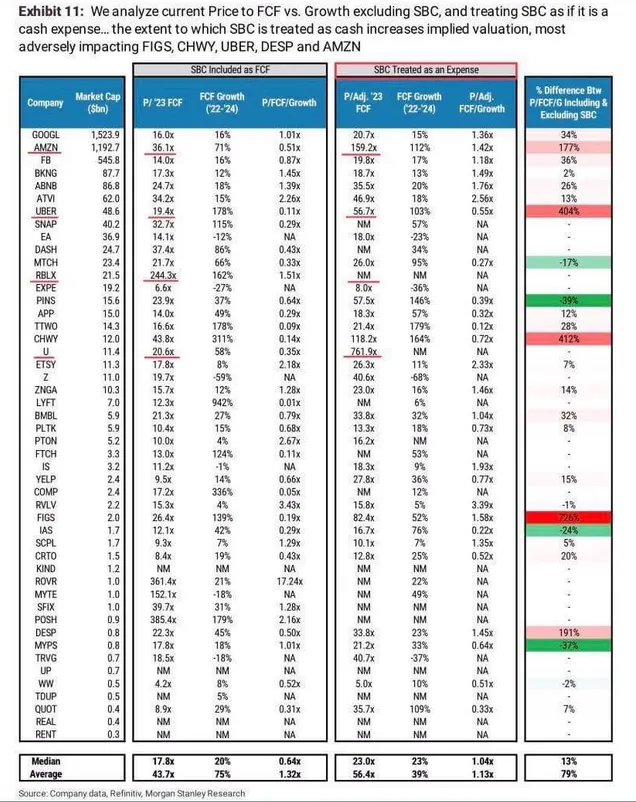

For investors, stock-based compensations are a cost as it dilutes existing shareholders.

As a result, you should always look at the FCF per share excluding stock-based compensations to get a more reliable and conservative view of the company.

As a result, you should always look at the FCF per share excluding stock-based compensations to get a more reliable and conservative view of the company.

Free cash flow = operating cash flow - CAPEX - stock-based compensation

For example, for Amazon the price to free cash flow based on the estimated free cash flow of 2023 is equal to 36.1.

For example, for Amazon the price to free cash flow based on the estimated free cash flow of 2023 is equal to 36.1.

8️⃣ Expected return

Last but not least, you can use the following rule of thumb to calculate your expected return as an investor:

Last but not least, you can use the following rule of thumb to calculate your expected return as an investor:

Expected return per year = FCF per share growth + buyback yield +/- multiple expansion (multiple contraction)

Shareholder yield = dividend yield + buyback yield

Shareholder yield = dividend yield + buyback yield

Let’s use Visa as an example again.

We estimate that Visa will be able to grow its free cash flow per share with 13% per year over the next 5 years. The dividend yield is equal to 0.9% and we estimate that the outstanding shares of Visa will remain constant over the next years.

We estimate that Visa will be able to grow its free cash flow per share with 13% per year over the next 5 years. The dividend yield is equal to 0.9% and we estimate that the outstanding shares of Visa will remain constant over the next years.

Furthermore, we think the current FCF Yield of Visa (4.2%) is fair, as a result no multiple expansion nor contraction will take place.

Under these assumptions the expected yearly return for Visa is equal to:

13% + 0.9% + 0% = 13.9%

Would you be happy with an annual return of 13.9% per year? If so, Visa might be an interesting investment.

13% + 0.9% + 0% = 13.9%

Would you be happy with an annual return of 13.9% per year? If so, Visa might be an interesting investment.

The end.

Would you like to reread everything in 1 article? Take a look at our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

qualitycompounding.substack.com

Would you like to reread everything in 1 article? Take a look at our website.

▪️ Each Tuesday we share 5 investment insights

▪️ Each Thursday we publish a deeper investment article

qualitycompounding.substack.com

Loading suggestions...