Does the money supply really drive inflation?

If so, how will Fed monetary tightening affect prices in the near future?

Time for a money 🧵👇

If so, how will Fed monetary tightening affect prices in the near future?

Time for a money 🧵👇

🤏 What is Narrow Money?

To understand money and supply, we first need to understand the different types of money and their definitions

We'll focus on US definitions and USD money supply for today.

To understand money and supply, we first need to understand the different types of money and their definitions

We'll focus on US definitions and USD money supply for today.

At the most restrictive end of the money supply measures, we have what's called narrow money, or M0 (‘em-zero’)

This includes only currency in circulation and cash kept in reserve by banks

Hence, M0 is often referred to as the monetary base.

This includes only currency in circulation and cash kept in reserve by banks

Hence, M0 is often referred to as the monetary base.

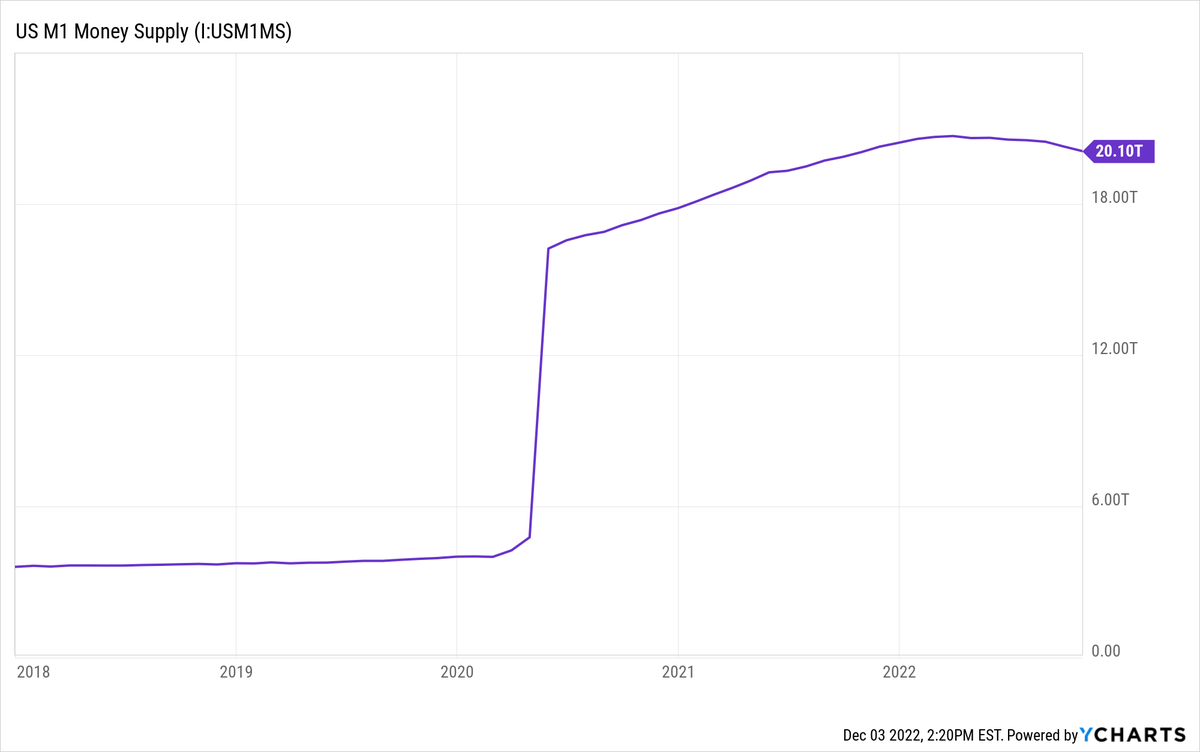

Moving up a notch, we have what's known as M1

M1 = M0 + demand deposits + any outstanding traveler’s checks

Demand deposits are just deposits in bank accounts that can be withdrawn at any time, i.e., customer checking and immediately accessible savings accounts.

M1 = M0 + demand deposits + any outstanding traveler’s checks

Demand deposits are just deposits in bank accounts that can be withdrawn at any time, i.e., customer checking and immediately accessible savings accounts.

Wait, you may ask, do banks have all this cash in the safe? Ready for withdrawal?

The answer is no. This money is accounted for digitally in the fractional reserve system.

The answer is no. This money is accounted for digitally in the fractional reserve system.

If you want to understand that better, we covered fractional reserve banking in a recent 🧠Informationist Newsletter, and you can find out more about that here: jameslavish.substack.com

TL;DR: Banks don’t hold all your cash in their vaults

They use risk models to determine the velocity of cash within their system and estimate how much needs to be available at various branches, etc. in absence of a run at the bank

The rest is just recorded on a digital ledger.

They use risk models to determine the velocity of cash within their system and estimate how much needs to be available at various branches, etc. in absence of a run at the bank

The rest is just recorded on a digital ledger.

🖖 What is Broad Money?

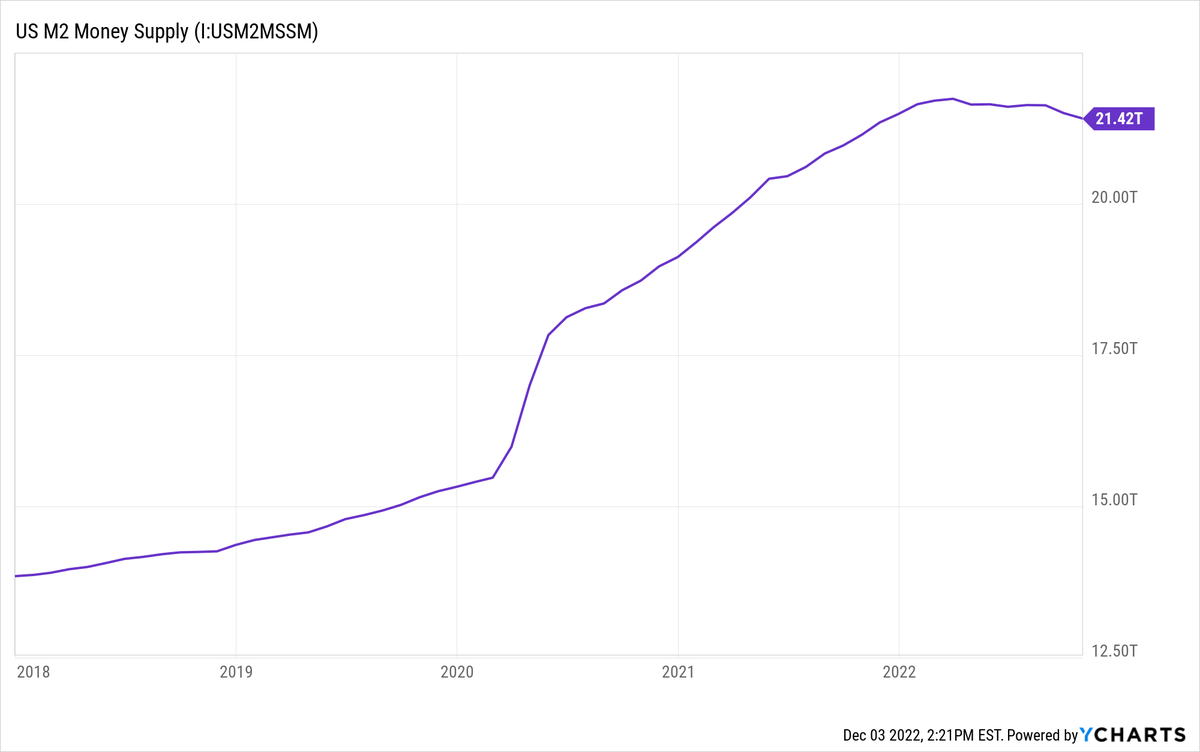

Moving our scope out a little bit, broad money includes all of M1 and more and can be defined as M2 and M3

M2 = M1 + money market savings deposits, small time-restricted deposits under $100,000, and shares of money market mutual funds.

Moving our scope out a little bit, broad money includes all of M1 and more and can be defined as M2 and M3

M2 = M1 + money market savings deposits, small time-restricted deposits under $100,000, and shares of money market mutual funds.

Expanding the scope further, we get to M3, or what is often referred to as near money

This includes all of M2 plus larger time deposits, institutional money market holdings, short-term repurchase agreements (i.e., repos), and other large liquid assets.

This includes all of M2 plus larger time deposits, institutional money market holdings, short-term repurchase agreements (i.e., repos), and other large liquid assets.

M3 is not as liquid as M1 or M2, and is considered a reflection of institutional-level holdings of money

Because these are less liquid forms of money, M2 and M3 are more of a measure of money being held as a store-of-value rather than a medium of exchange.

Because these are less liquid forms of money, M2 and M3 are more of a measure of money being held as a store-of-value rather than a medium of exchange.

Interestingly, the Fed stopped publishing estimates of M3 supply as of 2006

The claim here is that the cost to research and compile M3 as a data point had grown to outweigh the benefit of knowing the number

Uh huh. 🙄

The claim here is that the cost to research and compile M3 as a data point had grown to outweigh the benefit of knowing the number

Uh huh. 🙄

But how exactly is this happening, and what does it mean?

It’s highly likely that you’ve heard and read quite a bit about Quantitative Easing (QE) and Quantitative Tightening (QT) in the last two years

But a quick refresher...

It’s highly likely that you’ve heard and read quite a bit about Quantitative Easing (QE) and Quantitative Tightening (QT) in the last two years

But a quick refresher...

QE is when the Fed and Treasury work together to add liquidity to the markets

How:

The Treasury presses a button that creates new balances at the Fed, then the Fed goes into the open market and buys various assets, such as US Treasuries and mortgage-backed securities (MBS).

How:

The Treasury presses a button that creates new balances at the Fed, then the Fed goes into the open market and buys various assets, such as US Treasuries and mortgage-backed securities (MBS).

Of course, The Fed and Treasury can work to remove liquidity and decrease the money supply as well, using QT

The way they do this is by first letting some of those Treasuries or MBS mature without replacing them.

The way they do this is by first letting some of those Treasuries or MBS mature without replacing them.

Next, the Fed can enter the market and physically *sell* USTs or MBS, thereby removing cash from the system

Question is, what are the effects of all this expansion and contraction, and does it actually impact inflation?

Question is, what are the effects of all this expansion and contraction, and does it actually impact inflation?

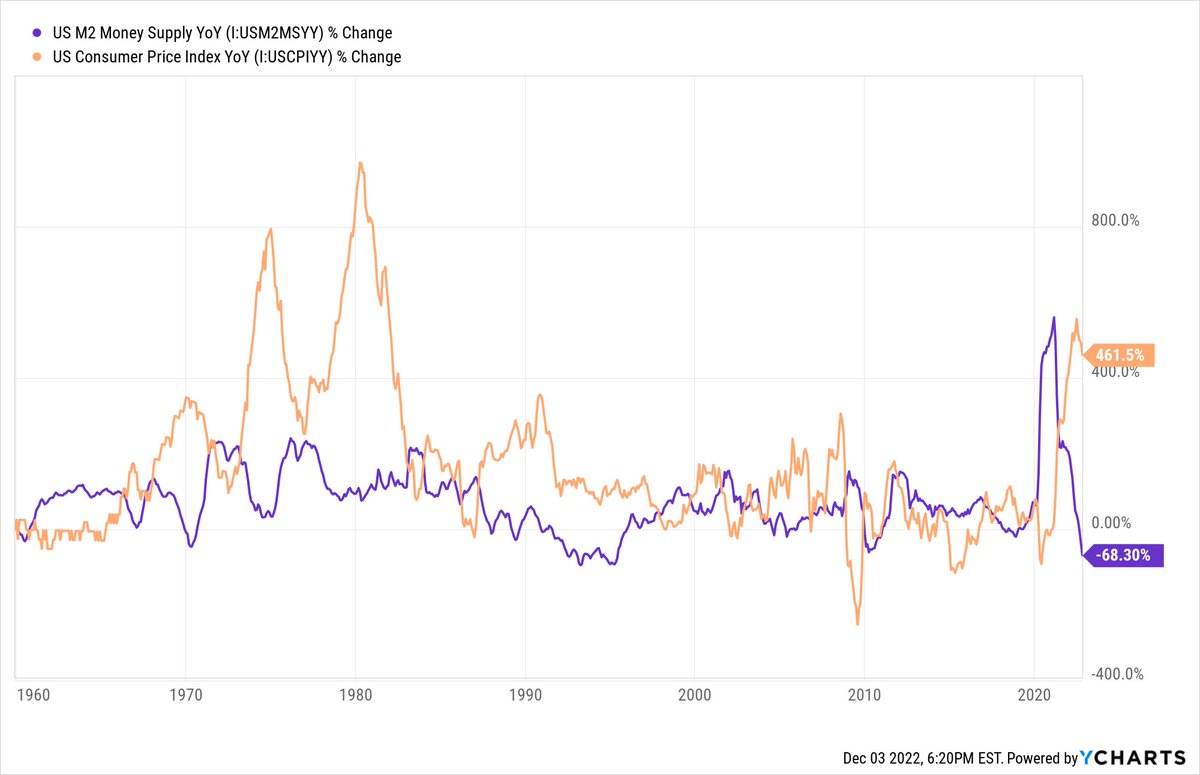

We should note that some of this price acceleration was caused by supply chain issues as well as stimulus checks given directly to consumers

These no doubt exacerbated the pricing pressures upwards.

These no doubt exacerbated the pricing pressures upwards.

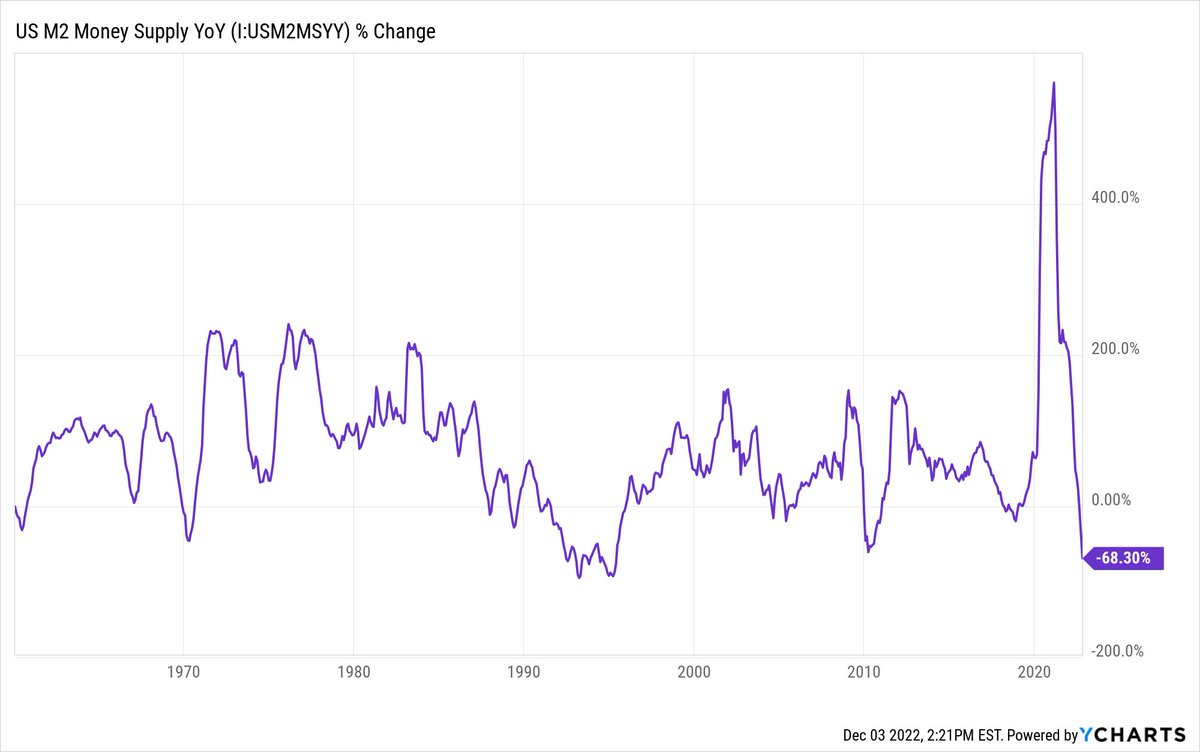

We can then note the pressures level out in the middle of 2022 (see chart above)

Interestingly, this is soon after the Fed stopped their QE program and halted their purchases of securities on the open market.

Interestingly, this is soon after the Fed stopped their QE program and halted their purchases of securities on the open market.

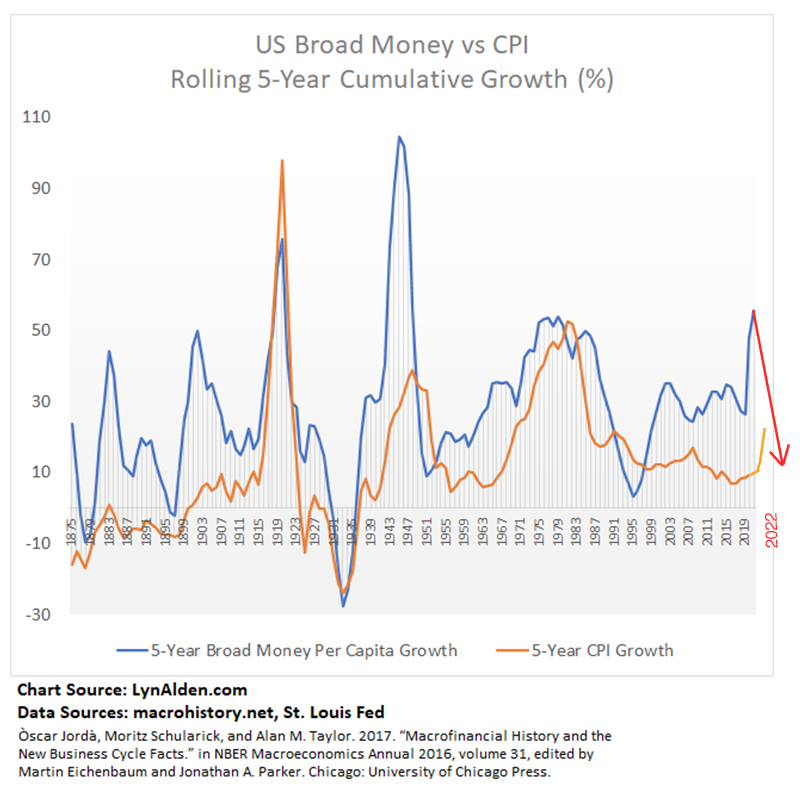

Yet, @LynAldenContact pointed out in one of her recent newsletters (highly recommended, BTW), that we should rather look at a *rolling 5-year per capita broad money against CPI* measure to mute that annual noise and see the clear correlation.

You may notice how CPI reactions often lag the expansion of broad money.

Adding some rough pro-forma data onto Lyn’s graph and considering the rapid decrease in M2 growth, the direction that this is going appears clear:

(#supply" target="_blank" rel="noopener" onclick="event.stopPropagation()">lynalden.com):

Adding some rough pro-forma data onto Lyn’s graph and considering the rapid decrease in M2 growth, the direction that this is going appears clear:

(#supply" target="_blank" rel="noopener" onclick="event.stopPropagation()">lynalden.com):

And so while it still may take a number of months for inflation to settle down, with the extreme reduction in M2 and broad money supply, I fully expect inflation to follow soon.

That said, with such drastic increases in Fed Funds and borrowing rates, we now face a serious possibility that the Fed over-tightens, removes too much liquidity, and sends the economy spiraling into a severe recession.

In this case, it’s back to the money printer and possibly QE-infinity

And then, all bets for taming inflation are completely off

As for me, I’ll be paying attention to the money supply.

And then, all bets for taming inflation are completely off

As for me, I’ll be paying attention to the money supply.

This thread is a summary of a recent 🧠Informationist Newsletter. If you enjoyed it, make sure to:

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly: jameslavish.substack.com

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified concept weekly: jameslavish.substack.com

Loading suggestions...