25 minutes in, Tether admits that Giancarlo Devasini and van der Velde are too busy for interviews because they’re hard at work helping Sam at Alameda.

Tether tried to get this interview deleted. They failed.

m.youtube.com

Tether tried to get this interview deleted. They failed.

m.youtube.com

FTX was a no-KYC/AML exchange. They only pretended to comply with KYC/AML.

When you’re laundering money, you need rich accounts with no KYC information. The rich accounts then get funded with dirty money. The rich accounts then make a series of bad trades on purpose.

When you’re laundering money, you need rich accounts with no KYC information. The rich accounts then get funded with dirty money. The rich accounts then make a series of bad trades on purpose.

So if you want to find out where the money went, find the winner accounts.

Oops, they lost all the records. How convenient.

Oops, they lost all the records. How convenient.

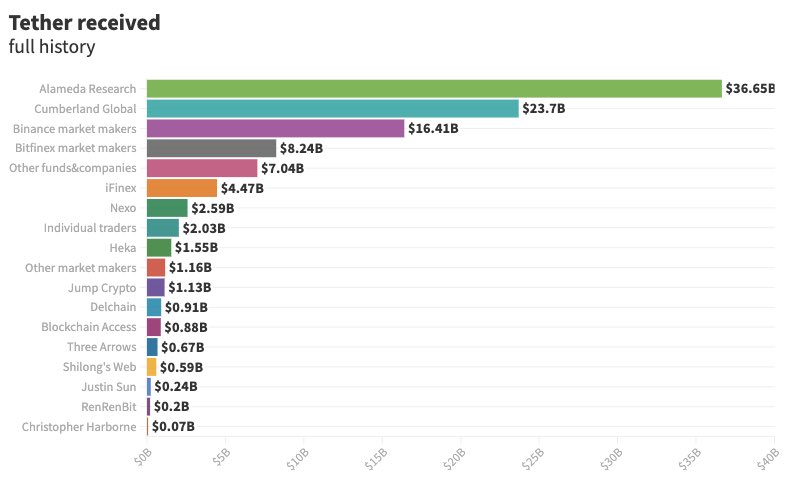

Bitfinex and tether create a lot of fronts. Crypto capital was one of them, then crypto capital was shutdown. Tether needed to create more fronts, tether had a billion dollar hole… and they need to fill it.

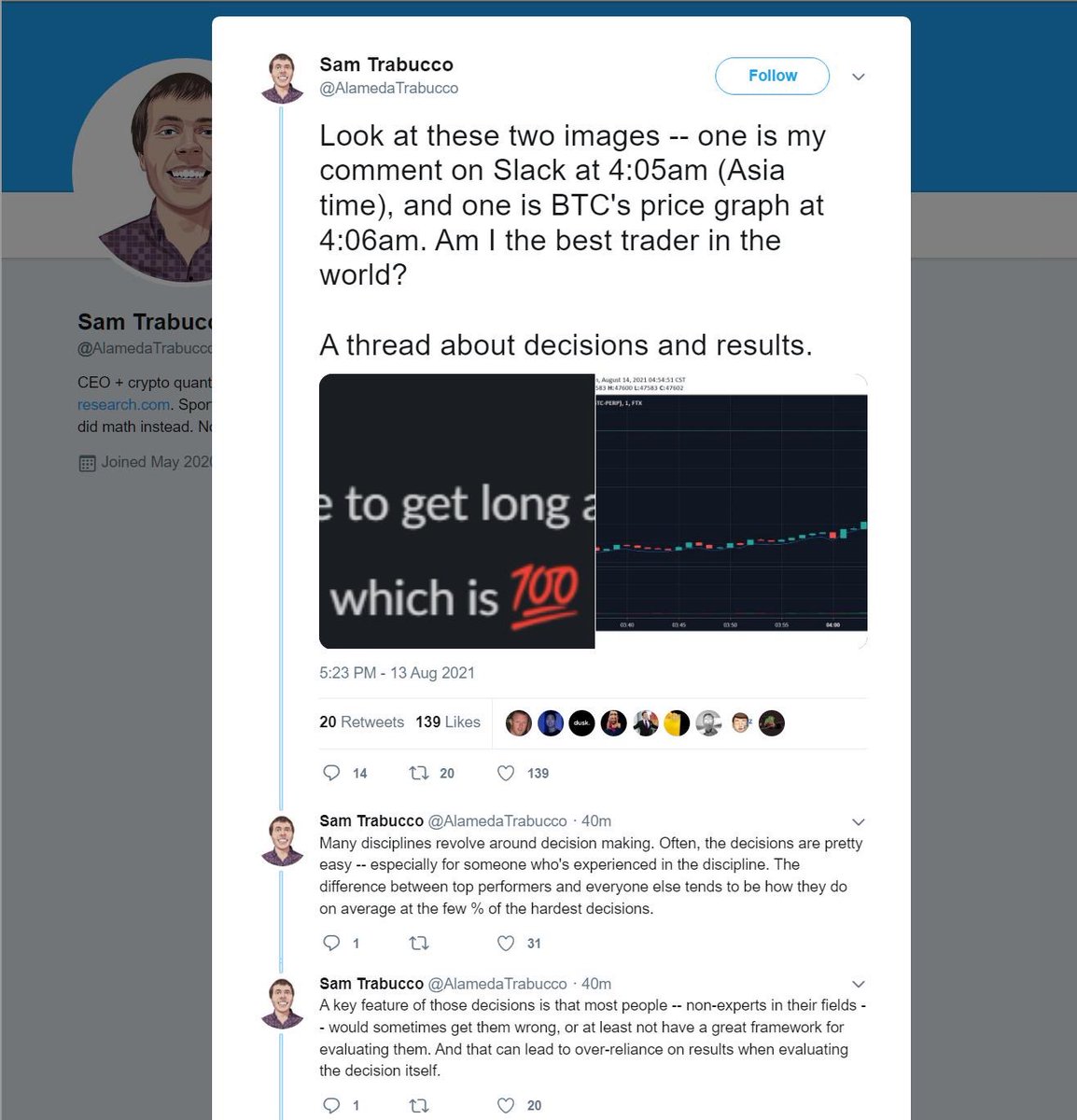

Are they really the best traders in history? Or are they just a fraud?

Are they really the best traders in history? Or are they just a fraud?

The solution? Create new fronts that conveniently lose all of their money after sending it to tether.

And that’s the reason why Tether will never produce any legitimate audits. Everyone will see they’re not geniuses, just lying thieves.

And that’s the reason why Tether will never produce any legitimate audits. Everyone will see they’re not geniuses, just lying thieves.

Loading suggestions...