Thanks to @zugmanfabio, I came to know about a follow up study by Bessembinder on long-term stock market returns.

Leaving my notes here.

Leaving my notes here.

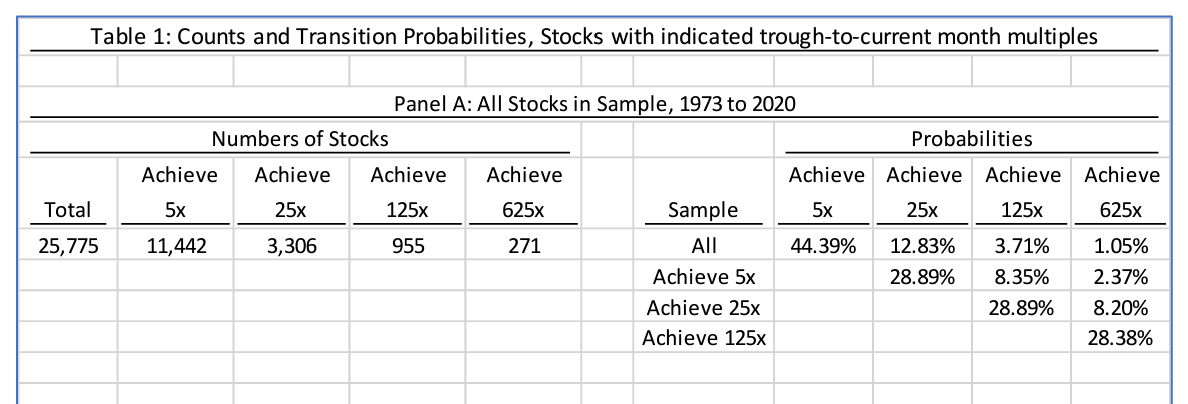

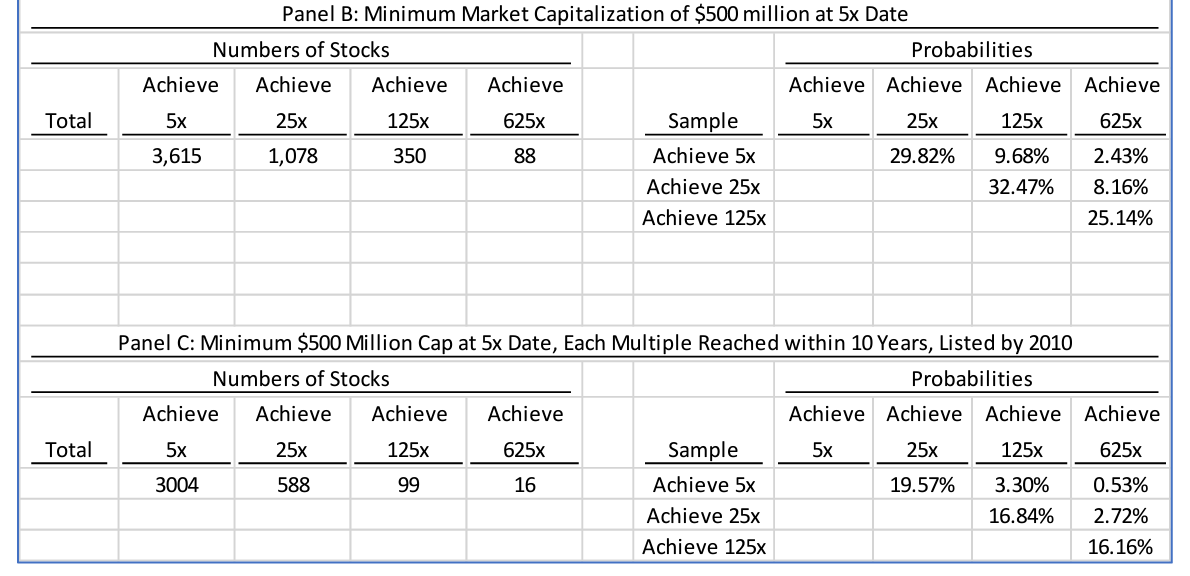

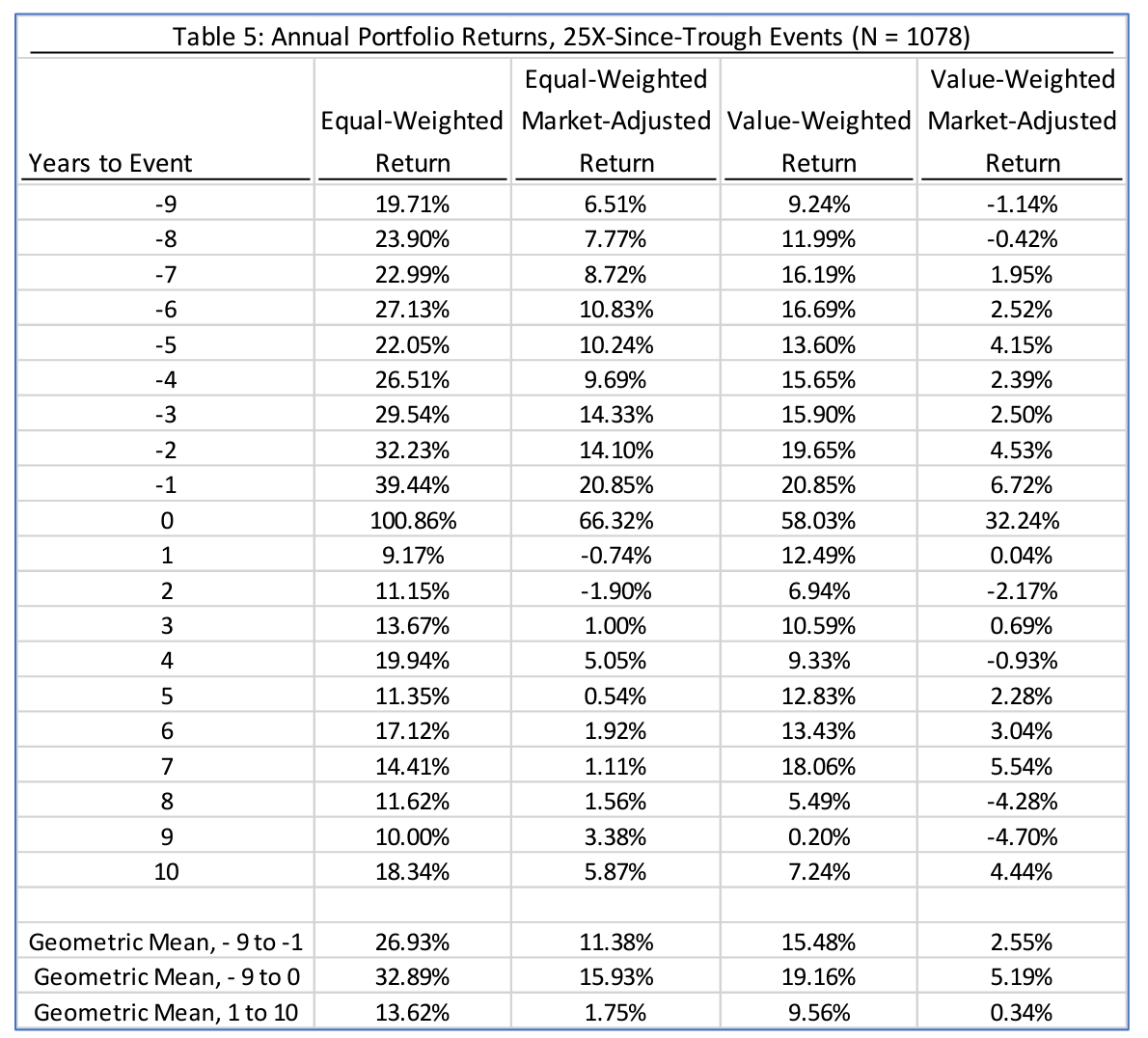

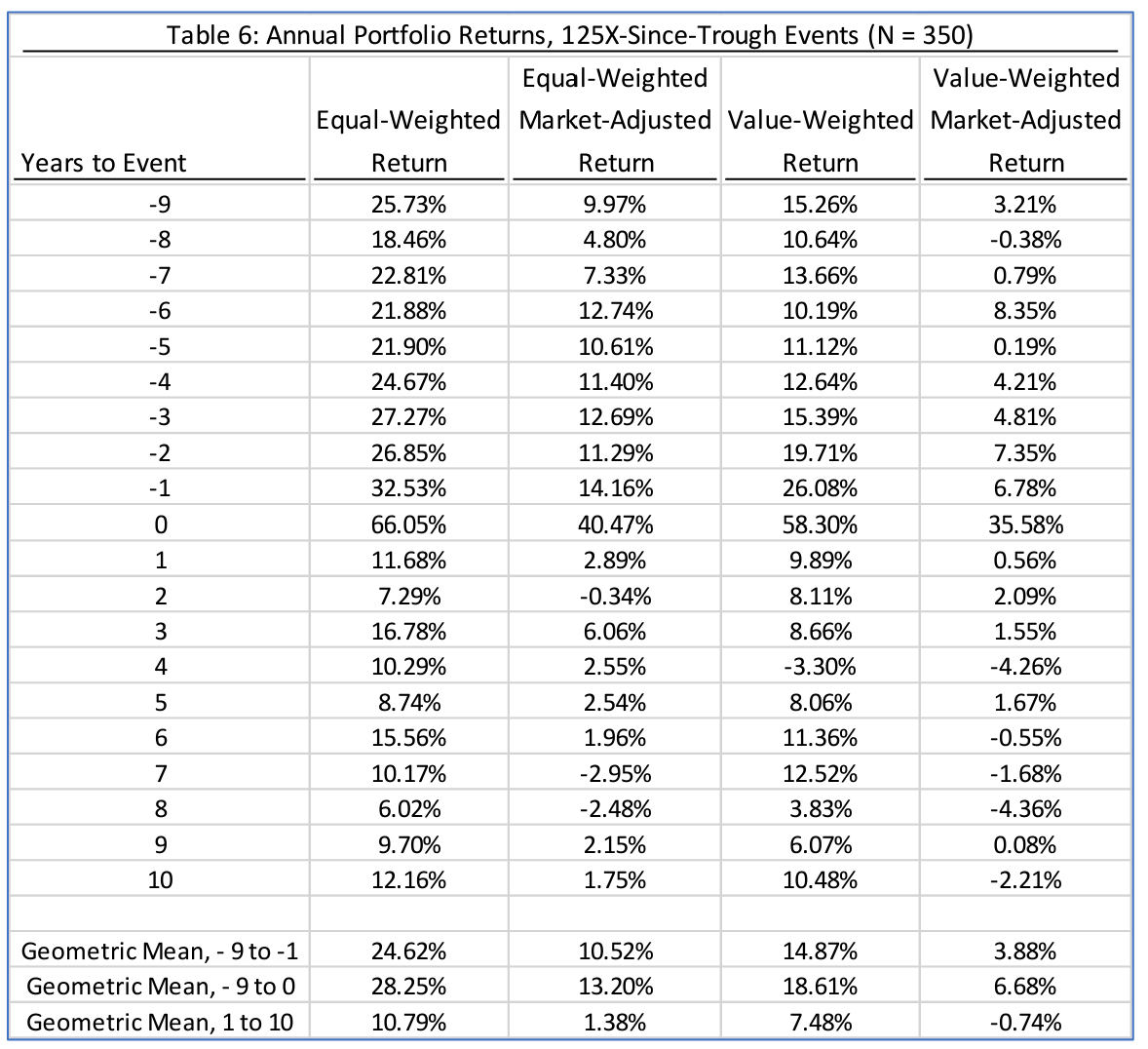

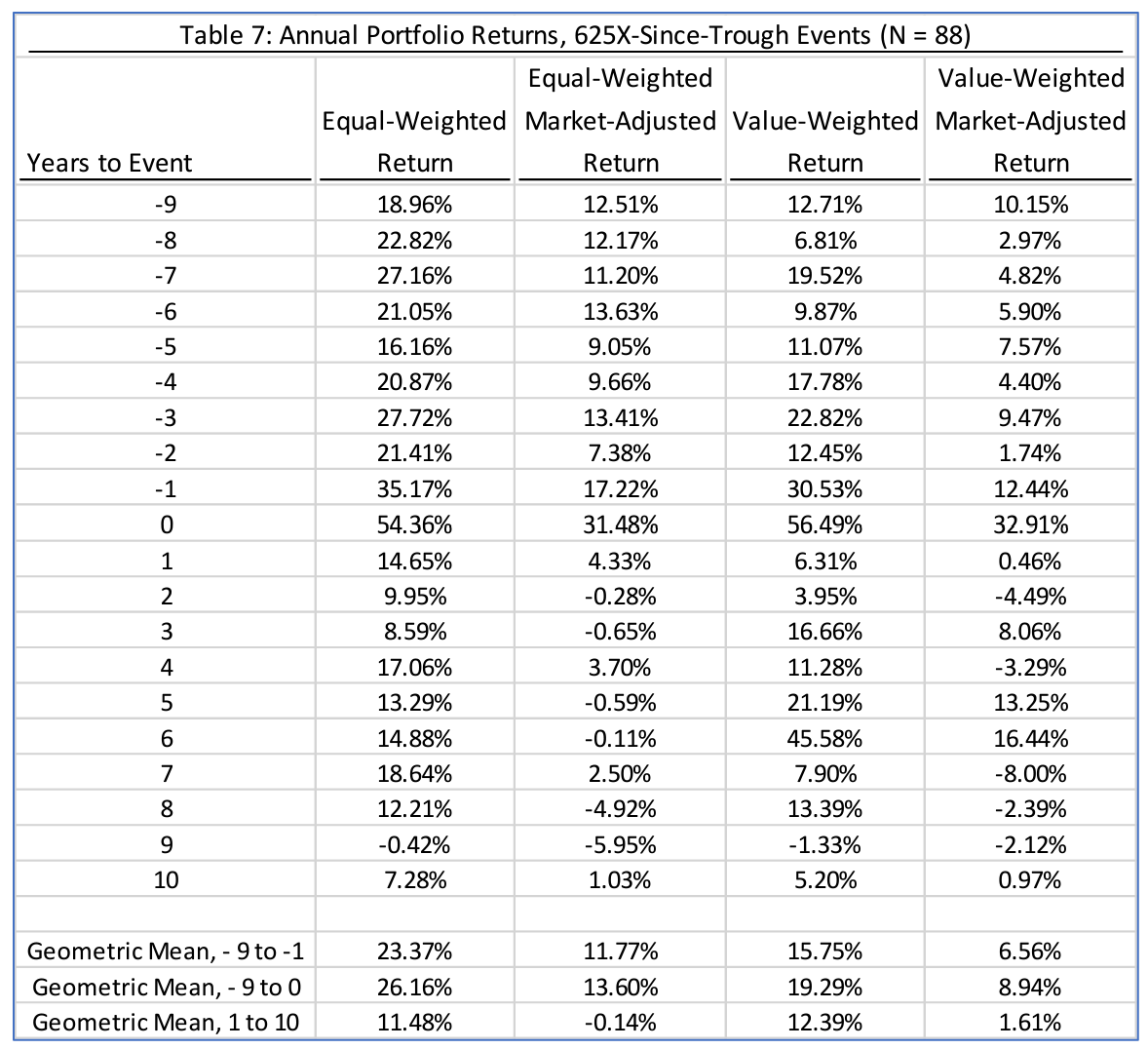

The within-sample probability that a sample stock that reaches one of these multiples will subsequently reach the next (from 5x to 25x, 25x to 125x, and 125x to 625x) is surprisingly stable at ~28-29%.

Kinda strange to see how consistent this number is.

Kinda strange to see how consistent this number is.

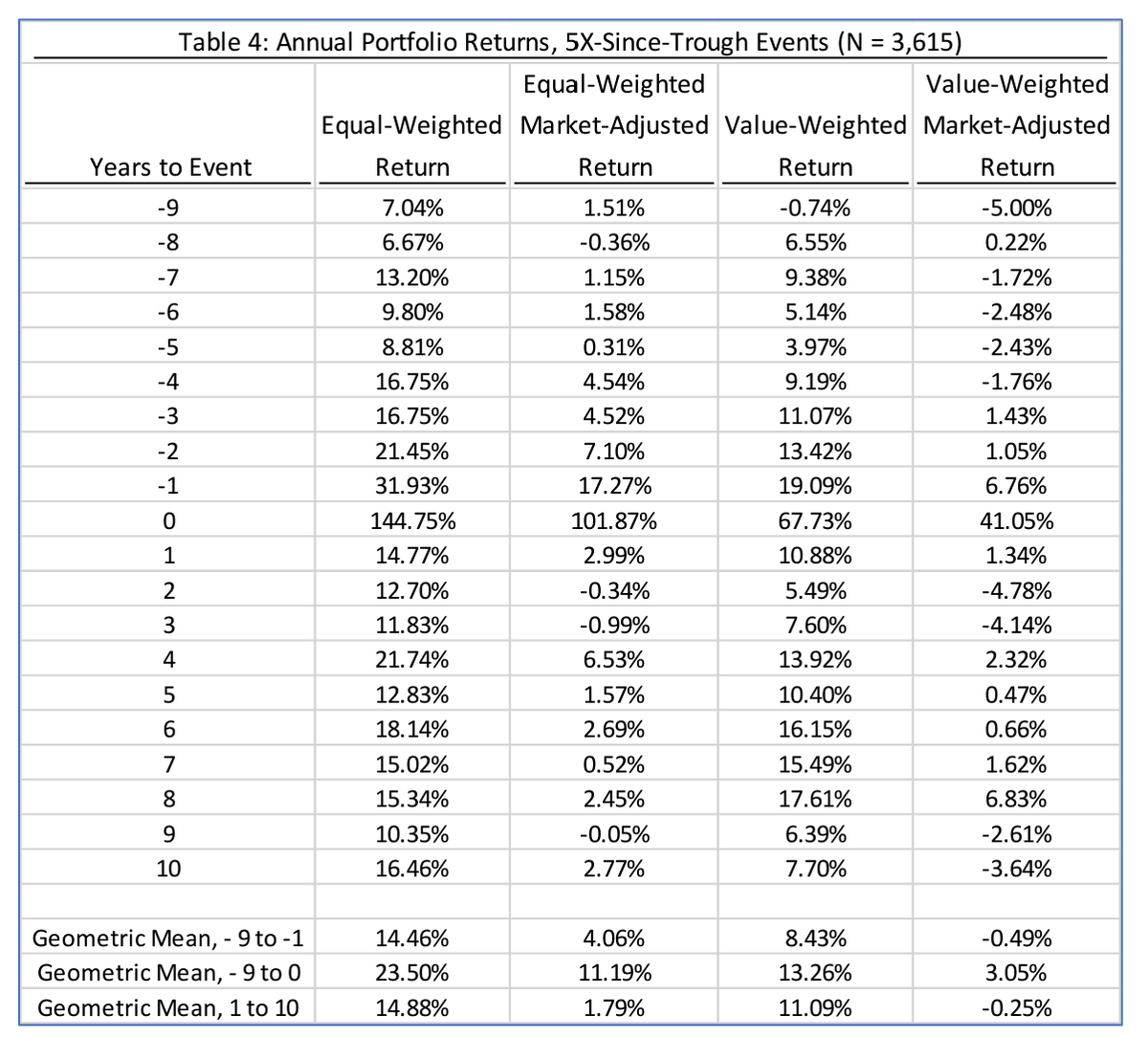

Equal weighted of "winner stocks" seem to do better than value weighted of "winner stocks" but after transaction costs, perhaps there is not much to gain from this "insight" as well.

"To be successful, investment strategies that involve concentrated portfolio positions require the ability to reliably discern in real time between stocks where the current market price fully incorporates the firm’s future potential versus those that do not."

In other words, active investing remains and perhaps will always remain very, very hard!

Full paper link: papers.ssrn.com.

Full paper link: papers.ssrn.com.

Loading suggestions...