**** Butterfly Deploy and Adjustments – With Credit and Debit Spreads ***

--> Every strategy in options is just combination of Credit Spread and Debit spread like

* Iron fly is combination of Two credit spreads

* Butterfly is combination of Credit and Debit Spreads

--> Every strategy in options is just combination of Credit Spread and Debit spread like

* Iron fly is combination of Two credit spreads

* Butterfly is combination of Credit and Debit Spreads

* Ratio Spread is nothing but Debit spread with extra sells

--> So here will explain Butterfly Adjustments treating as two different strategies like debit spread and credit spread.

--> So here will explain Butterfly Adjustments treating as two different strategies like debit spread and credit spread.

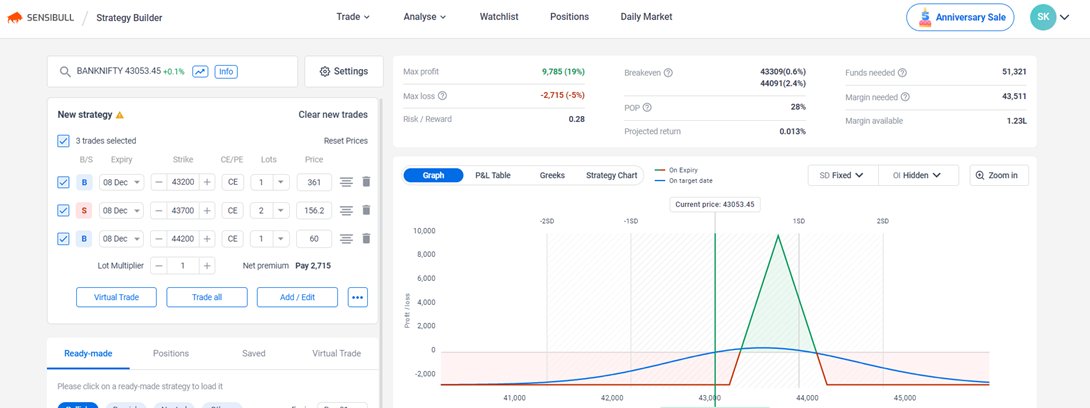

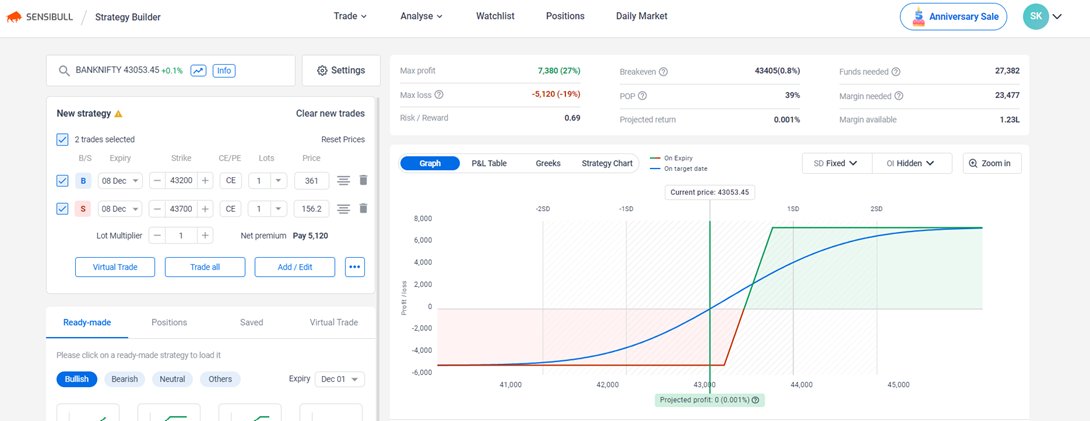

Bank nifty Spot is at 43050 so I selected Strikes of

8th Dec Expiry .

Strike selection for bullish view :-

43200 ce buy single lot

43700 ce sell double lots

44200 ce buy single lot

8th Dec Expiry .

Strike selection for bullish view :-

43200 ce buy single lot

43700 ce sell double lots

44200 ce buy single lot

When to deploy:-

1.If your view is directional then deploy.

2.If your view is sideways also you can deploy and adjust as per market movement.

3.Irrespective of VIX condition we can deploy this strategy.

1.If your view is directional then deploy.

2.If your view is sideways also you can deploy and adjust as per market movement.

3.Irrespective of VIX condition we can deploy this strategy.

Here will explain adjustment for this trade.

Case 1: -

--> When market is in favour

1) If you can see 5 to 8 % profit you can book and look for new opportunity.

2) If market came to sell positions i.e 43700 move hedges to 100 points i.e exit 43200 ce and enter 43300 ce .

Case 1: -

--> When market is in favour

1) If you can see 5 to 8 % profit you can book and look for new opportunity.

2) If market came to sell positions i.e 43700 move hedges to 100 points i.e exit 43200 ce and enter 43300 ce .

Exit 44200 ce and enter 44100 ce i.e loss become almost negligible so you can hold this till expiry.

Case 2:-

--> When market is not in favour

1. find out last week low or swing low in Hourly time frame if it cross and sustain means our view went wrong .

Case 2:-

--> When market is not in favour

1. find out last week low or swing low in Hourly time frame if it cross and sustain means our view went wrong .

Case 3:-

--> Market Crossed Butterfly and didn’t give chance to make 1st Adjustment: -

1)In this case if market is crossed our last buy position and crossed importance resistance levels also that means 44200 ce with out any given chance .

--> Market Crossed Butterfly and didn’t give chance to make 1st Adjustment: -

1)In this case if market is crossed our last buy position and crossed importance resistance levels also that means 44200 ce with out any given chance .

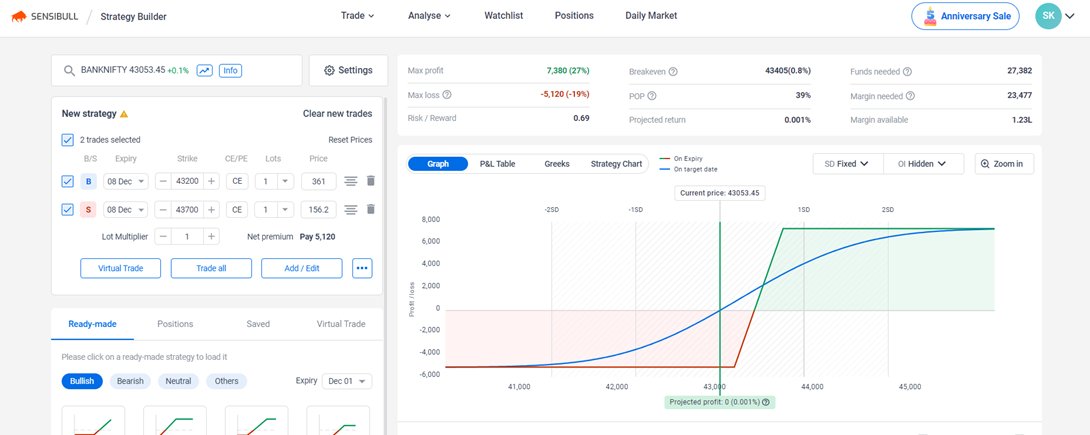

That condition in this strategy Debit spread will be in good profit we book this debit spread means

Exit 43200 ce one lot buy

43700 ce one lot sell

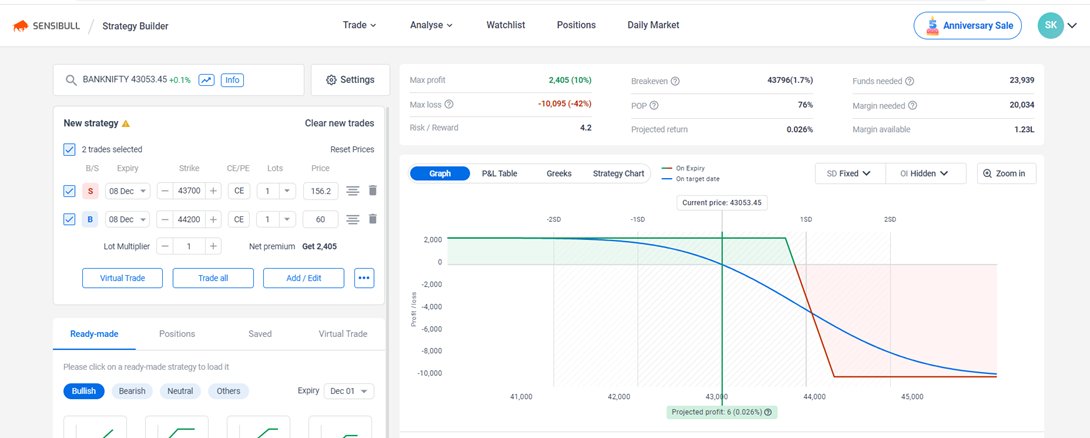

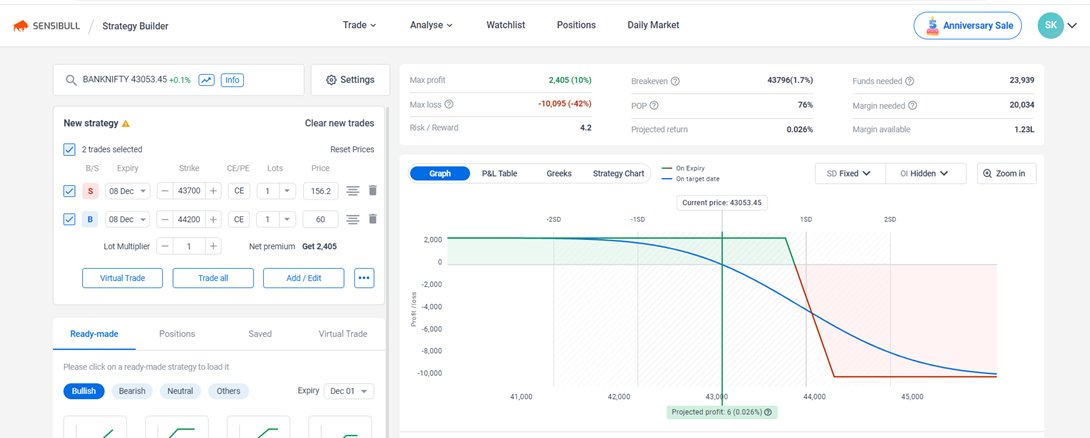

So now we have only credit spread which is in loss means

43700 ce sell

44200 ce buy

Exit 43200 ce one lot buy

43700 ce one lot sell

So now we have only credit spread which is in loss means

43700 ce sell

44200 ce buy

Now we need find support in chart in hourly time frame sell below puts.

If market take retracement to sell position means 43700 ce by that time we will be in profit in this credit spread also book that spread and close everything with extra sell also.

If market take retracement to sell position means 43700 ce by that time we will be in profit in this credit spread also book that spread and close everything with extra sell also.

For Bearish view also we can do same strategy with put strikes with same adjustments.

Keep Learning and Keep Growing 😍

Keep Learning and Keep Growing 😍

Disclaimer: - These Strategies I have learned from paid trainers, youtubers, books, some of the twitter handles, websites and google. These are not created by me and nobody so anybody can learn and use. Just learning purpose i have prepared this.

So you can find someone using this strategy and future also somebody will use these strategies so these are available for free everywhere.

Uploaded this strategy pdf in the below link.

github.com

Uploaded this strategy pdf in the below link.

github.com

Loading suggestions...