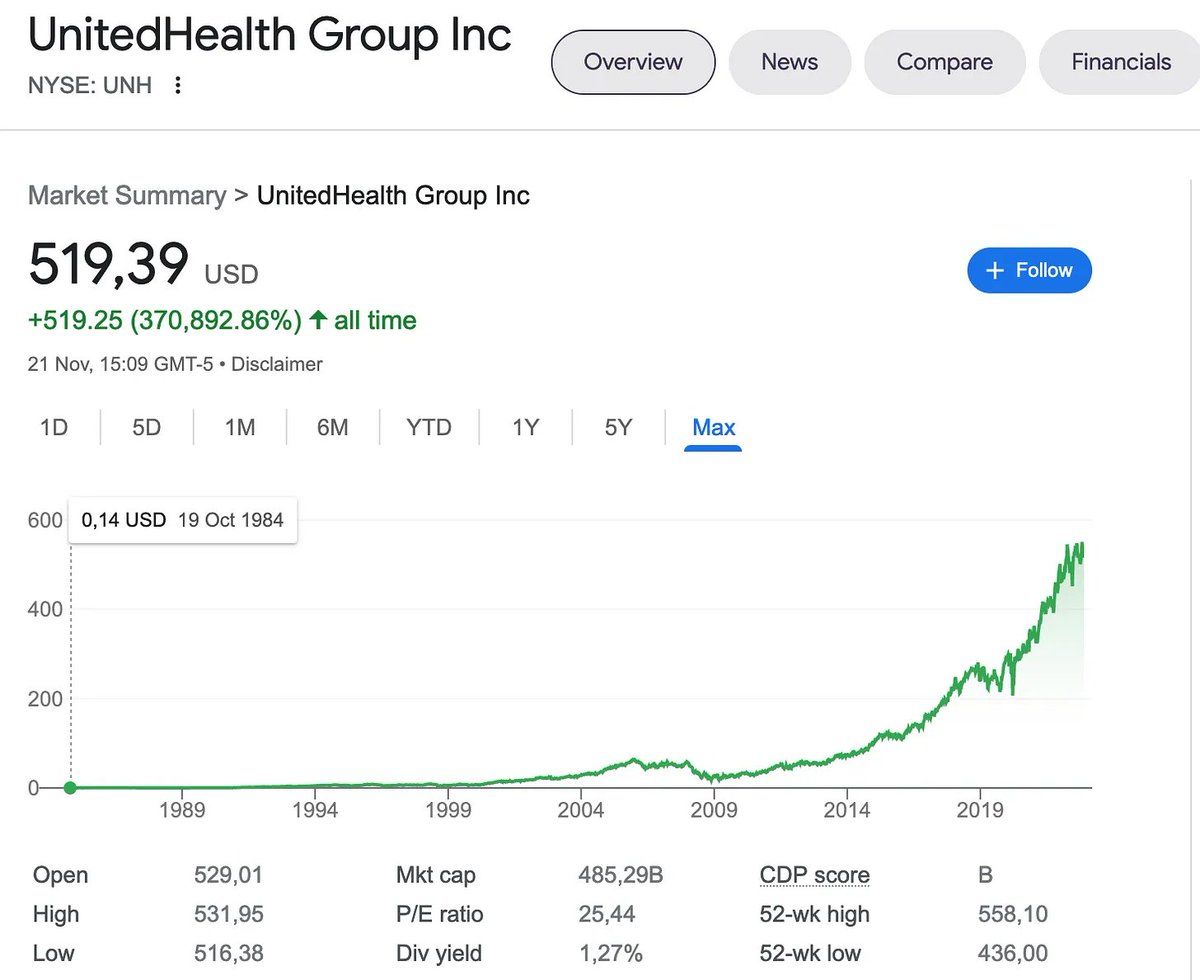

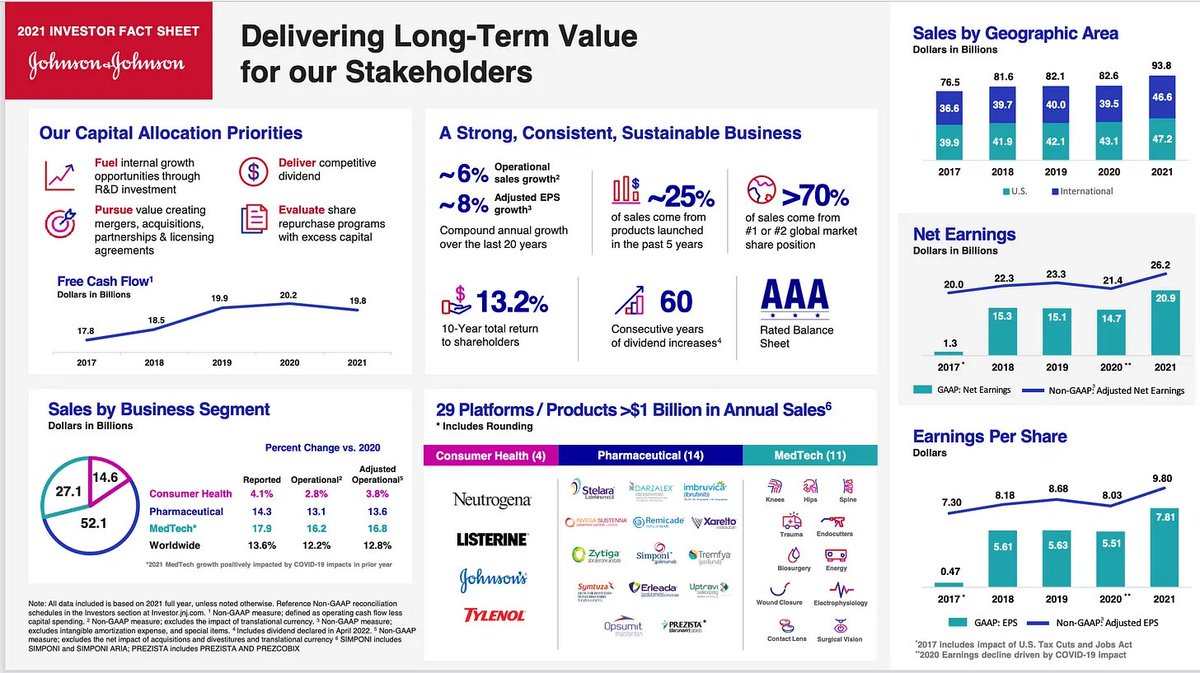

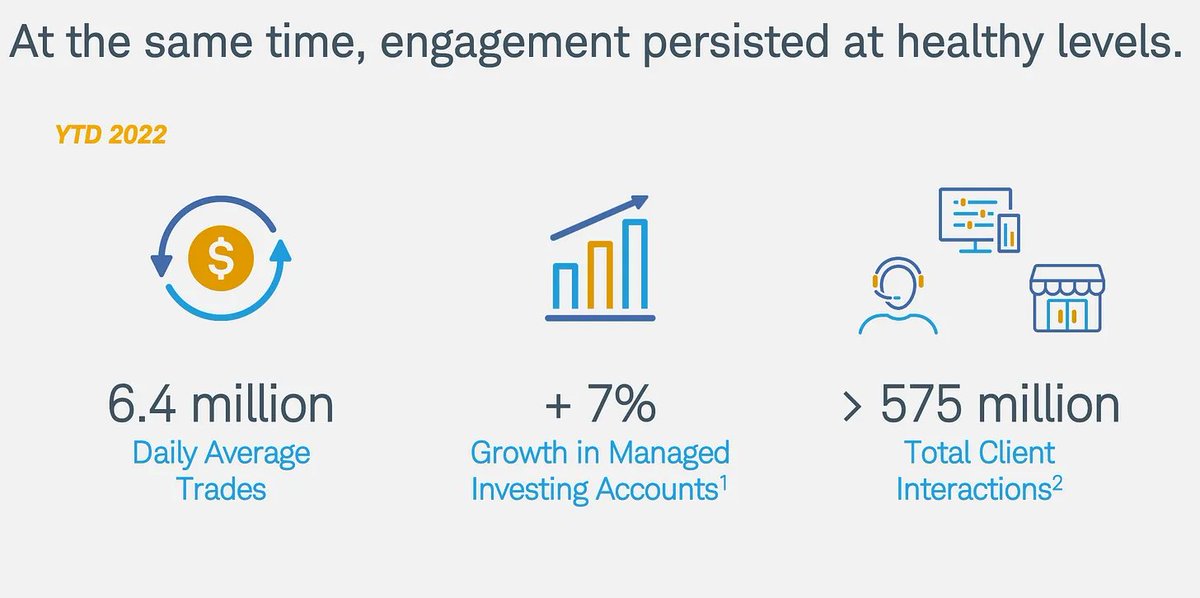

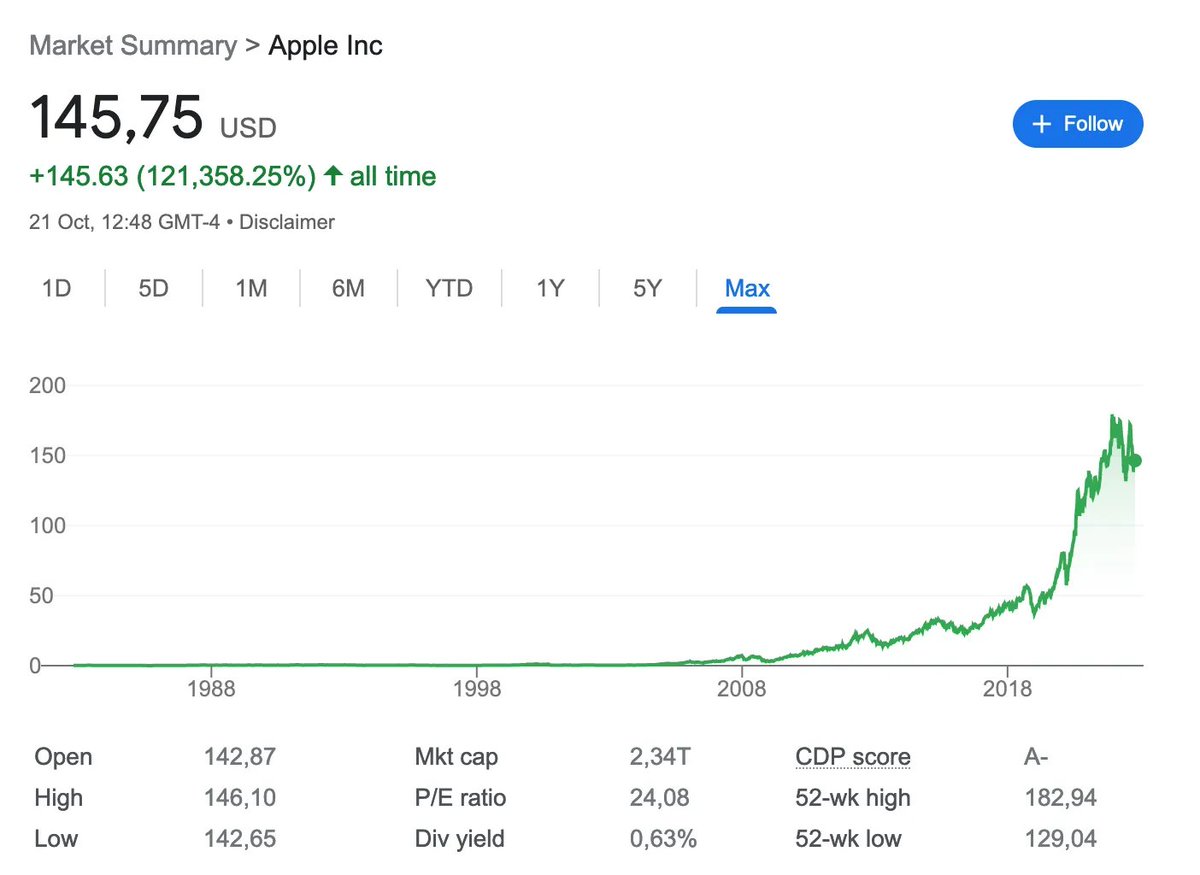

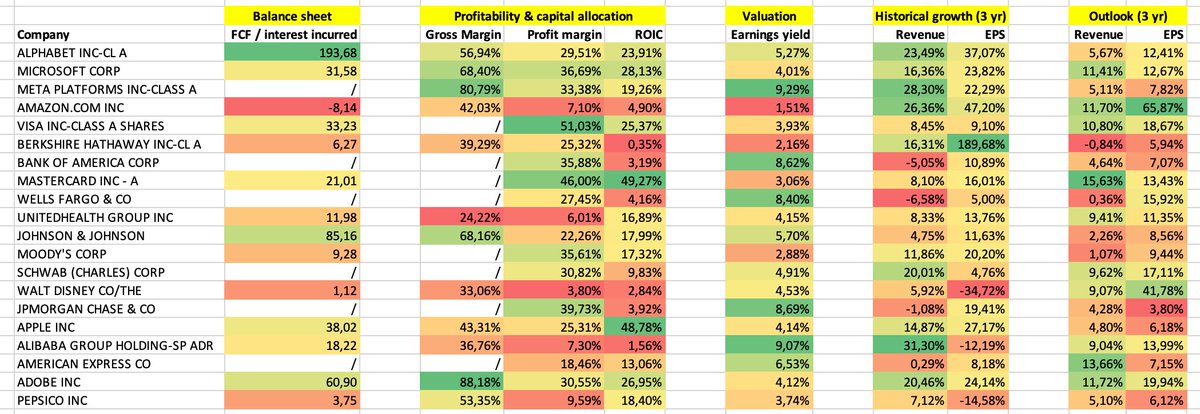

It's a wrap! Which stocks do you own of this list?

If you liked this, you will also love our website.

Here you can find more inspiration:

qualitycompounding.substack.com

If you liked this, you will also love our website.

Here you can find more inspiration:

qualitycompounding.substack.com

Loading suggestions...