1/ Curve just released the Curve stablecoin docs.

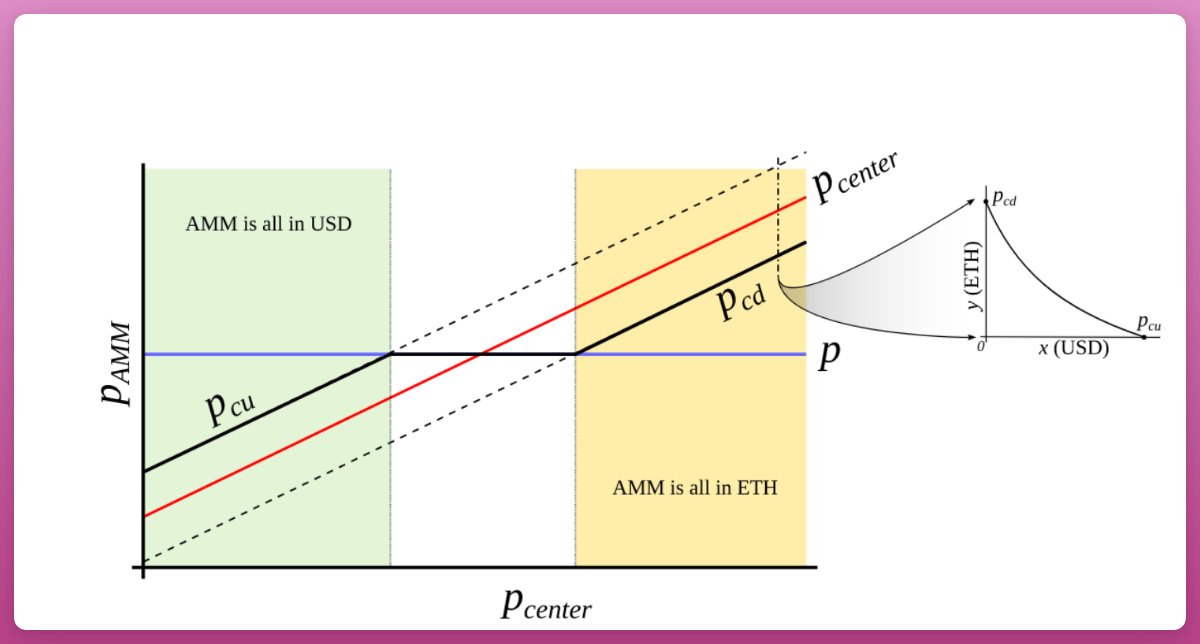

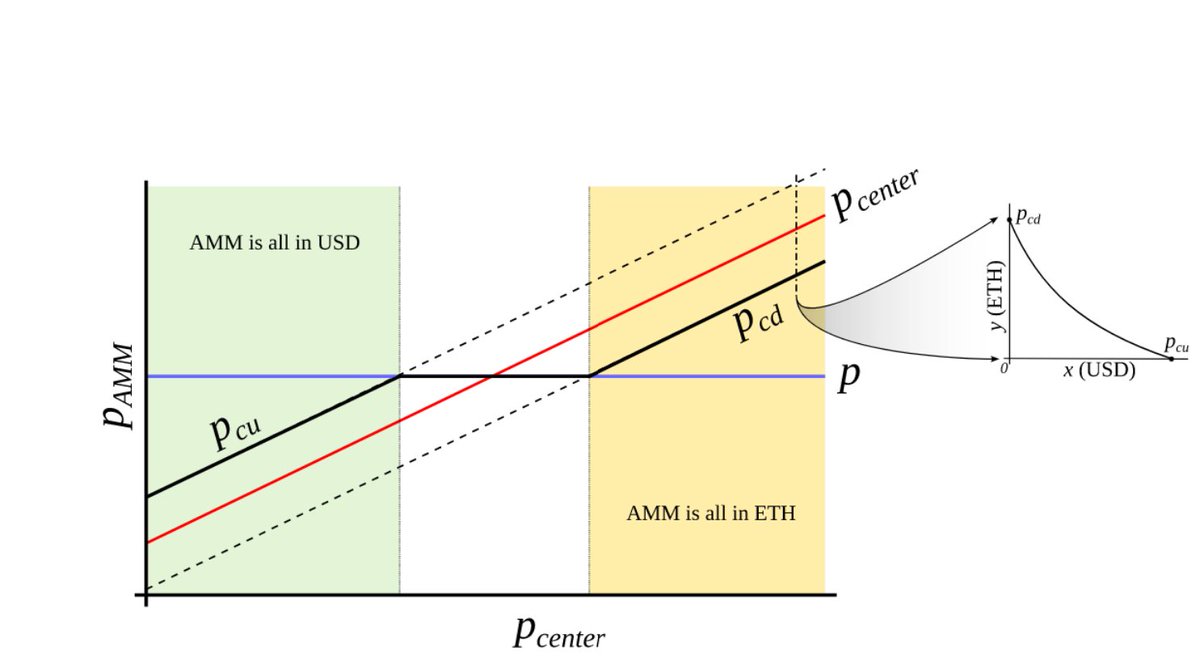

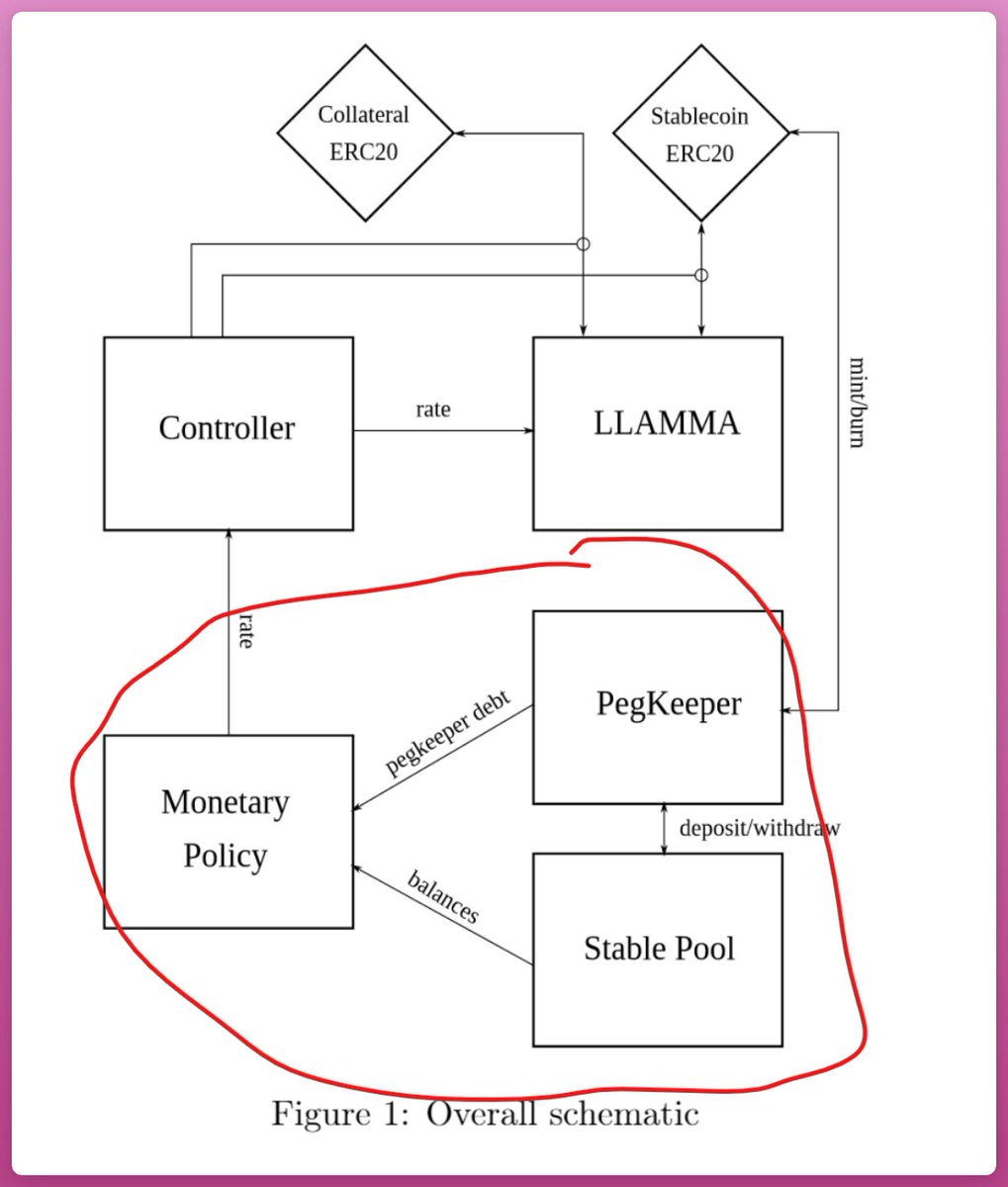

The biggest innovation is Lending-Liquidating AMM algorithm (LLAMMA).

So, how does it work?

*I'm learning as I'm writing this thread*

The biggest innovation is Lending-Liquidating AMM algorithm (LLAMMA).

So, how does it work?

*I'm learning as I'm writing this thread*

2/ The problem with current CDP (collateral-debt position) stablecoins is that they have to liquidate undercollateralized positions to keep the peg.

Partial liquidations help, but they have two problems:

1. Expose CDPs to bad debt

2. Users get penalized for liquidations

Partial liquidations help, but they have two problems:

1. Expose CDPs to bad debt

2. Users get penalized for liquidations

5/ This model prevents positions from being liquidated (it just gets closed down) and no risk of bad debt.

(On a side note, does it mean that collateral suffers from impermanent loss?)

(On a side note, does it mean that collateral suffers from impermanent loss?)

6/ Another important point is that LLAMMA uses ETH/USD as price source and $crvUSD could be traded above or under the peg.

If price is above the peg, crvUSD will use Automatic Stabalizer (similar to Frax's AMOs)

You can learn about Automated Market Operations below:

If price is above the peg, crvUSD will use Automatic Stabalizer (similar to Frax's AMOs)

You can learn about Automated Market Operations below:

8/ Once again, I studied the paper at same time as I wrote the tread, so let me know what I got wrong or did not mention.

Loading suggestions...