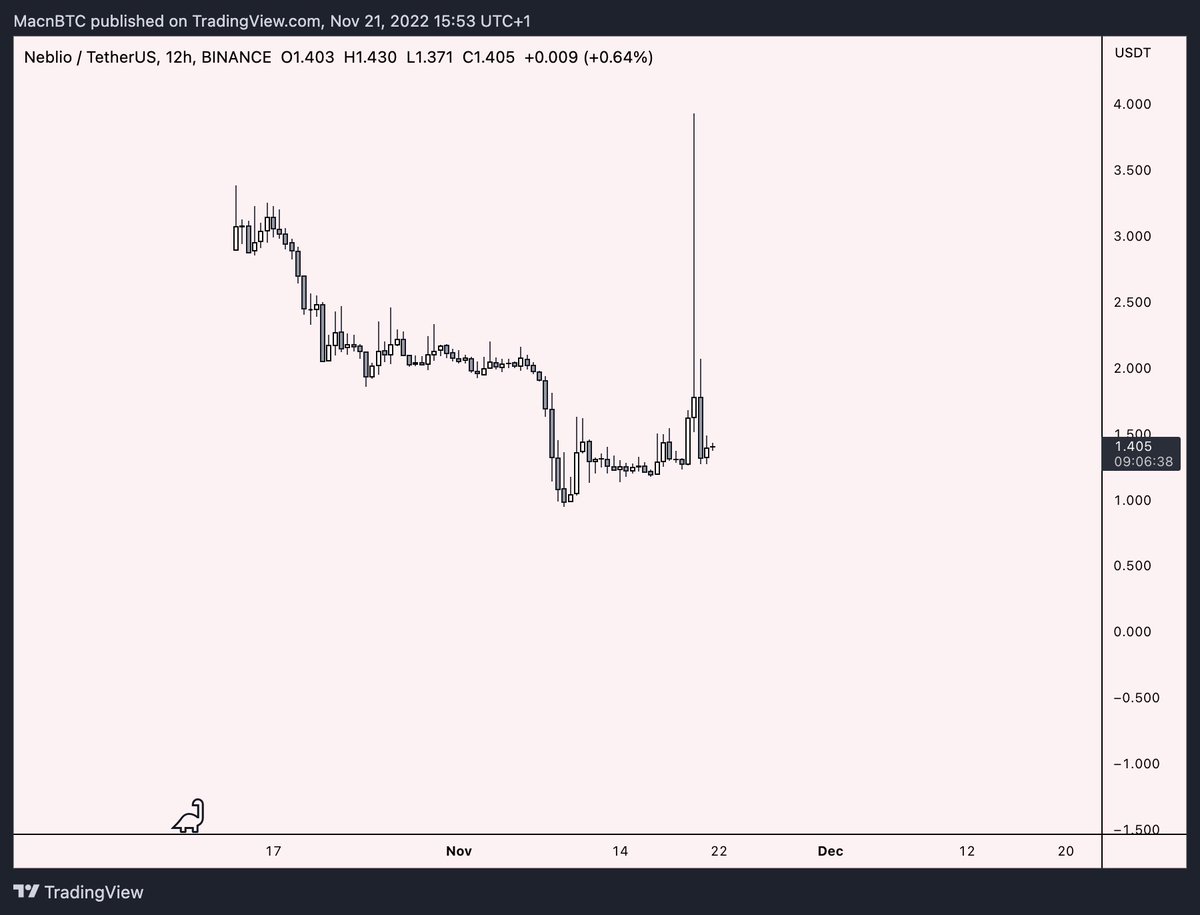

Many #altcoins have seen x2 to +10,000% price spike pumps such as this one in the recent weeks 🚀

this is how you profit 👇🏽🧵

this is how you profit 👇🏽🧵

Firstly before I go over all reasons these pumps happen more common recently it's important you learn and understand a few concepts.

2) Liquidity: Top tier exchanges have liquidity requirements for listed assets. A liquidity requirement might for example read something such as: "$50,000 worth of bids/asks within -+5% of market price"

Projects hire market-makers to provide sufficient liquidity on the exchanges.

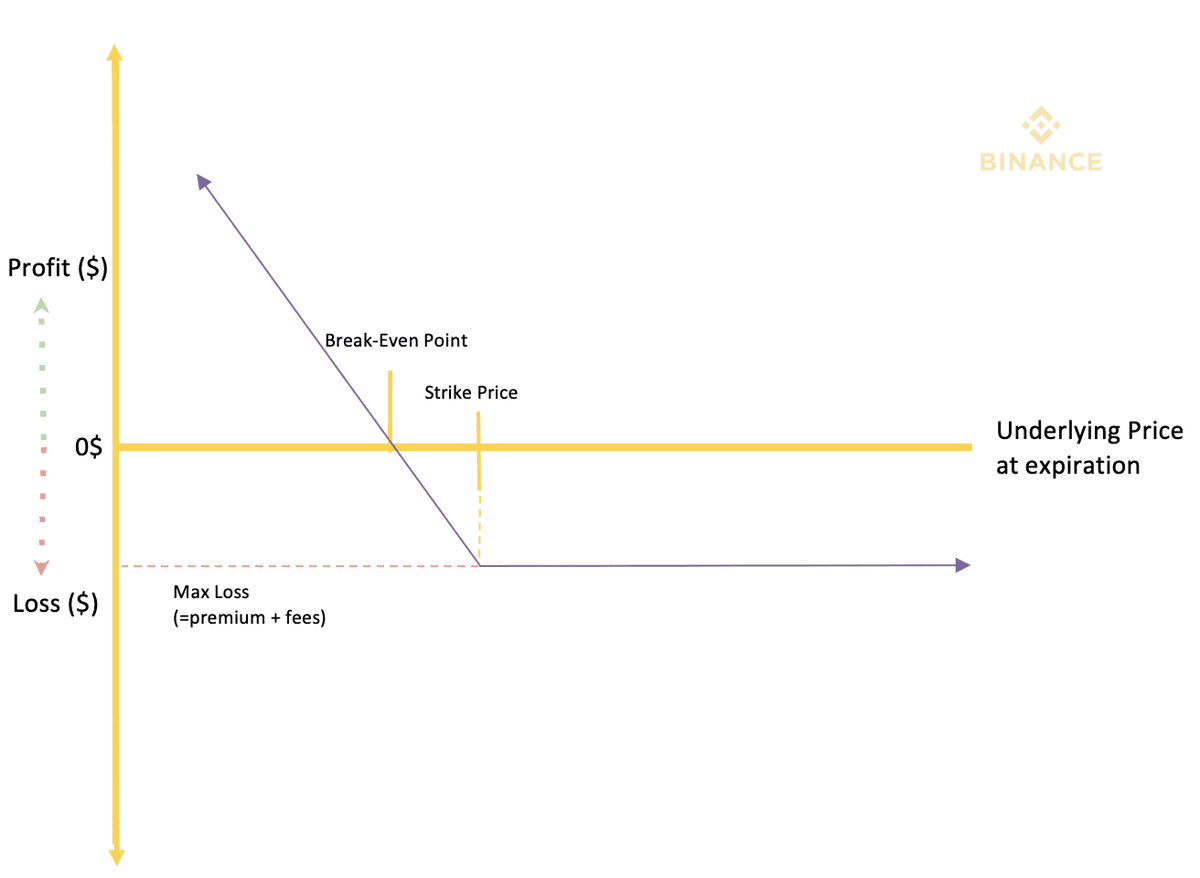

There are several different forms of market-making agreements but the most common is in form of a token loan/options

There are several different forms of market-making agreements but the most common is in form of a token loan/options

Sounds great right? Often projects do not even have to provide any USD to the market-maker. Seems like a great deal

Well let me tell you, it's not.

Here is why:

Well let me tell you, it's not.

Here is why:

Market-makers aim to be delta neutral.

It means that for example at the end of each day/week/month they aim to have executed the same value of bids/asks.

In practice it's nothing like that.

It means that for example at the end of each day/week/month they aim to have executed the same value of bids/asks.

In practice it's nothing like that.

The idea of "evil" market-makers.

I have over the years seen and heard feedback from project founders on how many market-makers do their business and it's shady.

• They do not give a fuck about the tokens, the main goal is to stack as much USDT from the token loan as possible

I have over the years seen and heard feedback from project founders on how many market-makers do their business and it's shady.

• They do not give a fuck about the tokens, the main goal is to stack as much USDT from the token loan as possible

• Your losses = their profits. Algorithms are designed to pull bids/asks once bigger orders are being execute to temporarily increase slippage

• Often times is no transparency over what the MM is doing with the borrowed tokens before end of the term

• Often times is no transparency over what the MM is doing with the borrowed tokens before end of the term

• ^ this is why we often see price being suppressed from pumping - it's simply a MM distributing tokens above certain price

All these points above have been confirmed by the fall of Alameda which used these tactics on a daily basis.

In addition the projects often use MM's to sell team/treasury tokens. The typical play is to ramp up marketing, release major news and then sell on retail

In addition the projects often use MM's to sell team/treasury tokens. The typical play is to ramp up marketing, release major news and then sell on retail

Okay now let's get back to why these pumps happen:

- It's costly to provide tight spreads on #altcoins therefore once the market takes a hit market-makers simply reduce exposure.

Often they reduce exposure below the liquidity requirements set in the token loan contracts

- It's costly to provide tight spreads on #altcoins therefore once the market takes a hit market-makers simply reduce exposure.

Often they reduce exposure below the liquidity requirements set in the token loan contracts

This leads to empty order books where a few thousand dollars is able to pump the price by a few %.

For altcoins that have perpetual swap pairs this means shorters can be hunted and liquidated cheaply for extra liquidity...

For altcoins that have perpetual swap pairs this means shorters can be hunted and liquidated cheaply for extra liquidity...

which is also attractive for pump and dump groups. Empty orderbook = cheap to pump price + additional liquidity from liquidated shorters

Hopefully this short rant thread was useful. This knowledge is useful to every trader and investor.

I'm crossing fingers for more transparency around the market-making firms in the future.

At the moment it's wild west and this space deserves better.

I'm crossing fingers for more transparency around the market-making firms in the future.

At the moment it's wild west and this space deserves better.

Loading suggestions...