𝗣𝗶𝗹𝗹𝗮𝗿𝘀 𝗼𝗳 𝗮 𝗧𝗿𝗮𝗱𝗶𝗻𝗴

🔸 𝘗𝘴𝘺𝘤𝘩𝘰𝘭𝘰𝘨𝘺

🔸 𝘔𝘢𝘳𝘬𝘦𝘵 𝘈𝘯𝘢𝘭𝘺𝘴𝘪𝘴 𝘢𝘯𝘥 𝘛𝘳𝘢𝘥𝘪𝘯𝘨 𝘚𝘺𝘴𝘵𝘦𝘮𝘴

🔸 𝘔𝘰𝘯𝘦𝘺 𝘔𝘢𝘯𝘢𝘨𝘦𝘮𝘦𝘯𝘵

[2/18]

🔸 𝘗𝘴𝘺𝘤𝘩𝘰𝘭𝘰𝘨𝘺

🔸 𝘔𝘢𝘳𝘬𝘦𝘵 𝘈𝘯𝘢𝘭𝘺𝘴𝘪𝘴 𝘢𝘯𝘥 𝘛𝘳𝘢𝘥𝘪𝘯𝘨 𝘚𝘺𝘴𝘵𝘦𝘮𝘴

🔸 𝘔𝘰𝘯𝘦𝘺 𝘔𝘢𝘯𝘢𝘨𝘦𝘮𝘦𝘯𝘵

[2/18]

How to keep Emotions in check ?

🔸 𝗕𝗲 𝗥𝗲𝗮𝗹𝗶𝘀𝘁𝗶𝗰 : Don’t Expect 10% in a month or doubling your account every 6 months , Anywhere between 2 to 5% per month is a great return

🔸 Keep a Trading Journal : helps you identify your weakness , strengths.

[3/18]

🔸 𝗕𝗲 𝗥𝗲𝗮𝗹𝗶𝘀𝘁𝗶𝗰 : Don’t Expect 10% in a month or doubling your account every 6 months , Anywhere between 2 to 5% per month is a great return

🔸 Keep a Trading Journal : helps you identify your weakness , strengths.

[3/18]

🔸 Set up rules of exit before entering a trade .

🔸 Stop Trading if you feel you are overtrading , and feel your performance is lagging , Its OKAY not to trade !

[4/18]

🔸 Stop Trading if you feel you are overtrading , and feel your performance is lagging , Its OKAY not to trade !

[4/18]

🔸 𝗗𝗼𝗻'𝘁 𝗖𝗼𝘂𝗻𝘁 𝗠𝗼𝗻𝗲𝘆 : Follow the process and don’t run behind money , if you are disciplines , have a profitable system , money will automatically come it !

🔸 Practise Sound 𝗠𝗼𝗻𝗲𝘆 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁( Position Sizing , Stoploss )

[5/18]

🔸 Practise Sound 𝗠𝗼𝗻𝗲𝘆 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁( Position Sizing , Stoploss )

[5/18]

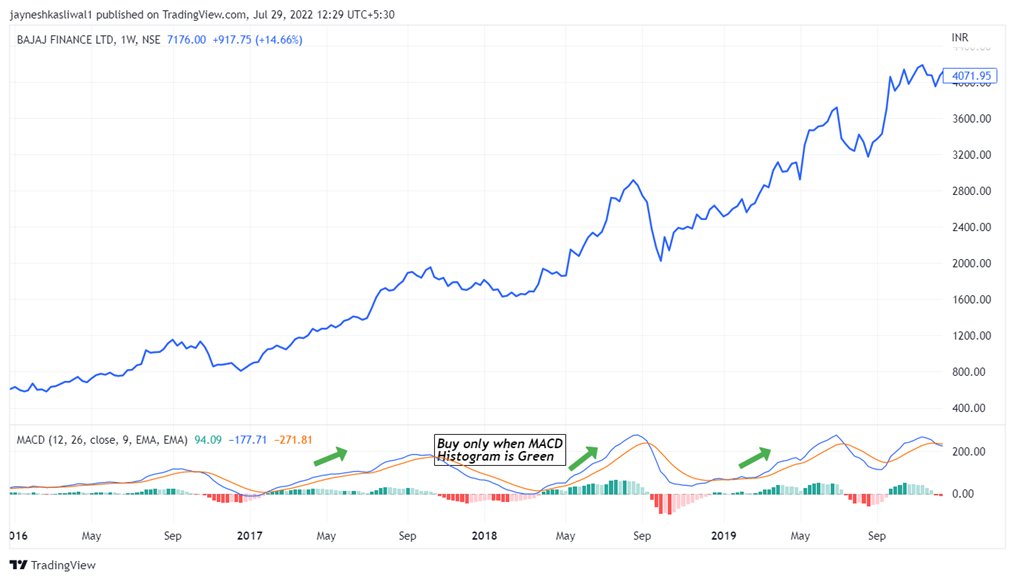

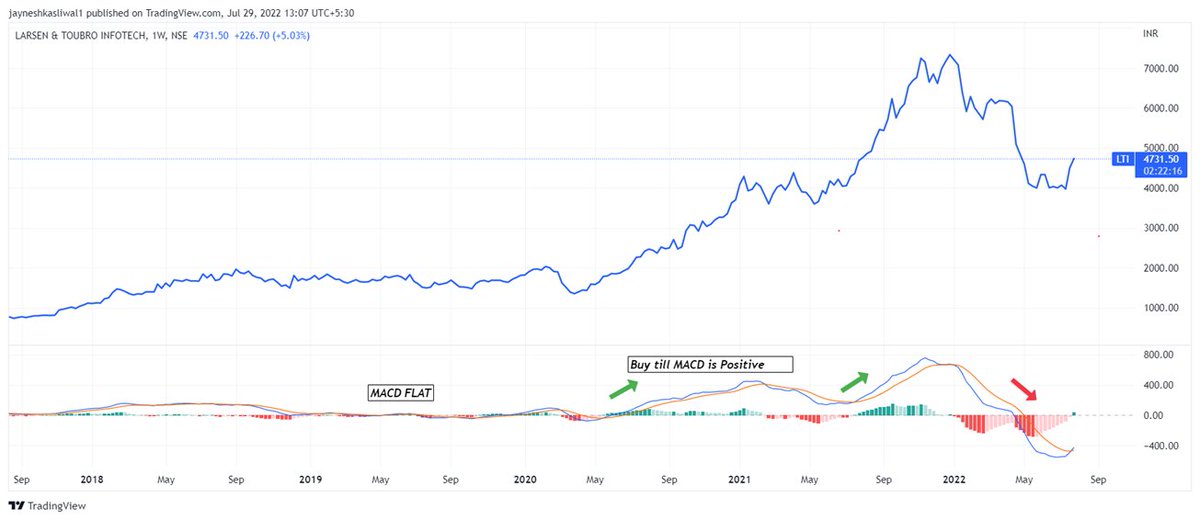

One Indicator to rule them all ?

Different Indicators , Different uses , Different Situations

🔸 Long Term Trend Indicator ( MACD ,EMAs ADX )

🔸 OSCILLATOR ( Stochastics , RSI , MFI)

🔸 You cannot use a Trend Following indicator in sideways market

[6/18]

Different Indicators , Different uses , Different Situations

🔸 Long Term Trend Indicator ( MACD ,EMAs ADX )

🔸 OSCILLATOR ( Stochastics , RSI , MFI)

🔸 You cannot use a Trend Following indicator in sideways market

[6/18]

3. Rules of Thumb to use Indicators

EMAs is better than SMAs And focus on recent price data rather than average price data over a longer period of time

Weekly > Daily>Hourly> Intraday Charts

Use Few indicators , learn when to use , when not to use and how to use them

[7/18]

EMAs is better than SMAs And focus on recent price data rather than average price data over a longer period of time

Weekly > Daily>Hourly> Intraday Charts

Use Few indicators , learn when to use , when not to use and how to use them

[7/18]

𝟰. 𝗧𝗵𝗲 𝗧𝗿𝗶𝗽𝗹𝗲 𝗦𝗰𝗿𝗲𝗲𝗻 𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗦𝘆𝘀𝘁𝗲𝗺

🔸 Trend is your friend ?

🔸 Buy Low , Sell High ?

🔸 Let your Profits Run ?

How high is high ?

And when to sell ?

Indicators can contradict each other , and they may Contradict itself.

[8/18]

🔸 Trend is your friend ?

🔸 Buy Low , Sell High ?

🔸 Let your Profits Run ?

How high is high ?

And when to sell ?

Indicators can contradict each other , and they may Contradict itself.

[8/18]

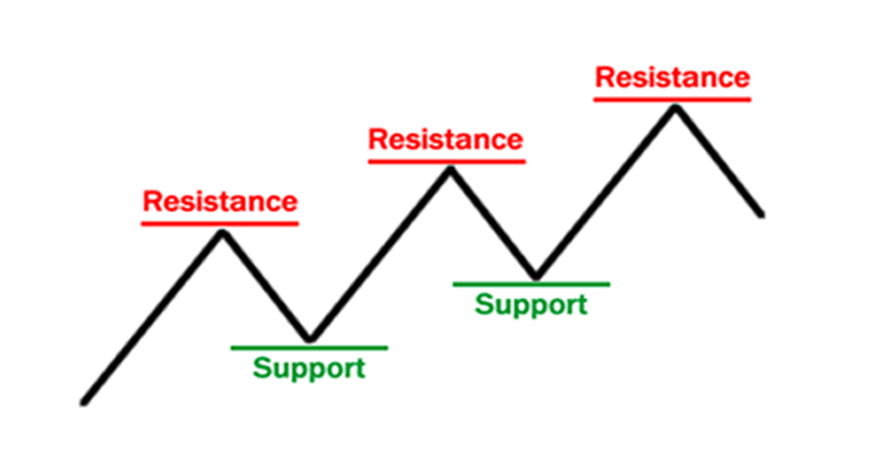

Market wave : Need to buy at correct places even in longer term trend as you may get stopped out

𝗜𝗻𝘁𝗿𝗮𝗱𝗮𝘆 𝗕𝗿𝗲𝗮𝗸𝗼𝘂𝘁

•When buying use Buying -Sell Stop and enter on breakouts if the longer term allows you to buy and Use stoploss as breakout candle low

[11/18]

𝗜𝗻𝘁𝗿𝗮𝗱𝗮𝘆 𝗕𝗿𝗲𝗮𝗸𝗼𝘂𝘁

•When buying use Buying -Sell Stop and enter on breakouts if the longer term allows you to buy and Use stoploss as breakout candle low

[11/18]

𝗣𝗼𝘀𝗶𝘁𝗶𝗼𝗻 𝗦𝗶𝘇𝗶𝗻𝗴

If you are long , then shift your stoploss upwards and not downwards !

How to Position Size ?

Capital = 1,00,000

Risk Per day = 2000

Stock Price =100

Stoploss = 90 ( Example Low of candle )

Qty = 2000/10 Rs

Total Qty = 200 !

[14/18]

If you are long , then shift your stoploss upwards and not downwards !

How to Position Size ?

Capital = 1,00,000

Risk Per day = 2000

Stock Price =100

Stoploss = 90 ( Example Low of candle )

Qty = 2000/10 Rs

Total Qty = 200 !

[14/18]

Algo Trading Details :

🔸 25L basket Slippage Add 1% so it includes brokerage as well.

🔸 50%+ Returns Every Year

🔸 Has Re entry, Re execute , CPR , Lock and Trail

🔸 Given Consistent returns on tuesdays ( no excuses of finnifty expiry :p ]

🔸 I run it live !

[16/18]

🔸 25L basket Slippage Add 1% so it includes brokerage as well.

🔸 50%+ Returns Every Year

🔸 Has Re entry, Re execute , CPR , Lock and Trail

🔸 Given Consistent returns on tuesdays ( no excuses of finnifty expiry :p ]

🔸 I run it live !

[16/18]

Strategies can be customised according to your capital

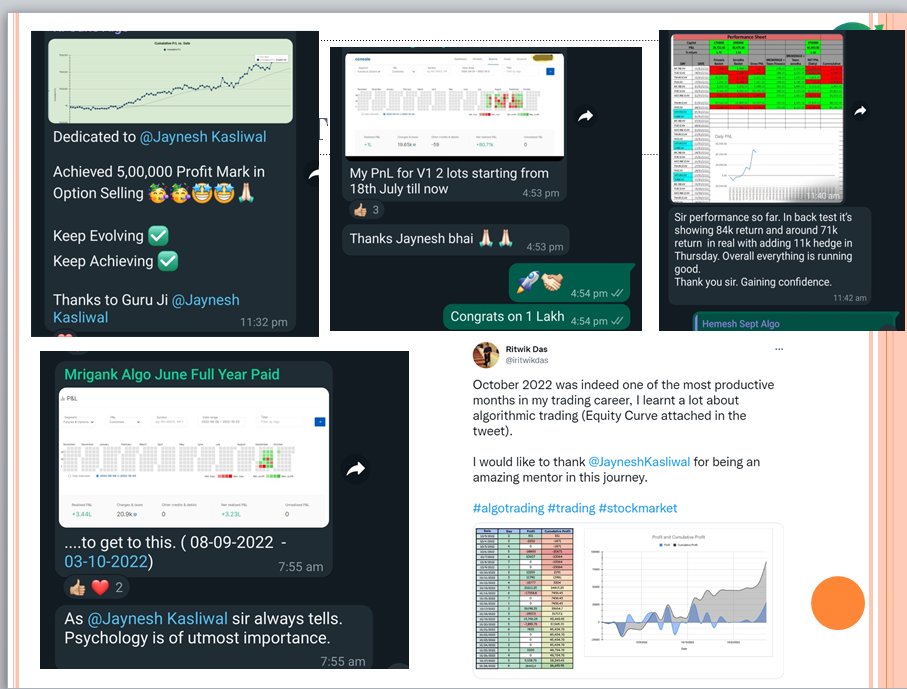

Client Feedback !

DM 7674007938 for the strategy details : wa.link

[17/18]

Client Feedback !

DM 7674007938 for the strategy details : wa.link

[17/18]

trin.kr/TechnoCharts

t.me/Techno_charts

Techno_Charts 📊🐉

This is An Educational Channel and no Stock Is recommended for you to buy. I'm only sharing my preci...

t.me/SystemTradersI…

Algo Trading Community

Welcome to Systematic Traders Community Here you will learn how to 1. Build Strategies 2. Optimise t...

If you like this thread please retweet the first tweet and follow me for more!

25L basket Details :

Pdf Link shared

pdfdrive.com

pdfdrive.com

جاري تحميل الاقتراحات...

![𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗳𝗼𝗿 𝗮 𝗟𝗶𝘃𝗶𝗻𝗴

A Book BY DR ALEXANDER ELDER

🧵 Thread 🧵

Retweet to get the PDF link [1/18] ht...](https://pbs.twimg.com/media/Fh2H0RhWAAMopU4.png)

![𝟯𝟬 𝗘𝗠𝗔 𝘃𝘀 𝗦𝘂𝗽𝗲𝗿𝘁𝗿𝗲𝗻𝗱 𝗪𝗲𝗲𝗸𝗹𝘆 [10/18] https://t.co/VB13CkQVhN](https://pbs.twimg.com/media/Fh2H0u-XgAAK3NA.jpg)

![𝟯𝟬 𝗘𝗠𝗔 𝘃𝘀 𝗦𝘂𝗽𝗲𝗿𝘁𝗿𝗲𝗻𝗱 𝗪𝗲𝗲𝗸𝗹𝘆 [10/18] https://t.co/VB13CkQVhN](https://pbs.twimg.com/media/Fh2H069WIAEP5Zi.jpg)

![The Triple Confirmation Trading System

[12/18] https://t.co/99InuVrSP3](https://pbs.twimg.com/media/Fh2H1F1XwAAWN-2.jpg)

![𝗠𝗼𝗻𝗲𝘆 𝗠𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝟭𝟬𝟭

1.Survival,

2.Steady returns,

3.High returns

[15/18] https://t.co/JHd27Nz8VP](https://pbs.twimg.com/media/Fh2H1Y-WAAERKBl.png)