1/ Follow DAO forum discussions to find Alpha in #DeFi

You learn about important changes before the general public, and get valuable insight directly from project founders.

So, these are a few live proposals you should know🧵

You learn about important changes before the general public, and get valuable insight directly from project founders.

So, these are a few live proposals you should know🧵

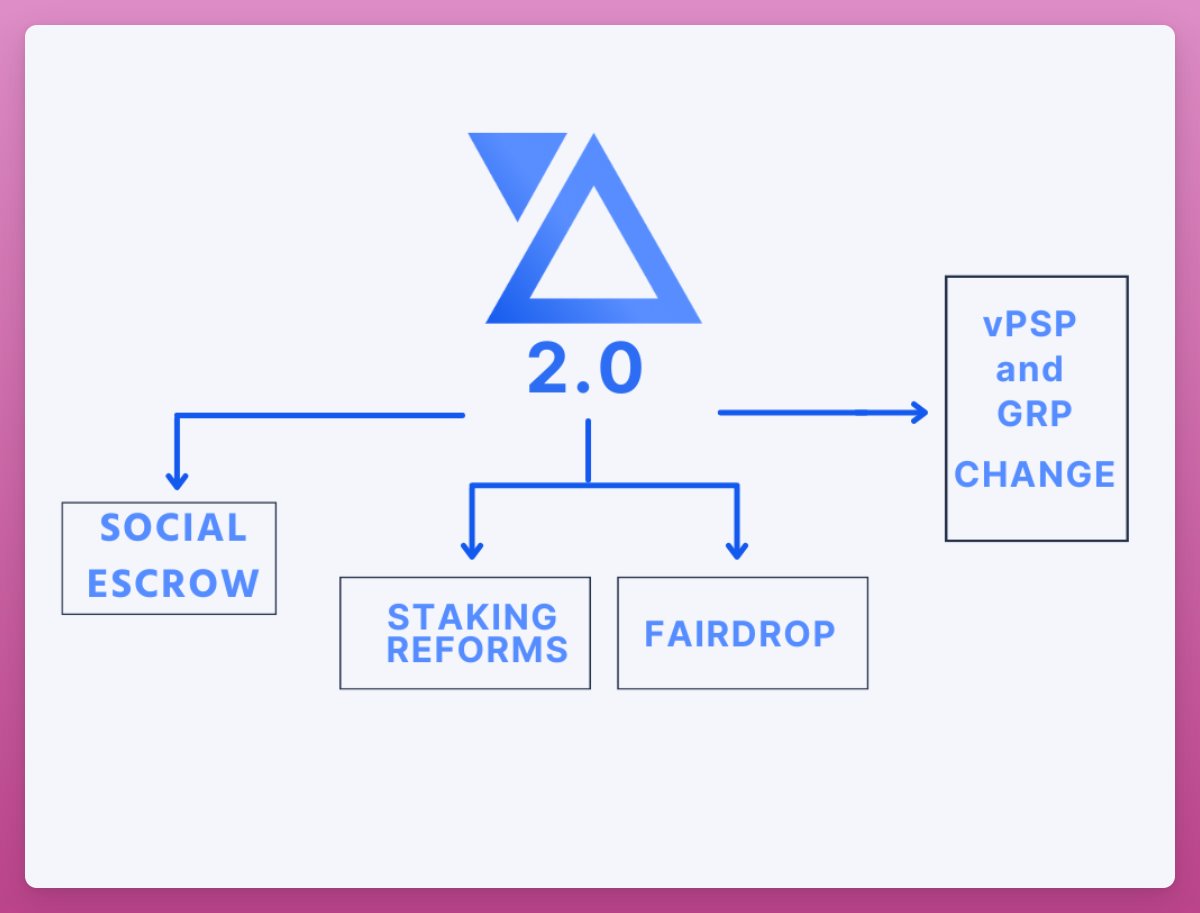

2/ @paraswap is discussing new tokenomics: PSP 2.0 Renaissance - Social Escrow, Fee Redistribution, and Fairdrop.

PSP 2.0 reduces token emissions, and creates revenue sharing model via Social Escrow PSP.

sePSP rewards users who perform actions beneficial for the protocol & DAO.

PSP 2.0 reduces token emissions, and creates revenue sharing model via Social Escrow PSP.

sePSP rewards users who perform actions beneficial for the protocol & DAO.

3/ Those actions include: trading, market making for limit orders, referrals etc.

PSP 2.0 would distribute 80% of the protocol fees to stakers.

(Airdrop will have a separate proposal)

Proposal: gov.paraswap.network

PSP 2.0 would distribute 80% of the protocol fees to stakers.

(Airdrop will have a separate proposal)

Proposal: gov.paraswap.network

4/ @Uniswap DAO is voting to deploy Uniswap V3 on Boba L2 network.

Uniswap DAO has 3 stage voting: Temperature, Consensus and main Governance vote.

The current Temperature Check will likely pass with 2 more days left to vote.

Proposal: gov.uniswap.org

Uniswap DAO has 3 stage voting: Temperature, Consensus and main Governance vote.

The current Temperature Check will likely pass with 2 more days left to vote.

Proposal: gov.uniswap.org

5/ Maker DAO is considering reintroducing Dai Savings Rate.

It would increase yields on stablecoins across #DeFi

Maker is generating yield from TradFi, and part of it would go to $Dai holders.

As Compound and Aave have DSR integration, yield on lending would go up.

It would increase yields on stablecoins across #DeFi

Maker is generating yield from TradFi, and part of it would go to $Dai holders.

As Compound and Aave have DSR integration, yield on lending would go up.

6/ @gelatonetwork discusses burning 90% of treasury $GEL to reduce the FDV

$GEL circulating supply is 100k tokens (~23.8% is circulating).

'If GEL price is too low, community, investors and team will all lose financial incentives and lose interest and patience for the project.'

$GEL circulating supply is 100k tokens (~23.8% is circulating).

'If GEL price is too low, community, investors and team will all lose financial incentives and lose interest and patience for the project.'

7/ Another idea is floating around to 'accelerate the allocations of private investors today.' 👀

This 'could fairly quickly reach a 50% MC/FDV ratio within a couple of months.'

Very interesting discussion, if you ask me 😊

forum.gelato.network

This 'could fairly quickly reach a 50% MC/FDV ratio within a couple of months.'

Very interesting discussion, if you ask me 😊

forum.gelato.network

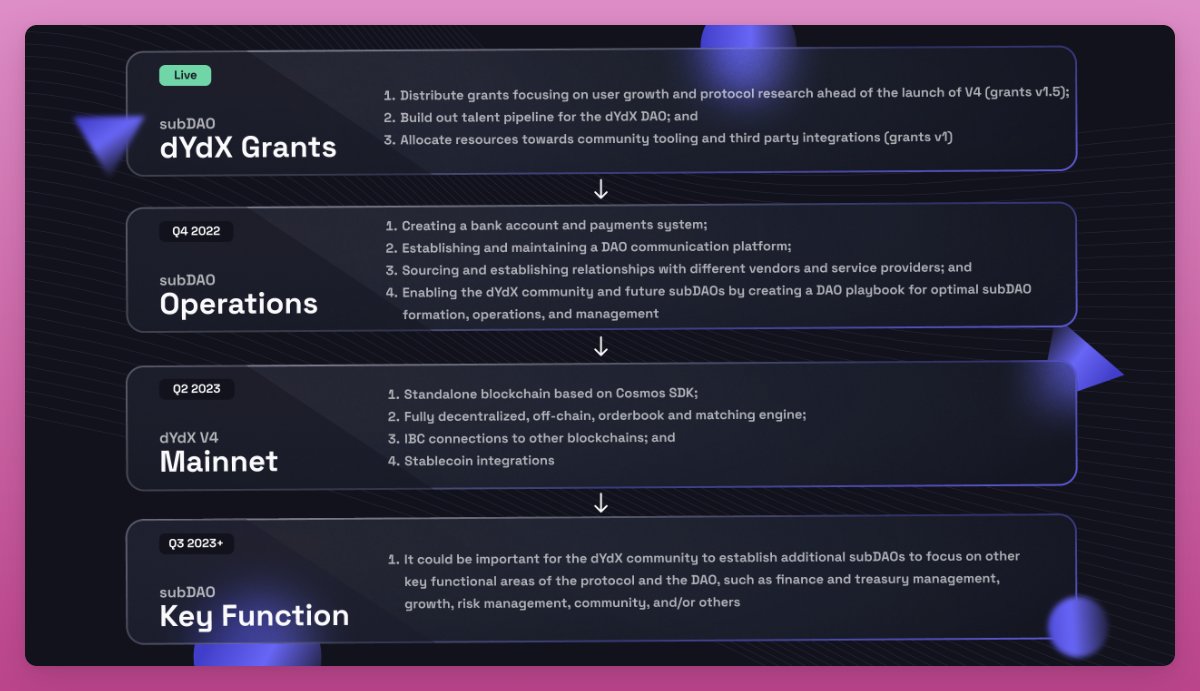

8/ @dYdX is discussing the future state of dYdx DAO as v4 is close to the launch.

The dYdX DAO will consist of several autonomous subDAOs, that each work on core functional areas of dYdX.

They will ultimately be accountable to the dYdX community (main DAO).

The dYdX DAO will consist of several autonomous subDAOs, that each work on core functional areas of dYdX.

They will ultimately be accountable to the dYdX community (main DAO).

9/ The first subDAO proposed is Operations subDAO.

Ops subDAO would establish fiat banking capabilities to cover non-crypto expenses, and manage a DAO communication channels.

Crucially, the 1st subDAO would serve as a playbook for other subDAO creation.

forums.dydx.community

Ops subDAO would establish fiat banking capabilities to cover non-crypto expenses, and manage a DAO communication channels.

Crucially, the 1st subDAO would serve as a playbook for other subDAO creation.

forums.dydx.community

10/ @AaveAave is discussing enabling $USDT as collateral on Aave v3 (Avalanche).

The proposal states that as 'stablecoins go, both $DAI and $USDC are currently enabled as collateral and we believe that USDT has a similar risk profile and should not be treated differently.'

The proposal states that as 'stablecoins go, both $DAI and $USDC are currently enabled as collateral and we believe that USDT has a similar risk profile and should not be treated differently.'

11/ 'Tether has taken significant steps towards increased transparency.'

'In fact, USDT is the longest-standing stablecoin and has met redemptions in strenuous markets in the past.'

If passed, it's an important recognition for USDT.

governance.aave.com

'In fact, USDT is the longest-standing stablecoin and has met redemptions in strenuous markets in the past.'

If passed, it's an important recognition for USDT.

governance.aave.com

12/ @GMX_IO DAO received a proposal from @STFX_IO for a token swap of $100,000 based on a Good Will Valuation

STFX is marketplace for turning trade ideas into investable vaults

The proposal is an invitation to collaborate as STFX brings liquidity to GMX

gov.gmx.io

STFX is marketplace for turning trade ideas into investable vaults

The proposal is an invitation to collaborate as STFX brings liquidity to GMX

gov.gmx.io

13/ Did I miss an important proposal? Let me know.

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...