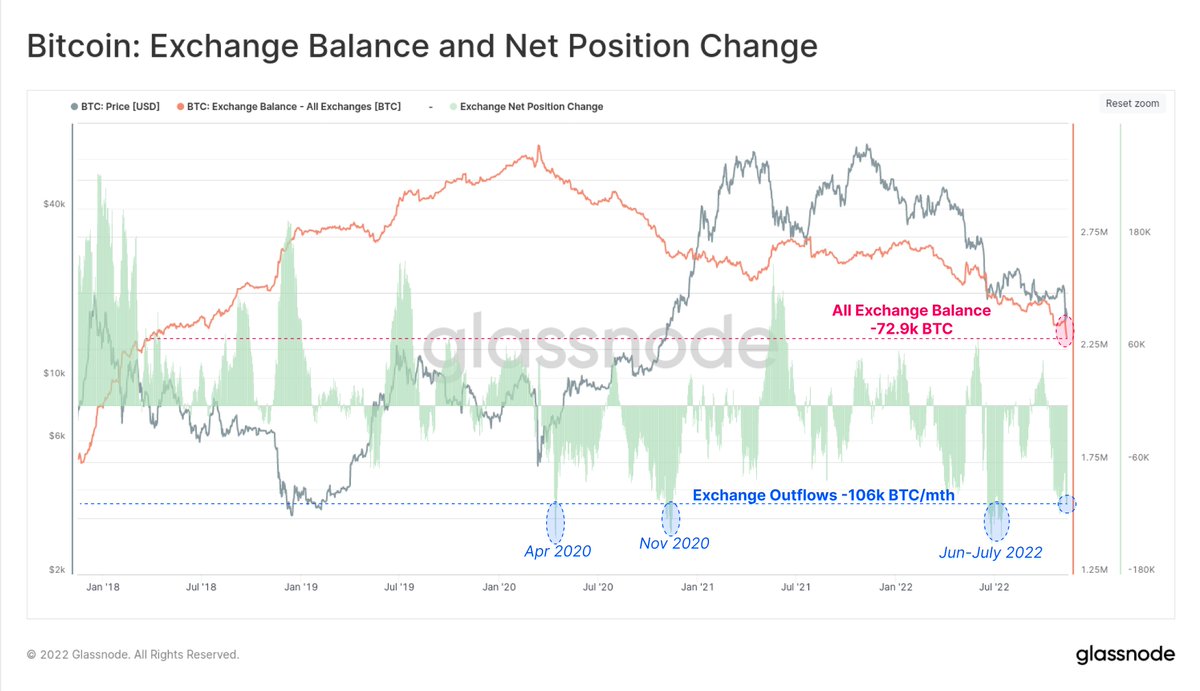

Following the collapse of FTX, #Bitcoin investors have been withdrawing coins to self-custody at a historic rate of 106k $BTC/month.

This compares with only three other times:

- Apr 2020

- Nov 2020

- June-July 2022

glassno.de

This compares with only three other times:

- Apr 2020

- Nov 2020

- June-July 2022

glassno.de

This has resulted in positive balance changes across all wallet cohorts, from shrimp to whales.

The failure of FTX has created a very distinct change in #Bitcoin holder behaviour across all cohorts.

The failure of FTX has created a very distinct change in #Bitcoin holder behaviour across all cohorts.

The balance change has been dramatic across all cohorts since 6-November.

🦐 [< 1 $BTC] = +33.7k BTC

🦀 [1-10 $BTC] = +48.7k BTC

🦈 [10-1k $BTC] = +78.0k BTC

🐋 [>1k $BTC] = +3.6k BTC

Adv Dashboard: glassno.de

Pro Dashboard: glassno.de

🦐 [< 1 $BTC] = +33.7k BTC

🦀 [1-10 $BTC] = +48.7k BTC

🦈 [10-1k $BTC] = +78.0k BTC

🐋 [>1k $BTC] = +3.6k BTC

Adv Dashboard: glassno.de

Pro Dashboard: glassno.de

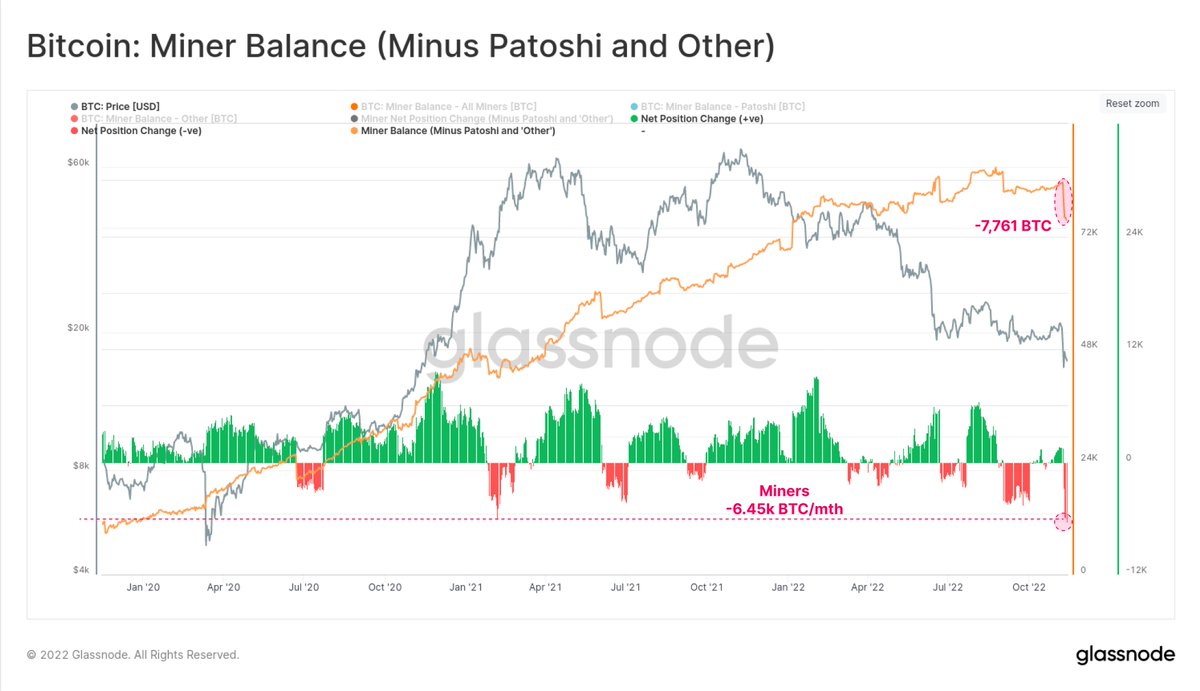

#Bitcoin miners are quite clearly under stress, having distributed 7,761 $BTC in the last week (9.5% of held balance)

It is highly likely that the mining industry will remain under pressure given all-time-low hashprice.

Hash Price Chart: glassno.de

It is highly likely that the mining industry will remain under pressure given all-time-low hashprice.

Hash Price Chart: glassno.de

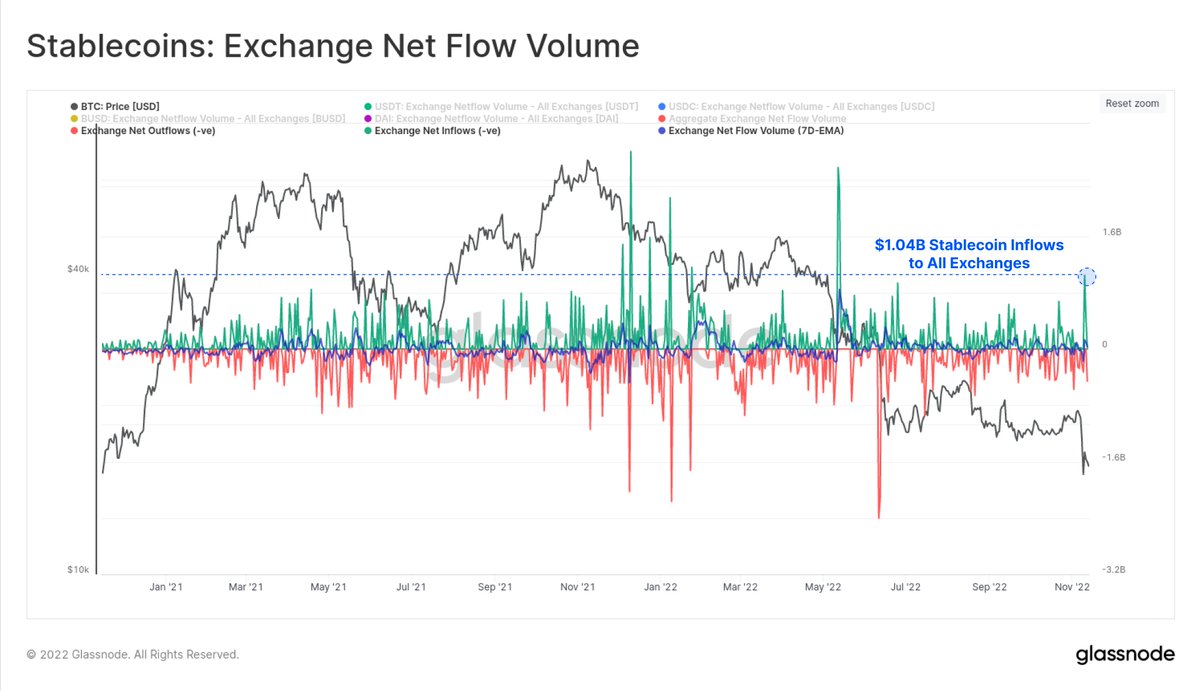

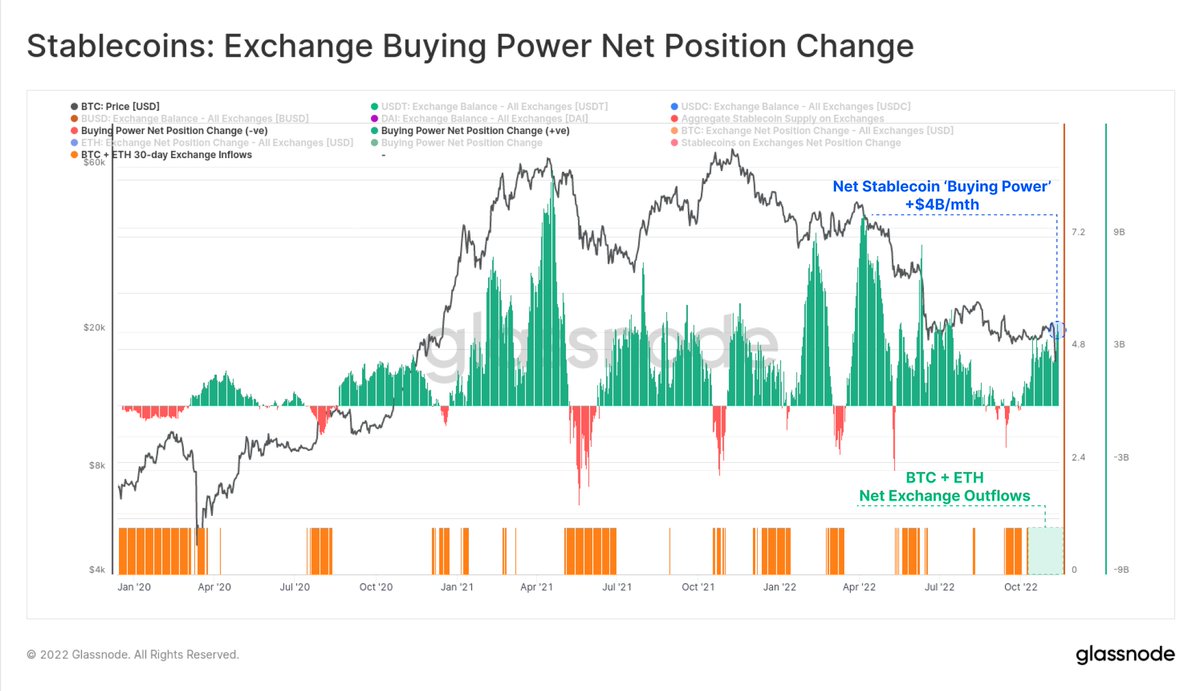

This week also saw one of the most dramatic one-day inflows of stablecoins across all exchanges on 10-Nov.

Over $1.04B worth of stablecoins flowed into exchanges following the collapse of FTX.

Live Chart: glassno.de

Over $1.04B worth of stablecoins flowed into exchanges following the collapse of FTX.

Live Chart: glassno.de

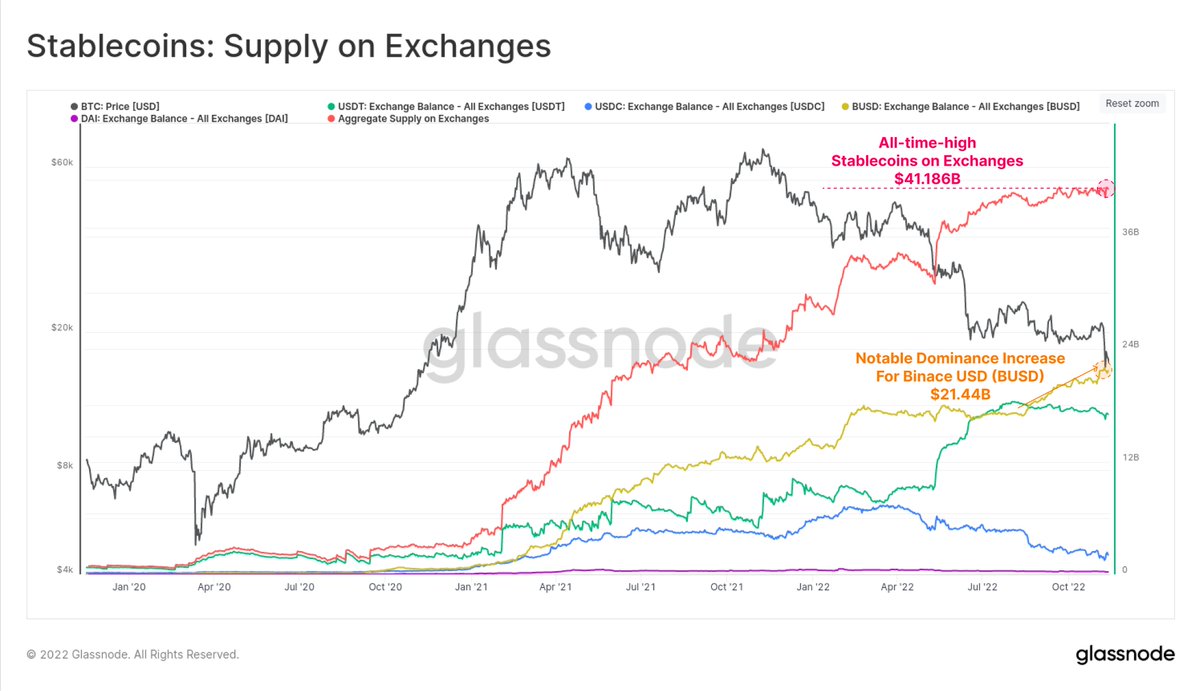

With stable coins flowing into exchanges on net, the total stablecoin reserve across all exchanges we track has pushed to a new ATH of $41.186B.

Of note is the growing dominance of $BUSD, as market participants move funds towards #Binance.

Live Chart: glassno.de

Of note is the growing dominance of $BUSD, as market participants move funds towards #Binance.

Live Chart: glassno.de

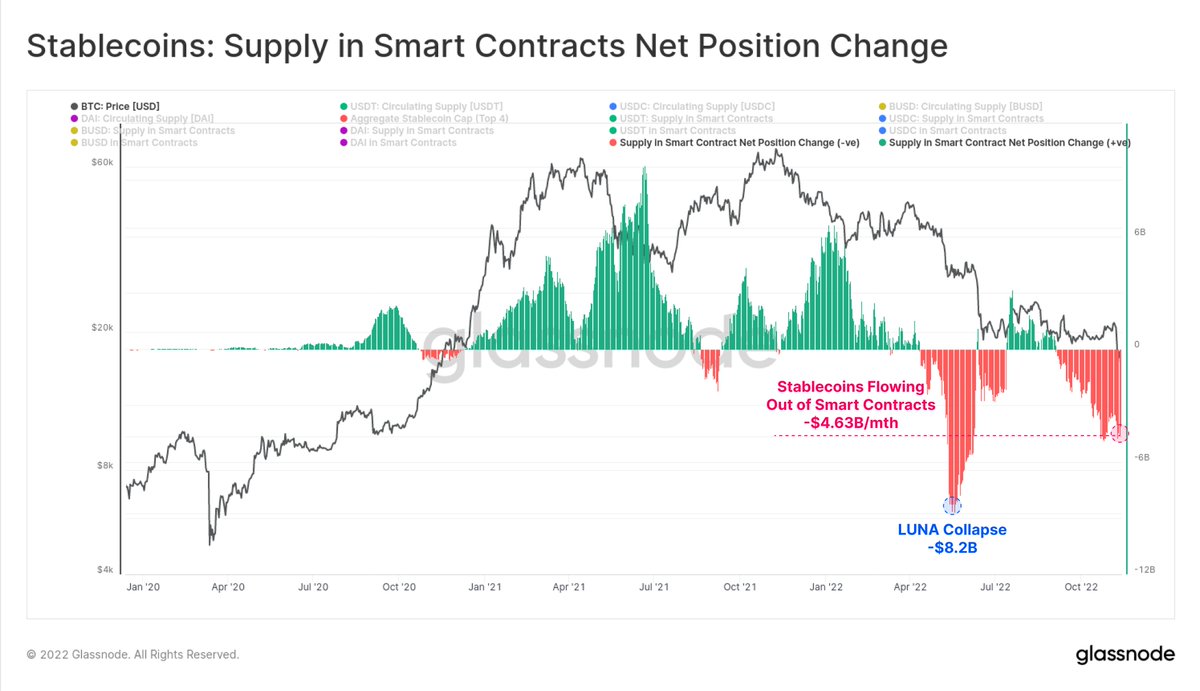

As a potential signal of market demand for USD liquidity, stablecoins are flowing out of #Ethereum smart contracts at the highest rate since the LUNA collapse.

Stablecoins in smart contracts are depleting at a rate of $4.63B/mth.

Live Chart: glassno.de

Stablecoins in smart contracts are depleting at a rate of $4.63B/mth.

Live Chart: glassno.de

On net, there appears to be a transition in investor holdings.

- Stablecoins are flowing into exchanges

- Trustless assets like $BTC and $ETH are flowing out

This leads to a net increase in stablecoin 'buying power' on exchanges of ~$4B/mth.

Live Chart: glassno.de

- Stablecoins are flowing into exchanges

- Trustless assets like $BTC and $ETH are flowing out

This leads to a net increase in stablecoin 'buying power' on exchanges of ~$4B/mth.

Live Chart: glassno.de

The echos of the FTX collapse will likely act to reshape the industry across many sectors, and shift the dominance, and preference for trustless vs centrally issued assets.

Summation:

- $BTC and $ETH is being withdrawn

- Stablecoins are deposited

- Miners under immense pressure

Summation:

- $BTC and $ETH is being withdrawn

- Stablecoins are deposited

- Miners under immense pressure

Loading suggestions...

![The balance change has been dramatic across all cohorts since 6-November.

🦐 [< 1 $BTC] = +33...](https://pbs.twimg.com/media/FheyJeTakAITvhA.jpg)

![The balance change has been dramatic across all cohorts since 6-November.

🦐 [< 1 $BTC] = +33...](https://pbs.twimg.com/media/FheyJfkaUAAOoGr.jpg)

![The balance change has been dramatic across all cohorts since 6-November.

🦐 [< 1 $BTC] = +33...](https://pbs.twimg.com/media/FheyJgcaYAI99yC.jpg)

![The balance change has been dramatic across all cohorts since 6-November.

🦐 [< 1 $BTC] = +33...](https://pbs.twimg.com/media/FheyJhgaAAA_mes.jpg)