What is a quality company?

For legendary quality investor Terry Smith, quality investing is based on 3 metrics:

1. Buy good companies

2. Don’t overpay

3. Do nothing

Here you can find a thread we recently wrote about Terry’s investment strategy:

For legendary quality investor Terry Smith, quality investing is based on 3 metrics:

1. Buy good companies

2. Don’t overpay

3. Do nothing

Here you can find a thread we recently wrote about Terry’s investment strategy:

The million-dollar question is how to find these quality companies.

Quality companies have the following characteristics:

- A wide moat

- Integer management

- Low capital intensity

- Good capital allocation

- High profitability

- Attractive historical growth

- A secular trend

Quality companies have the following characteristics:

- A wide moat

- Integer management

- Low capital intensity

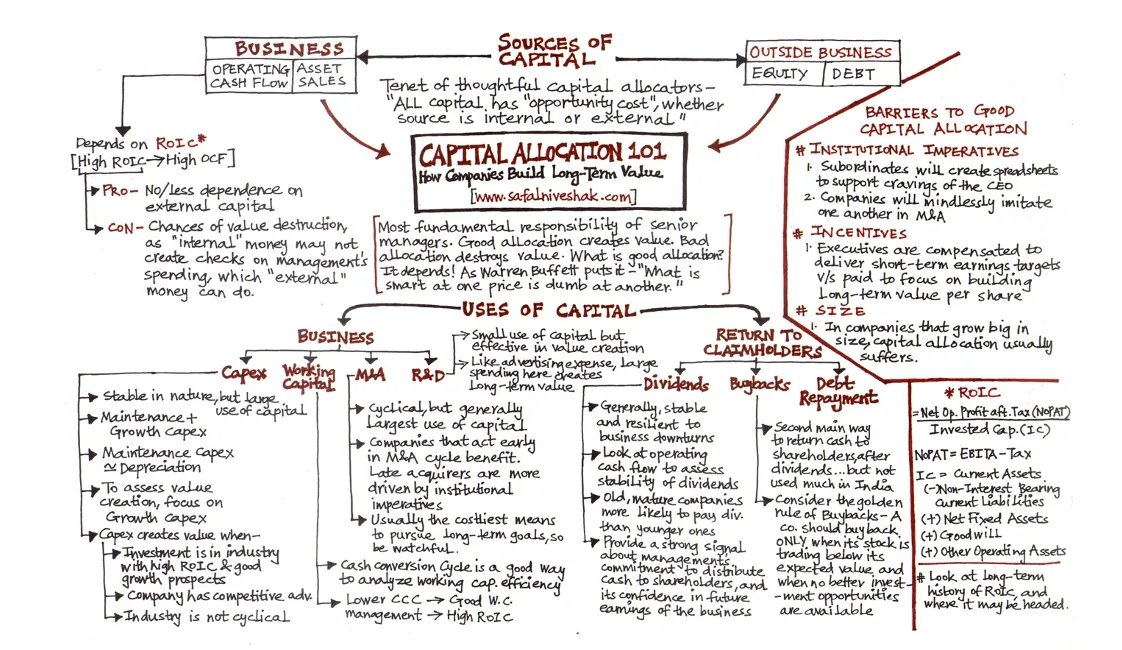

- Good capital allocation

- High profitability

- Attractive historical growth

- A secular trend

Wide moat

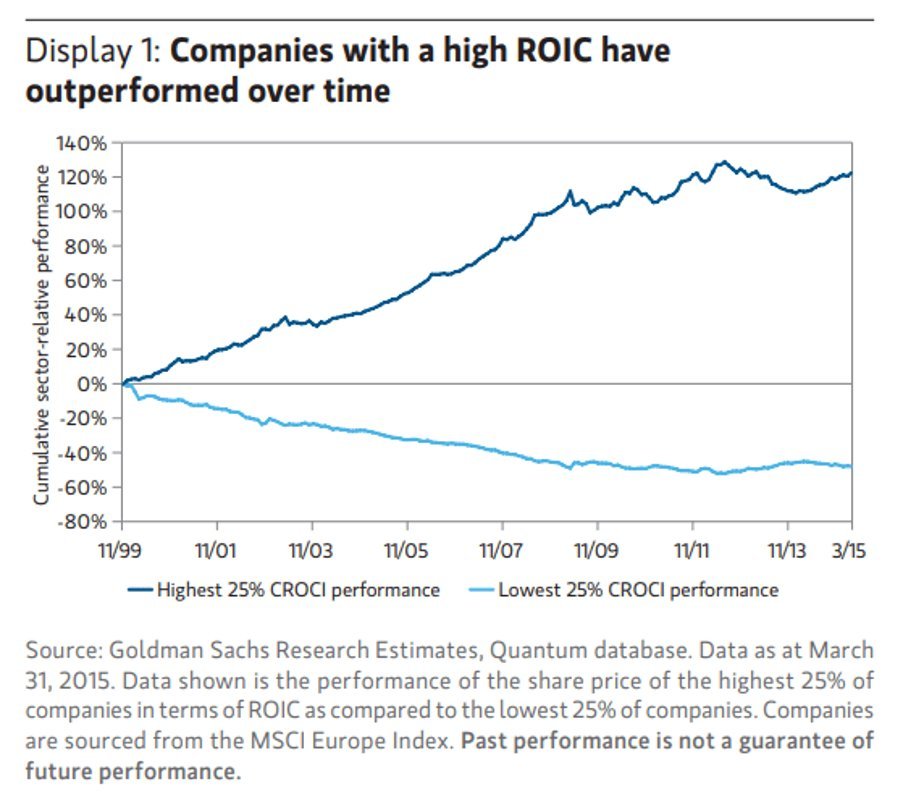

Over the past decade, wide moat stocks outperformed no-moat stocks with more than 8% (!) per year.

You want to invest in clear market leaders with strong pricing power and a great product/service which customers love.

Over the past decade, wide moat stocks outperformed no-moat stocks with more than 8% (!) per year.

You want to invest in clear market leaders with strong pricing power and a great product/service which customers love.

Learn more about skin in the game here:

Some low CAPEX quality businesses: Automatic Data Processing (CAPEX/Sales: 1.2%), Domino’s Pizza (CAPEX/Sales: 2.2%) and Blackrock (CAPEX/Sales: 1.8%).

This visual from @safalniveshak sums it up quite well.

High profitability

The free cash flow margin shows the percentage of sales that is translated into cash. When a company has a FCF margin of 30%, for every $100 the company sells, $30 of cash is generated.

The free cash flow margin shows the percentage of sales that is translated into cash. When a company has a FCF margin of 30%, for every $100 the company sells, $30 of cash is generated.

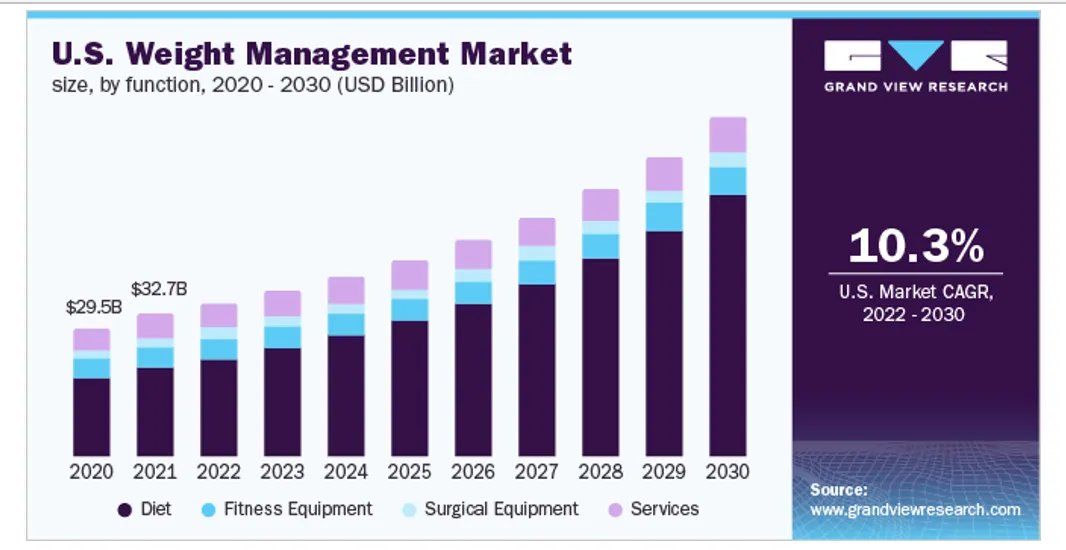

Secular trend

The trend is your friend. A lot of quality companies are active in a strongly growing market.

Think about themes like urbanization (Otis), cybersecurity (Fortinet), datacenters (Arista Networks), hearing aids (Sonova), and obesity (Novo Nordisk).

The trend is your friend. A lot of quality companies are active in a strongly growing market.

Think about themes like urbanization (Otis), cybersecurity (Fortinet), datacenters (Arista Networks), hearing aids (Sonova), and obesity (Novo Nordisk).

Valuation

For quality investors, the quality of the business is more important than the valuation.

In the long run, your return as an investor is equal to:

Return = FCF growth per share + shareholder yield +/- multiple expansion (contraction)

For quality investors, the quality of the business is more important than the valuation.

In the long run, your return as an investor is equal to:

Return = FCF growth per share + shareholder yield +/- multiple expansion (contraction)

Currently, we are not sharing our investable universe but we might in the future.

We are confident that in the future the outperformance of quality companies will persist.

We are confident that in the future the outperformance of quality companies will persist.

To summarize:

As a quality investor, you want to invest in the best companies in the world. Quality companies have the following characteristics:

- A wide moat

- Integer management

- Low capital intensity

- Good capital allocation

- High profitability

- Attractive growth

As a quality investor, you want to invest in the best companies in the world. Quality companies have the following characteristics:

- A wide moat

- Integer management

- Low capital intensity

- Good capital allocation

- High profitability

- Attractive growth

It's a wrap!

📚 Each Tuesday and Thursday we publish an article full of investment wisdom for free.

Take a look here and learn more with these 20 Golden rules of Peter Lynch:

qualitycompounding.substack.com

📚 Each Tuesday and Thursday we publish an article full of investment wisdom for free.

Take a look here and learn more with these 20 Golden rules of Peter Lynch:

qualitycompounding.substack.com

Loading suggestions...