Technology

Finance

Investing

Investment

Stock Market

Technical Analysis

Trading

Swing Trading

Stock Trading

Positional Trading

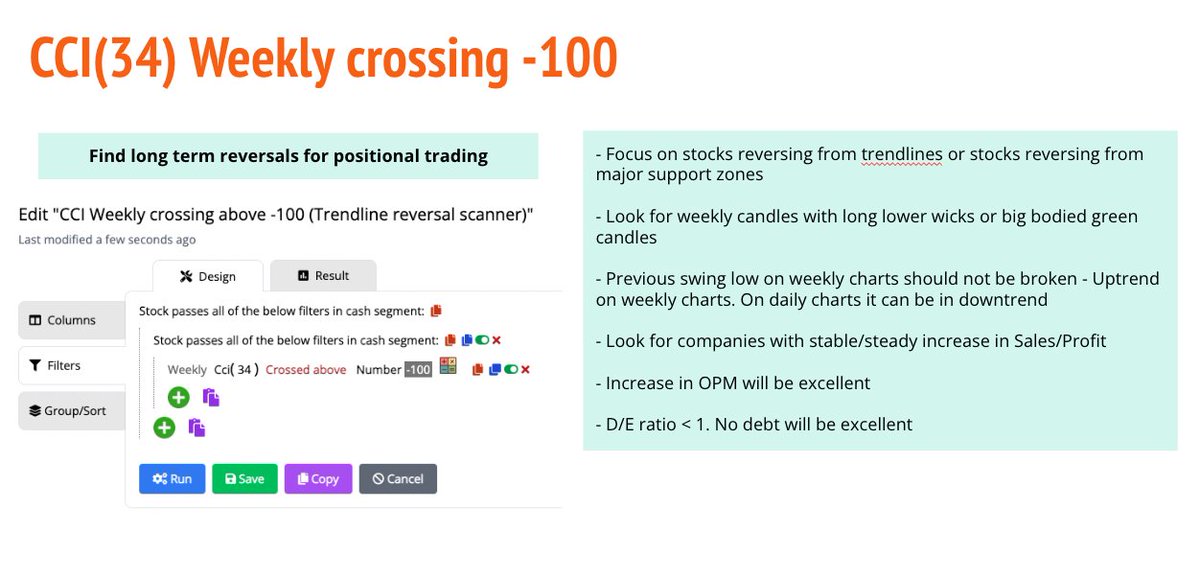

1⃣ Since the strategy scanner is based on CCI, let's learn what's CCI first 👇

The most important diagnostic tool for me that signals turning point in stocks. It’s very simple to understand, so give it a try after watching the video.

youtu.be

The most important diagnostic tool for me that signals turning point in stocks. It’s very simple to understand, so give it a try after watching the video.

youtu.be

4⃣ Watch the details in this video as to how to use this LONG TERM REVERSAL scanner.

CCI based reversal scanner to identify swing trades/positional trades/investment ideas. With some effort you can find the next potential multibagger!

youtu.be

CCI based reversal scanner to identify swing trades/positional trades/investment ideas. With some effort you can find the next potential multibagger!

youtu.be

7⃣ Example of #MONTECARLO

8⃣ Watch the details in this video as to how to use this SHORT TERM reversal scanner.

youtu.be

youtu.be

9⃣ Now that you've watched the video and understood the rules here is the scanner link itself 😃

Which stock would you trade for next week?

chartink.com

Which stock would you trade for next week?

chartink.com

🔟 If you've read still here don't forget to watch this video where I explain how to use both daily and weekly indicators in the same timeframe👇

youtu.be

youtu.be

1⃣1⃣ Looking for a similar BREAKOUT strategy? Refer to this thread 👇

Learnt something? If yes, please👇

1. Retweet the first tweet

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com

1. Retweet the first tweet

2. Follow @dmdsplyinvestor

3. Subscribe to my YouTube channel for more content! youtube.com

Loading suggestions...