1/ FTX liquidity crunch in 10 charts:

• Asset withdrawals

• Outflow destinations

• Liquidations

and more 🧵

• Asset withdrawals

• Outflow destinations

• Liquidations

and more 🧵

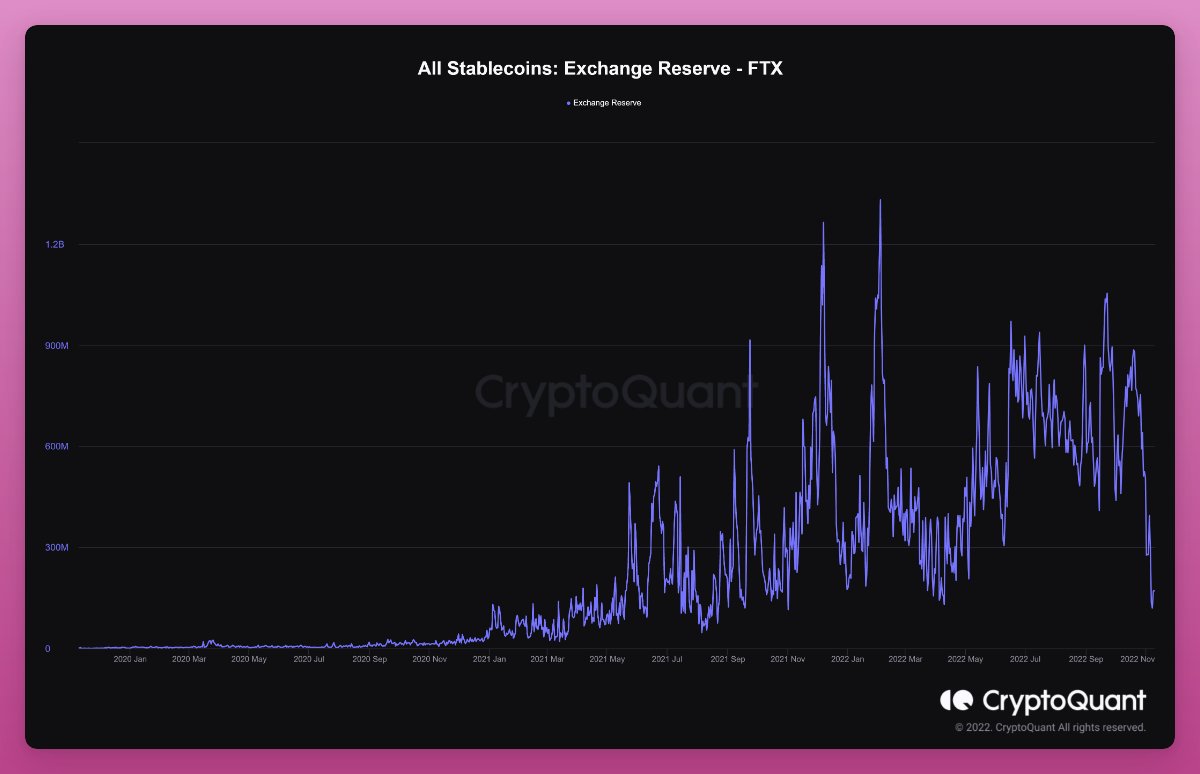

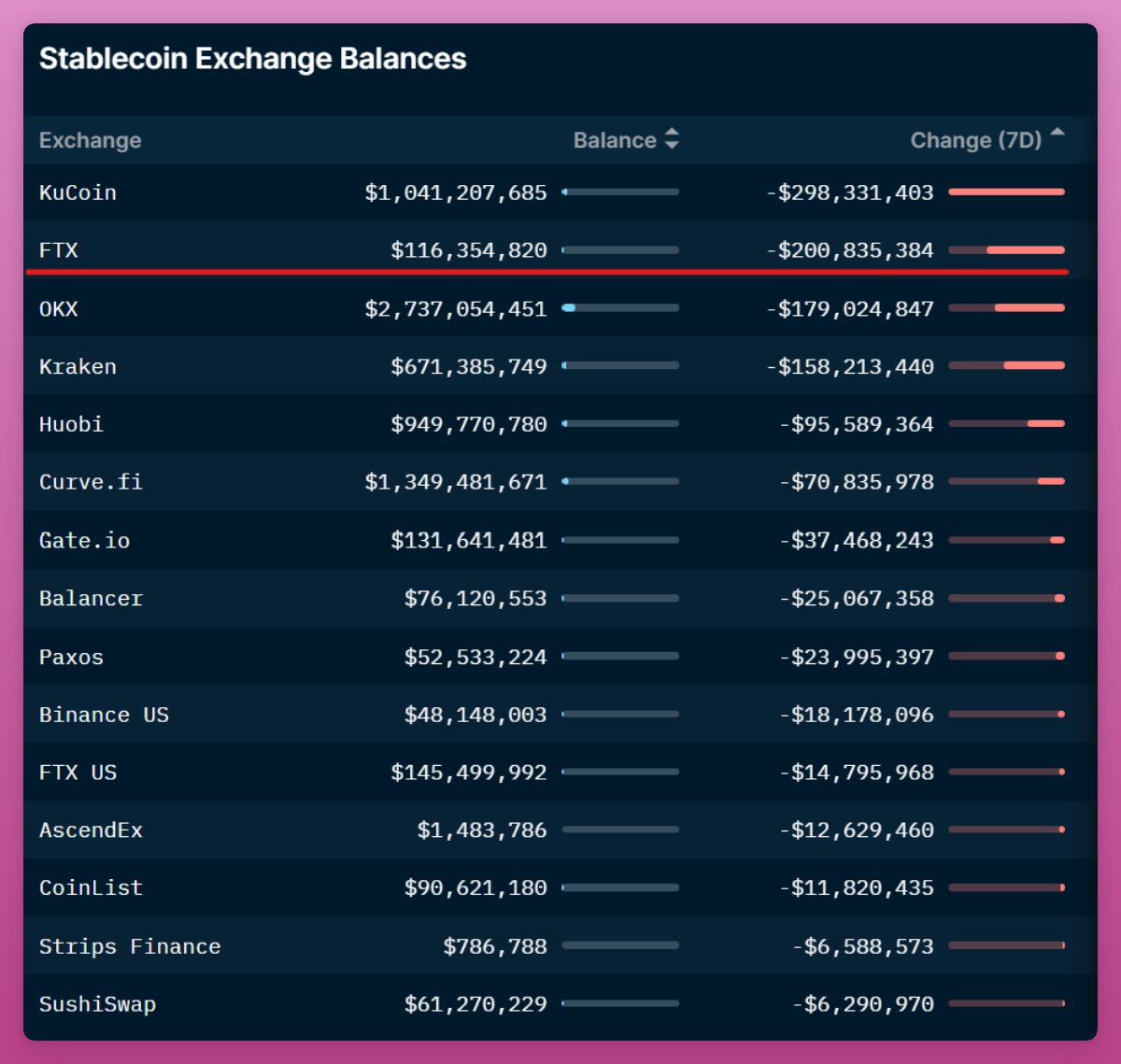

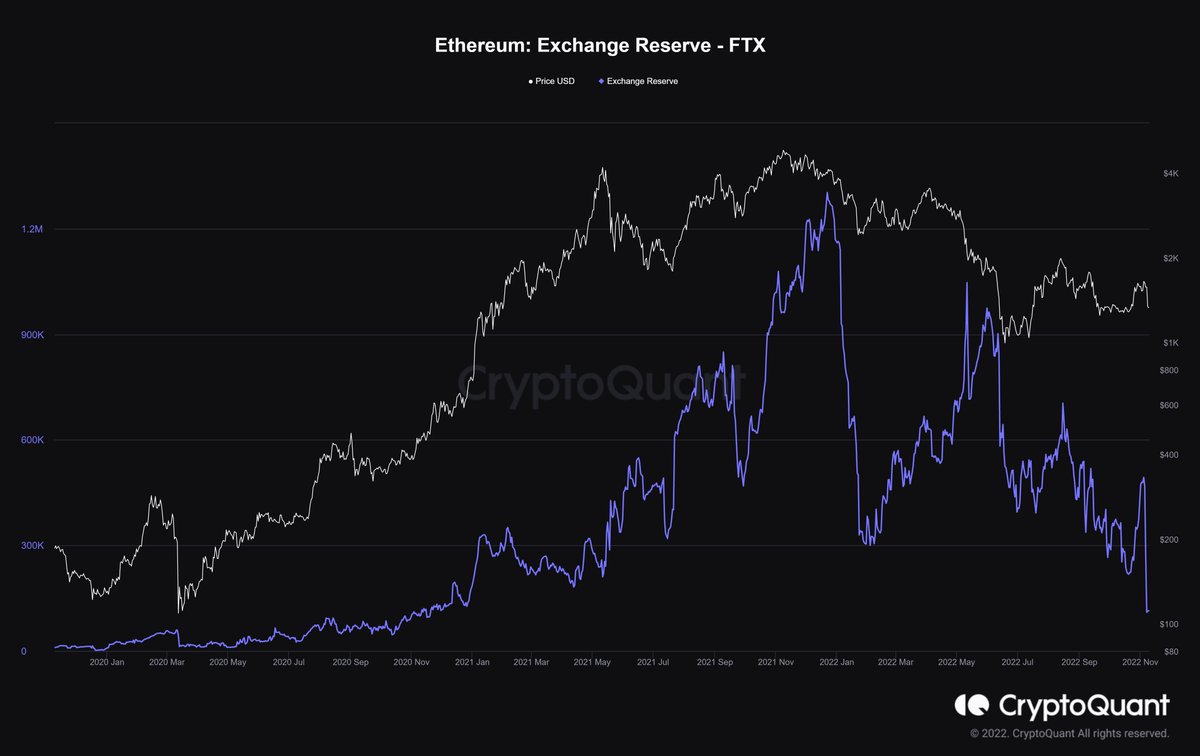

2/ @cryptoquant_com data shows that $708M USD in stablecoins have been withdrawn since Oct 20.

According to the data, $170M USD is still sitting in FTX exchange reserves.

According to the data, $170M USD is still sitting in FTX exchange reserves.

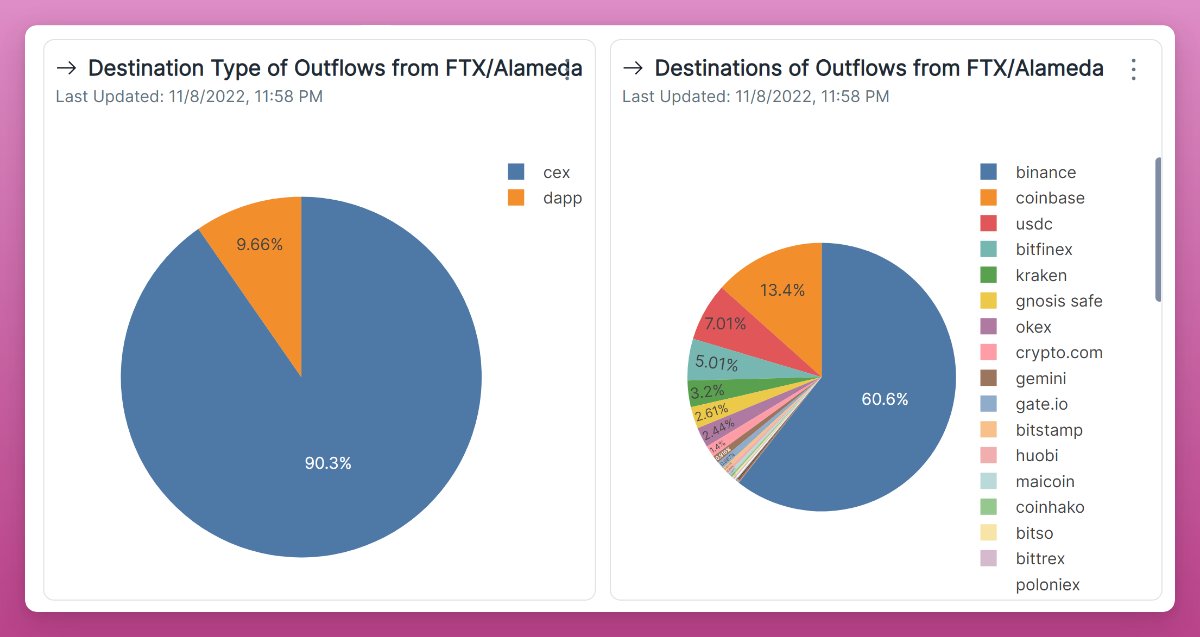

5/ Binance was the number 1 destination for crypto outflows from FTX.

60% of all withdrawals went to @binance, followed by outlows to Coinbase (13.4%)

90.6% of all outflows were destined to CEXes.

(Data: app.flipsidecrypto.com)

60% of all withdrawals went to @binance, followed by outlows to Coinbase (13.4%)

90.6% of all outflows were destined to CEXes.

(Data: app.flipsidecrypto.com)

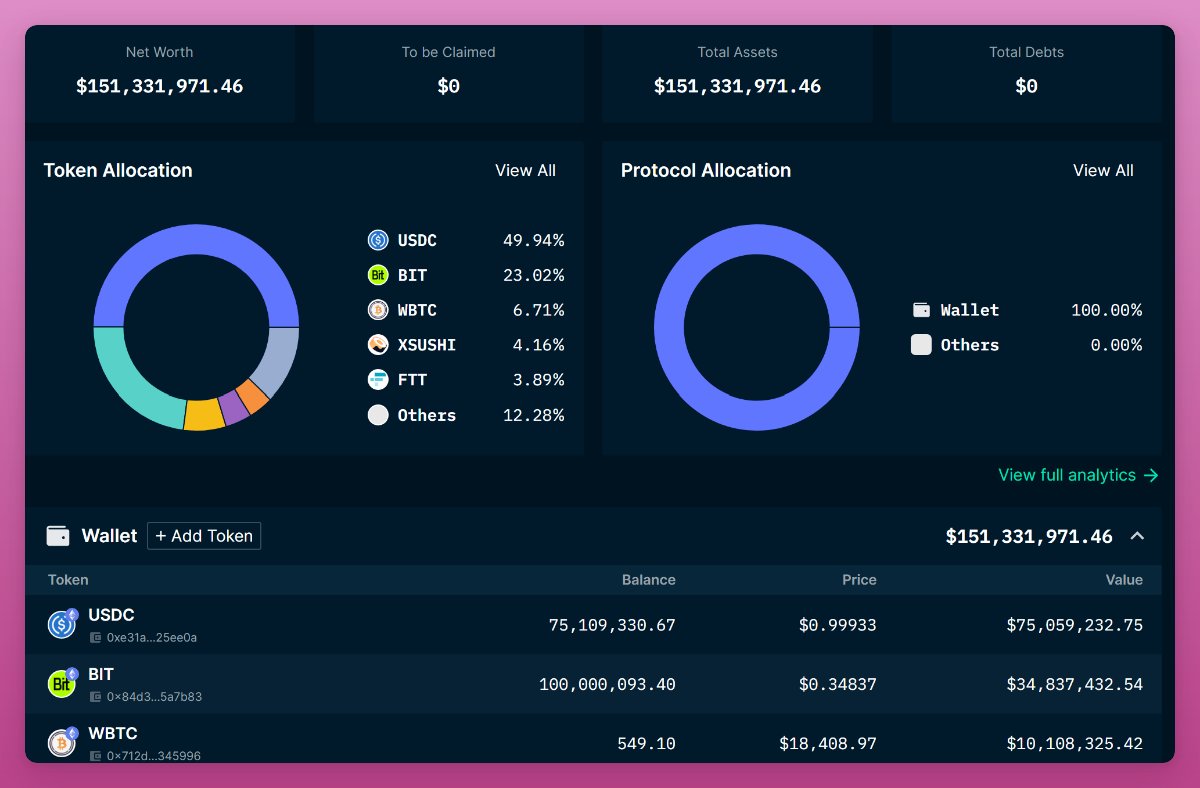

6/ Alameda/FTX Net worth across all EVM chains stands at $151M.

Biggest holdings are:

• $USDC - $75M

• $BIT - $34M

• $WBTC - $10M

• $xSUSHI - $6M

• $SRM - $3.6M

Link: portfolio.nansen.ai

Biggest holdings are:

• $USDC - $75M

• $BIT - $34M

• $WBTC - $10M

• $xSUSHI - $6M

• $SRM - $3.6M

Link: portfolio.nansen.ai

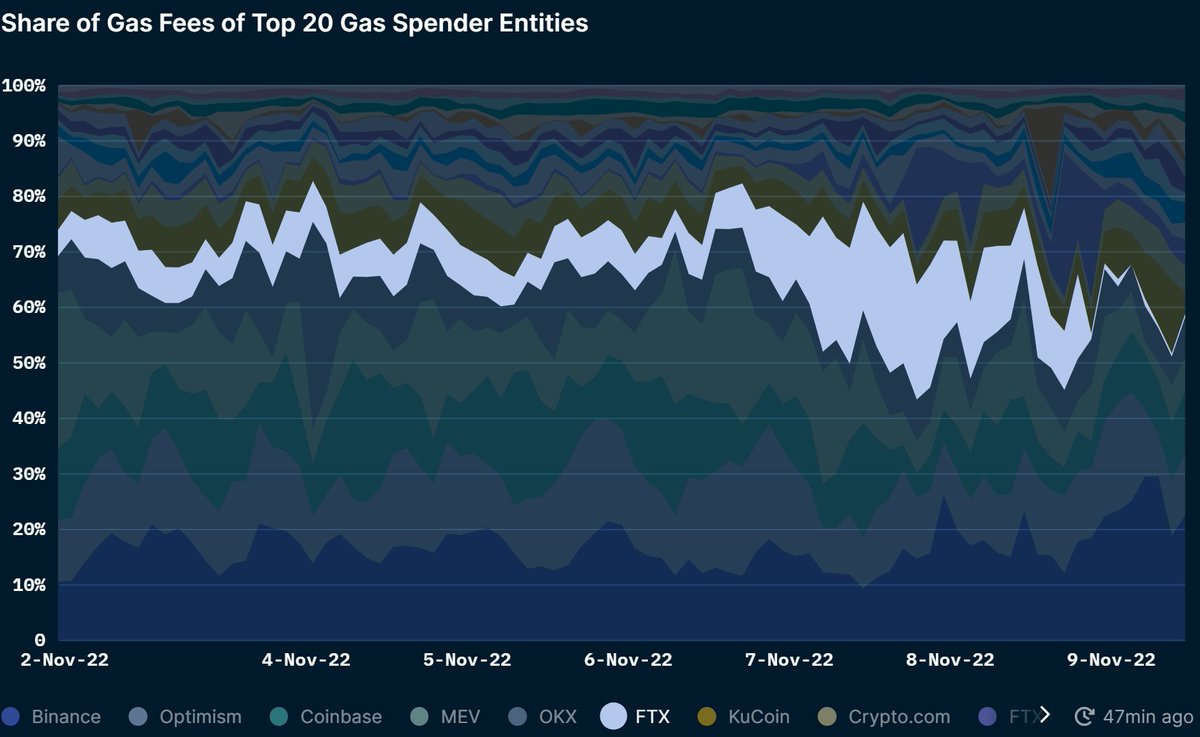

7/ We can see clearly when #FTX stopped processing withdrawals from the Share of Gas fees spending by entity.

FTX was one of the largest gas spender on November 7th.

But on the night of 8th to 9th gas spenditure almost disappeared.

Data: @nansen_ai

FTX was one of the largest gas spender on November 7th.

But on the night of 8th to 9th gas spenditure almost disappeared.

Data: @nansen_ai

12/ Any other interesting data I missed?

Would appreciate a follow @DefiIgnas

Like/Retweet the first tweet below if you can:

Would appreciate a follow @DefiIgnas

Like/Retweet the first tweet below if you can:

Loading suggestions...