1/ The Stablecoin Wars are heating up.

There are significant changes in the stablecoin positioning that went largely unnoticed.

So, these are the biggest developments🧵

There are significant changes in the stablecoin positioning that went largely unnoticed.

So, these are the biggest developments🧵

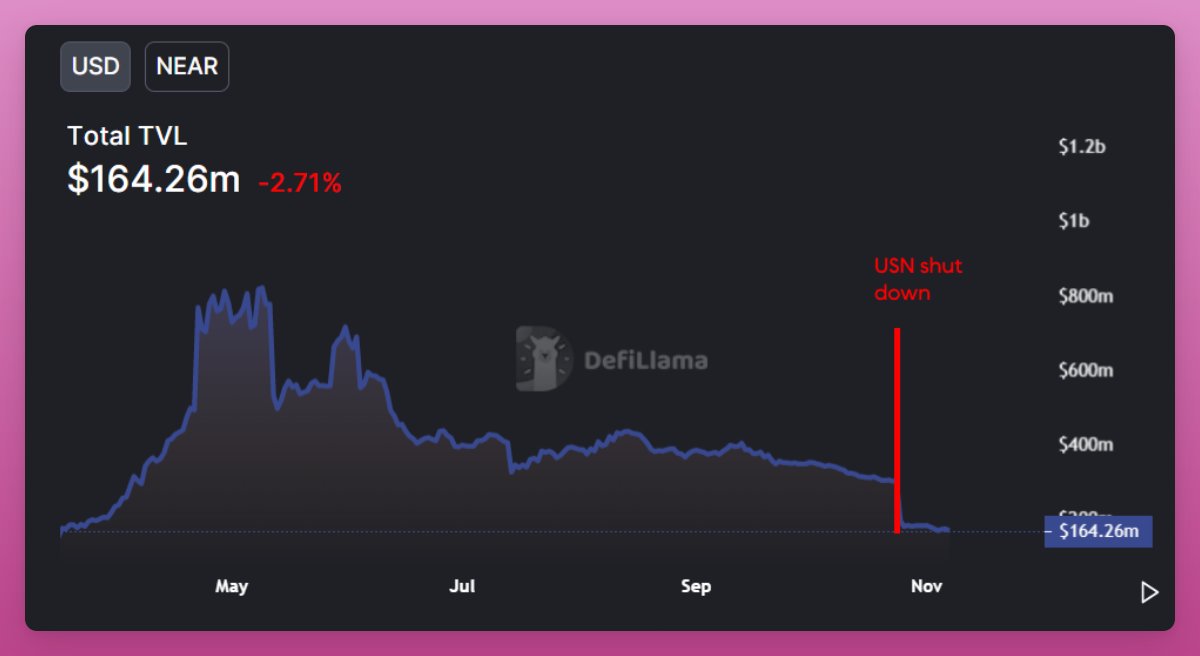

2/ Collapse of Near's $USN and Huobi's $HUSD

USN launched as an algorithmic stablecoin just 7 months ago.

But after UST collapse, USN v2 transitioned to minting USN with USDT.

Yet a '$40M missing collateral gap' appeared due to double-minting and the project was shut down.

USN launched as an algorithmic stablecoin just 7 months ago.

But after UST collapse, USN v2 transitioned to minting USN with USDT.

Yet a '$40M missing collateral gap' appeared due to double-minting and the project was shut down.

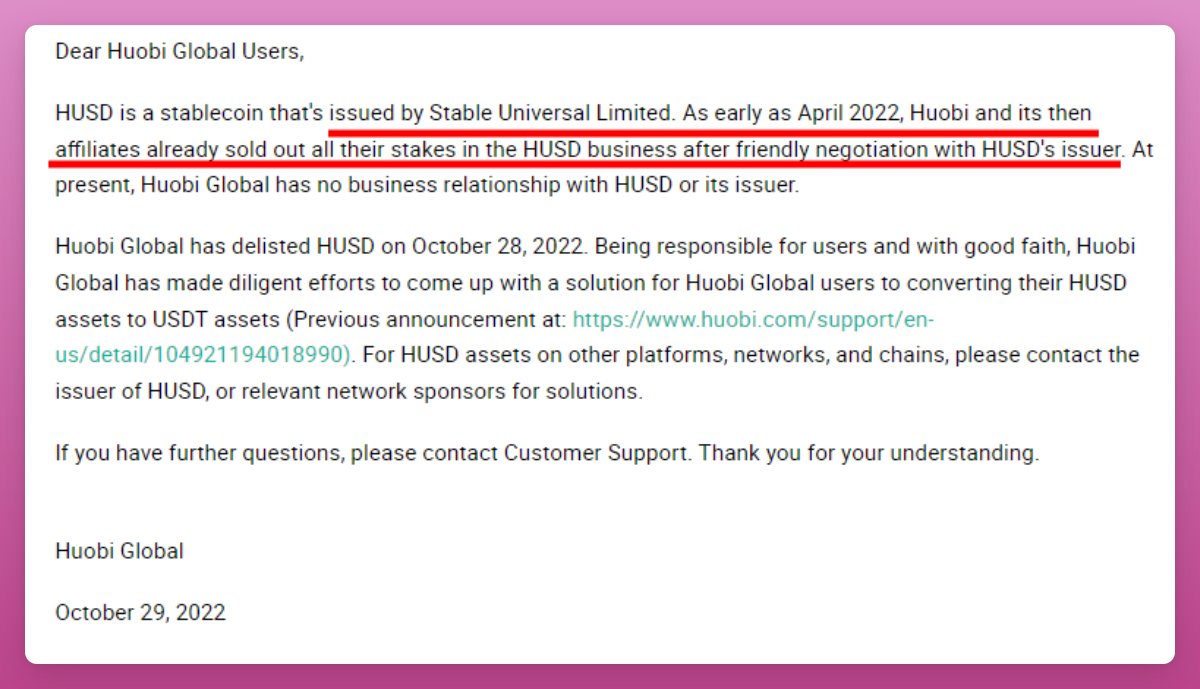

4/ Huobi's HUSD is currently at trading at $0.28 USD

It happened following the Huobi's acquisition by Justin Sun (which he denies), and Huobi delisting of HUSD.

HUSD was the backbone of Huobi ECO Chain, but HECO will 'merge' with Tron & BitTorrent Chains.

Bye HECO 👋

It happened following the Huobi's acquisition by Justin Sun (which he denies), and Huobi delisting of HUSD.

HUSD was the backbone of Huobi ECO Chain, but HECO will 'merge' with Tron & BitTorrent Chains.

Bye HECO 👋

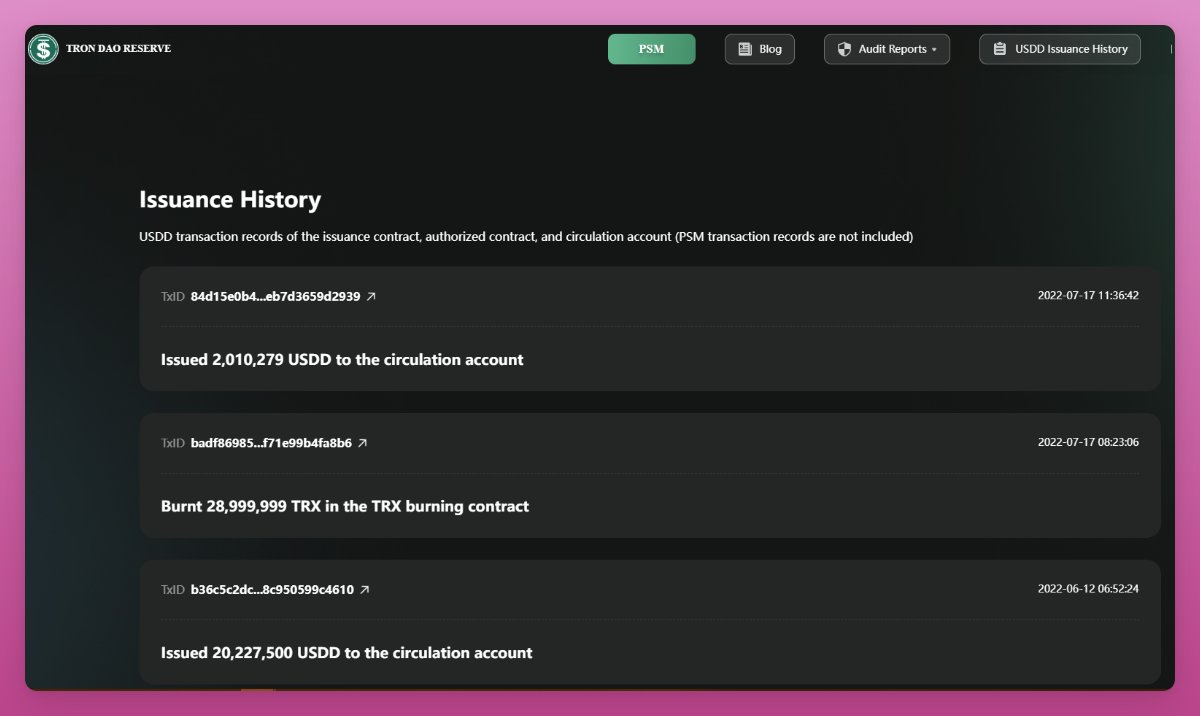

7/ $USDD is one of the few algorithmic stablecoins still standing.

USDD is MINTED solely by $TRX at 1:1 ratio, and only by pre-approved Members.

But Tron DAO Reserve claims that USDD is BACKED by other crypto assets at 293% collateral ratio.

USDD is MINTED solely by $TRX at 1:1 ratio, and only by pre-approved Members.

But Tron DAO Reserve claims that USDD is BACKED by other crypto assets at 293% collateral ratio.

9/ Another algorithmic stablecoin fighting for survival is $USDN

USDN suffered 3 major depegs with the worst one in April.

Since then $USDN has been struggling to keep $1 USD peg as it is not 100% backed by $WAVES collateral anymore.

USDN suffered 3 major depegs with the worst one in April.

Since then $USDN has been struggling to keep $1 USD peg as it is not 100% backed by $WAVES collateral anymore.

10/ Similarly to $UST or USDD, Neutrino's $USDN is backed by its native token $WAVES

Since the liquidity crunch on Vires finance in April, the backing ratio (BR) has fallen way below 100%.

BR currently stands at 25%, thanks to multiple market interventions.

Since the liquidity crunch on Vires finance in April, the backing ratio (BR) has fallen way below 100%.

BR currently stands at 25%, thanks to multiple market interventions.

11/ On a more positive note, $LUSD has managed to grow its market cap by 13% in the past month alone.

@LiquityProtocol launched an innovative bonding mechanism with dynamic NFTs - Chicken Bonds.

But the core value added is increased security against insolvency.

@LiquityProtocol launched an innovative bonding mechanism with dynamic NFTs - Chicken Bonds.

But the core value added is increased security against insolvency.

12/ As more $LUSD is bonded for $bUSD, LUSD is deposited to the Stability Pool.

Because LUSD Troves (collateralized debt positions) have low liquidation threshold (110%), this Stability Pool acts as the first line of defense in maintaining solvency.

Flywheel effect at its best.

Because LUSD Troves (collateralized debt positions) have low liquidation threshold (110%), this Stability Pool acts as the first line of defense in maintaining solvency.

Flywheel effect at its best.

13/ The elephant in the room for decentralized stablecoins is $DAI

At $5.8b MC it's the largest #DeFi stablecoin with $FRAX behind ($1.2b)

The DAO just passed the most important vote in its history: potentially abandoning USD peg, launching MetaDAOs, and MetaDAOs token farming.

At $5.8b MC it's the largest #DeFi stablecoin with $FRAX behind ($1.2b)

The DAO just passed the most important vote in its history: potentially abandoning USD peg, launching MetaDAOs, and MetaDAOs token farming.

14/ It's quite surprising how little publicity the vote has aroused relative to its significance.

I'd guess it's due to the plan's complexity.

The Endgame Plan assumes eventual regulatory crackdown on real world assets collateral, which includes $USDC.

Learn more below 👇

I'd guess it's due to the plan's complexity.

The Endgame Plan assumes eventual regulatory crackdown on real world assets collateral, which includes $USDC.

Learn more below 👇

16/ $DAI free float won't happen overnight, but we can expect the launch of two other DeFi stablecoins soon: $GHO and $crvUSD

• Details on $crvUSD are scarce

• Aave's $GHO might have revenue sharing model for $AAVE staking

• Details on $crvUSD are scarce

• Aave's $GHO might have revenue sharing model for $AAVE staking

18/ Now it all comes to what FTX will do.

And they want to take part in the 'Second Great Stablecoin War'

SBT recently told that the FTX stablecoin launch is 'not-too-distant future.'

They'll do it in cooperation with a partner.

Who will it be ? 🤔

And they want to take part in the 'Second Great Stablecoin War'

SBT recently told that the FTX stablecoin launch is 'not-too-distant future.'

They'll do it in cooperation with a partner.

Who will it be ? 🤔

19/ Quite appropriately for the current FTX vs Binance situation, SBT made an insightful comment about stablecoins:

'by now they've all learned the core lesson: NEVER EVER BLOCK REDEMPTIONS or your stablecoin will no longer be stable'

Same for exchange withdrawals 😎

'by now they've all learned the core lesson: NEVER EVER BLOCK REDEMPTIONS or your stablecoin will no longer be stable'

Same for exchange withdrawals 😎

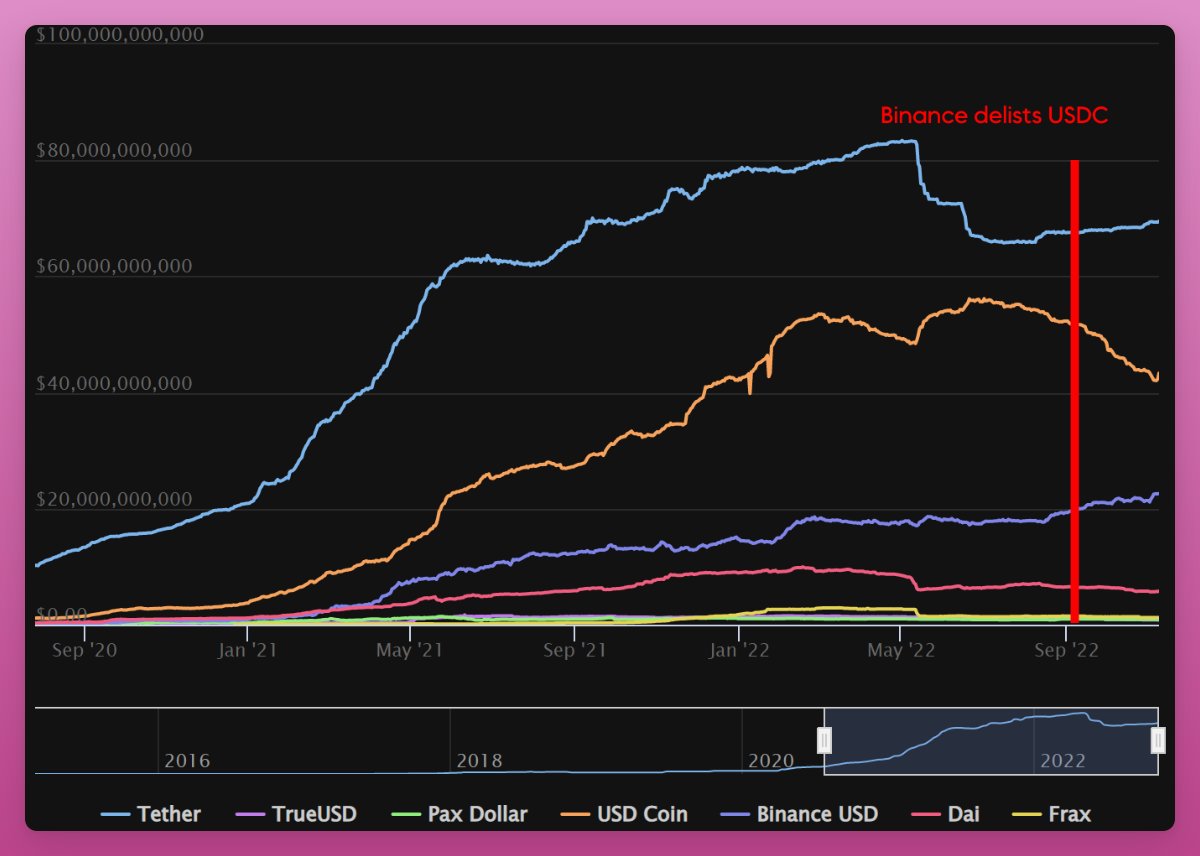

20/ Finally, $USDT

Last month Tether reduced commercial papers to zero, and increased exposure to US Treasuries

Tether previously condemned rumours that its commercial paper is '85% backed by Chinese or Asian commercial papers and being traded at a 30% discount.'

Last month Tether reduced commercial papers to zero, and increased exposure to US Treasuries

Tether previously condemned rumours that its commercial paper is '85% backed by Chinese or Asian commercial papers and being traded at a 30% discount.'

21/ Overall, stablecoin market isn't static as the total market cap would suggest.

Centralized stablecoins dominate the market with its decentralized counterparties struggling to compete.

I previously analyzed 25 #DeFi tokens, so check it if you want to learn more.

Centralized stablecoins dominate the market with its decentralized counterparties struggling to compete.

I previously analyzed 25 #DeFi tokens, so check it if you want to learn more.

22/ Did I miss something important?

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:O

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:O

Loading suggestions...