1/ Looking for new #DeFi projects?

I launched early stage project database 2 weeks ago.

There are already 50 exciting projects! Ranging from high-yield lending protocol to your DegenScore as an NFT.

These are 7 of them🧵

I launched early stage project database 2 weeks ago.

There are already 50 exciting projects! Ranging from high-yield lending protocol to your DegenScore as an NFT.

These are 7 of them🧵

2/ First of all, this database includes SELF-reported project information and is accessible at ignasdefi.notion.site

DYOR!

I created it for:

• Projects trying to get noticed

• And users looking for something new

I will update it as more projects reach out to me.

DYOR!

I created it for:

• Projects trying to get noticed

• And users looking for something new

I will update it as more projects reach out to me.

3/ @SturdyFinance has a unique value proposition.

It offers interest-free borrowing and high yield lending.

But ... how?

It stakes provided collateral into #DeFi protocols like Yearn, Convex, and Lido.

The yield rewards are used to pay interest to depositors.

It offers interest-free borrowing and high yield lending.

But ... how?

It stakes provided collateral into #DeFi protocols like Yearn, Convex, and Lido.

The yield rewards are used to pay interest to depositors.

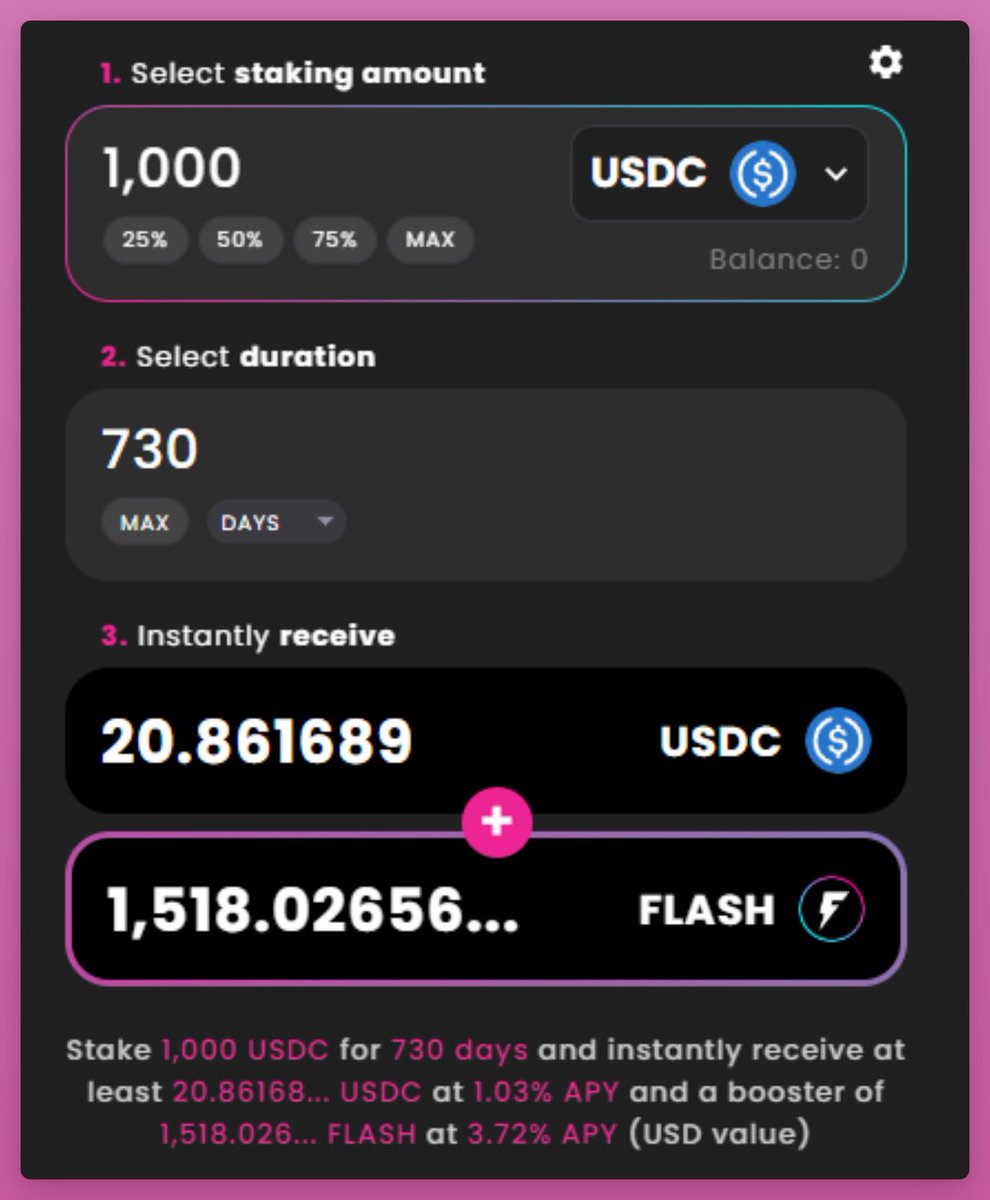

4/ @Flashtake too is as simple as it gets.

Lenders can claim up to two years' worth of yield, today.

Simply choose an amount to stake and time-lock for the upfront yield & $FLASH rewards.

Current strategy deposits assets to Aave V2 with more strategies to come.

Lenders can claim up to two years' worth of yield, today.

Simply choose an amount to stake and time-lock for the upfront yield & $FLASH rewards.

Current strategy deposits assets to Aave V2 with more strategies to come.

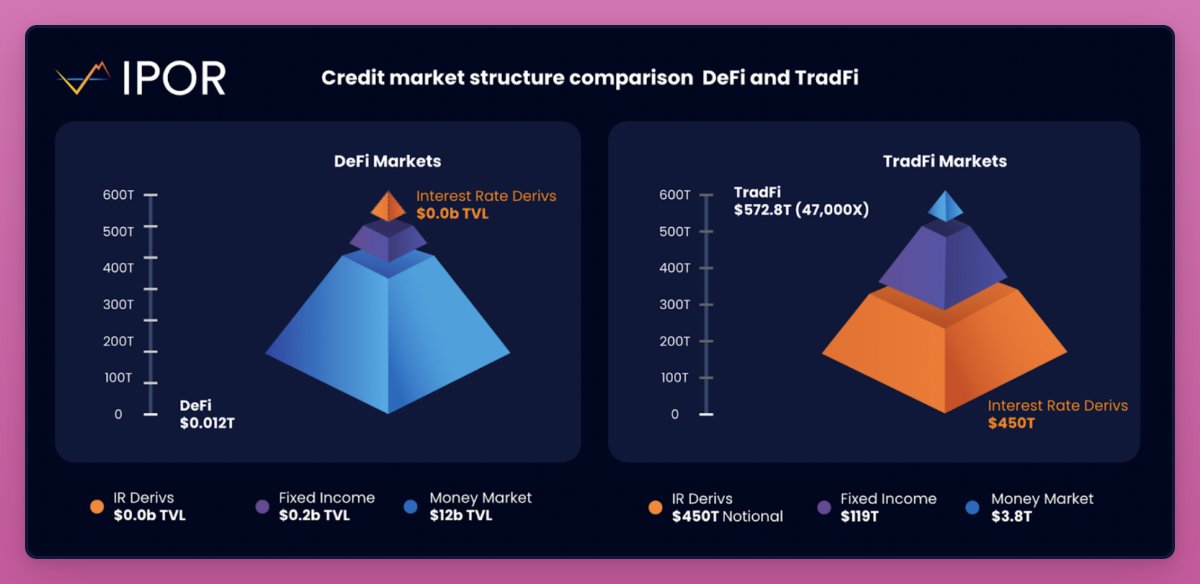

6/ The goal is to bring transparency and stability to the volatile #DeFi credit market.

Traders can hedge, arbitrage and take directional positions on the interest rate movements.

It allows managing risk across their credit portfolios.

Traders can hedge, arbitrage and take directional positions on the interest rate movements.

It allows managing risk across their credit portfolios.

7/ @SoulbondsNFT is building continuously evolving NFTs reflecting on-chain activity with Soulbound tokens.

They partnered with @DegenScore so we can expect to convert our #DeFi degen score into an always improving PFP 🤓

Got rugged? At least you'll get a cool avatar.

They partnered with @DegenScore so we can expect to convert our #DeFi degen score into an always improving PFP 🤓

Got rugged? At least you'll get a cool avatar.

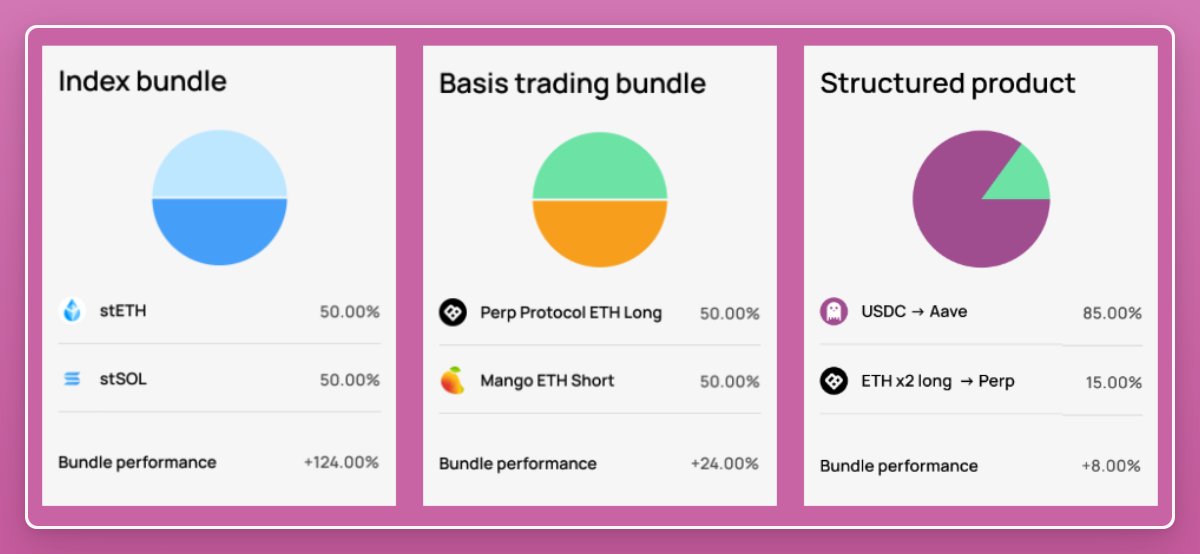

8/ @decommas builds automated cross-chain DeFi strategies using LayerZero tech.

A few examples:

• stETH/stSOL cross-chain index

• Automated cross-chain basis trading strategy

• Stable lending position and ETH perpetual long

Community will be able to build own strategies.

A few examples:

• stETH/stSOL cross-chain index

• Automated cross-chain basis trading strategy

• Stable lending position and ETH perpetual long

Community will be able to build own strategies.

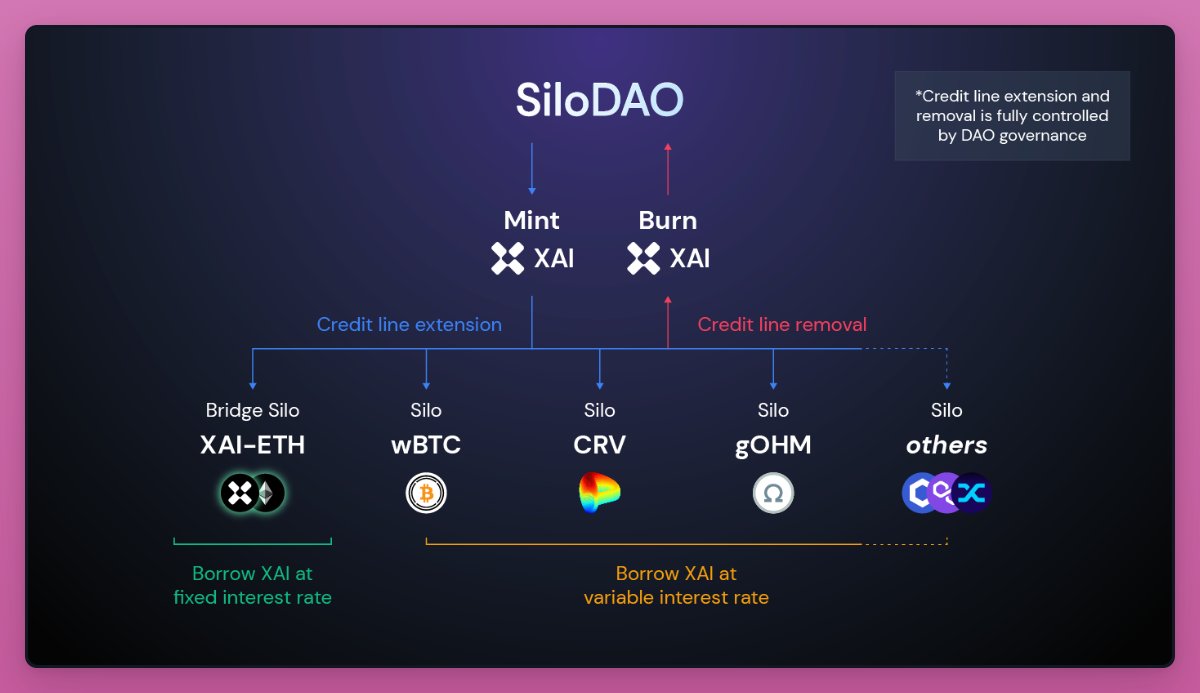

9/ @SiloFinance is building lending & borrowing for all tokens.

Silo’s markets or “Silos” are like Uniswap liquidity pools.

Each token is confined to its own pool, but swaps between pairs happen via the bridge asset (ETH and Silo stablecoin $XAI which is close to release).

Silo’s markets or “Silos” are like Uniswap liquidity pools.

Each token is confined to its own pool, but swaps between pairs happen via the bridge asset (ETH and Silo stablecoin $XAI which is close to release).

10/ @syndrhq is building options & futures exchange on their own Layer3 zkRollup.

Yep, L3.

This L3 combines on-chain and off-chain features to give what's the best of both worlds:

• Low latency

• High throughput

• Capital-efficiency: good for delta-neutral positions

Yep, L3.

This L3 combines on-chain and off-chain features to give what's the best of both worlds:

• Low latency

• High throughput

• Capital-efficiency: good for delta-neutral positions

11/ DISCLAIMER

This is not a paid promotion.

None of the projects included paid to be featured here.

If you want to include an EXCITING early stage project, send me a DM.

This is not a paid promotion.

None of the projects included paid to be featured here.

If you want to include an EXCITING early stage project, send me a DM.

12/ Feel free to share any exciting early stage #DeFi project.

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...