1/ Do #DeFi protocols really need a token to work? 🧵

2/ Yesterday I asked CT to 'name a #DeFi protocol that wouldn't work without a token.'

Answers are eye-opening.

Ranging from 'all of them' to 'could prove there is none'.

So... is there any?

Answers are eye-opening.

Ranging from 'all of them' to 'could prove there is none'.

So... is there any?

3/ I'd argue that the majority of projects launch a token out of financial necessity.

Token sale is a preferred and the easiest way to raise funds.

Without a necessary funding there wouldn't be that many projects in the first place.

Token sale is a preferred and the easiest way to raise funds.

Without a necessary funding there wouldn't be that many projects in the first place.

4/ Secondly, token serves a role for bootstrapping liquidity.

Without liquidity mining, Sushiswap wouldn't have been able to attract any TVL/users since it didn't add any additional value to Uniswap's V2.

I wonder if Uniswap launched $UNI because of Sushi threat? 🧐

Without liquidity mining, Sushiswap wouldn't have been able to attract any TVL/users since it didn't add any additional value to Uniswap's V2.

I wonder if Uniswap launched $UNI because of Sushi threat? 🧐

5/ Token is also used as a community building tool.

But building a community around the token and NOT around the protocol itself is a short-term strategy.

Your community will abandon you when the price plummets.

But building a community around the token and NOT around the protocol itself is a short-term strategy.

Your community will abandon you when the price plummets.

6/ Some #DeFi protocols integrate their tokens into the core functioning mechanism:

• $SNX, $GNS, $AMP, $RUNE facilitate liquidity creation & transfer

• $USDD, $USDN, $UST, $FRAX are backed by native tokens

• $OHM bonding for liquidity

• $SNX, $GNS, $AMP, $RUNE facilitate liquidity creation & transfer

• $USDD, $USDN, $UST, $FRAX are backed by native tokens

• $OHM bonding for liquidity

7/ Yet many protocols could technically function without a token:

• DEXes, derivative exchanges, DEX aggregators

• Lending protocols

• Yield aggregators

• Collateralized stablecoins

• Wallets

Their core business models don't depend on the token.

• DEXes, derivative exchanges, DEX aggregators

• Lending protocols

• Yield aggregators

• Collateralized stablecoins

• Wallets

Their core business models don't depend on the token.

8/ Token for (some) of these protocols is a risk management tool!

$MKR is a backstop for insolvency: holders take risk of dilution to cover undercapitalized debt.

Perpetual DEXes use the token to build up insurance fund in case of failed liquidations.

multicoin.capital

$MKR is a backstop for insolvency: holders take risk of dilution to cover undercapitalized debt.

Perpetual DEXes use the token to build up insurance fund in case of failed liquidations.

multicoin.capital

9/This risk management extends to the protocol ownership.

Would you use Aave or Compound if one entity controlled a key to all assets and protocol parameters?

Protocols can use multi-sig to prevent it, but a governance token scales multi-sig to millions of people.

Would you use Aave or Compound if one entity controlled a key to all assets and protocol parameters?

Protocols can use multi-sig to prevent it, but a governance token scales multi-sig to millions of people.

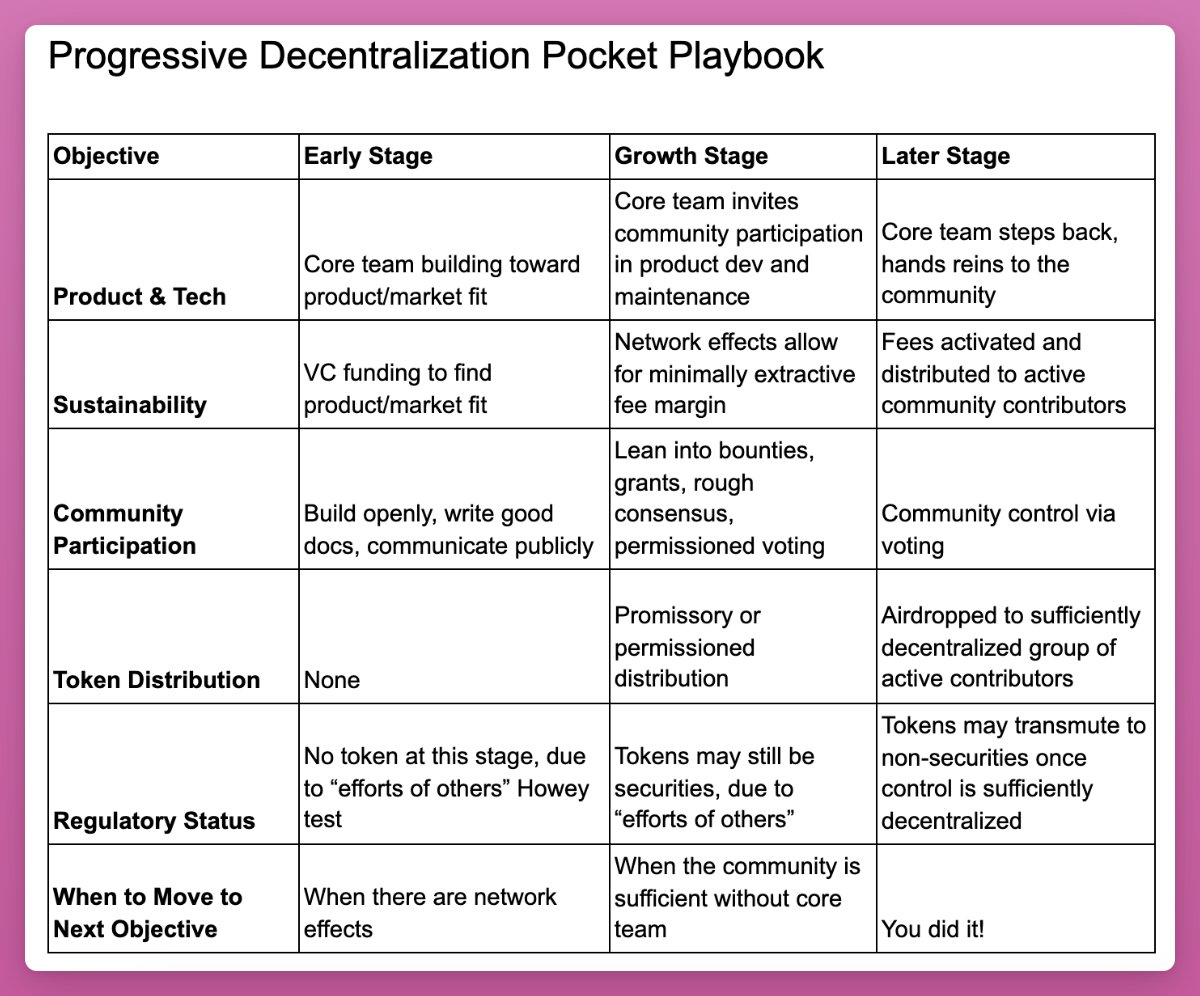

10/ Unfortunately, not all protocols reached this level of governance decentralization.

But decentralization is a spectrum and 'a token is an option on future utility.'

So while a token serves as a fundraising tool at first, the utility is can be added later on.

But decentralization is a spectrum and 'a token is an option on future utility.'

So while a token serves as a fundraising tool at first, the utility is can be added later on.

12/ On the final note, $UNI seems to be a controversial one.

• $UNI doesn't manage any risk, and contracts are immutable so no parameters to change

• Revenue sharing is value-destructive for LPs @multicoincap

But $UNI is the largest $DeFi token by market cap.

• $UNI doesn't manage any risk, and contracts are immutable so no parameters to change

• Revenue sharing is value-destructive for LPs @multicoincap

But $UNI is the largest $DeFi token by market cap.

13/ IMO $UNI's value comes from:

• Option for future utility

• Governance to influence other protocols

Uniswap DAO voted to launch on zkSync, potentially giving zkSync a leadership position in zk-Rollup race.

That's power.

• Option for future utility

• Governance to influence other protocols

Uniswap DAO voted to launch on zkSync, potentially giving zkSync a leadership position in zk-Rollup race.

That's power.

14/ Overall, many protocols exist thanks to the token: from fundraising to liquidity attraction.

They facilitate community building and redistribute revenue.

But at the end, ensuring security of the protocol and governance gives the ultimate reason for a token to exist.

They facilitate community building and redistribute revenue.

But at the end, ensuring security of the protocol and governance gives the ultimate reason for a token to exist.

15/ Did I miss something important? Please let me know 👐

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Follow me @DefiIgnas for more.

Like/Retweet the first tweet below if you can:

Loading suggestions...