4/

We've covered a lot.

Let's get our hands dirty.

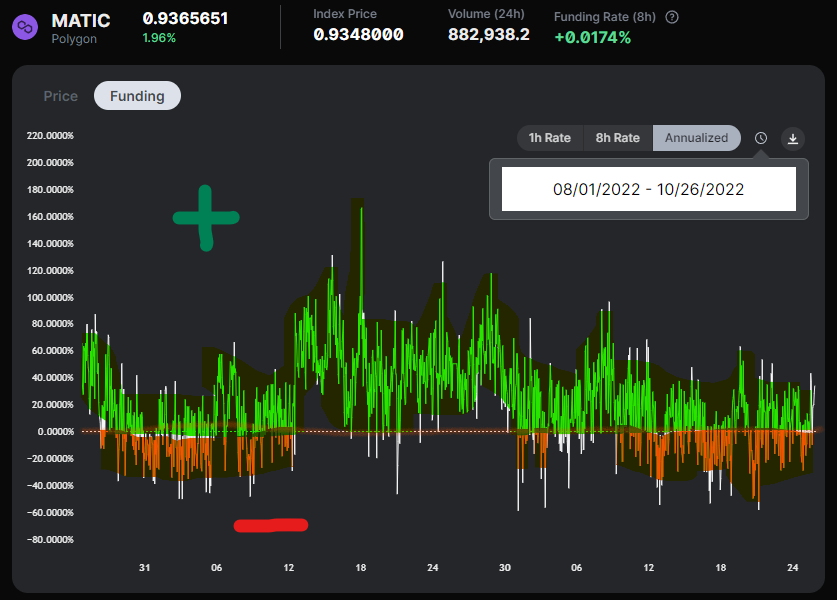

$Matic has positive funding on @perpprotocol on average.

Below we see hourly funding for the past couple months, annualized.

Because most data points are >0 (highlighted in green) longs are generally paying shorts.

We've covered a lot.

Let's get our hands dirty.

$Matic has positive funding on @perpprotocol on average.

Below we see hourly funding for the past couple months, annualized.

Because most data points are >0 (highlighted in green) longs are generally paying shorts.

5/

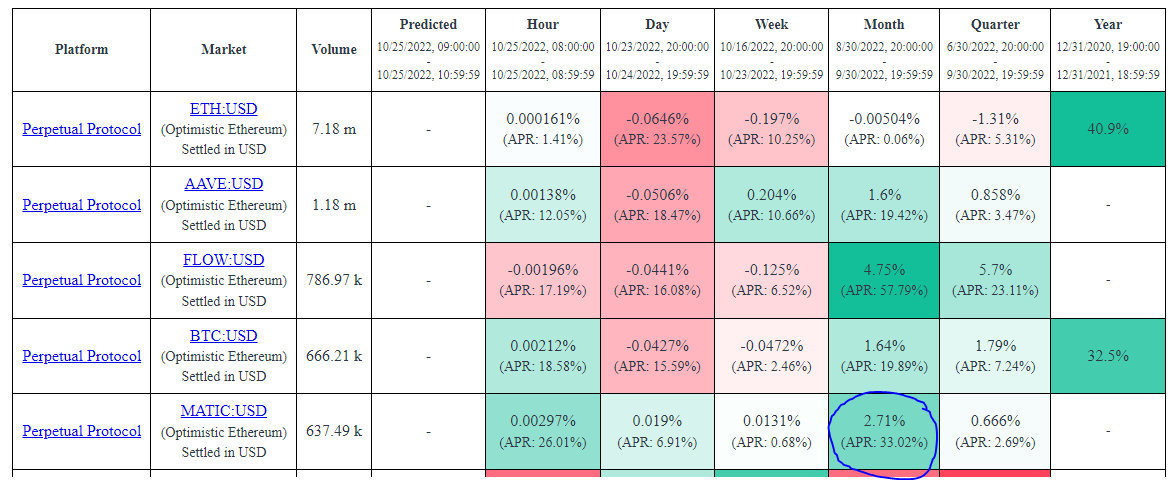

The chart above is from perp.com.

Unfortunately, they don't give us historical averages.

Fortunately, @r72_fi has historical averages for @perpprotocol.

Matic had a monthly gain of 2.71% in funding on shorts. Annualized, that's 33%.

r72.fi

The chart above is from perp.com.

Unfortunately, they don't give us historical averages.

Fortunately, @r72_fi has historical averages for @perpprotocol.

Matic had a monthly gain of 2.71% in funding on shorts. Annualized, that's 33%.

r72.fi

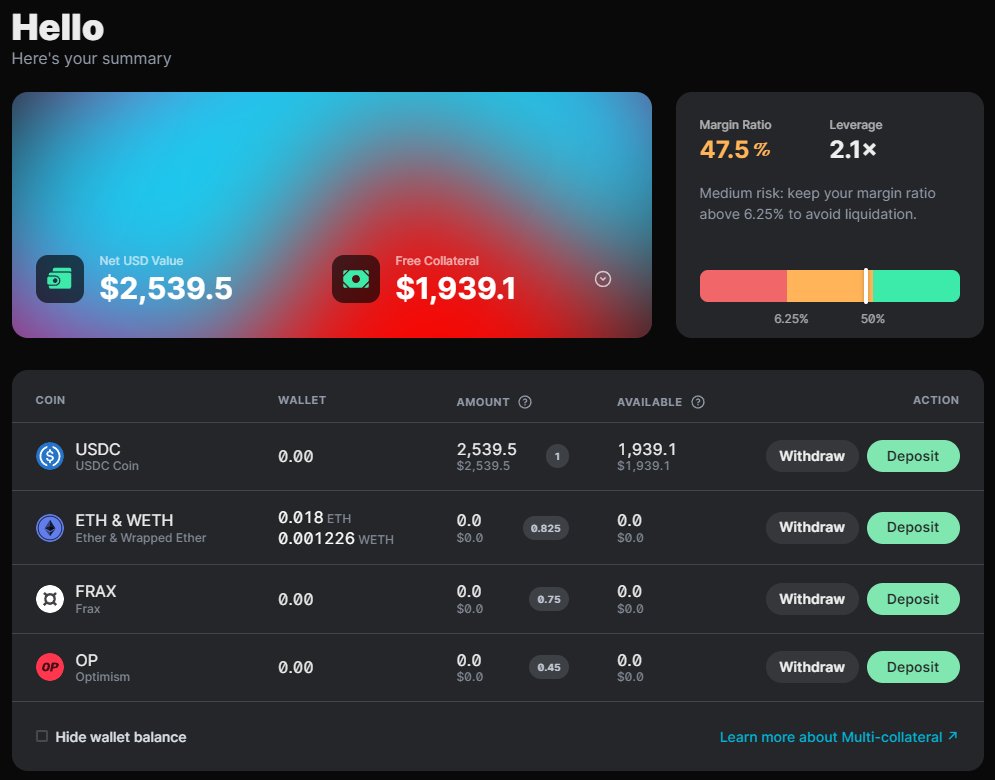

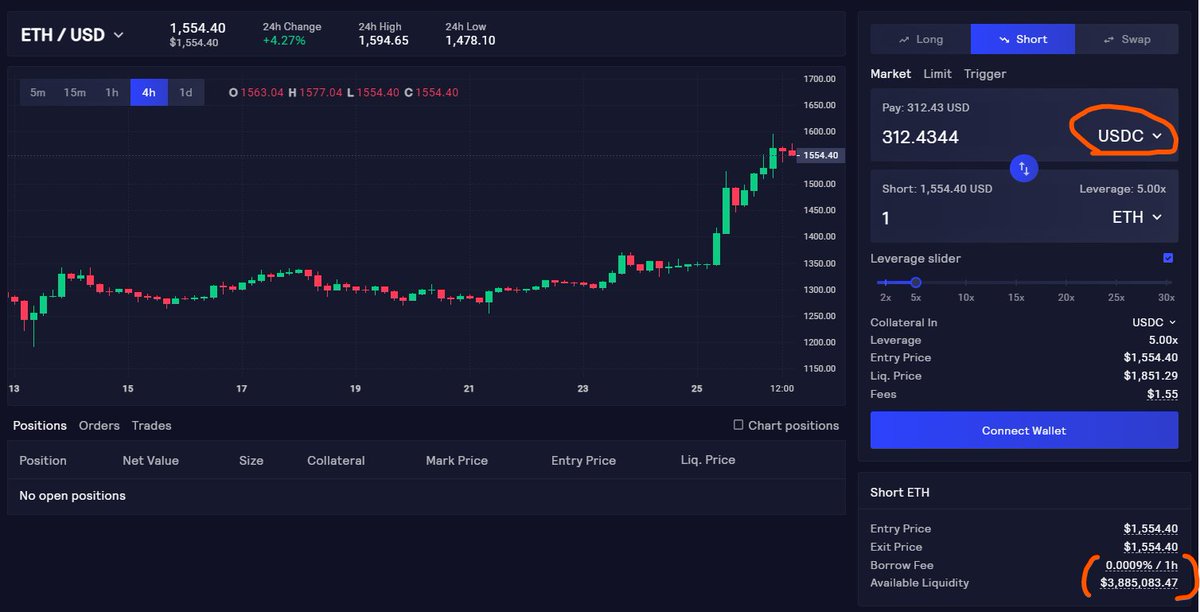

7/

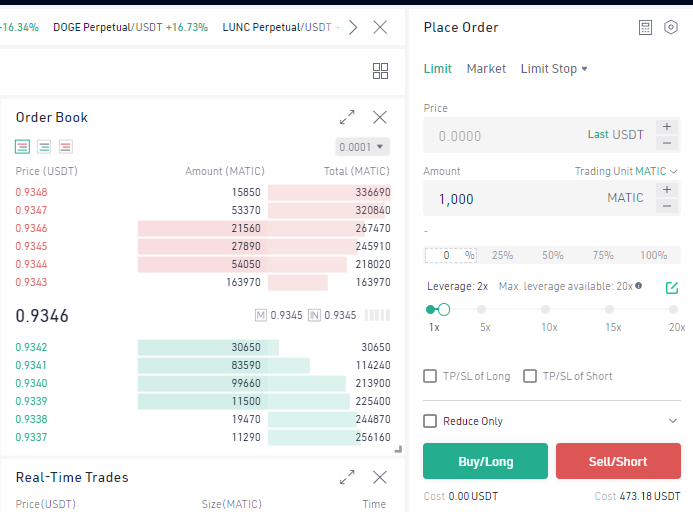

How do you open a position?

This varies between platforms.

On CEXs:

1. Transfer Money to Futures Account

2. Type in amount of Matic to short

3. Choose leverage

4. Open position

5. (to be neutral) Buy the same amount of Matic

@kucoincom for reference.

How do you open a position?

This varies between platforms.

On CEXs:

1. Transfer Money to Futures Account

2. Type in amount of Matic to short

3. Choose leverage

4. Open position

5. (to be neutral) Buy the same amount of Matic

@kucoincom for reference.

9/

Other protocols (@GMX_IO, @GainsNetwork_io, @PikaProtocol, e.g.) function more like CEXs; you preselect your leverage, and your margin is isolated.

Generally, those use liquidity vaults (GLP, Dai, USDC) and FR Arbitrage is not as viable.

Some have no funding rates at all.

Other protocols (@GMX_IO, @GainsNetwork_io, @PikaProtocol, e.g.) function more like CEXs; you preselect your leverage, and your margin is isolated.

Generally, those use liquidity vaults (GLP, Dai, USDC) and FR Arbitrage is not as viable.

Some have no funding rates at all.

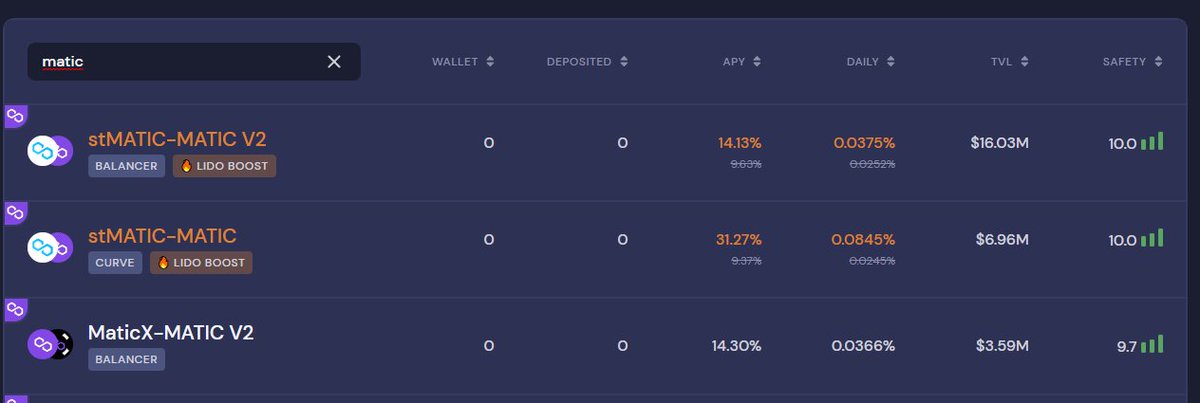

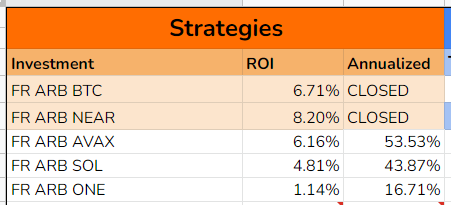

13/

What tools can help you pick a good position?

○ @coinglass_com

○ @r72_fi

○ This tool my community (DeFi Dojo) has made:

tinyurl.com

○ @DuneAnalytics

Pictures: a Pika example for Dune

My community has actually made a few other cool tools for FR Arb.

What tools can help you pick a good position?

○ @coinglass_com

○ @r72_fi

○ This tool my community (DeFi Dojo) has made:

tinyurl.com

○ @DuneAnalytics

Pictures: a Pika example for Dune

My community has actually made a few other cool tools for FR Arb.

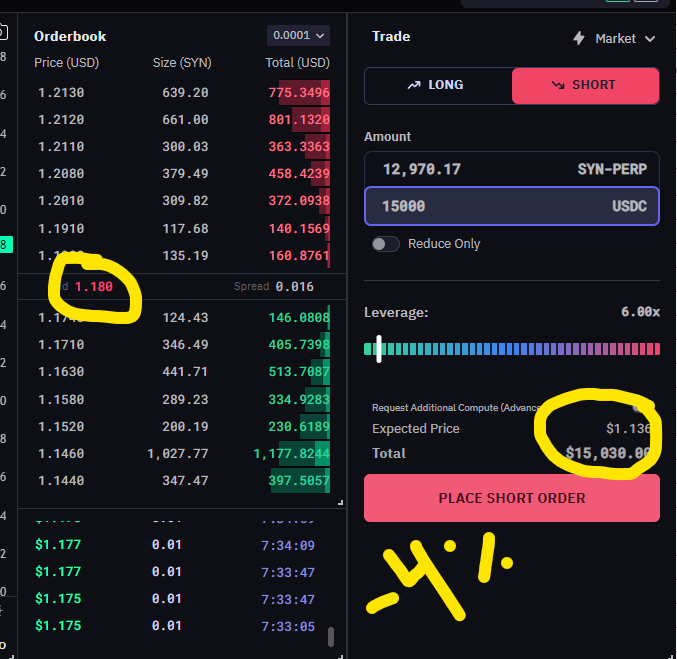

14/

When should you exit your position?

It sucks when the funding rate flips, but there's a silver lining.

If the funding rate has flipped, that means you //might// be able to exit at a premium.

Example up next👇

When should you exit your position?

It sucks when the funding rate flips, but there's a silver lining.

If the funding rate has flipped, that means you //might// be able to exit at a premium.

Example up next👇

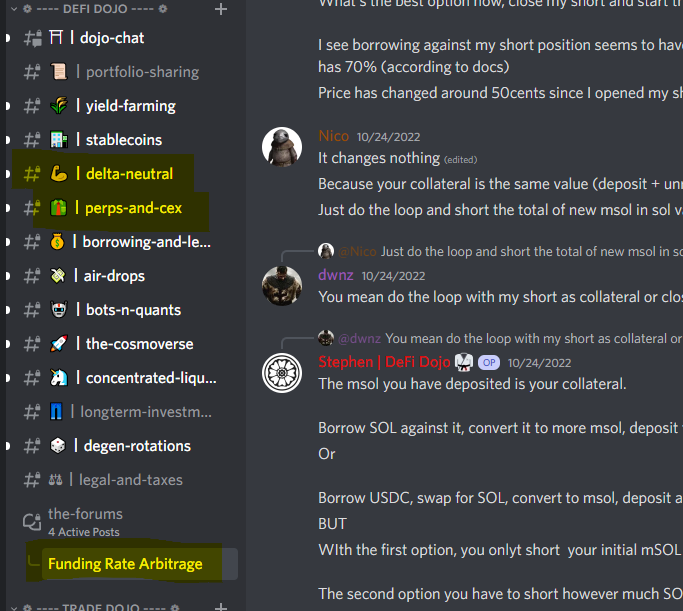

20/

So join my Discord, get the first month free.

If you don't like it, leave without paying a dime.

Check out my portfolio, talk to >1,000 premium members & DeFi Power Users, or talk to some of your favorite DeFi teams.

We'll be happy to have you.

launchpass.com

So join my Discord, get the first month free.

If you don't like it, leave without paying a dime.

Check out my portfolio, talk to >1,000 premium members & DeFi Power Users, or talk to some of your favorite DeFi teams.

We'll be happy to have you.

launchpass.com

Loading suggestions...