What’s to come?

• A year in retrospect

• The Optimistic Ones

• The ZK Ones

• The Polygon Ones

• L2 value capture

• What’s the play?

• A year in retrospect

• The Optimistic Ones

• The ZK Ones

• The Polygon Ones

• L2 value capture

• What’s the play?

The full detailed newsletter is here, but if you want to stick with the thread that's also cool.

alphapls.substack.com

alphapls.substack.com

I’ve done my best to sum up the activity and how the landscape is looking currently. It's a high level snapshot. I am inevitably going to miss a ton of stuff, so feel free to comment anything major that's missing.

--A year in retrospect--

It’s been more than a year since the launch of the major L2s. The chains have matured and ecosystems and communities have clearly formed.

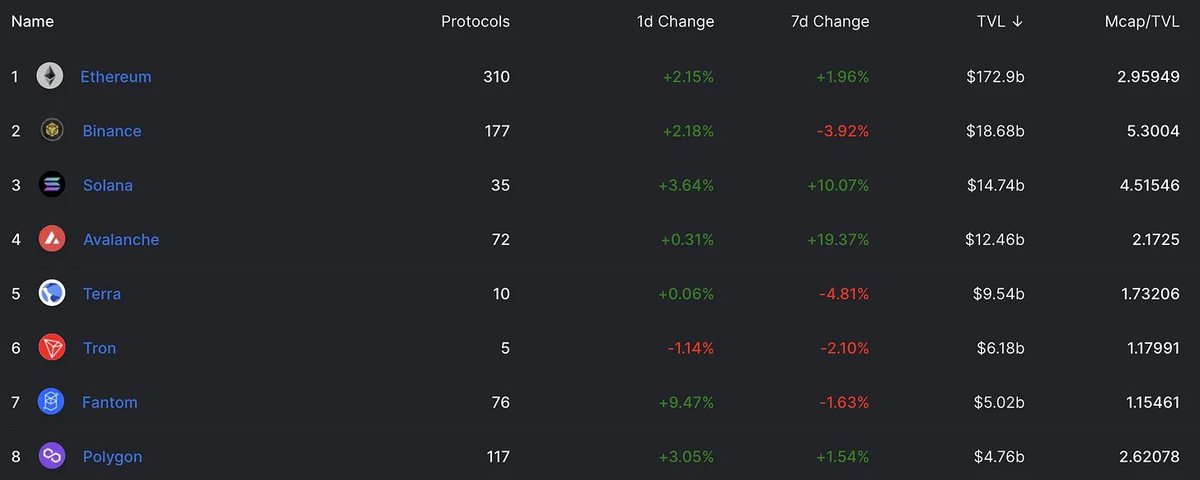

I posted this almost a year ago, just before the market started its descent to goblin town

It’s been more than a year since the launch of the major L2s. The chains have matured and ecosystems and communities have clearly formed.

I posted this almost a year ago, just before the market started its descent to goblin town

I’m going to pull out a few references from that thread to show some of the progress made by L2s.

Fees were relatively high across the major ORUs.

Fees were relatively high across the major ORUs.

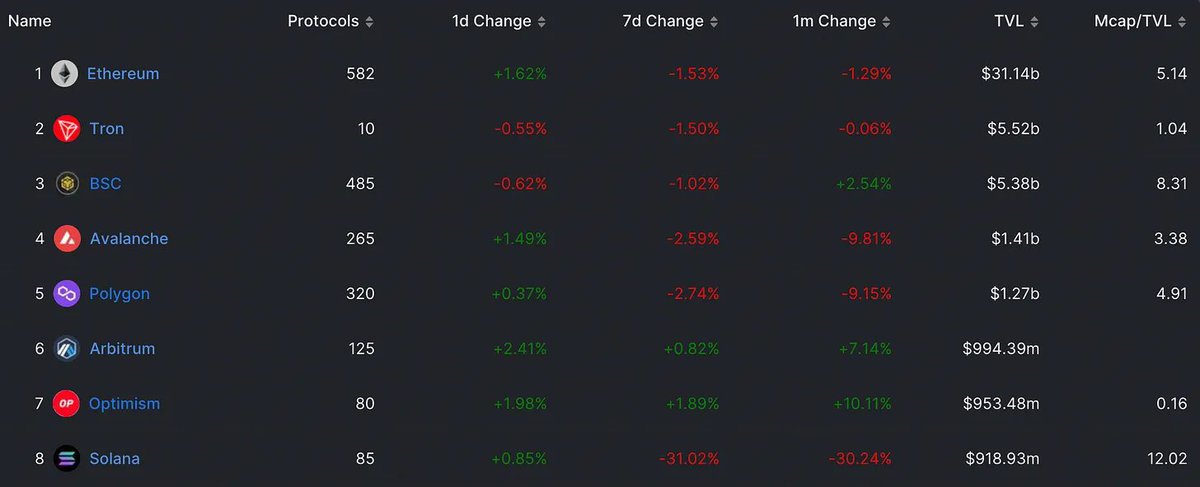

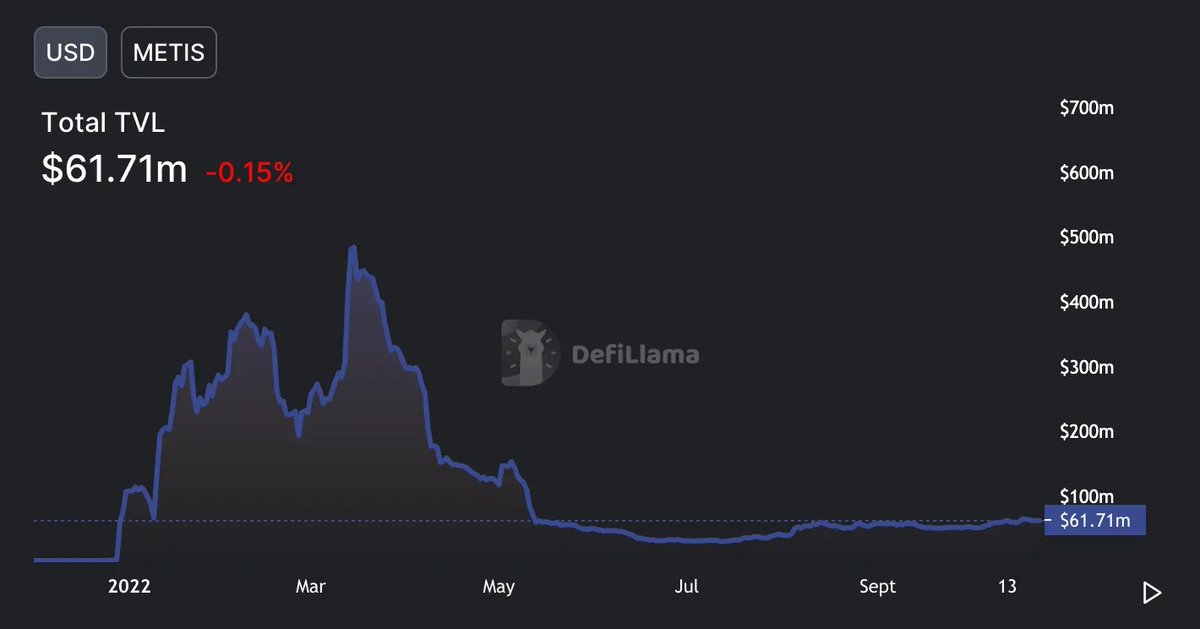

And the two major ORUs are holding up better than most during this bear market.

That was a high level data snapshot of where L2s are right now in terms of adoption. We can definitely see progress has been made, but I’m going to look in more granular detail now.

--The Optimistic Ones--

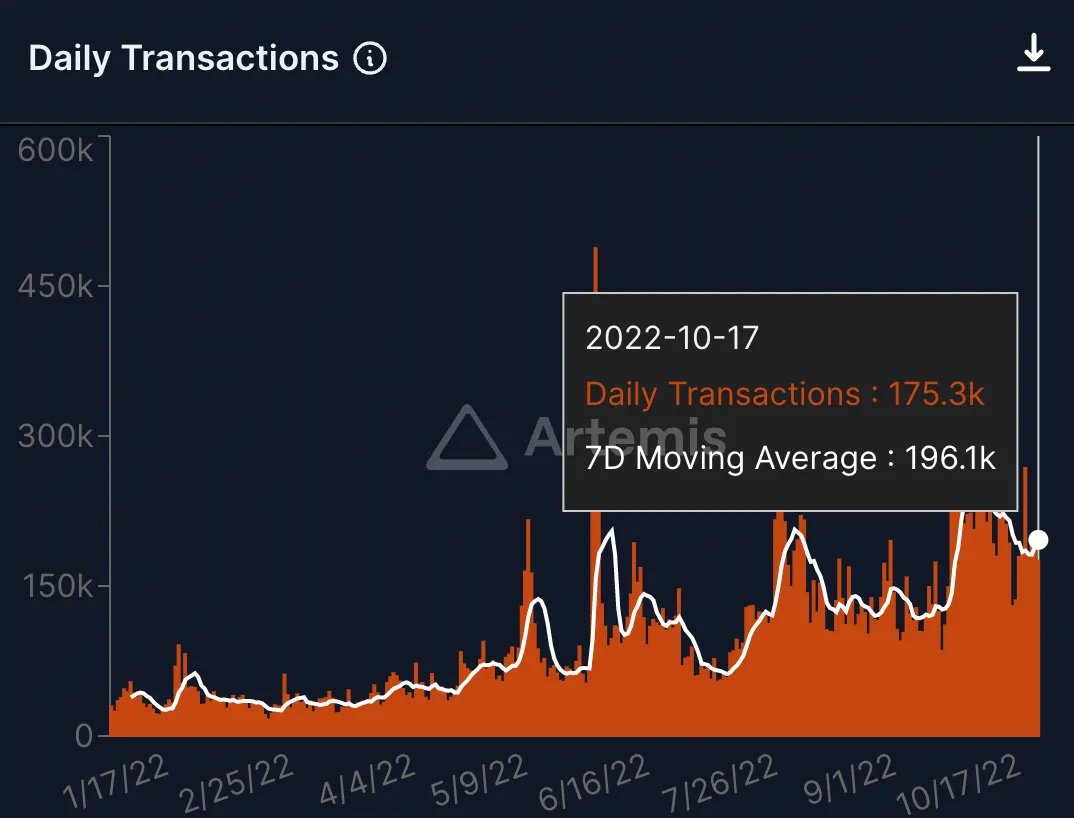

@arbitrum has shipped their flagship upgrade: Nitro. And despite the bear market they have seen their daily transactions 4x.

@arbitrum has shipped their flagship upgrade: Nitro. And despite the bear market they have seen their daily transactions 4x.

• Arbitrum have acquired Prsym Labs. Prysmatic Labs developed and still operates the computer software Prysm, which over 43% of Ethereum nodes use to run the Ethereum network.

I would suspect Arbitrum acquired Prysm because the future sequencer can then be built similarly to Prysm, making it easy for the majority of Ethereum validators to run it.

If validators can run the Prysm client on a single device then they are quite likely to run Ethereum and Arbitrum sequencers using the same hardware (and earn the Arbitrum token).

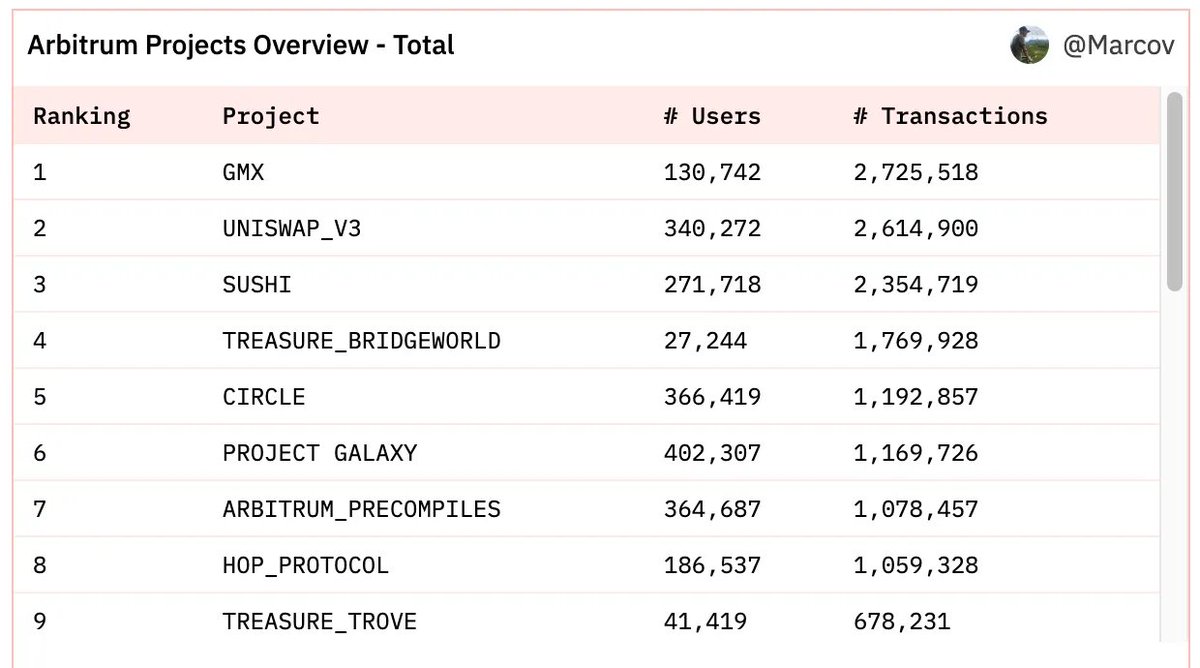

Arbitrum has managed to grow the largest cult of all the L2s so far. Looking at the size of the community and engagement on Twitter, and the fact that certain native dapps ( $GMX & $Magic ) have their own die hard fans, it seems Arbitrum have a powerful base to grow from.

And @optimismFND?

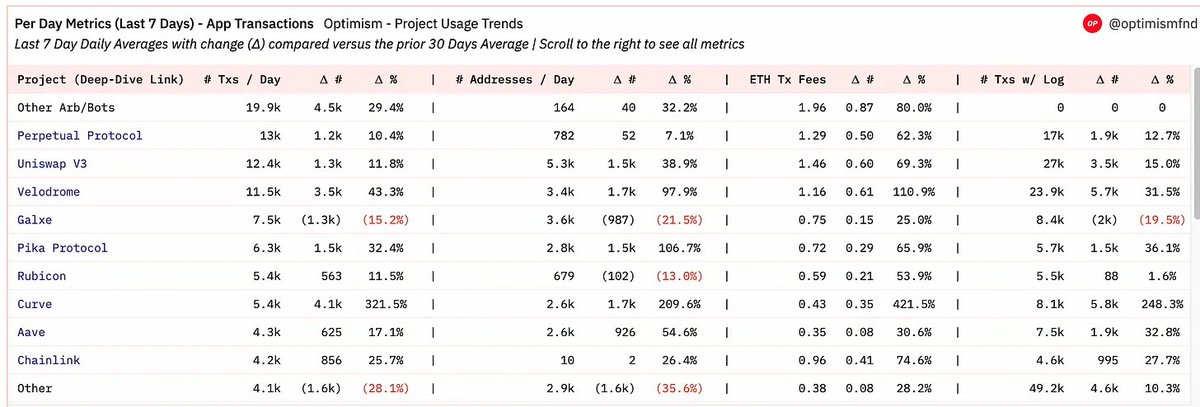

It’s clear to see that Optimism’s native token OP has had the intended effect, with daily transactions also up and to the right.

It’s clear to see that Optimism’s native token OP has had the intended effect, with daily transactions also up and to the right.

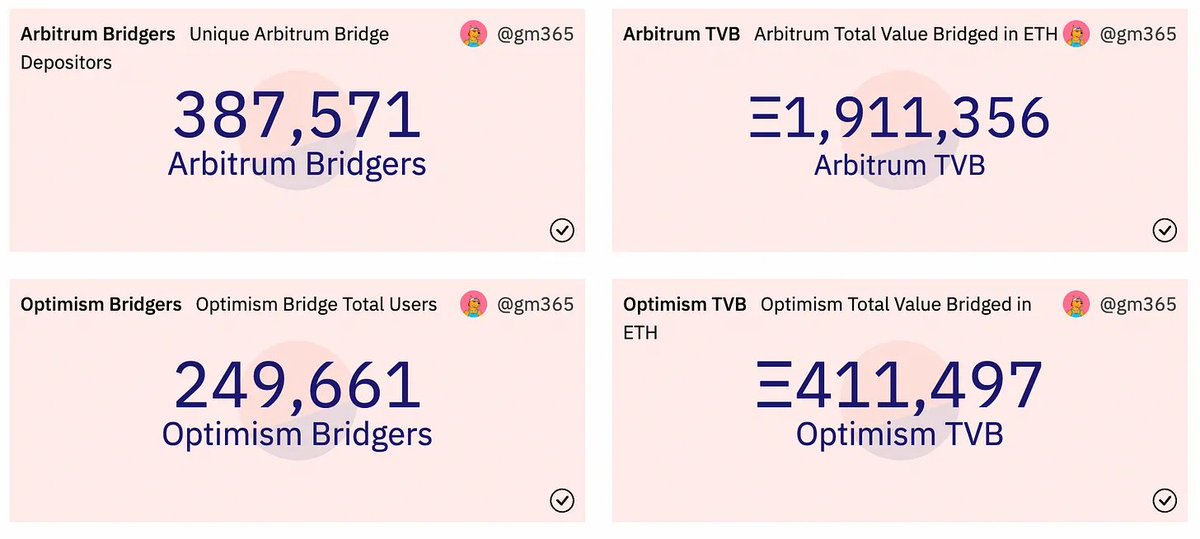

The other interesting metric for both Optimism and Arbitrum has been their developer adoption over the last year. These stats are taken from Alchemy’s recent web3 report:

Optimism:

• >1000% growth in active developer teams YTD

• >1000% growth in active developer teams Y/Y

• 460% growth in API consumption YTD

• >1000% growth in active developer teams YTD

• >1000% growth in active developer teams Y/Y

• 460% growth in API consumption YTD

Arbitrum:

• 516% growth in active developer teams YTD

• 795% growth in active developer teams Y/Y

• 121% growth in API consumption YTD

• 516% growth in active developer teams YTD

• 795% growth in active developer teams Y/Y

• 121% growth in API consumption YTD

The ecosystem of dapps on both Arbitrum and Optimism has increased a fair bit since their launch. There are over 280 projects listed on Arbitrum’s ecosystem website and over 200 on optimism’s.

The OP Stack and the Superchain

Optimism have just announced another major upgrade is dropping soon: Bedrock. And they introduced the “OP Stack” in a blog post recently.

Optimism have just announced another major upgrade is dropping soon: Bedrock. And they introduced the “OP Stack” in a blog post recently.

The OP Stack will allow developers to build modular blockchains. It’s a series of modules, with each component implementing a specific layer of the stack: Consensus, execution and settlement.

Theoretically you could swap out Ethereum’s DA layer for Celestia & run Bitcoin as the execution layer.

One team has already built something kind of cool using the OP Stack. OPCraft runs on an OP Stack custom rollup.

One team has already built something kind of cool using the OP Stack. OPCraft runs on an OP Stack custom rollup.

This is a phenomenal talk on the OP Stack.

youtube.com

youtube.com

Last word on the ORUs. Both Arbitrum and Optimism have a path to use validity proofs and can evolve to remain competitive if they need to. This is worth remembering.

--The ZK Ones--

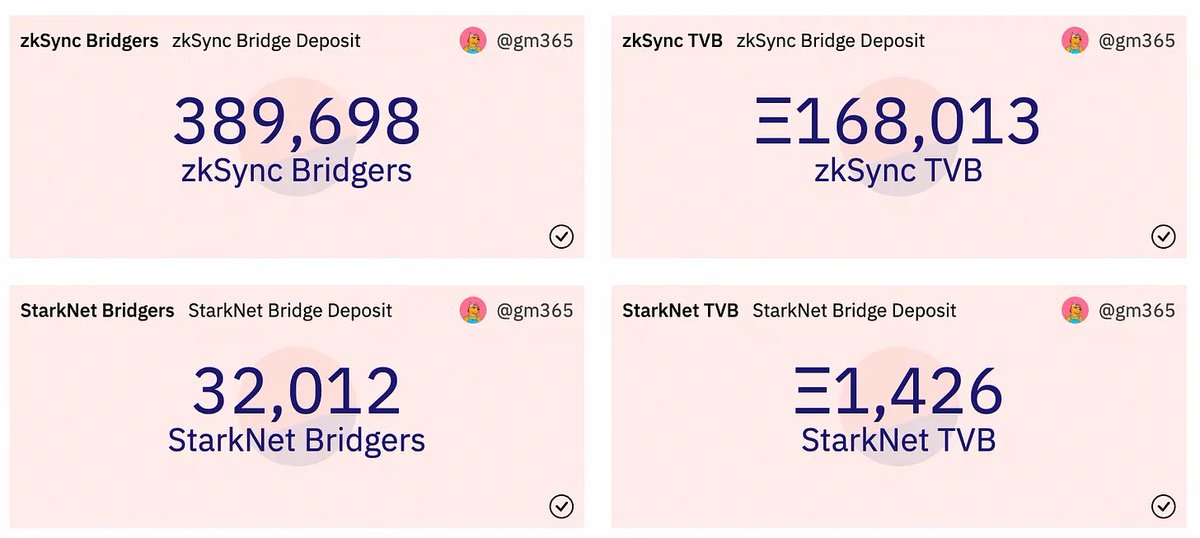

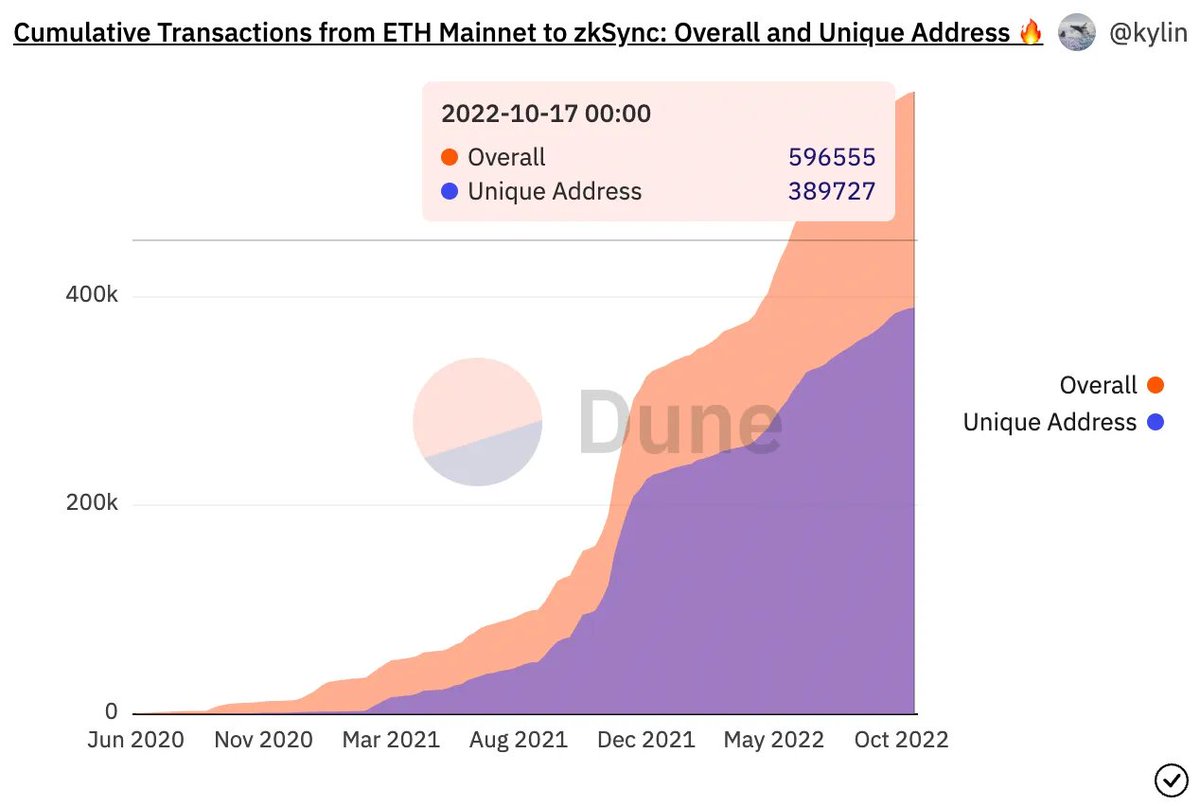

Zero-Knowledge Rollups have come on tremendously in the last year.

During ETHSeoul in August this year, @VitalikButerin projected that ZK-Rollups would win the Layer 2 scaling warfare against Optimistic Rollups.

Zero-Knowledge Rollups have come on tremendously in the last year.

During ETHSeoul in August this year, @VitalikButerin projected that ZK-Rollups would win the Layer 2 scaling warfare against Optimistic Rollups.

Argent’s mobile app allows anyone to create a ZkSync wallet from their phone, use DeFi quickly, cheaply, with the security guarantees of Ethereum whilst navigating around with great UI/UX. All the complexity is abstracted away into the background.

Account abstraction is going to change crypto. Both StarkNet and zkSync support it. The below thread explains the power of AA. TLDR: Better UX. Greater security. More flexibility, and much more. Seed phrases will be a thing of the past.

zkEVM

The zkEVM was once thought to be years away, but zkSync are now on the cusp of launching zkSync 2.0. They say it will be the first fully working end-to-end zkEVM.

The zkEVM was once thought to be years away, but zkSync are now on the cusp of launching zkSync 2.0. They say it will be the first fully working end-to-end zkEVM.

The ZkEVM is the first zero-knowledge scaling solution that’s fully compatible with Ethereum. It makes it super easy for developers to migrate their dApps from chains compatible with the EVM.

Yup, big deal. This thread outlines zkSync’s vision.

Yup, big deal. This thread outlines zkSync’s vision.

It’s actually expected to launch in alpha fully at the end of the year. No users will be able to externally bridge until then. Steven Goldfeder, co-founder of Arbitrum, shared his skepticism of the timeline that is being portrayed.

We have two other teams in the ZkEVM race. Scroll and Polygon.

@Scroll_ZKP Pre-Alpha Testnet is Live. Their previous version onboarded over 10k users to test their bridge and demo forks of dapps like Uniswap.

Their new testnet upgrade enables smart contract deployment on Scroll, allowing developers to write and deploy their own contracts on Scroll using the same Ethereum developer tools they are familiar with. Their alpha testnet will come next.

I’m going to quote Vitalik again:

"Starkware is made up of very smart cryptographers who are actually sane".

"Starkware is made up of very smart cryptographers who are actually sane".

Every time I hear Eli and Uri (@StarkWareltd founders) talk I become more convinced that their vision has a great chance of becoming reality.

StarkNet has been in alpha for while. They just released 0.10.0 on mainnet. They are still restricting the amount that can be bridged to StarkNet while they focus on improving performance.

Over 70 million NFTs have been minted across Sorare & ImmutableX.

This shows the scale achieved by the StarkEx prover and verifier.

That is orders of magnitude more than the combined total of NFTs minted across other L1s &L2s.

This shows the scale achieved by the StarkEx prover and verifier.

That is orders of magnitude more than the combined total of NFTs minted across other L1s &L2s.

The combined StarkWare (StarkEX and StarkNet) transactions last week were 1.6x Ethereum.

Cairo 1.0 is a big release, which will take place at the end of 2022. Cairo 1.0 has been “rebuilt for a decentralised network.”

It is designed to support StarkNet’s requirements as a permissionless network, allowing the protocol to become simpler and safer.

It is designed to support StarkNet’s requirements as a permissionless network, allowing the protocol to become simpler and safer.

StarkNet Alpha is now progressing towards Regenesis.

After Regenesis, StarkNet will work only with Cairo 1.0-based contracts, and will start from a new genesis block with the existing state.

After Regenesis, StarkNet will work only with Cairo 1.0-based contracts, and will start from a new genesis block with the existing state.

Some have been skeptical about whether developers would commit to learning Cairo in order to build on StarkNet.

Interestingly, AAVE and Maker are currently building on StarkNet and neither are transpiling their solidity code into Cairo. They are starting from scratch.

Interestingly, AAVE and Maker are currently building on StarkNet and neither are transpiling their solidity code into Cairo. They are starting from scratch.

Both are committing resources into their first non EVM chain. And that chain is StarkNet.

They have also announced the STARK token:

• StarkNet’s decentralization involves a native token & a new foundation.

• The StarkNet token is used for governance and as the network’s payment and staking asset.

• Ten billion tokens have been minted & their allocation has begun.

• StarkNet’s decentralization involves a native token & a new foundation.

• The StarkNet token is used for governance and as the network’s payment and staking asset.

• Ten billion tokens have been minted & their allocation has begun.

A quick word on ImmutableX.

ImmutableX is a rollup designed to go after gaming. Immutable already offers incredible scale, which is needed to support games (9k tps).

ImmutableX is a rollup designed to go after gaming. Immutable already offers incredible scale, which is needed to support games (9k tps).

One of the blockchain games I’ve been following for a long time is Illuvium and I think it was a big vote of confidence for ImmutableX that they decided to make that the home of their games.

Aztec

OFAC has done a lot of damage to privacy projects recently. A lot of crypto natives are quite concerned about this. Aztec offers a glimmer of hope.

Aztec basically acts like a VPN and allows users to use protocols natively on L1.

OFAC has done a lot of damage to privacy projects recently. A lot of crypto natives are quite concerned about this. Aztec offers a glimmer of hope.

Aztec basically acts like a VPN and allows users to use protocols natively on L1.

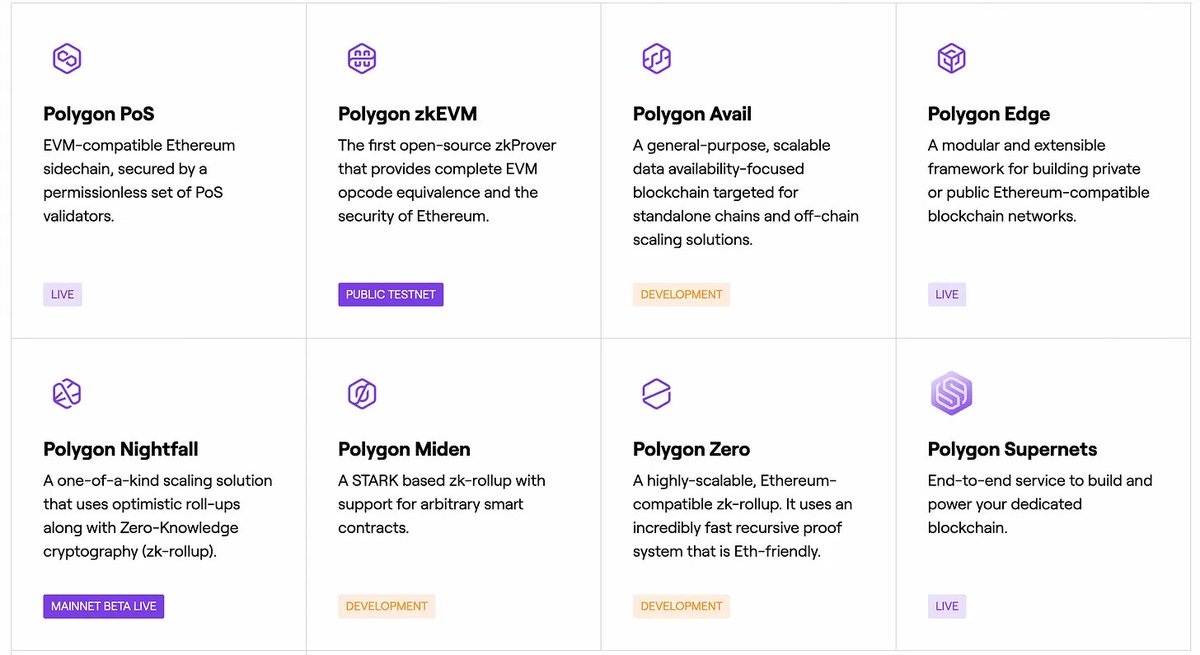

The Polygon zkEVM is certainly in the running to become the first zkEVM live in production.

As you would expect from a founder, Mihailo is fully backing the Polygon zkEVM as the most comprehensive solution.

As you would expect from a founder, Mihailo is fully backing the Polygon zkEVM as the most comprehensive solution.

Polygon recently announced that their zkEVM is now the first zkEVM to reach a major milestone: We are entering our testnet with a complete, open-source ZK proving system.

It’s worth noting the testnet version of Polygon zkEVM has limited throughput capacity, which means it’s far from its final form as an optimized scaling machine. It still has a long way to go.

If you want to learn more about zkEVM, Polygon have a great free introductory course.

university.polygon.technology

university.polygon.technology

One of the things that is so impressive about Polygon is their business development team. They really do manage to bring the big brands onboard. This isn’t specific to L2s, but they’ve recently partnered with Starbucks and Robinhood.

They have an impressive track record of gaining brand adoption, so I’m sure that pipeline is going to help with the adoption of their L2 solutions.

MATIC is the token that I’m presuming will be used as the fee token across their entire suite of scaling solutions. That could bring quite a bit of intrinsic value to the token.

--L2 value capture--

There are many predicting L2s will be a more profitable play than the alt L1 rotation trade in the coming years.

There are many predicting L2s will be a more profitable play than the alt L1 rotation trade in the coming years.

Optimism or any L2, could decide to distribute that revenue to stakers, but that simply won’t make sense until an L2 has matured sufficiently.

Chains that build with the OP stack could decide to use the OP token to power their chain, which creates more demand for the token.

STARK’s token will be used as a fee token instead of ETH. Although Starkware say that users will also be able to pay in ETH “for good UX”. This means ETH will likely get converted automatically into STARK via a DEX.

ImmutableX already require 20% of the protocol fee on every transaction to be paid in IMX. If you do not currently own IMX, they convert the fee by purchasing IMX on the open market (preserving a seamless user experience). These fees are then distributed to stakers.

MEV is going to be another way L2 tokens can capture value. L2s may see more sophisticated MEV and coordination by validators and sequencers.

MEV Auctions sell the power of sorting transactions, winners gain the sorting power of blocks. Proceeds raised by the auction can then be sent to the DAO’s public goods treasury or redistributed to tokenholders through a buyback or burn.

This is still the best piece I have seen written on the topic of L2 tokenomics.

If rollups onboard millions of users then it’s clear there are many ways for them to capture significant value.

--What’s the Play?--

All L2s are going to reward their community for being loyal and active participants. L2s want to get their tokens into the hands of the community.

All L2s are going to reward their community for being loyal and active participants. L2s want to get their tokens into the hands of the community.

You should be exploring all of the ecosystems, bridging, playing with dapps, using test nets, being an active member of the community in discord etc. This thread is a handy starter guide.

The rollup centric roadmap will pay dividends for ETH and I expect the strongest L2s to eventually capture value.

However, the distribution of the tokens will take years, just like it took years for effective distribution of Ethereum. We will see low circulating supply for a good while and you will have to consider the fully diluted valuation when assessing value.

Thanks for reading if you made this far! This took a fair bit of time to put together. If you found the thread useful an RT would be most appreciated! And follow me @alpha_pls 🫡

I'll continue writing during the bear here. It's free to subscribe.

alphapls.substack.com

alphapls.substack.com

Loading suggestions...